Mumbai airport announcement: change needed for the global aviation industry

1st April 2021 |

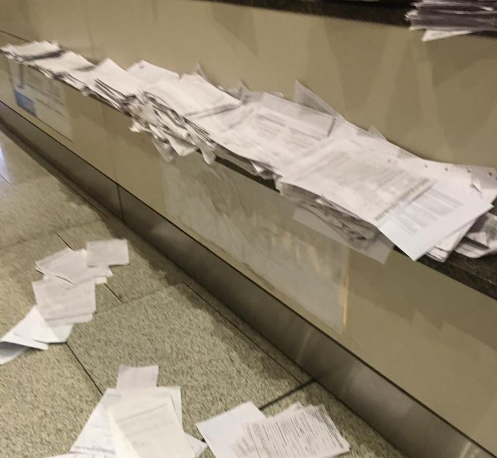

Have a look at this…

It’s a picture that a mate sent to me from the immigration checkpoint at Mumbai airport.

The officials are manually filling in the details of arriving passengers.

This is their best attempt to keep track of the movement of people again in a Covid-19 ravaged world.

This is just one glimpse at the shambles into which the global aviation industry has descended.

But it’s an industry that’s been on the brink of disaster for a long time – perhaps decades.

It’s why so many airlines struggle to stay afloat. It’s why in the last two major global financial/ economic crises (2008 and 2020) the airlines have requested (and received) government bailouts.

It won’t get much better for the airlines either unless there’s some change – and dramatic change at that.

The likely alternative to dramatic change is the permanent closure of many more airlines…

… which results in one of two outcomes.

One possibility is even further concentration of the global aviation industry. There will be few survivors.

The other possibility is people simply travel far less by air. In this scenario, a reduction in capacity on major global routes results in higher prices and a lot of people simply deciding not to travel along those routes.

Neither of these outcomes is great.

That is why we expect that the change in the global aviation industry over the next ten years will be faster than ever before.

That is really saying something.

This is an industry which has dealt with huge shifts such as: the arrival of jet aircraft; the development of bigger aircraft; the development of better aircraft; an enormous rise in the numbers of people globally who can afford to fly; and continuous improvement in safety standards.

And these are just the changes since the late 1950s that come to mind immediately. There are many, many others.

Part of the change in the global aviation industry over the next decade will come via the adoption and integration of new technologies.

Part of the change will be strongly driven by governments wanting to boost their weak economies with new and “green” policies.

The UK government is a particularly good example.

The UK introduced a net zero emissions law in June 2019, which seeks to bring all greenhouse gas (carbon dioxide – CO2) emissions to net zero by 2050. We touched on this idea of “net zero” last week talking about Rolls-Royce (RR.L)

Well, it’s not only Rolls-Royce getting in on the “net zero” act.

In order achieve “net zero”, the government has revealed that it will be investing £15 million into its “FlyZero” study. It is a 12-month project, being delivered by Aerospace Technology Institute (ATI). The project will investigate the strategic, technical and commercial issues in designing and developing zero-emission aircraft.

In addition, a “Jet Zero Council” has been developed by the UK government. One of the big beneficiaries when this was announced was Velocys (VLS.L): this is something which we covered in our initial recommendation of this stock.

Note: we recently updated our report on Velocys and put it together in a new report called “Green Skies Champion.” You may see us talking about the “Green Skies Champion” in some of our marketing material you stumble across. Don’t worry, though: the recommendation and the report is exclusively for subscribers only. You can see the updated report here.

This Jet Zero Council is a partnership between the UK government and aviation industry. It will see ministers and chief executives regularly meet to discuss the delivery of new, sustainable aviation technologies.

Another of our stocks, Meggitt (LSE:MGGT), is currently a member of the Jet Zero Council. The company provides components and sub-systems for the aerospace industry and is playing its part in helping the government and the aviation industry achieve their emissions goals. You can see our original recommendation here.

Currently, Meggitt has ambitions to reduce its carbon emissions by 50% by 2025. It is investing two thirds of its research and development budget in new technologies that are needed for sustainable aviation and low carbon power generation.

In addition, Meggitt currently has a policy of generating 100% of its electricity from “green sources” in the UK. In other words, all the power used will come from entirely natural sources, such as wind and the sun.

Meggitt is well equipped to lead the government green agenda in the aviation industry. And if it can pull it off along with the likes of Rolls-Royce and Velocys, we believe all three stocks have significant long-term potential to deliver for investors.

Napster

Following the name change from MelodyVR to Napster Group (NAPS), we expected that there would be a renewed focus on the potential of this small AIM-listed pioneer.

Both the way in which we consume music, and the way in which music is released, is in the midst of rapid change.

How artists are paid, along with how they reach audiences, are the focus of more attention from industry insiders, investors and commentators than ever before.

By way of example, the music industry is looking into new technologies like non-fungible tokens (NFTs) – crypto technology that allows a digital item to retain scarcity and uniqueness.

However, the benefits of all this appear to have bypassed Napster completely.

In fact, the stock has continued to fall – so much so that it has triggered our trailing stop/loss that we put in place some time ago when it was known as Melody VR.

As such, we’ve been stopped out of the Napster position with a 50% loss recorded for record tracking purposes.

We will watch what happens carefully over the coming weeks.

We would stress that we are still optimistic about Napster’s medium to long-term prospects.

For now, though, we will stay on the sidelines, looking for a suitable time and price to re-enter the stock.

IQE

Another stock that’s been on the decline has been IQE (IQE.L). The semiconductor materials company released its full-year results last week.

The results were actually pretty decent considering the headwinds of 2020. In fact, IQE delivered record revenues of £178 million for the year.

Its after-tax loss for the year fell to £2.9 million – a huge leap down from the £35.9 million loss the prior year.

Everything is heading in the right direction from our perspective.

However, the market didn’t see it that way. In particular, a research report from investment house Canaccord Genuity downgraded the stock from “speculative buy” to “hold”.

This exacerbated the market response and has seen IQE track lower.

We think that they’re wrong.

The long-term potential for IQE amidst a global chip shortage holds up well in our view.

At this point, we believe this is a minor blip for IQE and that’ll press on to an even stronger 2021.

The stock remains a buy at the current level. You can find the original recommendation here.

Immotion

A few weeks ago, we told you that Immotion Group (IMMO.L) was hopeful of announcing an exciting new project at the Clearwater marine aquarium in Florida.

This has now actually happened.

The 22-seat Undersea Explorer opened for the first time on 21 March. The number of visitors was said to be strong at the aquarium, and early uptake of the installation was “very encouraging”.

In addition, restrictions at the Shark Reef Aquarium in Las Vegas have been eased. Immotion’s largest installation is situated there. Capacity is now at 50% and is likely to increase in the coming months as the threats from the Covid-19 pandemic diminish.

With this improvement in the Covid-19 outlook in the US, we expect demand to rise for Immotion’s products. As a result, we expect this to be reflected in Immotion’s share price in the near term.

Additionally, Immotion announced last week that its “Tower Coaster” virtual reality ride at the Sydney Tower Eye in Australia is now open to the public. This now gives Immotion three sites, all of which are fully open, in that country. Lockdowns in Australia have been easing since November last year.

Immotion’s share price has increased more than 25% since last Tuesday, which is a significant gain. At the time of writing, it sits at 5.21p per share.

The stock market is clearly excited about the stock, and so are we. Continue to hold Immotion.

The Frontier Tech Investor “Top Three”

Sometimes it’s hard to decide on which stocks to invest in from our buy list

Below is our Frontier Tech Investor “Top Three” section showing three stocks in open BUY positions. If you’re trying to figure out what to invest in next, these are three that we think are a great place to start.

This doesn’t mean our other stocks are no good: this is just a tool to help you spot the next Frontier Tech Investor stock that could be worthy of your consideration.

Kanabo Group (KNB.L) – one of the world’s most controversial investment ideas is around the legalisation of medicinal and recreational cannabis. It’s sweeping across Canada and now the US. Both countries are leaders on the way to legalisation. In Australia a similar path is being followed. And now the UK is on the same track. Kanabo is one of the newest and best plays into this huge investment opportunity. You can find our recommendation here.

IQE – our most recent recommendation, IQE, is a key part of the supply chain getting semiconductors into the world. You can find our latest discussion, and a link to the original report, above. With a gigantic increase in the demand for semiconductors the world is facing a “chipageddon”. This is a situation where there simply aren’t enough semiconductors to supply the world’s biggest, most demanding companies. IQE is one of the few UK listed stocks that are a play on this theme.

Velocys – there’s no doubt that governments are going to continue to push their “green agenda”. This means that they will do what they can to support industry in ways that will help enable carbon neutral economies. Velocys is a big part of this developing sustainable fuels for transport and logistics (in particular aviation) with pioneering technology. Some discussion, and a link to our report on Velocys can be found above. If you’re looking for a great “green energy” play, Velocys is a very good place to start.

Until next time,

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor