Stock Alerts: reversing 30 years of drift on nuclear power

24th March 2022 |

The term “false promise” is relevant to energy markets right now.

Following the COP26 climate summit talks in November 2021, we were promised a greener and cheaper future of energy by policy-makers.

What do they take us for?

The only thing we’re getting right now is soaring energy bills and an obvious realisation that the only meaningful energy policy is one that relies on domestic energy generation.

For example, from 1 April 2022, a price cap is being implemented which could see the price of gas and electricity (combined) rise from £1,277 per year, to £1,971 for the average UK household.

That is the theory.

The practice is different.

Here’s my (Sam) household gas tariff from November 2021:

![]()

And the electric tariff from the same period:

![]()

That was the final month of my previous energy deal.

We moved on to the cheapest deal our energy provider had to try and keep costs down… We thought that our bills would stay roughly the same.

How wrong we were.

Now look at the new gas tariff…

![]()

… and the new electricity tariff:

![]()

That’s a 174.6% increase in gas costs and 85% rise in the cost of electricity!

Together, it’s more than doubling the overall power bill – assuming that actual usage remains the same.

This isn’t a by-product of recent geopolitical conflict. This has been in the making for over 18 months.

What the events in Russia and Ukraine have achieved, though, is to open everyone’s eyes to the fact that reliance on other countries for energy is a policy that can produce domestic disaster.

Russia accounts for around 40% of the European Union’s gas supply. Although the UK only gets 5% of its gas from Russia, it could still be vulnerable to higher prices due to the inter-connectiveness of global energy markets.

In fact, according to analysis of government data by think tank ECIU, energy prices could rise to £3,000 per annum in October 2022, which is almost triple the current price of gas and electricity bills.

There has to be a better way forward for the UK.

Thankfully, there is.

Energy’s “dirty” little secret

The UK government‘s headline-making policy of net zero carbon emissions by 2050 seems very powerful in principle.

But what most people don’t recognise is there’s a massive caveat to “net zero”. All bets are off if the security of Britain’s energy is under threat.

All net zero policies are, in the government’s words, “… subject to security of supply.”

The need for energy independence is more important than the need to achieve net zero.

This isn’t some conclusion we’ve come to. It is etched in the detail of the net zero policies themselves.

Our view is that energy independence will become the most powerful political policy of the 2020s.

It is the need to generate energy at home so that regardless of what happens outside your borders, you secure your entire energy supplies at home.

In a country like the United Kingdom, there will be a number of ways forward to energy independence. But there is only one way to achieve it without burning the natural environment to the ground or polluting the air to Beijing-style levels.

There is actually a clean, green and cheap way forward for energy in the UK. It is perceived to be dangerous and dirty. However, the perception is wrong.

The way forward to the UK’s energy independence is nuclear power.

Up until now, the world has underestimated the potential of and need for nuclear power.

In comparison to fossil fuels, nuclear is a cheaper, lower carbon energy source and contrary to the misinformed narrative, is a highly reliable source of energy.

For instance, it can be generated anywhere at any time, and even beats other renewable sources such as solar and wind power because it doesn’t need the sun to be shining or wind to be blowing.

Also, nuclear energy is capable of producing larger amounts of energy than fossil fuels.

It is estimated that the amount of energy released in a nuclear fission reaction (the process in which uranium atoms are split to create nuclear energy) is ten million times greater than the amount released when burning fossil fuels.

However, there’s also no doubt that nuclear energy has some negative connotations in the public domain. Nuclear is a dirty-word to the general public.

Why? Well, it’s quite simple. Misinformation.

Planes, cars and nuclear meltdowns

Statistically you’re more than likely to die in your daily commute than from a plane crash.

So why are so many more people afraid of flying than riding in a car?

The visceral images of a plane crash are dramatically worse than a car crash. A burning plane in pieces loaded with hundreds of people is a far more terrifying thought than a car with four occupants.

In the United States the odds of dying from a car crash were 1 in 101. The odds from dying from a dog attack were 1 in 69,016. The odds from dying in a plane crash were, “too few deaths to calculate odds”.

Yet it’s estimated around one in every three people have some level of a fear of flying.

Why? Perception. That’s it. It’s simply the perception of danger that’s more dangerous than the activity will ever be.

This is exactly the same problem with nuclear energy. The perception of danger and disaster is far greater than the reality. This perception has driven public policy on the sector for decades.

People still have lingering fear from the infamous Chernobyl nuclear disaster of 1986 which indirectly killed around 4,000 people. The hugely popular Chernobyl TV series on Sky didn’t help public perception of nuclear energy either.

In addition, security fears have been reignited from Russia’s recent attack on Ukraine’s Zaporizhzhia Nuclear Power Station on 4 March 2022. The malicious headlines threatening impending nuclear disaster only reinforced negative and incorrect perceptions.

According to the World Nuclear Association, only two major nuclear accidents (Chernobyl and Fukushima Daiichi) have occurred in over 18,500 cumulative nuclear reactor years.

Perception: nuclear power plants are dangerous.

Reality: they’re not. They’re the cleanest, greenest way for the UK to achieve energy independence.

Reality is sinking in, in the form of skyrocketing energy prices. People can see that government promises for cleaner and cheaper energy and a world of “net zero” is going to end up in a failed promise.

People want action from the government and are getting it. The UK government is “reversing 30 years of drift,” on policy that we believe is going to be the single most important factor for the energy independence of Britain.

In our opinion, nuclear energy is the only way that the UK can take back control. It’s our view that it’s the smartest, most lucrative opportunity in the UK market today.

This is why we’re bringing you two new stocks that can help Britain achieve energy independence.

25 May 2022: the most important date in Britain’s energy history

While nuclear power is critical to energy independence, it’s also one of the cleanest and greenest sources of energy in existence.

In fact, nuclear power could make ambitious “net zero” targets not so far-fetched. Nuclear power could single-handedly help Britain be energy independent and achieve net zero targets by 2050.

Tom Greatrex, chief executive of the London-based Nuclear Industry Association, said, “We can’t get to net zero without investing in new nuclear capacity, and this is a clear signal from government to investors that it sees nuclear as essential to our clean energy transition.”

Currently, the UK has two major nuclear energy projects in the pipeline. These, we believe, will inject new life into the UK’s transition towards nuclear energy independence and net zero.

These two large-scale nuclear power plants could help set the nuclear power agenda correctly back on its rails and provide an impetus for a select group of UK-listed nuclear-related stocks.

Hinkley Point C in Somerset is a £23 billion nuclear power station, due to “come online” in 2026. It will account for around 7% of the UK’s total energy supply.

Equally as huge and important is another – Sizewell C, planned for Suffolk.

It is a proposed £18 billion nuclear power station project, subject to government approval and a “Final Investment Decision”.

However, it’s clear the government is already quite well along the road with Sizewell being the large-scale nuclear power station of choice.

The government recently threw £100 million to, “… support the continued development of the Sizewell C project in Suffolk.”

According to the government’s press release,

If built, Sizewell C would power the equivalent of around 6 million homes, as well as supporting up to 10,000 jobs in Suffolk and across the UK.

According to Statista, electricity generation from nuclear power in the UK will double from 2025 to 2040, rising from 43 terawatt hours to 86 terawatt hours.

It is clear that existing nuclear power and upcoming massive large-scale projects, like Hinkley Point and Sizewell, are crucial to that trend.

However, in our view while this might seem like a long-term investment story as Britain embraces nuclear energy to achieve energy independence, it is a decision that’s scheduled to drop no later than 25 May 2022 that could send the nuclear industry and a select group of stocks into the stratosphere.

You see, the National Infrastructure Planning department, through the secretary of state, has to issue a decision on the Sizewell Point C project by 25 May 2022.

On 18 March 2022 the project approval process noted that:

The Secretary of State for Business, Energy and Industrial Strategy has today requested information from the Applicant, the Environment Agency, the Marine Management Organisation, Natural England and the Office for Nuclear Regulation. The deadline for response is 23.59 pm on 1 April 2022

This information request is primarily focused on the water supply and environmental impact of construction. With any concerns allayed, the secretary of state is expected to decide on Sizewell Point C by 25 May 2022.

We expect the information to be provided, with any concerns addressed. In short, we fully expect that Sizewell Point C will be approved. We expect it to be headline news – that will change the perceptions of nuclear power in this country.

We expect it will send two UK listed nuclear stocks skywards.

Introducing your first way to play the nuclear energy independence of the UK…

Yellow Cake PLC (LSE:YCA) is a physical uranium-holding company, offering direct exposure to the spot price of uranium without exploration, development, mining or processing risk.

It is an AIM listed company on the London Stock Exchange. It has a market cap of £683.26 million and a current share price of 383.5GBp.

The company was incorporated in St. Helier, Jersey, in 2018.

Yellow Cake gets its name from the colloquial term “yellowcake”, referring to the physical appearance of uranium oxide, U3O8 (its chemical compound).

U3O8 is a vital ingredient in the generation of nuclear power. It’s obtained through mining and processing and is then manufactured into fuel pellets contained within fuel rods that are then used in the reactors.

The whole process of splitting atoms to generate nuclear energy and the creation of nuclear power is highly scientific. But the critical mineral needed is uranium of suitable purity. And with nuclear energy being the pathway forward for energy independence and achieving net zero, in our view companies like Yellow Cake which have direct exposure to uranium make for the perfect investment.

Yellow Cake’s business model is quite simple.

It accumulates physical uranium oxide and has no other operating assets. In doing so, it provides investors with direct exposure to uranium, without the risks that come with exploration, mining, developing or processing of uranium.

The company has a major commercial partnership with NAC Kazatomprom JSC (formerly Kazatomprom), the world’s largest producer and seller of uranium. It gives Yellow Cake unfettered access to large hoards of uranium at globally competitive prices.

The terms of the contract are also simple.

Yellow Cake and Kazatomprom agree a fixed price for the uranium oxide to be purchased. Crucially, a price is agreed and locked based on the “prevailing spot price at the time Yellow Cake elects to make a purchase”, shielding it from price volatility and ensuring it can maximise its profit margins.

Under the current terms of the agreement, Yellow Cake has the right to purchase up to $100 million per annum worth of uranium oxide up until 2027.

The basic idea is that Yellow Cake buys X amount of uranium oxide with the anticipation that it will appreciate in value. So that (up to) $100 million worth of uranium oxide brought at a specific time might be worth $120 million later (or more).

Also, while significant, this agreement also doesn’t prevent Yellow Cake from buying from other sources either.

Rise in U3O8, rise in Yellow Cake

As explained, Yellow Cake has no operating assets other than its stockpile of uranium.

With this in mind, we are particularly interested in the net asset value of the company. In other words, the value of its inventory minus its liabilities.

The value of Yellow Cake’s holdings and overall business is largely dependent on the uranium spot price. Currently, the spot price of uranium is $59.15/lb.

This time a year ago, the spot price of uranium was $27.7/lb, meaning it has almost doubled in the space of a year.

Yellow Cake currently holds 18.8 million lb of uranium oxide. That’s roughly 8,527 tonnes of uranium oxide, the equivalent of 45 empty Boeing 747 jumbo jets. It also means the current value – on the basis of the spot price – of all that uranium is around US$1.1 billion (£833 million).

So just looking at the net asset value alone, and Yellow Cake’s market cap (around £778 million) you can see the company is trading at about a 10% discount to its net asset value.

In short, this is a play on the long-term price of the uranium commodity soaring higher on an increase in demand long term with constricting supply.

This is hugely exciting and makes its current share price of 420GBp still undervalued when you consider the direction the uranium market is heading.

Yellow Cake managed to raise $150 million across three separate share placings throughout 2021. In part, these funds have been used to increase its uranium oxide holdings to the 18.81 million lbs total.

The large proceeds raised show the strong investor interest in the company and the uranium market, which from an investor’s perspective, is hugely encouraging to see.

It’s also reassuring to note that Yellow Cake is currently debt free.

In addition, as it grows its uranium holdings, Yellow Cake is effectively taking uranium oxide off the market. In doing so, the supply squeeze could lead to further rises in the uranium price if there is also high demand.

That said, it’s important to consider the risks.

Risks

Yellow Cake’s valuation is strongly correlated to the spot price of uranium.

So, if there is a downturn in the uranium market, Yellow Cake’s valuation will almost certainly fall.

In particular, if the nuclear energy boom that we are anticipating doesn’t materialise, the demand and price for uranium will drop. We’ve seen uranium booms and busts before, and the busts are not pretty.

Yellow Cake is currently subject to geopolitical risk through its main contractor, Kazatomprom.

In its native Kazakhstan, civil unrest unfolded on 2 January 2022 in relation to sharp increases in fuel prices. A two-week state of emergency was subsequently declared, with the country being brought to a standstill.

Although this was over two months ago, Kazatomprom has stated that supply chain disruptions could occur, thereby affecting Yellow Cake’s supply line of uranium oxide. According to Yellow Cake, it is “closely monitoring” the situation.

So, even though one of Yellow Cake’s unique selling points is the fact that it comes without exploration or mining risk, the geopolitical risk is one that still remains.

Yellow Cake’s bumper contract with Kazatomprom will be coming to an end in 2027. If the two companies fail to agree a new contract, the security of uranium oxide supply for Yellow Cake will be under threat and may lead to a drop in uranium holdings.

It’s also worth noting that in order to fund several of the purchases, Yellow Cake undertakes capital raises through the market. Typically, capital raises can dilute holdings. In the case of Yellow Cake, this would only happen if it were paying a premium for the uranium oxide that it is buying.

Also, in terms of the wider nuclear industry there may be lingering public concerns about the safety and viability of nuclear power as an energy source. The treatment of nuclear energy waste is still something that holds back the industry: this is in spite of perceptions being a lot worse than the reality.

According to Statista, nuclear energy will consistently account for 9% of the world’s final energy generation mix through the 2025-2040 period. This suggests that the transition to nuclear power could be gradual.

However, as outlined above, attitudes towards nuclear energy are changing. And we could very well see a resurgence in the nuclear energy industry right here in the UK in the context of a greater focus on energy independence.

Yellow Cake provides a simple yet potentially lucrative avenue into the nuclear energy market with direct exposure to the price of uranium. If we’re right about the prospects for nuclear energy, the value of the stockpile should rise.

Action to take: BUY Yellow Cake (LSE: YCA). Current price of 426GBp. Buy up to 500GBp.

Name: Yellow Cake

Ticker: YCA.L

Closing price as of 24 March: 426p

Market cap: £778.77 million

52-week high/low: 454.50/238.5GBp

Buy up to: 500GBp

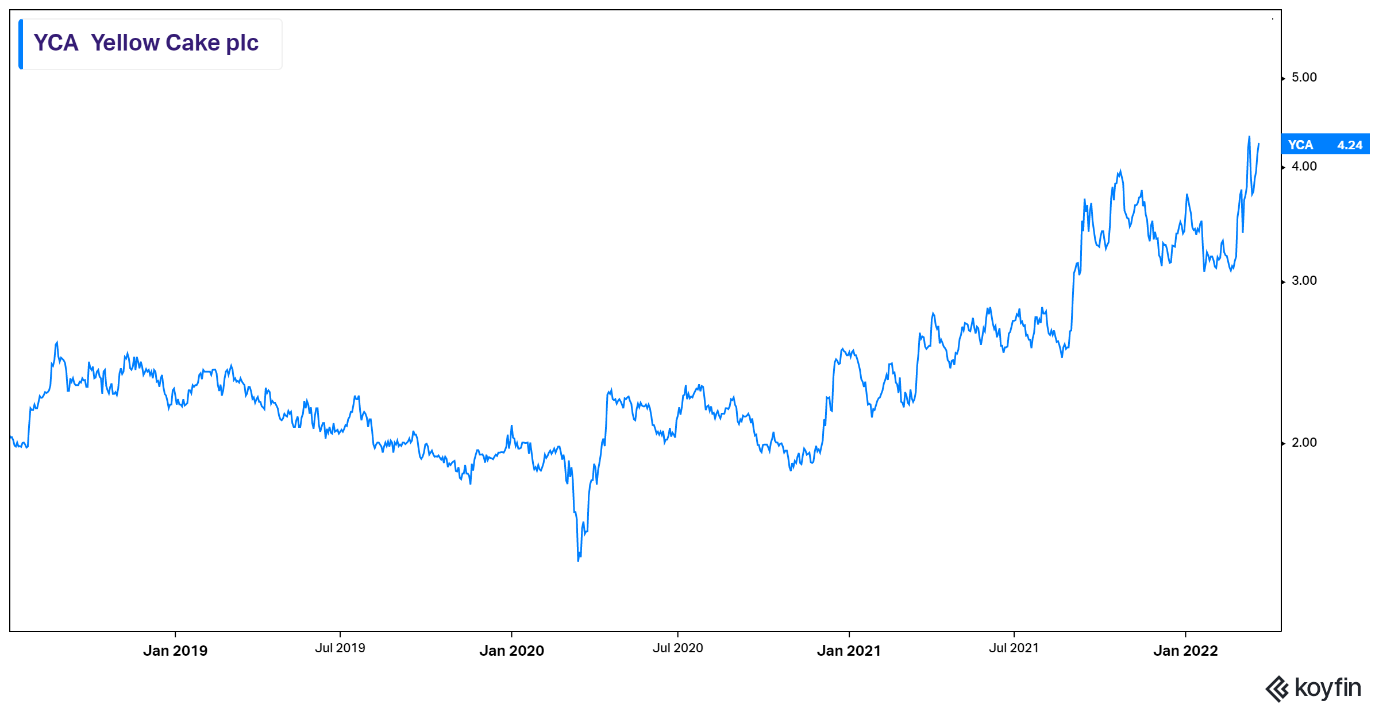

Performance since listing. Source: Koyfin

Performance since listing. Source: Koyfin

Now, we said we have two plays to ride Britain’s nuclear energy independence. The first as a direct exposure play to uranium. The second, a little riskier, but equally as exciting as Britain nuclear future really takes off.

So, what’s…

… your second way to play to play the nuclear energy independence of the UK?

Aura Energy (LSE: AURA) is an Australian-based mining company that focus on the exploration and production of uranium and vanadium.

Based in Melbourne, Aura Energy is dual-listed on the Australian Stock Exchange and AIM of the London Stock Exchange. It has a market cap of £68.97 million and a current share price of 15.50GBp.

As is the case with many mining companies, Aura Energy is a high-risk mining company that is aiming to go from being an explorer to becoming a producer – a task that is by no means an easy feat.

One of the riskiest aspects of the life cycle is the discovery and exploration phase. However, if a successful deposit is found, and a company can prove the commercial validity of the mine, and fund it through to mining, extraction and production, the overall risks are significantly reduced.

This is why we believe it’s a perfect time to bring Aura into the mix as it makes that transition from explorer to potential production. It has the proven resource. It has signed offtake agreements. It is now in a position, after a recent capital raising, to commence engineering and to move towards an ultimate decision to mine in Q4 this year.

We anticipate that the decision will be to go ahead with mining. We see that as being a major catalyst for the company. That is why we want to position in the stock now, in anticipation of that decision and while the uranium market continues to soar higher.

Where’s its uranium?

Aura Energy’s main project is the Tiris project based in Mauritania, Africa. As its primary site, a lot of Aura’s success hinges on that project’s development.

A feasibility report of the project first conducted in 2019, and updated in August 2021, found some key findings:

- Estimated production of 12.4 million lbs of uranium oxide over 15 years, with the potential to produce more. For context, the whole Tiris project area is said to contain 56 million lbs of uranium oxide.

- The total project should produce $214 million in cash after taxes. However, bear in mind this was calculated at August 2021 uranium market prices, which were hovering between $30-$35/lb.

- All-in sustaining cost (AISC – including capital and variable costs) is $29.81/lb of uranium oxide. With uranium oxide currently at $51.25 and looking set to head higher, profit margins for Aura will likely grow.

What makes Tiris a standout from other mining projects is that it needs low capital expenditure.

For example, the project area is flat, low-lying land with a depth of resource between one and five metres. In the scheme of things, that makes the uranium easy to get to.

It’s also located well out of the way of humans (being near to the Sahara Desert in fact), meaning there’s no real environmental impact to neighbouring pockets of population.

What’s more, no machine drilling or blasting is required in extraction, making for a sustainable, zero emission mining process.

Aura is well into the development phase and is seeking to progress to near-term production.

In the first half of 2021, Aura undertook extensive water drilling around 30km from the Tiris project. The purpose of this was to locate water in several identified mining locations. Water is essential for a smooth and efficient mining process.

According to its managing director, Peter Reeve, this will “expedite” the production process, which means an increasing likelihood that the company’s ultimate decision will be to commence mining.

In addition to uranium, Aura mines another rare earth metal called vanadium. Vanadium is a steel alloy-based metal used in a number of applications, including electric vehicle charging, telecommunications, and solar and wind energy.

Aura has full ownership of the Haggan vanadium project in Sweden, which holds around 15.2 billion lb of vanadium. The current spot price of vanadium is $12.10/lb.

At the Haggan project, Aura is currently in the development phase, having completed several drilling operations. Reeve has hinted that the company is seeking to “get involved” with a vanadium redox flow battery manufacturer. This is hugely exciting because it could lead to Aura disrupting other areas of the growing renewable energy market as well as nuclear.

Finally, Aura also has another property in Mauritania, called the Tasiast South Gold project. As the name suggests, it’s involved in the exploration gold, along with other more conventional metals such as cobalt and nickel. Aura hopes to begin exploration here in 2022.

In our view, Aura is ready for take-off solely based on the potential of its Tiris uranium site. With the uranium market surging , it’s hurtling towards commercial production and on the cusp of becoming a fully established mining company that produces some of the most sought-after minerals of the modern day.

Financials, risks and action to take

Aura is pre-production, so it isn’t producing any revenue from operations.

Again, it’s necessary to look at its net asset value here and its future potential of resource.

For the half-year ended 31 December 2021, Aura had a net asset value of A$24.79 million. This is up from the A$22 million figure reported for half-year ended 30 June 2021.

In addition, for the half-year ended 31 December 2021, Aura had cash reserves of A$3.26 million. This is a slight increase on the A$3.21 million figure recorded for the half-year ended 30 June 2021.

Most of the funds will be needed for the engineering required to get the mine into production.

Aura recorded an operating loss of A$624,077 for the half-year ended 31 December 2021. Although it’s making a loss, it’s very encouraging to see that this figure is almost half the A$1.49 million loss figure reported for the half-year ended 31 December 2020.

Clearly, it’s having some success in cutting its costs, which is partly down to the friendly mining conditions at the Tiris project.

If it can successfully move into the production stage, which is looking increasingly likely after the water discoveries, the company can realise the full potential of the Tiris project which has a total JORC* resource estimation of 56 million pounds of U3O8.

*Note: JORC resource is an Australian mining classification for the public reporting of minerals and ore reserves. In short, it means what it says is there meets the professional code of practice.

At the current price of uranium (US$59.15), this means Aura’s future mine potential is in the vicinity of US$3.3 billion.

The company expects that the Tiris project will, “… ultimately operate at 3 to 5 Mlbs U3O8 production per year.”

At a market cap of £68.95 million, that gives Aura a “sky’s the limit” amount of potential upside.

Given current prices, annual output should be around US$177 million (£134 million) to US$295 million (£223.5 million).

That is assuming prices stay the same. Should prices of uranium continue to rise, then so too does that potential cashflow.

That said, it’s important to consider the risks because going from exploration and an JORC estimated resource to actually production and offtake agreements is not easy, or cheap.

Aura is a pre-production mining company.

It’s hugely dependent on future cash stream flows which cannot be guaranteed. It also means that to get to production capital raisings are an expectation, rather than merely possibility.

Thankfully we’re coming in right off the back of a capital raising of A$8.8 million which will help to, “… commence the engineering phase for the Tiris Project, securing an Engineering Consultant and initiating the Front End Engineering Design (FEED) study, progressing us towards a decision to mine in Q4 2022.”

As noted, the route to becoming a fully-fledged, successful mining company is arduous. Even though Aura looks to be moving past the development stage, the production phase could provide new challenges.

For example, the quality of the uranium ore it extracts it might be sub-standard or be low in uranium density. Also, some of the deposits may not be entirely recoverable, meaning that Aura doesn’t deliver on its mining projections.

Even if the extraction process goes to plan, it still has to find a buyer. This isn’t a given, especially if the world’s future appetite for uranium (and nuclear energy) wanes due to security or viability concerns.

Aura does currently have an offtake agreement with Curzon Uranium Trading, but are seeking to bring in more offtake agreements. Should it achieve its production targets, considering the demand for uranium moving forward, we would expect they won’t have trouble finding new offtake agreements.

In addition, Aura could be subject to geopolitical risk through its Tiris mining project. Mauritania is a less economically developed country and has a corruption perception index rank of 140 out of 180 assessed countries in the world.

As such, Aura’s mining practices could be subject to political instability in the way that we’ve seen with Yellow Cake and Kazatomprom earlier.

Some of these risks are mitigated with the vanadium project in Sweden, but our primary focus of Aura’s potential is uranium. Therefore, if there are geopolitical issues in Mauritania, it would hurt the company’s stock price.

Finally, in the uranium industry, Aura is up against competitors with far larger resources and cost bases than its own.

For example, Kazatomprom produced 23% of the world’s uranium in 2020 and is domiciled in a country that provided 41% of the global uranium supply in 2020.

However, the huge risks faced by companies such as Aura can bring equally huge rewards.

Unquestionably, Aura is a speculative investment into the growing demand for uranium and it brings risks that an early-stage miner carries. So the company will need to be successful in its operations.

In anticipation of Auris deciding to progress with the mining of Tiris, we believe now is an opportune time to take a position in the stock.

Action to take: BUY Aura Energy (LSE: AURA). Current price of 15.05GBp. Buy up to 20GBp.

Name: Aura Energy

Ticker: AURA.L

Closing as of 24 March: 15.05GBp

Market cap: £68.95 million

52-week high/low: 22.5/0.45GBp

Buy up to: 20GBp

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor