Don’t make this mistake when markets are this wild

5th August 2024 |

I’m going to start this update with some not so good news.

Expect all your stocks to be worth less by the end of today.

This much is inevitable.

The reason is an unwinding of asset positions in relation to the cost of borrowing rising in Japan, further market correction sell pressure into a market that has been on bit of a heater in the last year and what might seem like impending all-out war in the Middle East (again).

Here’s the thing, times like this are the true window into your tolerance for risk.

Because when markets are like this, there are three things that you can do.

- Sell

- Nothing

- Buy

Granted, those are the three things you can do at any time. But when markets are this volatile there’s an overwhelming desire to do number 1.

Considering the CBOE Volatility Index, also familiarly known as the VIX, is up over 100% in trading today (so far) it really is one of the most volatile days we’ve seen in markets since… well, since Covid.

In fact, during Covid the VIX got to over $80, and the only time before that was 2008. In other words, when the VIX is up and really up, then things are pretty dire.

Right now the VIX is at $47 and climbing. Good chance it breaks $50. And from there, well, $80 is certainly closer than where it was trading last week ($16).

The question to ask is, is now that bad? Is it 2008 bad? Is it 2020 Covid markets bad?

My take, no.

Could it get that bad? Sure. It could, but I don’t see it as that level, as in a black swan-style event. Therefore now is the time to check where your risk appetite sits, because while the feeling might be to sell and sit out, if you’re a long-term investor, all the data suggest that’s the worst thing to do.

To invest for the long term, the best thing you can do is to still be fully invested through this period. If you happen to have additional cash that you were going to use to invest, then it makes sense to dollar cost average into the market.

But to sell up and get out? No.

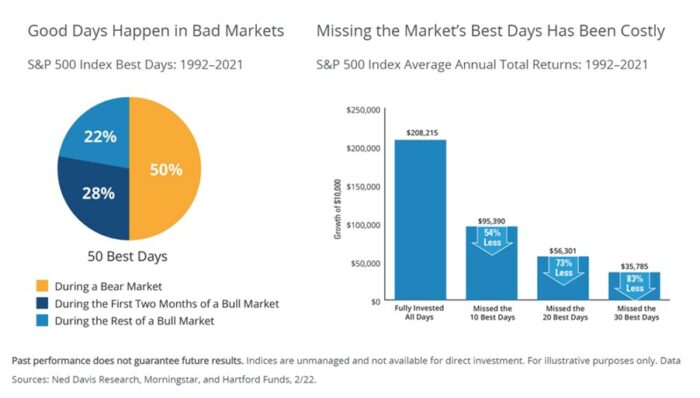

It’s not just my take on that either. Below is data from JMG Financial that also references data from other research organisations about when good days in the market happen and the cost of being out of the market versus fully invested through it.

Charles Schwab also has a great article on timing the market (you can see it here).

It has even crunched the numbers to demonstrate what happens if you can perfectly time the market (which is impossible to do), if you invest immediately after getting investment capital, if you dollar cost average into the market evenly every month, if you try to time the market but really suck and have bad timing, and then if you avoid it altogether and stay in cash.

Staying in cash is the worst outcome. Perfectly timing the market is the best (but impossible).

That leaves investing immediately and dollar cost averaging. They’re pretty close. Close enough to suggest that it doesn’t really matter.

They both beat having bad timing (but not by as much as you’d think). But all of them absolutely trounce being and staying in cash. The Schwab takeaways are as follows:

- Given the difficulty of timing the market, the most realistic strategy for the majority of investors would be to invest in stocks immediately.

- Procrastination can be worse than bad timing. Long term, it’s almost always better to invest in stocks—even at the worst time each year—than not to invest at all.

- Dollar-cost averaging is a good plan if you’re prone to regret after a large investment has a short-term drop, or if you like the discipline of investing small amounts as you earn them.

- Lastly, it’s important to note that there’s no guarantee you’ll make money through investing in stocks. For instance, there’s always a chance we could enter another period like the 1960s through early 1980s.

In short, doing nothing sucks. Understanding your risk and knowing that long-term investing is the key is the way to go.

That volatility will be ever present, and even when things get really bad, it still pays to be invested.

That’s why, the best action to take here, after what’s coming later on today, is to stick with your investment strategy, and where risk capital is available, look to add to your positions.

I’ve written a few things today to various publications, and my take is the same across the board: know what you like and have conviction in your investment ideas.

That means if there’s a stock you like and it’s now at a hefty discount, and your view is long term on that stock, then it makes sense to add it, or add to it.

So, yes, these markets are scary. Yes, there’s a lot of things you’ll see and hear that will scare the pants off you. Some things will make you want to pack up shop, sell everything and move off grid.

Those thoughts even enter my mind sometimes! But then logic and rational decision making kicks in. And you fast realise when the market is like this, it’s time to be active, to find bargains and have conviction in your investment ideas.

That’s what I’m doing, and what I suggest you do too.

Regards,

Sam Volkering

Co-editor, Southbank Growth Advantage