Stock Alert: solving the UK’s biggest problem for electric vehicles

12th May 2022 |

Electric vehicles (EVs) are taking over the roads – both here in the UK and elsewhere.

In 2020, around 3% of new car sales were EVs in the UK.

By the end of the decade, this is expected to be 93%.

However, there is a big problem – and, for now, it is growing rapidly.

That problem is that it is still too hard for EV owners/drivers to recharge the vehicles’ batteries.

In part, this is because the existing charge points are not in the right places.

Around one third (9.2 million) of Britain’s 28.3 million households don’t have off-street parking.

Many of these households live in urban areas where street parking is the only parking option.

Therefore, they don’t have the luxury of charging their cars using mains electricity supplies from a driveway.

This creates nagging “range anxiety” where users doubt if they have enough charge to complete a journey without running out of power.

This also creates an over-reliance on public charge points, even though their availability can’t always be guaranteed.

The charge points are not evenly distributed across the country.

For example, the north of England has 65% fewer charge points per 100,000 people than the south of England.

Distances between charge points are sometimes worryingly long.

For instance, in the county of Devon, it’s not uncommon for users to have to travel more than 10km to the nearest charge point.

In comparison, EV users in Southwark, London, can find a public charge point every 97 metres.

The latest evidence also suggests that the provision of charge points is not keeping up with the sale of EVs: this is partly due to the disruption of supply chains because of the Covid-19 pandemic.

One estimate is that the shortfall of EV charge points in the UK is estimated to reach 250,000 by 2032.

In fact, according to the Daily Mail, there are currently just 0.28 charge points per EV in the UK. In 2018, there were around nine chargers per EV.

The problem could get worse – as falling prices of EVs make them more affordable for many households, with the result that sales soar further.

According to Visual Capitalist, the average price of a 350-mile range EV has dropped from $50,000 in 2019 to $39,000 in 2021, with the price expected to drop to $26,000 in 2023.

However, every problem is an opportunity for a solution.

With this in mind, take a look at the picture below.

Source: editor’s own photo

Source: editor’s own photo

Just a ten-minute stroll away from the Southbank Investment Research office, between Lambeth North and Borough tube stations, is a lamp post which has been converted into an EV charge point.

It’s one of the 1,300 lamp post EV charge points in operation in Greater London. What used to just support illumination, now also provides energy.

So, there is a solution to the big problem.

The question for us here at Frontier Tech Investor is simple: which listed company looks well placed to benefit from delivering the solution?

Charging towards an EV future…

Your latest Frontier Tech Investor stock recommendation doesn’t rely on enlightened local councils deciding to convert lamp posts into charge points.

The company in question delivers chargers that cater for all EV users, whether they’re at home, work, parking up on the street, or stopping by at one of their favourite commercial centres.

Its EV charge point network stretches to all corners of the UK.

If any company is able to ensure that the provision of charge points catches up with and then matches the growth in the UK’s fleet of EVs then this company, we believe, is it.

Introducing your new Frontier Tech Investor recommendation…

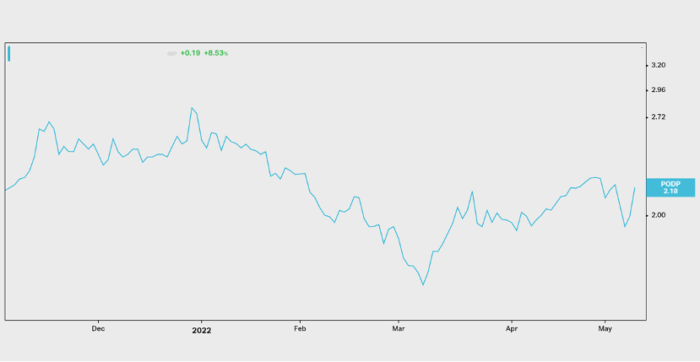

Pod Point Group Holdings (LSE: PODP) is a provider of EV charging infrastructure. It is listed on the main market of the London Stock Exchange (LSE).

It has a market cap of £332 million and a current share price of 216.00GBp (as of 12/05/2022).

The company was founded in 2009 by current CEO Erik Fairbairn.

It completed its initial public offering (IPO) in November 2021.

The successful listing raised £120 million in capital for Pod Point, and saw it receive the Green Economy Mark. This is an accolade given to LSE-listed companies who derive more than 50% of their revenues from products that contribute to environmental objectives, such as pollution.

Energy group EDF Energy acquired a majority 78% stake in Pod Point in 2020.

Pod Point is based in London, UK.

Pod Point operates 6,200 public charging bays across the UK and has manufactured around 137,000 charge points.

Its chargers are compatible with all plug-in vehicle brands.

This year, the UK government has brought in legislation which states that all new-build homes and commercial buildings must have EV charging points.

This means that around 145,000 new charge points will be installed across the UK each year.

In any case, EV home charging is the most popular and cost-effective way of charging EVs. Around 80% of EV charging in the UK currently takes place at home.

Pod Point’s home charging infrastructure is called Solo.

The latest version, called Solo 3, is compatible with any EV and comes with three power ratings: 3.6kW, 7kW or 22kW.

The 22kW version can provide up to 90 miles of range per hour.

Home installation is included within the price of the charger, with prices ranging between £799 to £1,599.

In addition, Pod Point has a twin charger, which is suitable for commercial and public installations. It has the same power ratings as the Solo 3 chargers.

Next, Pod Point’s array solution allows multiple 3kW or 7kW charge points to be installed on a single unit.

The company also has a media solution. In this, Pod Point installs EV charge points with a built-in screen at customer locations.

The buyer of the charge point can then lease out advertising space on the charge point.

Finally, Pod Point is a provider of fast charging (or DC) technology. These are provided by third party suppliers, including ABB, Tritium and Delta.

Many Pod Point units are free to use at the time that the EV is charged – these include private home units and a limited number of workplace and destination locations.

For the majority of commercial charging points, including fast charging points, a fee is charged through Pod Point’s own app.

The app allows users to find and pay for Pod Point network charging, monitor charging activity and costs from any Pod Point charge point, and gain access to customer support.

Customers can even schedule charges.

The bottom line is that Pod Point could play a key role in resolving the shortage of charge points in this country.

Financials, risks and action to take

Pod Point makes money by selling its charging installations to consumers and businesses.

You can find Pod Point’s installations across some of the UK’s most recognised commercial centres.

This includes Heathrow Airport, and even tourist destinations such as Center Parcs.

Pod Point has even deployed its charging infrastructure to 400 Tesco supermarket stores across the UK.

What’s more, Pod Point has strong commercial ties with some of the world’s largest automotive manufacturers.

In April 2022, Pod Point inked a deal with BMW, which will see Pod Point’s chargers recommended to BMW’s UK EV customers after purchasing a BMW or MINI EV. This follows on from a partnership with Mercedes-Benz in November 2021 also seeing Pod Point as the preferred recommended charger supplier for all Mercedes EV buyers.

Pod Point’s financial position is solid.

For the year ended 31 December 2021, Pod Point recorded revenues of £61.4 million. This is an 86% increase on 2020.

Also, for the year ended 31 December 2021, gross profits were £16.3 million. This a 99% increase on the previous year.

Pod Point also reported a gross margin of 27% for 2021. This is a 2 percentage point rise.

Currently, Pod Point is still running at net a loss. Losses before tax were £14.3 million for 2021, up from £12.9 million in the previous year.

Such losses are par for the course for a young, innovative company like Pod Point that is ploughing money into expanding its EV charging network.

Within the space of a year, the company nearly doubled the number of charge-point installations, rising from 35,763 in 2020 to 66,000 in 2021.

In addition, the company faced one-off costs associated with its IPO, so the losses for 2021 may appear a little artificial.

As noted, Pod Point installed 66,000 charge points this year, earning revenues of £61.4 million. On average, that’s £930 of revenue per charge point.

Its current market share of the UK EV charging network (across home and commercial charging) is 18% for home charging and 4% for commercial charging.

By 2030, the government hopes that the number of public charge points will increase tenfold to 300,000.

And then, by 2030, there should be an extra 1,160,000 home charging points, in light of the government’s EV charger policy for new-build homes.

Assuming that its market share of each EV charging segment remains constant, Pod Point will install 218,800 new charge points by 2030. And at an average revenue of £930, it will accrue £204.2 million in revenues from new installations alone, which is four times its current revenues.

It’s a rough projection, which of course doesn’t include other revenues Pod Point earns, such as the costs of charging.

In addition, it assumes Pod Point’s market share will stay fixed, when in reality, it will likely grow. For instance, its home charging market share grew by 2 percentage points from 2020 to 2021.

So, we could perhaps be looking at revenues nearer the £500 million mark by 2030, which promises solid upside potential for Pod Point.

That said, it’s important to consider the risks the company faces.

The shortage in EV chargers outlined above could lead to Pod Point getting caught in a vicious cycle.

A lack of EV chargers may slow the adoption of EVs. Drivers may be deterred by the lack of EV charging options and stick to internal combustion engine (ICE) vehicles.

As such, demand for EV technology may lower, which could lead to a greater charging imbalance, and so on.

In addition, Pod Point is facing growing competition from several EV charging companies.

For example, BP Pulse has around 8,000 public charge points in the UK, ranging from fast 7kW chargers to rapid 150 kW chargers. According to BP, it is the largest fast-charging operator in the UK.

Also, Ubitricity is a strong rival to Pod Point. It currently operates around 5,000 EV charge points in the UK. The company was acquired by energy company Shell in February 2021 and plans to install 50,000 public charge points by 2025.

Another is ChargePoint Holdings (NYSE: CHPT), which is a competitor with a stock market value of $3 billion.

The competitive pressures are offset somewhat by Pod Point’s diversification into home and workplace charge points.

According to the Competition and Markets Authority (CMA – the government agency which seeks to promote competition that benefits consumers), Pod Point is also the second largest provider of workplace chargers in the UK, with 10-20% of market share.

Pod Point is also under the stewardship of energy giant EDF, which provides it with expertise to navigate the EV charging market.

Another risk is that the home charging grant will no longer be offered by the UK government’s Office for Zero Emission Vehicles (OZEV) after 30 April 2022.

This could lead to a significant reduction in the demand for Pod Point’s home EV charger.

Home chargers accounted for 65% of Pod Point’s revenues in 2021, so the affect could be profound.

Finally, consumer perceptions and uncertainties could hamper the demand for EVs, and Pod Point’s technology.

This includes costs, convenience, practicality, performance and difficulties in adjusting to a new transport network.

Nevertheless, we see huge potential for Pod Point.

Its diverse range of charging options allows it to cater for all EV users, at a time where the UK is seeking to rapidly expand its charging network to keep pace with demand.

Action to take

Pod Point is listed on the main market of the London Stock Exchange. It has a market cap of £332 million and a current share price of 216GBp.

The average volume is around 199,900 per day, which equates to around £431,784.

This makes it a relatively illiquid stock in our view.

On recommendation, the price may spike higher. So, please ensure you stick to our buy limits.

If it moves above the limit, it becomes an active hold. And if it moves below, it becomes an active buy.

Action to take: buy Pod Point (LSE: PODP). Current price of 216.00GBp. Buy up to 250GBp

Name: Pod Point

Ticker: PODP.L

Price as of 12/05/2022: 216.00GBp

Market cap: £332.53 million

52-week high/low: 291.50GBp/152.00GBp

Buy up to: 250GBp

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Analyst, Frontier Tech Investor