Stock Alert: cleaning up the “City of Angels”… with a Thunderbolt…

12th August 2021 |

Bangkok’s historical name included the descriptor “City of Angels”.

Today, “City of Frightening Motor Traffic” might be a better descriptor.

Bangkok’s reputation for appalling traffic congestion is well deserved, both within Thailand and globally.

A World Economic Forum report of early this year noted that the city’s congestion index had improved (i.e. fallen) by 9 percentage points in 2020 – thanks to the economic disruption of the Covid-19 pandemic.

However, with a congestion index of 44%, Bangkok is still the world’s 10th most congested city (after Moscow, Mumbai, Bogotá, Manila, Istanbul, Bengaluru, Kyiv, New Delhi and Novosibirsk).

As visitors to the city in the last two years, we can attest that the chaotic reality on the ground matches the hard numbers.

What makes the congestion in Bangkok different to, say, a traffic jam on the UK’s M25 (the motorway that orbits London) is that it is dominated by light vehicles – motorcycles, motor scooters and tuk-tuks (the three-wheeled motorised rickshaws) – and not cars and lorries.

Consider this: as of 2021, China and Northeast Asia produced 46% of the world’s light vehicles.

In comparison, Europe accounted for 22% of production, and North America 18%.

Readers of Frontier Tech Investor – and other publications here at Southbank Investment Research – will know that we are excited about the prospects for electric vehicles (EVs).

Growing demand – and supply of EVs – is an important part of the much larger Green Energy Transition megatrend.

But when you think of “EVs” what is the first thing that comes to mind?

We’ll tell you what comes to mind for us… Teslas, Audi e-Tron, all these new fancy, futuristic trucks in the United States, cars and maybe a semi-trailer or two.

If that’s what you think too… then you’re completely missing the bigger EV story.

The EV opportunity isn’t just about cars. That’s just a portion of it. The world we rarely see, parts of Asia, Africa, South America, are dominated by light vehicles. And it’s the “light EV” revolution which you really need to pay attention to.

So, an obvious question is: who is involved with light EVs – electric motorcycles, scooters and tuk-tuks?

To understand the relevance of the question, bear in mind the following:

- Thailand is just one country in Asia – India is home to the largest number of motorbikes in the world (approximately 37 million).

- Two- and three-wheeler vehicles are popular because they are all that many households can afford: in 2019, Asia’s GDP per capita (a rough measure of average income) was $7,259; in contrast, the UK’s was $41,030.

- These light vehicles contribute to Asia’s excessive air pollution: For example, according to the World Air Quality Report 2020, India has nine of the world’s ten most polluted cities (and three of the ten cities with the worst traffic congestion). By contrast, London is ranked 78th on the list of the world’s most polluted cities.

- Although India and China were part of the virtual climate summit meeting of 22-23 April 2021, which saw national leaders set ambitious emissions targets, they did not set out any specific targets. Currently, they have only outlined “rough” targets, which are as follows:

- In September 2020, Chinese President Xi Jinping stated the country would look to increase the share of non-fossil fuels in energy consumption to 25% by 2030.

- India is currently exercising the option of a “net zero” emissions target by 2050.

The logic behind your latest Frontier Tech Investor recommendation is, therefore, simple.

The world many don’t know is undergoing fundamental change too. Asian governments are keen to fight pollution and carbon dioxide emissions. A lot of the pollution comes from motor vehicles. And these regions are dominated by light vehicles.

Hence light EVs aren’t just the solution to the problem, they are the future of transportation in Asia and other light EV-dominated countries.

A light EV company…

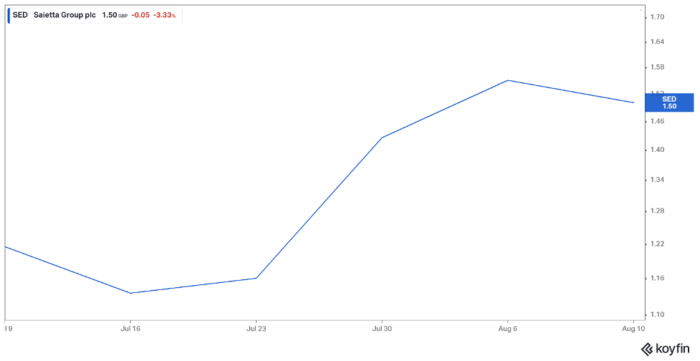

Saietta Group (LSE: SED) is your latest Frontier Tech Investor recommendation. Saietta is an engineering company that specialises in the production of electric propulsion motors for the EV market.

It is an AIM-listed company on the London Stock Exchange. It has a market capitalisation of £127.56 million, and a current share price of 150GBp.

The company is based in Oxfordshire, UK.

It was founded as “Agility Racing Limited” in 2008 as an e-motorbike manufacturer, by former Formula-1 engineer Lawrence Marazzi.

It re-branded as Saietta in 2015, after shifting production towards electric propulsion motors.

Marazzi’s Italian heritage is apparent in his re-naming of the company.

Saietta directly translates to “thunderbolt” from the Italian language.

Saietta’s main products are its patent-protected axial flux technology (AFT) electric motors.

The motor has a unique, compact design that allows for the mass electrification of the lightweight vehicles market.

In the EV motors market, there is an efficiency paradox.

High efficiency motors are expensive. Lower efficiency motors, as you might expect, are cheaper.

Because of this, lower efficiency motors require more batteries (which increases a vehicle’s cost) to achieve the same range as the more efficient motors.

At the same time, this adds more weight to the vehicle.

In essence, it’s a lose-lose situation for customers, regardless of how efficient their electric vehicle’s motor is.

A solution from Saietta’s technology

This is the problem that Saietta is intending to solve.

This is through its revolutionary AFT motors.

In particular, this is via the AFT 140, Saietta’s flagship and first commercial product.

The AFT 140 provides high torque at low speed.

Torque, in simple terms is the amount of power an engine can produce.

In the case of EVs, where there aren’t traditional combustion engines, it’s a motor and armature that produces the torque.

Saietta’s motors can deliver a high level of power (torque), even at low speeds.

This generates increased efficiency and range for EVs, which is a vital differentiator in what is becoming an increasingly competitive market.

To operate the AFT, smaller and less expensive batteries are required. The motor itself requires few component parts, meaning manufacturing costs are lower.

These lower costs enable Saietta to provide affordable, yet high-quality motors to its customers.

In short, Saietta’s technology looks to be ideally suited to the massive Asian light EV market.

Saietta has created variants of its AFT 140 motor, which allows them to be applied to a variety of vehicles.

This includes mid-power motorbikes, last mile delivery vehicles, and tuk-tuks.

What’s interesting is that Saietta is seeking to move motor technology out of the vehicle and into the wheels, particularly in last-mile delivery vehicles.

These particular AFT 140 motors are “pancake” shaped, allowing them to attach to the shape of the wheel.

They free up additional space above the chassis, increasing transportation capacity and eliminate the need for more complex, heavier in-vehicle motors.

Saietta also has other propulsion motors: the AFT 110 and the AFT 190. Both are currently under development.

The AFT 110 is tailored for lower power motorbikes and scooters, and also for the marine sector.

The AFT 190 is designed for high-performance cars.

In addition, the motors can provide high power with low voltage, making the electrical systems in the engine safer.

Also, the motors are liquid cooled, allowing them to function well in tropical climates.

Some hard numbers from the Asian markets for (light) EVs

Global annual motorbike sales are forecasted to reach 100 million by 2030. 40% of these are expected to be EVs.

In a broader sense, the Asian light EV market is projected to reach $52.8 billion by 2024, according to the latest available data from 2019. This is a compound annual growth rate (CAGR) of 7% from 2019.

In the main, these healthy projections stem from China and India’s growing use of lightweight commercial EVs.

By 2025, the Indian EV market is expected to be worth around £4.8 billion by 2025. Two wheelers currently account for 62% of this market.

In addition, China sold more than half of the world’s light EVs in 2019.

Crucially, Saietta is looking to become involved in both of these markets.

Saietta’s AFT 110 and 140 technology is so niche, that according to its board of directors, it has no direct competitors.

This means that – for now – Saietta has a market that is projected to reach $52.8 billion by 2024, all to itself.

Saietta is already in the process of deploying its AFT 140 motors to the Asian market.

On 6 May 2021, the company announced a commercial agreement with Padmini VNA, one of India’s main automotive suppliers.

In the deal, Saietta will be applying its technology to India’s electric two-wheel market, and gain exposure to Padmini’s customer base.

This customer base includes Hero MotoCorp, TVS, Bajaj Auto and Royal Enfield.

In addition, Saietta has received five expressions of interest from Chinese manufacturers for its products.

A formal tendering process is due to get underway in 2H21, which could see Saietta earn new business in China.

Looking beyond EVs to autonomous vehicles

Saietta isn’t just looking to stay relevant to EVs, though.

As Saietta CEO Wicher Kist notes:

“Ultimately we believe that inner city electric vehicles will be fully autonomous and our in-wheel motor technology can play an important role in this market.”

Taking the longer view, we believe that this provides another growth opportunity, which the market hasn’t yet priced in.

Financials, risks and action to take

In the 12 months ended 31 March 2021 (FY2021), the company earned revenues of £870,966. This represents growth of 440% on the corresponding period in the previous year (FY2020).

Gross profits in FY2021 were £680,930. This is a 425% increase on FY2020.

Losses (before taxation and interest) for FY2021 amounted to £7.3 million. This is a 408% rise from FY2020.

The widening loss is something we are aware of, but not worried about.

This is because we consider Saietta to be still pre-commercialisation. It is still investing heavily into its R&D, which is inflating its costs.

Further down the road, this should give it the best chance of expansion and generating business growth.

What’s really impressive to us is the company’s ongoing growth in revenues.

Clearly, it is making strong early progress in commercialising its motor technology.

Such a significant rise in revenues, particularly in the midst of the coronavirus pandemic, points to something far bigger than just your everyday engineering company.

The company first listed on the AIM market of the London Stock Exchange on 7 July 2021.

Although it’s still early days, Saietta is off to a solid start. It’s share price has risen 23% since its 7 July close.

That said, it’s important to consider the risks that Saietta currently faces.

Saietta’s commercialisation of its technology is at a nascent stage.

Its technology is relatively untested in its target markets. With this in mind, mass production may be impacted if its motors’ performance does not meet standards.

This could be due to environmental factors, damage and/or poor maintenance by end users.

In addition, Saietta’s target market is at an embryonic stage with EVs.

The light EV market in Asia is still vastly outnumbered by internal combustion engine (ICE) vehicles.

With the governments of China and India so far failing to commit to any official emissions targets in the near term, Saietta’s motors may be of little interest and priority to light EV customers here.

Also, Saietta plans to expand production through the development of a Pilot Production Factory at its Oxford premises.

The plans are, to say the least, very ambitious.

Increasing production from 50 AFT motors per annum to 100,000 per annum (within the space of three years) will be difficult, and so customer demand may not be fulfilled.

Another point to consider is the growing competitiveness of the light EV market.

As the transition to EVs throughout Asia gathers momentum, Saietta will likely face more competition, and potentially, end up capturing a smaller share of the market.

Finally, bear in mind that Saietta is looking to sell mainly to countries that are not particularly easy in which to do business: language barriers and cultural differences may provide challenges.

The uncertainty and bureaucracy caused by Brexit may also halt its supply chains here in the UK.

Nevertheless, we believe Saietta has excellent upside potential.

It has identified one of the biggest opportunities the EV market currently has to offer.

In time, Saietta just may help make Bangkok worthy of its old name – the “City of Angels”.

Buying instructions

Saietta Group (LSE: SED) is an AIM-listed company on the London Stock Exchange. It has a market capitalisation of £127.56 million, and a current share price of 150GBp.

Average volume is around 77,000 per day, which equates to around £115,500 in value per day.

We’d classify this as a relatively illiquid stock, meaning that on recommendation, the open price in the market the next day may spike higher.

That’s why it’s important to stick within buy limits, and should the stock trade over our buy limit, it moves to a “hold”, and you should wait for the buying activity to die down.

Should the stock to return to a price under the buy limit it will move back to an active buy recommendation.

Action to take: BUY Saietta Group (LSE:SED), current price 150GBp, buy up to 178GBp. We will set a hard stop at 90GBp representing a 40% floor under our entry of 150GBp.

Name: Saietta Group PLC

Ticker: SED. L

Price as of 12.08.21: 150GBp

Market cap: £127.56 million

52-week high/low: 160GBp/112GBp

Buy up to: 178GBp

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor