Stock Alert: the Revenge of Geoffrey Dummer – how to profit from “chipageddon”

11th February 2021 |

In 1952, a British engineer named Geoffrey Dummer flew across the Atlantic to Washington, DC.

He was visiting to deliver a presentation at the symposium Progress in Quality Electronic Components about what would become a civilization-changing technology.

Dummer had been working at the Telecommunications Research Establishment (TRE), a high-level British think tank and science research institute based in Malvern, UK.

The TRE had become famous during World War II for its pioneering work on developments in radar technology.

Only the smartest scientist in Britain worked at the TRE. Dummer was one of them.

His presentation in Washington was about the integrated circuit. His explanation would later become widely regarded as the first discussion of what today is almost as common – and essential – as the air we breath and the water we drink.

The smart devices in your pockets, the TV in your living room, the old “vintage” radio on the shelf, even the computer you’re reading this report on, the very fabric of modern society is all built upon Dummer’s work.

But unless you’re a science geek, you’ve probably never heard of Dummer. That’s because his own government, and military, didn’t see the extraordinary potential of the integrated circuit.

Speaking about it later in his years, Dummer said,

“The plain fact is that nobody [in Britain] would take the risk. The Ministry wouldn’t place a contract because they hadn’t an application. The applications people wouldn’t say we want it, because they had no experience with it. It was a chicken-and-egg situation. The Americans took financial gambles, whereas this was very slow in this country.”

The financial gambles the Americans would take paid off, big time.

A few years after Dummer’s presentation in Washington, in September 1958, a man named Jack Kilby at a then small technology company called Texas Instruments would go on to demonstrate the world’s first working integrated circuit.

Six months after that, Robert Noyce, co-founder of Intel, developed the integrated circuit with integrated interconnect, another massive leap forward in semiconductor technology.

Kilby later received the Nobel Prize in Physics for his work. Even now, it’s Kilby who’s considered the inventor of the integrated circuit.

But it’s simply not the case. He was merely building on work done before him. Work pioneered by Geoffrey Dummer, the British engineer from the TRE in Malvern.

Today, Texas Instruments is a semiconductor manufacturer with a market capitalisation of $160 billion. Intel is a chip giant that is valued at nearly a quarter-trillion dollars.

The US dominates the global semiconductor industry.

Slow, but not too late

In 2018, the US accounted for around 45% of the global semiconductor industry. From there, Asia fills the bulk of the rest of the manufacturing. Korea accounts for about 24%, Japan 9%, Taiwan 6% and China 5%.

The inaction of the British back in the 1950s set them back half a century.

However, while slow to the party, the British weren’t too late. In fact, one of Britain’s greatest manufacturing success stories is a semiconductor company, ARM Holdings.

In 2016 Japanese tech giant SoftBank purchased ARM for $31.4 billion. And last September, 69 years after Geoffrey Dummer laid the foundations of the industry, it was announced that tech giant Nvidia would buy ARM from SoftBank for $40 billion.

And I believe there’s another company here in the UK, based in and founded in Cardiff, that holds the key to the next leaps forward in the global semiconductor industry.

A company listed on the AIM with a market cap of £634 million and the potential to become one of Britain’s most important technology companies.

A semiconductor company that took a derelict, unused facility originally built for LG Semiconductors and turned it into a semiconductor materials “mega-foundry”.

Note: a semiconductor foundry is the place where semiconductors and semiconductor materials are made. A mega-foundry is a really big one!

This company could in time become the “next ARM” – a global success story of the British semiconductor industry.

Its work, and this opportunity, couldn’t come at a better time too.

You see, right now the world is in the midst of what’s been described as “chipageddon”.

This is a global semiconductor and microprocessor shortage. A shortage that we’ve never seen before and which is crippling supply chains across the world.

In fact, this global supply shortage is so bad that General Motors has already shut down three plants in North America and even just recently extended the shutdown.

The company simply cannot get semiconductors that are a critical element of all the new cars it assembles.

GM isn’t alone. Volkswagen, Fiat Chrysler, Ford, Nissan and Honda are all being affected by “chipageddon”. Volkswagen has also adapted production numbers. Ford has also shut down an entire production facility. Honda is going to produce 4,000 less cars because of it. Fiat Chrysler is scheduling “downtime” at a Canadian plant.

It’s a critical time for companies that rely on semiconductors for their products. Critical and possibly about to get worse. Demand for semiconductors is only skyrocketing. Connected cars, autonomous systems, “smart” cities, global 5G network rollouts – these are all heavy semiconductor consumption industries.

They desperately need more and right now. Even with the weight and size of the semiconductor manufacturing industry in the US and Asia, it’s just not enough.

That’s why Nvidia inked a deal to buy ARM in September 2020 – it sniffs a massive opportunity in the semiconductor industry.

It’s also why I’m now recommending to you one of Britain’s most promising semiconductor companies as “chipageddon” sets in and creates immense demand for semiconductors globally.

Introducing your latest Frontier Tech Investor recommendation…

IQE Plc (LSE:IQE) is listed on the AIM sub market of the London Stock Exchange with a market cap of £634 million and a current stock price of 79.20 GBp.

IQE is a semiconductor company. It provides advanced semiconductor materials to the semiconductor industry. In particular, it manufactures semiconductor wafers, known as “epiwafers”, which are a key part of electronic and photonic components.

The company has been around for over 30 years and has built up a strong portfolio of intellectual property, with over 175 patents. It invests in research and development and has global manufacturing capacities across the world from the UK (Wales) through Asia and the US.

IQE’s key business units are wireless technologies and photonics. But it also has development in emerging areas such as energy and power, and silicon integration with compound semiconductors.

Some of the markets that IQE serves includes wireless applications from smartphones and “smart” devices to WiFi and, importantly, 5G technologies. IQE also finds its products in military and defence systems using infrared and sensing technology and even solar energy cells.

It’s the rise of 5G and connected technologies that I believe presents the immediate opportunity for IQE. Furthermore, as the world expands into more autonomous systems, with systems required to “see and sense” their environment, the importance of IQE products will be ever more important and relevant.

Consider the complexity of an autonomous delivery vehicle. For a start the vehicle itself requires an immense number of processors and semiconductors to ensure it can “see” the world around it. It must be able to safely navigate the world using technology such as LiDAR, radar, camera systems, audio systems, and then processors to control speed, cornering and function of its doors, boot, whatever it has.

It also then needs to wirelessly connect to infrastructure around it. It must be able to send data so that the operator knows where it is and what it’s doing. The wireless towers it links to also link to other wireless systems. Which connect to central operating networks, which also have processors and computers to manage entire fleets.

You start to think about smart cities, smart infrastructure, all wirelessly connecting, then the people in those environments, with connected devices, wireless data, augmented reality, smart and green energy grids.

The simple fact is that everything in our world has a growing need for technology that at its foundation requires semiconductors, microprocessors, chips and al the materials and technology that goes into those.

It’s a supply chain that’s complex, ever expanding, increasingly critical and that at the core root of it all, is a company like IQE as a major supplier to the electronics and semiconductor industry.

Against the backdrop of what is a never ending supply squeeze, it presents a great opportunity for investors in the current state of global technology to buy a slice of a British semiconductor company.

The reason why I believe IQE is perfectly positioned now is the fact that in September 2019 it competed the construction of its “mega foundry” in Newport, Wales.

This facility is 350,000 square feet of space over three floors. That’s the equivalent of four and half football pitches of space with a 10X potential for scale to meet increasing demand.

In other words, IQE has got one of the most state-of-the-art semiconductor foundries in the world, down in Newport and with the capacity to increase production 10-times over.

IQE is ready to meet the increase in demand that’s coming for semiconductors.

The company also sees the opportunity in these connected systems as a major driver of growth. In particular the 5G opportunity.

It has identified 5G base stations, 5G infrastructure, high-speed datacoms and augmented reality applications in smart devices as shorter term opportunities. Over the next few years that expands further with 5G infrastructure, 5G handsets, further augmented reality expansion, smart girds, sensing technology such as LiDAR and environmental and health technologies.

The company is also a supplier to major global companies like Raytheon and BAE Systems, having received supplier awards in 2020 from both companies. Furthermore, the Newport mega-foundry is already in production, as the company explains in a company presentation, for an existing “large OEM” and a “major chip customer in Android [smart device] supply chain.”

IQE taps all major areas of global technology that I see as some of the biggest tech trends of the next decade. Autonomous systems, 5G, sensing systems (eg, LiDAR), wireless connectivity, M2M communications, robotics, telehealth and smart grids.

Every aspect is an area that IQE supplies. It is entrenched in the global supply chain for semiconductors. It is in a position to capitalise from “chipageddon” and it’s financially heading in the right direction, even after the events of the last year.

Financials, risks and action to take

In the 2020 year, IQE expects revenues to be £178 million. That’s a rise from £140 million in 2019 and over 27.1% year-on-year growth. IQE also had free cash flow of £18 million ending in a net cash position for the end of the year.

As CEO Drew Nelson noted in a trading update last month,

“IQE has achieved real strategic progress over the past year with excellent results. I am extremely proud of our strong financial and operational performance in 2020, which represents a record revenue performance for IQE.”

The group also expects the full-year 2020 results to show a significant reduction in net debt from £16 million in 2019 to “low-single-digit £m.”

We don’t yet have the full figures for the full 2020 year. But it’s on that basis that my recommendation is coming now. I’m expecting those numbers to be better than expectations in the market and better than the 2019 year. However, it’s worth noting it hasn’t been all smooth sailing for the company in the last couple of years.

In 2019 the company lost two key customers. This had a significant impact, which saw revenues drop from its 2018 and 2017 full-year numbers. IQE’s 2019 difficulties also pushed the company into a net loss, whereas the four years prior it was profitable.

Will IQE record another net loss for the 2020 year? It’s possible, likely even. However, I still expect a marked improvement from 2019.

This is due to the global demand building and the shortage of semiconductors the world is currently facing.

At the end of November 2020 IQE also picked up its “largest Military & Defence sector purchase order to date from a major US customer.” That indicates a company that’s getting back on track and is globally recognised for its capabilities.

IQE has already noted in the trading update that it has achieved record revenues in 2020. It has also focused on cost controls in 2020 and picked up significant contracts. My view is that with a solid 2020 year against difficult economic and global conditions, this will be a spring board for IQE as the world moves out of those difficulties.

Additionally, as we know there is a global “chipageddon” unravelling and causing havoc, the demand for semiconductors, and the companies involved in the entire supply chain, will only increase.

However, there are other risks involved with the company as well.

While I expect through 2021 IQE to pick up more new orders, deals and see an increase in 2021 on its 2020 record numbers, there’s a risk of losing contracts too as evidenced by its 2019 year.

There’s also some geopolitical risk too. As we know in 2019 it was a particularly tumultuous period with US/China trade tensions causing havoc in global supply chains. This no doubt impacted IQE. With a new US government, that appears to be relatively China friendly, and the sheer demand for semiconductor technologies, I don’t envisage that geopolitical headwinds will be as significant to IQE in the coming years as it has been in the past.

While the pandemic continues it has had little effect on IQE; if anything, it has reinforced the importance of its products and position in the global supply chain for semiconductors.

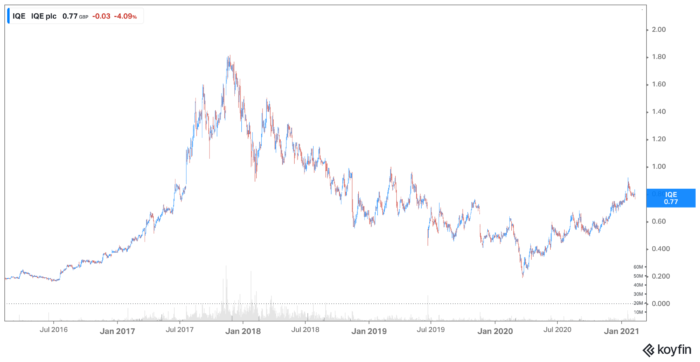

Finally, you will note the company’s stock price peaked in late 2017 and then until March 2020 was in a downward spiral.

I believe IQE has steered the ship back in the right direction and is now heading back to previous heights. As I said, 2019 was a troublesome year for the company. But in 2020 it has proven to be resilient and important to the future technologies of our world.

The stock price has rallied since March 2020 and I believe will continue to do so, even reaching and surpassing its 2017 five-year highs.

Buying instructions

IQE Plc (LSE:IQE) is listed on the AIM sub market of the London Stock Exchange with a market cap of £634 million and a current stock price of 79.20 GBp.

It’s a larger stock than I’d normally look to bring you, but with “chipageddon” setting in, I believe it is a critical company in semiconductor manufacturing that is at a perfect point to invest in.

Being slightly bigger, IQE is also widely traded, with volumes averaging around 2.8 million shares per day. That should make the company piqued enough for you to get a position at a reasonable price within our buy limit.

While our recommendation may bump the price slightly, I’m not expecting a massive jump that takes it outside our buy limit.

Even still, if it does, then ensure you stick to our buy limits and don’t overpay for the stock.

Action to take: BUY IQE Plc (LSE:IQE). Current price 79.20 GBp. Buy up to 89 GBp. Use a trailing stop/loss set 50% below your entry to protect potential downside market volatility.

Name: IQE Plc

Ticker: IQE LN

Price as of 11.02.21: 79.20 GBp

Market cap: £634.22 million

52-week high/low: 91.75p/18.86p

Buy up to: 89p

Source: Koyfin

Source: Koyfin

Regards,

Sam Volkering

Editor, Frontier Tech Investor