Stock Alert: Breaking Britain’s energy crisis

22nd September 2022 |

The United Kingdom is experiencing an energy crisis. This has been brewing for some time, and it is going to get worse.

A cold winter in 2021 left European gas supplies depleted. Lockdowns lifted.

Russia then decided to invade Ukraine, and to turn off the gas tap.

As a result, demand for gas and electricity has soared, and supply has plummeted. That has only meant one thing: soaring energy prices.

Take a look at what’s happened to us for a real-world example…

Here’s our gas tariff from November 2011:

That was the final month of our previous energy deal.

We moved onto the cheapest deal our energy provider had to try and keep costs down… thinking our bills would stay roughly the same.

How wrong we were.

When our latest bill landed, we took a closer look at the new gas tariff:

That’s a 174.6% increase in gas costs and an 85% increase in electricity! Together, this is more than doubling the cost of our energy.

This isn’t a by-product of recent geopolitical conflict. It has been in the making for over 18 months. We’re actually one of the lucky ones as we fixed our tariffs before things got really crazy and before inflation soared into double digits.

This crisis has even led to 28 energy suppliers going bust in the UK because gas has become too expensive to produce.

For example, come October 2022, the average annual household gas and electricity bill will be £2,500. This is almost double that of October last year.

As a result, this year, spending power in the UK as a percentage of the household budget is set to fall by 8.3% – the largest decline across Western Europe.

We could go on and on about the damning facts and statistics. What really matters is that the crisis has exposed the urgent need for energy security and independence in the UK.

In other words, we need to end dependence on unreliable and costly energy from foreign sources and produce our own.

With the ongoing green-energy transition, the only way forward is to adopt secure and sustainable energy sources that can guarantee energy security. In our view, there are two absolute winners in a push towards such security, and these are nuclear and hydrogen energy.

The UK government is building much of its energy security policy around these two sources. For example, as part of the “British Energy Security Strategy”, the UK government seeks to treble nuclear energy capacity by 2050.

There are plans to build eight new nuclear reactors by then, when one quarter of our electricity demand will be met by nuclear, up from 16% today.

Government money is pouring into the trend. Only last week, the government allocated £700 million in funding for the country’s largest nuclear energy project, Sizewell C.

You may also recall that a few months ago we recommended two nuclear energy-based stocks. Given macroeconomic conditions, and the changing narrative towards nuclear, we deemed it an opportune moment to introduce them to the buy list.

The solid progress of Yellow Cake (LSE: YCA) and Aura Energy (LSE: AURA), even in the most turbulent market conditions, has reinforced our view that the nuclear opportunity is one that we must bring to you again.

However, what’s worth noting is that it’s not just the UK that’s going full-nuclear. More on that shortly.

The second energy winner during this unique window of opportunity is hydrogen. It’s a relatively unknown, but incredibly versatile and powerful energy source.

Hydrogen acts as a storer of energy, and can be transported in gas or liquid form. It can be transformed into electricity under a heat-intensive process, helping to power homes, and even transport.

When converted to energy, hydrogen doesn’t produce any carbon emissions. However, it’s currently produced mainly using fossil fuels.

In fact, around 95% is produced from non-renewables, such as coal and oil. Just 5% is made using electricity from renewable sources. This has left huge scope for increasing “green” hydrogen use.

In April 2022, the UK government doubled its hydrogen target, aiming to generate 10GW by 2030 instead of 5GW, which will now come from green hydrogen sources. Also, for the government’s 2050 net-zero goal to be met, it estimates that hydrogen will need to deliver 35% of the UK’s energy supply.

Nine billion pounds in government investment has been set aside to support the country’s switch to hydrogen energy.

The government is thus in a race against time.

It’s also under pressure to protect the UK people from further energy price hikes, which could have a devastating impact on livelihoods. And it’s clear for the future of this country that there must be a push towards energy independence and security.

This is fuelling the huge tailwinds behind nuclear and hydrogen energy.

And it’s not just the UK that’s seeking energy security, either. Other nations are doing the same.

More than a decade on from the Fukushima disaster, Japan is planning a shift back to nuclear energy, aiming to generate around 20% of its electricity from nuclear power by 2030.

The European Commission has also earmarked €210 billion to secure its energy independency in the face of Russia’s war actions.

That’s why we’re introducing three recommendations to you. These stocks are listed right here on the LSE and offer global exposure to the green energy transition and a future of sovereign energy independence.

Introducing your first Frontier Tech Investor recommendation…

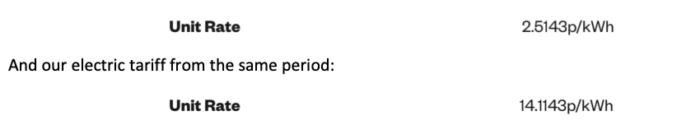

The HANetf Sprott Global Uranium Miners UCITS ETF (LSE:URNM) or URNM, is your first recommendation.

Note: there are two versions of this ETF, the URNM and the URNP. URNM is denominated in USD whereas the URNP is denominated in GBP. The difference is only what currency they’re priced in.

We are currently recommending the URNM version due to the strength of the US dollar and the likelihood that at least for the short term, that strength will continue. However, if you choose to use the URNP, it’s the same fund just without the US currency exposure.

Investing in an ETF isn’t the typical “stock” recommendation you’re used to. URNM is an exchange-traded fund (ETF), provided by HanETF providing access to the Sprott Uranium Miners ETF but listed here on the London Stock Exchange. Sprott is a global investment manager, specialising in the provision of commodities and metal investments.

An ETF is a fund that invests in a basket of stocks or assets. Most ETFs track a specific index; for example, the S&P 500, or a basket of stocks that are related to a particular theme. Their value is underpinned by the progress of the index.

ETFs provide diversified exposure across a range of securities, which can (but doesn’t always) mitigate risk.

The hallmark of an ETF is low transaction fees; the only real cost is a one-off brokerage commission, similar to stock trades.

Another feature is strong liquidity, because ETFs are usually traded on major and well-regulated stock exchanges where they can be easily bought and sold.

They also allow easy exposure to foreign assets, which would otherwise be difficult to obtain. Foreign investing can be a confusing and highly bureaucratic process.

For example, investing directly into the US markets requires a W8-BEN form, which is very complicated.

Ultimately, ETFs give investors the opportunity to invest in a thematic investment idea without having to deal with the complexities of portfolio mixing and rebalancing, and dealing with the costs involved for multiple stocks across many jurisdictions.

About URNM

URNM allows investment in the nuclear energy industry through exposure to uranium-producing companies. These include uranium miners, producers and developers. The ETF also invests in entities that hold physical uranium and uranium royalties.

Uranium is essential in the generation of nuclear energy. Under a heat-intensive process, uranium atoms are “split” in a nuclear-fission reaction, releasing vast amounts of energy.

Exposure to uranium stocks provides exposure to the nuclear energy trend.

URNM first launched on 3 December 2019 under the name “North Shore Global Uranium Mining Index”. However, in April 2022, the ETF was rebranded to become the URNM fund, in partnership with HANetf.

It listed on the LSE in May 2022.

Being an ETF, URNM tracks a specific index which is a basket of stocks – in this case, involved in the mining exploration, development, production and holding of uranium and uranium assets. This basket is called the North Shore Sprott Uranium Miners Index. The index tracks a basket of 36 uranium-centric stocks.

URNM invests 80% of its assets in securities of the North Shore index. Specifically, the index targets companies that have devoted at least “50% of their business activity” to the uranium industry.

The index includes several giants of the uranium and nuclear energy worlds. For example, Cameco (NYSE: CCJ) and Kazatomprom (LSE: KAP) make up 17.47% and 17.41% of the index, respectively at the time of writing.

Cameco accounts for around 17% of the world’s global uranium production. Last year, Kazatomprom accounted for 24% of the world’s global uranium production.

You can see a list of the top 10 holdings and download the full list of holdings via the HANetf site here.

The index is adjusted twice a year, on the last trading day of March and September.

So far, URNM has delivered strong returns to shareholders, given turbulent macroeconomic conditions. For example, between 5 July and 31 August 2022, the ETF’s price increased 38.5%. Over the same period, the S&P 500 was up just 3%.

Although URNM is an ETF, don’t expect it to produce index-style stable returns. While it spreads risk across several assets, the thematic idea of uranium is commodity-based. Commodities naturally bring volatility, as they’re more prone to speculation and uncertainty from geopolitical and weather events.

Nevertheless, without risk there’s no reward. The nuclear energy transition has strong momentum behind it, with governments recognising its importance in delivering a greener future.

In our view, URNM encapsulates this exciting trend, whilst also providing easy investor access to it.

Risks and action to take

Several of URNM’s holdings are strongly correlated with the price of uranium. If there is a downturn in the uranium market, the valuation of the ETF will almost certainly fall.

This could happen due to several factors, including supply issues, falling demand, geopolitical risks, and lingering misconceptions about the safety of nuclear energy. For example, around 70% of the world’s nuclear reactors are set to be decommissioned by 2050, due to licensing expiries and security concerns.

If new nuclear infrastructure isn’t built at the same pace, demand for uranium and nuclear energy will fall. Given that the average nuclear plant takes more than five years to build, this is a real possibility.

Then, there’s also political and mining risks to consider. For example, the second-largest index holding, Kazatomprom, was caught up in political unrest in its native Kazakhstan in January 2022.

In addition, the mining process can be affected by closures and extraction difficulties. Paladin Energy, for example, which makes up 5.22% of the fund at the time of writing, had to mothball its main uranium mine, and it won’t be back online until 2024.

What’s more, young uranium mining companies are largely dependent on future cash-flow streams, which can’t always be guaranteed. It could be a while before these companies in the index produce a sizeable return.

Finally, there is also currency risk to consider with URNM, which is denominated in US dollars.

Buying the URNM ETF means that you will need to process the trade in USD. Most brokers do this automatically for you, but do charge a conversion fee. On top of this, you are then also exposed to currency risk via fluctuations with the USD vs. the GBP. Currency can move both for you in the event the USD gets stronger against the GBP, or against you should the USD weaken against the GBP in this case.

Hence if you are not comfortable investing in URNM in USD, you can also use the URNP ETF which is the same ETF but denominated in GBP and also listed here on the London Stock Exchange.

Investing in nuclear energy undoubtedly poses some risks. Nevertheless, we believe URNM provides a fantastic vehicle to ride this growing trend.

Action to take: BUY Sprott Global Uranium Miners UCITS ETF (LSE: URNM). Buy up to US$8.

Name: Sprott Global Uranium Miners UCITS ETF (LSE: URNM)

Ticker: URNM.L

Price as of 22.09.2022: $7.35

52-week high/low: $6.19/8.82

Buy up to: US$8

Source: Yahoo Finance

Source: Yahoo Finance

So, one down, two to go. Let’s move on to our next clean energy play.

Introducing another energy opportunity in this time of crisis…

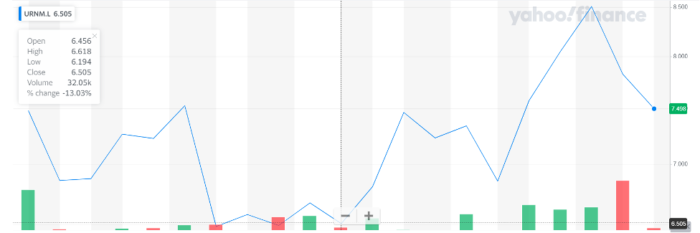

HydrogenOne Capital Growth (LSE: HGEN) is your second Frontier Tech Investor recommendation.

HydrogenOne is an investment fund which, in its own words, “invests directly or indirectly in a diversified portfolio of hydrogen and complementary hydrogen focused assets.”

It’s the first ever hydrogen fund listed on the LSE. You can buy shares in it through your broker, just as you would with other LSE-listed stocks.

Investment funds work by pooling money together from several investors. The fund manager then invests the funds into a range of assets, such as shares, based upon a thematic investment idea.

Investment funds seek to make a capital gain on investments. They can provide easy access to overseas assets, at an affordable rate. In a fund, you’re sharing the costs of investment with other people, across several stocks.

As a result, you’re not incurring continuous fees for individual share purchases.

In HydrogenOne’s case, the fund invests in a mixture of both private and publicly listed hydrogen companies.

Private companies don’t have publicly listed stock so as a “retail” investor you can’t directly invest in them through a stock exchange like the London Stock Exchange. To raise equity, they often sell allocations of the company stock to investment funds, banks and high-net-worth clients. As well as the investment, these institutions can provide guidance and expertise to the company, helping it to grow.

HydrogenOne provides unique exposure to hydrogen assets that would otherwise be out of reach to ordinary investors, which is part of why we like this play.

Having broad exposure to private companies can bring some benefits. For example, private companies can grow and develop quickly due to the abundant capital and expertise given by their investors.

They can expand away from the public eye, without the pressure of public markets. The fund, underpinned by the value of the explosive potential of these private holdings, can grow healthily too.

However, private equity investment can incur notable risks. For example, it can involve investing in early-stage companies without a solid track-record.

In addition, private equity investing often requires several years of financing, with funds typically locked in for a period of five to ten years. If the target company falters, the investor is unable to redeem its capital, facing a sustained period of losses.

Nevertheless, private equity exposure provides a unique and lucrative alternative for investors and access to companies that you might otherwise be shut away from.

About HydrogenOne

HydrogenOne invests in hydrogen-focused assets. These include hydrogen producers, distributors and supply chains.

As stated, hydrogen is set to power the homes (three million UK homes by 2030) and vehicles of the future. In fact, there are already around 12,000 hydrogen fuel cell-powered vehicles on roads.

Crucially, the HydrogenOne fund seeks to invest in green hydrogen companies. In other words, companies that produce hydrogen using water, rather than carbon or natural gas.

In this sense, it’s obtained using a process called electrolysis, which you’ll learn more about later.

Hydrogen produced via green electricity is entirely renewable, making it a necessity for a greener global economy. It’s estimated that clean hydrogen demand could increase by over 200 times between 2019 and 2030.

The HyrdogenOne fund is predominately comprised of six private companies, accounting for 74% of the total fund.

This broad exposure to private companies is what we really like about HydrogenOne. It provides investment opportunities that aren’t available to the ordinary investor.

Just 4% of the fund is made up of publicly listed companies, with 22% made up of cash. You can view the full portfolio list here.

The net asset value (NAV) of the fund is £124.8 million. The top three investments in the fund, as a percentage of NAV, are Elcogen, Sunfire GmbH (both with 16.6%) and HiiROC (10.4%).

In particular, Sunfire GmbH develops industrial electrolysers that transform renewable electricity into renewable hydrogen and syngas for industrial applications.

As the fund suggests, the hydrogen sector is predominantly funded by private investment. This shows how underinvested and early stage the hydrogen industry is today.

What’s more, HydrogenOne could be about to (indirectly) benefit from government support for hydrogen. The UK government has launched the Net Zero Hyrdogen Fund, which will allocate around £240 million in government funding to low-carbon hydrogen projects.

On 30 September 2022, applicants will be notified on whether they’ll receive the first or second round of funding. There are four rounds altogether.

Because HyrdogenOne can invest privately, its portfolio companies may get the benefits of this funding helping to accelerate their growth and valuations, thereby increasing the NAV and return of shareholders in HydrogenOne.

Risks

The first risk is that the hydrogen sector doesn’t take off. As shown by HydrogenOne’s investment fund, the hydrogen industry is still at a nascent stage in terms of commercialisation.

There aren’t really any leading hydrogen providers with a solid track record. Most hydrogen companies are private and small-scale, with limited manufacturing capacity.

Applications need to be proven, and up-scaled before the clean hydrogen sector really kicks off.

In addition, the majority of hydrogen production is still fossil-fuel based. Money in the hydrogen sector has yet to really find its way to green hydrogen companies.

As a result, it may be a while before HydrogenOne delivers value to shareholders.

It can also take up to four years to build a green hydrogen facility.

Another reason for slow hydrogen adoption is security concerns. Hydrogen is highly flammable, and can cause serious explosions when mixed with air.

In fact, using hydrogen in the home would be around four times more dangerous than using natural gas.

Investing in HydrogenOne undoubtedly carries some risk through the high-risk nature of the private companies they’re investing in. However, the growth projections for the green hydrogen industry are strong. It is expected to reach a valuation of $9.8 billion by 2028, up from just $0.3 billion in 2020.

We believe the strong tailwinds behind clean hydrogen give HydrogenOne and its portfolio companies fantastic investment potential.

Action to take: BUY HydrogenOne Capital Growth (LSE: HGEN). Buy up to 100 GBp.

Name: HydrogenOne Capital Growth

Ticker: HGEN.L

Price as of 22.09.2022: 94 GBp

Market cap: £ 121 million

52-week high/low: 127 GBp/84.8 GBp

Buy up to: 100 GBp

Source: Koyfin

Source: Koyfin

Introducing your third Frontier Tech Investor recommendation…

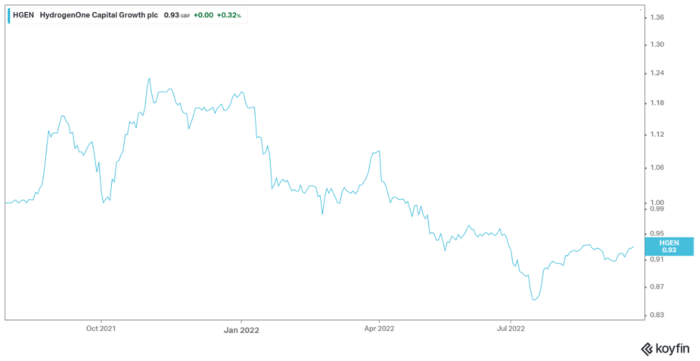

Your final recommendation is Clean Power Hydrogen (LSE:CPH2). For brevity, we’ll refer to it as CPH.

CPH is a UK-based provider of hydrogen electrolysers. The company was established in 2012 by entrepreneurs Joe Scott and Dr. Nigel Williamson.

It listed on the AIM section of the London Stock Exchange in February 2022.

CPH is a developer of membrane-free hydrogen electrolysers. Hydrogen is a ubiquitous element on earth, found mainly in water. This helps explain water’s chemical formula of “H2O”, with the “H” standing for hydrogen (and the “O” for oxygen).

To be obtained, hydrogen molecules need to be separated from oxygen molecules. Electrolysers use electricity and anodes and cathodes to attract the oppositely charged hydrogen and oxygen atoms.

However, CPH has come up with its own unique electrolyser.

In a conventional water electrolyser, a polymer membrane sits between the two electrodes. Think of it as a wall. Its role is to prevent explosions in the splitting process, by keeping the two gases apart. However, these membranes are expensive to produce and require regular replacement.

Only pricey metals such as platinum and iridium are suitable for the electrolysis process, due to their stability at high acidity.

With CPH’s electrolyser, a membrane isn’t required. It uses an alkaline electrolyte to carry the hydrogen and oxygen atoms to a separating tower, where the gases are then extracted. This is a complex process, which you can learn more about here.

Ultimately, CPH’s electrolysis process provides a cheaper and more efficient way of extracting hydrogen. Its electrolysers also have a 25-year life span, producing hydrogen with a purity of 99.999%.

Currently, they operate on 1MW of power, producing 450 kg per day of green hydrogen. CPH is developing a 2MW membrane-free device that can produce up to 900kg of green hydrogen per day.

In an industry plagued with high production costs, the technology could encourage uptake of hydrogen energy alternatives.

The product is patented, and is already giving its hydrogen customers a strong competitive edge. For example, CPH announced a landmark deal in May 2021 with green hydrogen producer Octopus Hydrogen.

It was the first membrane-free electrolyser the company sold to a UK-based hydrogen producer.

CPH’s technology is unique, valuable and delivers a competitive edge that no other has listed on the London Stock Exchange. This uniqueness combied with our long view on the importance of the green hydrogen industry for the UK makes CPH one of the most exciting hydrogen stocks arguably in the world.

Financials, risks and action to take

For the year ended 31 December 2021, CPH recorded revenues of £28,000, down from £107,000 the previous year.

Also, between 2020 and 2021, operating losses almost doubled from £1.8 million to £3.4 million. We acknowledge the losses, but are not too concerned by them.

The company is still largely pre-commercialisation, and is still bringing its electrolyser up to speed. Nevertheless, it started to receive “significant orders” for its product in the second half of 2021. In fact, CPH revealed it has a potential order pipeline worth 160MW.

It’s even projecting a move into profitability in 2023, estimating profits of around £3 million for the year.

Also, CPH is hoping to achieve 4GW production capacity by 2030 with its electrolysers. This would give it a 10% market share of the European electrolyser market, which could reach a valuation of €47 billion by 2030.

By this metric, CPH could reach a valuation of €4.7 billion by 2030. This is a huge mark-up from its current market capitalisation of €125.78 million (£109.75 million).

That said, it’s important to understand the risks the company faces.

CPH shares many risks with HydrogenOne. Its success is heavily dependent on the uptake of hydrogen energy alternatives. With the industry still having a lot to answer for in terms of safety, cost and roll-out times, the transition to hydrogen won’t be smooth.

Also, the hydrogen industry is becoming increasingly competitive. CPH faces stiff competition from hydrogen companies such as Eneraqua Technologies (LSE: ETP) and Powerhouse Energy Group (LSE: PHE). Nevertheless, it mitigates this by having its revolutionary technology patented.

CPH has something that others don’t. Its technology is an industry first, helping to make hydrogen energy more affordable and efficient than ever before.

It has all the ingredients to evolve into a hydrogen-producing powerhouse, and become a pillar of the UK’s green energy transition.

Action to take: BUY Clean Power Hydrogen (LSE: CPH2). Buy up to 48.50 GBp.

Name: Clean Power Hydrogen

Ticker: CPH2.L

Price as of 22.09.22: 41.35GBp

Market cap: £ 109.75 million

52-week high/low: 78 GBp/34 GBp

Buy up to: 48.50 GBp

Source: Koyfin

Source: Koyfin

A final note on your reports

We are sending a new broadcast out to new Frontier Tech Investor readers. As you may know, this is something we do from time to time so that newcomers can access our research and recommendations. This latest briefing is based around our investment ideas on the coming boom in hydrogen technologies in the UK. It’s information we’ve already published on stocks for you so far in reports to which you already have access.

You might also see today that we’ve made some small tweaks to our special reports, such as title changes, updated financial figures, and one or two new commercial updates. Again, this is all information to which you have access.

However, should you have any questions, please feel free to email us at [email protected] and we will get back to you. Continue to look out for our weekly updates, where we will keep you informed on our positions.

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Analyst, Frontier Tech Investor