How to make a killing in the crypto gold rush

21st August 2017 |

Why is everyone so interested in initial coin offerings (ICOs)?

It’s a question a lot of people unfamiliar with the cryptocurrency market may be asking. The process of launching your own cryptocurrency is getting easier and the number of these vehicles is proliferating. The media is filled with stories of companies raising hundreds of millions of dollars overnight instead of listing on the stockmarket to fund expansion. Investment bankers are leaving high paying jobs to join the ICO craze. By getting in on the ground floor the rewards can be immense for the owners of newly minted coins, assuming of course there is a ready secondary market to sell them into later.

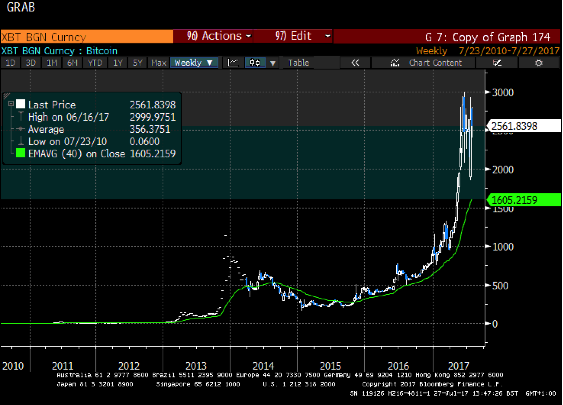

A picture really is worth a 1,000 words. Look at these two pictures of bitcoin.

The first is the nominal price you’re probably familiar with.

The second is a logarithmic chart where the right-hand scale depicts a percentage gain rather than nominal appreciation.

For a leveraged trader, the nominal scale is the most important because they are interested in how many percentage points the price moves. The higher the price, the greater the number of points it moves, and the more potential for profit or loss.

For unleveraged investors, which are the majority of people participating in the cryptocurrency boom, I would argue the log scale chart is more important. With a log scale chart you get a true representation of how explosive the initial growth stage is and how much the price has to rise to replicate that initial couple of doublings.

In simple terms, it is easy to double when the price is 1 but requires an additional multiple to double when the price is 2.

The log scale chart of bitcoin highlights the extent to which it has already rallied from modest beginnings and helps to illustrate why there has been such interest in ICOs. After all, it is much easier for a cryptocurrency to double from $0.01 to $0.02 than from $1,000 to $2,000.

That’s true of just about all markets. One of the reasons emerging markets so often represent high beta plays on developed markets is for the exact same reason. Imagine someone in Africa or India who has worked for $1 a day for the last decade and her salary increases to $2. Her standard of living has just doubled – she can literally buy double the quantity of goods and services she could yesterday. The impact that has on an economy is much greater than if someone making $25 an hour suddenly moves up to $26.

It’s also why small-cap shares tend to outperform large-cap shares. It’s why small business growth rates have the potential to outpace much larger businesses. For example, my wife’s business is set to grow 300% this year because she started small and is leveraging up conservatively. For Apple to grow 300% in a year would require a new product as successful as the iPhone.

The simple reason then that so many people are interested in ICOs is because if you can get in at the ground floor you have massive potential to make a profit.

Logarithmic scale charts are useful for another reason too. The difficulty of minting new coins increases in a predictable manner. The trajectory of the price of a cryptocurrency should follow a log scale chart because value should increase as the cost of minting new coins increases, assuming traffic over the blockchain network backing it increases in at least the same manner.

In a closed system, when supply of a commodity is strictly controlled, the cost of mining and demand for it will be the only factors influencing price.

In an open system where supply can come from a number of sources, such as when a central bank has complete control over the supply of a currency, or banks can lend money into existence, the demand side of the equation is less important. In fact in the vast majority of cases, it is supply which dictates price, while demand for the commodity or currency grows at a reasonably steady pace.

That’s why the question of a hard fork in the bitcoin blockchain is so important. It’s a big deal but let me first explain what it means. The bitcoin blockchain is built on rules which all miners must abide by in order to mine bitcoin. As with a nation’s constitution there is often a time when people feel the need to improve it either because there was a deficiency in the original document or because events have occurred which change circumstances. Generally speaking the government of the day puts it to a referendum to decide what to do.

At its core, the current issue dominating the bitcoin community is regarding the currency’s ability to scale. The debate is between the crypto equivalent of monetary purists, who are opposed to anything that would tamper with the existing supply of coins, and those focused on promoting growth by expanding supply.

Bitcoin’s blockchain was originally set up so that there could only ever be 21 million coins. Back in 2007 that sounded like a lot, but as interest in the technology boomed, and mining activity proliferated, the question of how to facilitate further growth became progressively more urgent. If bitcoin and its blockchain are to fulfil the potential we believe it has to create a new global marketplace for smart contracts, international transfers, record keeping, etc, then the scaling issue must be addressed once and for all.

Since bitcoin miners make money by creating and holding new coins, they are sensitive to anything that affects the value of the cryptocurrency. They are the equivalent of monetary purists interested in curtailing supply to support prices. The bitcoin mining community is dominated by Chinese industrial scale operators like a cryptocurrency equivalent of De Beers. They control the mining infrastructure and have an interest in withholding supply to support prices. They would need a very good reason to change that stance.

On the other side of the argument are those who are focused on growth to drive profitability. They want the blockchain to expand into just about every facet of our lives – they want every person on Earth to have access to the blockchain. They want to circumvent the established status quo, increase lending transparency, promote greater efficiency and lower costs to all financial and legal transactions. These are lofty goals, but to allow the system to grow to those proportions the network must scale.

Even under a gold standard, new mining increases supply in an unpredictable fashion. Gold rushes, when new seams were discovered, whether in South America, California, Australia or South Africa, all created inflation from the new supply of money entering the economy.

The pace of bitcoin mining is controlled both by the difficulty in verifying transactions on the blockchain, and electrical and computing power required to do this. These ensure that fresh bitcoin does not suddenly flood into the system and have an inflationary effect.

Creating a system that allows supply to increase in line with the ideal of monetary purism is possible provided the rate of supply is not arbitrarily influenced. The problem with the fiat currency world we have lived with since the end of the Bretton Woods agreement in 1971 is that the supply of currency is controlled by a small number of people within central banks and in the board rooms of lending institutions. Their acceptance of the Keynesian system of fiat currencies is so complete that nary a thought is given to whether it functions for the benefit of the majority.

I’m reminded of the old Victoria quip focused on the healthcare sector, “the operation was a success but the patient died”. The constant attempts by this fiat elite to create inflation eventually work. Governments or banks seeking to inflate debt away or boost the perception of growth debase their currencies. This leads to a loss of faith and scepticism in fiat currencies, but would be a death knell for cryptocurrencies. What holds the bitcoin network together is faith in the value and ability of the currency to fulfil transactions as an alternative to government-mandated fiat.

A split in the system

As you can see there are strong arguments on both sides, but the most important thing to understand is a hard fork does not represent an existential threat. An Ethereum hard fork was completed last year, after being the subject of a hack which allowed one holder to acquire 25% of the outstanding balance of coins. The community went through a painful debate over what to do about it and the decision was eventually made to go back through the history of Ethereum transactions to before the point where the hack had taken place and create a new currency from that point forward. Some miners were against this winding back of time, and kept the transactions the hacker had used on their blockchain – this original iteration of Ethereum became known as Ethereum Classic. The new currency was known simply as Ethereum, and was also created with the ability to incrementally increase the total number of Ether tokens in existence. In effect, the hack was a catalyst for Ethereum to focus on the growth of the network, in opposition to the monetary purists.

Since both the original and new coins still exist, we now know which one the community of investors most fervently supports. The answer is the new iteration of Ethereum, which focused on growth rather than monetary absolutism. That’s important for the bitcoin argument because it provides an example of what a hard fork looks like and which outcome worked best.

On 21 July, the bitcoin community decided to adopt the SegWit2x protocol. The aim of this fix will be threefold. The first question it answers is whether to allow supply to increase. 91% of developers backed its first iteration known as “BIP91”. One of the inhibiting factors that has dogged bitcoin’s evolution has been that the speed of the network is often slow, with transactions taking a long time before being verified on the blockchain. SegWit2x is designed to address this issue, and is essential if bitcoin and its blockchain are to ever take on the likes of Visa or Mastercard. It is going to take at least a few months of testing to ensure the new system works as expected, but the news was greeted with near euphoria among the cryptocurrency community.

The bitcoin price rallied smartly from $2,000 to almost $3,000 in four days.

I’m in China right now and have been talking with bitcoin miners; I’m waiting on news of whether I can visit one of the primary factories producing ASIC ANT machines (computers used to mine cryptocurrencies) in Shenzhen. Two things I’m hearing from a number of sources, via Mrs Treacy, who is originally from Beijing, is that a lot more people are getting into Ethereum mining. The news about the adoption of BIP91 being adopted has been greeted with enthusiasm, but the volatility in Ethereum pricing makes it a more attractive mining target.

The second point everyone is talking about is the Commodity Futures Trading Commission’s decision to allow the derivative creation and trading of bitcoin – this will be active within the next few months. The introduction of leverage into a market which has previously been dominated by unleveraged investors is a transformative event, and should have a huge impact on the price of the underlying currencies. We have only one recent example of a market where options were introduced and that is in China from early 2015. The market had been rallying in advance of the Shanghai-Hong Kong Stock Connect program which allowed direct trading between the two cities. However, the introduction of options sent the bull trend into overdrive and the market doubled in a short period of time. Take a moment to consider that the Shanghai A-Share market is comprised of the largest companies in the world’s second largest economy and it doubled following the introduction of options.

What effect will the introduction of options have on bitcoin? Bitcoin is a fraction of the size of the Chinese stockmarket. The volatility that approaches could present huge opportunities, which is why Chinese investors are getting so excited about the introduction of options. They know what leverage can do to prices.

In a mining boom, sell shovels

It was for this reason I recommend you take a position in Advanced Micro Devices (AMD). With the potential for options to pour fuel on the bullish consequences of the scaling decision, a manufacturer of crypto mining equipment should perform well.

Not all cryptocurrencies will survive in the future, but all of them require mining architecture – provided by chip manufacturers like AMD. While the cryptocurrency space that demands mining architecture has been devastatingly volatile, the shares for companies that provide that architecture has consistently improved.

Having visited China recently and speaking to a number of bitcoin miners I have discovered that they are beginning to migrate over to Ethereum mining because they see more upside in the price. This is good news for chip manufacturers.

Combining these arguments, the time is right to initiate a long position in AMD with a buy up to price of $18. My target for the next 12 months is $25 and $50 over the next three years.

Cryptocurrencies are a volatile sector so there is always risk attached, but from AMD’s perspective its competition with Nvidia has to be a major consideration, while the constantly evolving market for chips will also represent a constant challenge for every company in the sector to remain competitive. An economic downturn could also threaten the price.

BUY Advanced Micro Devices

Name: Advanced Micro Devices Inc. (AMD) (figures accurate as of last market close 16/08/2017)

Ticker: AMD US

Market cap: $12.33 billion

Price: $13.02

Buy below: $18

52-week high/low: $15.65/$5.66

Past performance (accurate up to 31/07/2017): |2012: -57.51%|2013:58.25%|2014:-26.72%|2015:13.72%|2016: 371.31|Year to date: 12.49%

All the best,

Eoin Treacy

Investment Director, Frontier Tech Investor