Stock Alert: the real driver of the 90s gaming boom that’s still keeping gamers coming back for more…

10th March 2022 |

The last three years of my (Sam’s) life have been a massive adjustment.

However, it’s nothing to do with a pandemic that’s swept across the world.

It’s nothing to do with investing, markets or anything financial.

It’s that I became a dad and have learnt “on the job” to navigate a baby, who then grows into a toddler and is starting to become a little boy.

Also, in the midst of that, another one came along so that my wife and I could go through all that again.

I’m not special, plenty of people become dads and go through similar things. My dad did it, his before, so on and so on. Maybe you’re a dad and you’re learning on the job too, or perhaps you’ve been there, done that and are quite thankful to not do it again!

Because let’s face it, parenting is bloody hard – as we say in Australia.

There’s no instruction manual (although there are plenty of books, which on the balance are completely useless) and there’s no roadmap to follow.

As a new parent, you’ve got to “wing it” and just do the best you can to help these little people grow into the best people they can be.

Any help you can get along the way is also extremely useful. And when it comes to help, what’s available today is radically different from what was around when I was a kid and certainly when my dad was a kid.

And when my kids are dads, I expect things will be radically different again.

For example, my son just turned three and has his own tablet. It’s an Amazon Fire Tablet and it is wonderful. Now I know people have these weird ideas about kids and “screen time” and how much damage it can do to kids… but that’s garbage.

A bit of time on the tablet is a godsend when you’re juggling a toddler and a baby. What is available on the tablet is incredible to assist in his learning too.

You see we don’t just let him brainlessly watch YouTube videos. Web videos are blocked. We don’t just let him play racing games or ridiculous fighting games… he’s got plenty of time for those when he reaches double digits.

No, all the apps he uses on his tablet are educational. They help him to spell, count, read, do maths, draw, paint, and yes that’s a mix of interactive gaming and digital books. For what it’s worth, something is working because he’s been able to read since he was two and a half.

There are a couple of apps that he absolutely adores. They are usually the first things he goes to when he’s allowed some “tablet time”. One in particular is the Very Hungry Caterpillar Play & Explore app.

Now we all know Eric Carle’s Very Hungry Caterpillar – it’s a kids’ book classic originally published in 1969, but it has stood (and will continue to stand) the test of time.

Now, there’s a range of educational apps that the Very Hungry Caterpillar guides the kids through.

For example, in one of the Very Hungry Caterpillar apps, the kids can do puzzles, plus learn about insects and plants. Another lets them do puzzles with shapes. Others help them with counting, painting and so on. There are songs, games… I won’t lie, they’re all, really good app and my son loves them.

Another app he loves is Miffy. Miffy is a Dutch story book character, a little bunny. In the Netherlands she’s known as Nijntje.

Anyway, with Dutch origins, our family sent the boys a “Nijntje” before we ever thought about letting them use a tablet. So when the Miffy app appeared on the tablet, my son was straight into it!

However, I noticed something about the Very Hungry Caterpillar app and the Miffy app. In the bottom corner of the app icons was a little sun. And I began to notice it on more and more of the apps that my son was using on the tablet.

It didn’t take me long to realise that this little sun (as you can see in the photo I took) and these apps were part of a company that – in mid-2021 – became part of a bigger company that I’ve had my eye on for some time.

I’m a big advocate of investing in what you know, what you use and what you’re familiar with (if it’s great). And when I consider the opportunities for apps in gaming, education and a future where they become more ingrained into the lives of our kids and their kids and generations to come… the decision is a no-brainer.

All this leads to a massive investment story and an opportunity that I believe is far too big to ignore any longer.

The $198.4 billion opportunity

Gaming forms an integral part of our everyday lives. As a child of the 1980s I grew up with gaming, with video games as a staple part of my existence. And it’s something that never leaves you. But my world went from 8-bit to augmented reality and immersive gaming in less than a generation.

My kids are digital natives. They only know a world now of augmented reality, immersive gaming and realism in gaming. In future, it may be hard for them to figure out what’s digital and what’s physical.

The way in which the children interact with games and educational content is crucial to understanding the market opportunity of the gaming industry.

At this point, I should point out that gaming in this context means any form of electronic gaming. Electronic gaming can take several forms, including console gaming, computer (PC) gaming, mobile gaming, educational gaming or futuristic metaverse-style immersive gaming.

Historically, gaming originated as a medium of entertainment. However, its purpose is quickly evolving. And more recently the benefits of educational gaming and content directed at younger digital natives have been realised and capitalised on.

As we are seeing, gaming is now being used to deliver educational content and connect global communities.

To understand the opportunity at hand here, it’s worth considering some hard numbers:

- According to Statista, there were 3.2 billion video gamers in 2021. That is, any individual who participated in any sort of online game. In all, that was more than 40% of the global population in that year.

- The gaming market was valued at $198.4 billion in 2021 and is predicted to be worth $339.95 billion by 2027.

- In 2021, mobile gaming (which includes tablet and smartphone gaming) accounted for more than half of the total value of the gaming market, with a valuation of $93.2 billion.

Looking at these statistics, one thing is very clear.

Globally, there is insatiable demand for gaming services, which is showing little sign of relenting.

As the world emerges from coronavirus lockdowns, some sceptics will say that gaming is going to come off the boil as people “get back into the fresh air”. However, your latest Frontier Tech Investor recommendation is ensuring that gamers keep on coming back for more.

Introducing your new Frontier Tech Investor recommendation…

Team17 Group (LSE: TM17) is a video game developer and publisher.

The company is an AIM-listed company on the London Stock Exchange. It has a market cap of £730 million and a current share price of 500GBp.

The company’s headquarters is in Wakefield, UK.

It has two game development studios, one of which being in Wakefield, and the other in Manchester. It also has a commercial centre based in Nottingham.

Team17 was founded in 1990, following a merger between UK publisher 17-Bit Software, games retailer Microbyte and Swedish game developer Team 7. It incorporated as Team17 Software Limited.

The company was born out of the 1990s gaming boom which saw the arrival of gaming consoles such as Nintendo’s Super Entertainment System and legendary games such as Super Mario.

After publicly listing in 2018, the company rebranded to become Team17 Group in 2018.

Each company in the original merger shared a single vision – to deliver unique gaming experiences for the Commodore Amiga 1000 computer.

This beast of a computer introduced us to the wonders of the internet for the first time in the mid 1980s.

Whilst the Amiga computer opened our eyes to this new digital world, it is also remembered for its ability to deliver the ultimate gaming experience through its arcade-quality visuals and sounds.

It became a target for game developers and fostered some of the most popular games of the times.

One of which was Worms – the games series created by Team17.

Worms was (and still is) one of the most iconic games series to ever grace our screens. If you grew up in the 1990s, you may recall the popularity and sheer mania behind the games at the time.

The Worms games are artillery-based, tactical video games where gamers have to eliminate enemy worms using weapons, with the winner being the “last man standing”.

If you have ever played any of them (like we have) you’ll know just how engaging and addictive the games are.

Team17 has built a strong reputation in the gaming world, based on the foundations laid from its flagship Worms games.

In fact, the games have been so popular over the years, that Team17 has managed to sell over 75 million copies of the Worms games since its inception. What’s more, around 23 versions of the game have been developed.

The latest version, released in 2020, is known as Worms Rumble. It’s a man-for-man combat game where 32 players go up against each other in an arena, with survival again being the ultimate goal.

Team17 isn’t just a one-trick pony, though.

To date, it has developed and released over 90 different games.

Some other popular games in its collection include The Escapists, Overcooked, and Sheltered. You can explore all of Team17’s games here.

In particular, Overcooked is a BAFTA award-winning game which requires gamers to work in teams to cook up a tasty meal for hungry customers before the time limit is up (and the hangry customers storm out).

Importantly, Team17 is keeping up with the times. That is, its games are now compatible with other contemporary technology platforms aside from just computers, including smartphones (in particular, Android and iOS, Apple’s operating system), gaming consoles such as Xbox and PlayStation and even as we explained earlier, kids’ tablets.

Team17 also works with independent gaming developers in 13 different countries around the world, helping it to stay relevant to global gaming audiences.

The beauty of Team17 is the simplistic and engaging nature of its games, which keeps gamers coming back for more. In addition, its games are suitable for a wide audience, with the minimum age restriction for gamers being 13 years old.

So, why are we taking a position in the company now?

As outlined above, the gaming industry is currently surging in size. The digital transformation which we are currently in the midst of means that it’s difficult to ignore the potential of a company such as Team17.

We’ve had our eye on it for a while, but the recent sell-off in technology-related stocks means that it’s at a level we can’t ignore, even though the company is a lot bigger than what we are used to here at Frontier Tech Investor.

As you will see, the company is on the cusp of realising further growth potential: it is looking to build on its legacy, which was born out of the 1990s gaming boom.

Sunny apps and controversial games

Team17 makes money by selling its games to customers. Its games can be purchased on its very own games store or through major gaming retailers such as Game.

For the year ended 31 December 2020, Team17 recorded revenues of £83 million. This is a 34.3% increase on 2019.

In addition, Team17 recorded an operating profit of £26.2 million for the 12 months ended 31 December 2020. This is 37.9% increase on the previous year.

What’s more, the company has a very healthy cash position. It currently has £61.5 million in cash and cash equivalents.

In part, Team17’s strong figures were driven by lockdown restrictions, with people being stuck at home and turning to gaming as a means of entertainment.

However, despite restrictions easing, Team17 still continues to produce positive results.

For example, for the six months ended 30 June 2021 (H1), revenues were £40.1 million, which is a modest 3.4% increase on the same period in the previous year.

Even though the gaming boom spurred by lockdowns may have cooled off a little, Team17 still looks primed for further growth.

In part, this is due to a $26.5 million acquisition of Irish app developer StoryToys, in July 2021.

StoryToys creates educational games for children under the age of eight and has collaborated with several leading children’s brands including Disney and Pixar.

The little sun on the apps that our son loves so much is the icon for StoryToys. Every time I see an app with that little sun, it’s from StoryToys, which is now part of Team17.

Without his – or (up to now, my) – realising it, the most used applications my son has on his tablet are also a part one of the most exciting gaming companies on the London Stock Exchange.

The StoryToys acquisition is significant because it moves Team17 into another exciting area of the gaming world: educational gaming. It could also open Team17’s other apps up to StoryToys’ clients and generate further commercial opportunities.

Educational gaming has soared in popularity over the past two years. In particular, with schools being shut during lockdowns, it became arguably the only viable source of education for children.

In fact, the educational gaming market is predicted to increase ten-fold between 2019 and 2027, rising from $9.20 billion to $88.11 billion.

Even as children return to school, educational gaming is here to stay. It’s not only a source of entertainment, but also, an engaging way to deliver otherwise mundane content which helps children to retain knowledge.

What’s also exciting is that the company recognises the potential of another popular, yet lucrative area of the gaming market: non-fungible tokens (NFTs). However, Team17’s recent exposure to NFT gaming is a little controversial to say the least…

NFTs are digital assets which are encrypted by immutable code. They can represent almost any object, ranging from artwork, pixelated characters and even NBA basketball footage.

On 31 January 2022 Team17 announced an NFT project called MetaWorms, based upon its flagship Worms games series.

However, the new project faced huge backlash from Team17 stakeholders and partners and was cancelled the next day.

The brunt of this backlash came from external partner Aggro Crab, an indie game studio based in Seattle, in the United States.

In a statement, Aggro Crab noted:

We at Aggro Crab condemn Team17’s decision to produce and engage with NFTs. We believe NFTs cannot be environmentally friendly or useful, and really are just an overall f****** grift.

Here, Aggro is referring to the unsustainability behind cryptocurrency mining, which obtains cryptos that are then used for NFT purchases.

In our view, it’s a massive overreaction from Aggro (its business name isn’t lost on us given its reaction).

As we speak, crypto networks are taking great measures to become more sustainable, whether that be switching from a proof-of-work to proof-of-stake consensus mechanism (for example, Ethereum) or using renewable energy when mining crypto (as fellow Frontier Tech Investor holding Argo Blockchain (LSE: ARB) is doing).

Frankly that backlash is an example of how misunderstood the NFT market is and how so many are quick to jump to conclusions without proper understanding about what they’ve decided to decry.

Nevertheless, Team17’s flirting with NFTs is, we believe, a recognition that it’s open to new ideas and opportunities. We expect that Team17 will circle back to NFT gaming and the opportunities that lie within that emerging sector.

All that said, it’s important to consider the risks this company faces.

Risks

There remains a question mark as to whether the gaming industry will sustain the rate of growth it has seen over the lockdown period. With people returning to normal life, other means of entertainment may become more desirable.

Judging by Team17’s H1 2021 revenues figure, which were only 3.5% higher than H1 2020’s figure, this may already be apparent.

In addition, the rise of blockchain gaming could weigh heavily on Team17’s success if it is not adaptable to this emerging sector of the market.

Blockchain gaming is online gaming hosted on decentralised platforms (for example, crypto networks) which incorporates digital assets such as NFTs into the games.

It has soared in popularity in line with the arrival of crypto in mainstream financial systems.

According to Grit Daily, the blockchain gaming market was worth around $3 billion and is expected to grow to around $39.7 billion by 2025, equating to a compound annual growth rate (CAGR) of 90.7%.

In contrast, the traditional gaming market is due to grow at a CAGR of just 12.4% over the same period, according to research firm, Research and Markets.

To mitigate this, Team17 may re-consider its plans to move away from the blockchain and NFT space. Clearly, it has some intention to move into it after the Meta Worms project – it’s just a case of whether this can be executed in a way that aligns with its stakeholder interests.

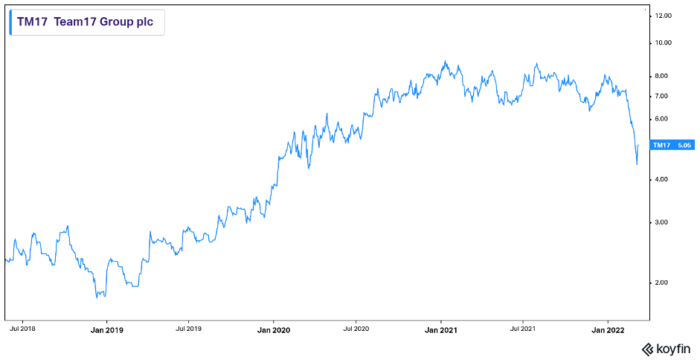

Furthermore, recent market conditions have seen a large sell-off in tech companies both in the UK and on US markets. Team17 hasn’t been spared.

In fact, the share price hit a 52-week high of 870GBp in the middle of 2021. And, year-to-date, the price has fallen from around 800GBp to its current 470GBp or so.

Fundamentally the company is strong, robust and part of a market that in our view is only heading in one direction. Team17 is able to partner with game developers and bring into the company acquisitions that add value to the company as evidenced with StoryToys.

The long-term prospects for the gaming market are still strong, and Team17 is a major player in game development and publishing. We believe that current market conditions merely provide us with an attractive opportunity to enter a great, profitable stock at a comparatively low price.

Action to take

Team17 is an AIM-listed company on the London Stock Exchange. It has a market cap of £680 million and a current share price of 470GBp.

The average daily traded volume is around 280,000 shares per day, which equates to £1.44 million in value.

We’d say that this is a fairly liquid stock, meaning the price should stay relatively stable upon recommendation.

Nevertheless, it’s important to be wary of any volatility, especially at a time where financial markets are very sensitive to ongoing geopolitical events.

With this in mind, please remember to stick to our buy limits. If it moves above, the stock is a hold, and if it moves below, it is a buy.

Action to take: buy Team17 (LSE: TM17), current price 500GBp. Buy up to 565p. As a reminder, we are doing away with stop losses altogether, to save us getting stopped out unnecessarily of stocks that have solid long-term potential. So, please ensure to manage risk accordingly, and stay up to date with our advice on any action to take.

Name: Team17

Ticker: TM17.L

Closing mid-price on 10.03.22: 500p

Market cap: £730.33m

52-week high/low: 870p/204p

Buy up to: 565p

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor