Taking stock: all our positions reviewed and re-assessed

20th May 2021 |

The name of every one of Southbank Investment Research’s publications is chosen very carefully.

Frontier Tech Investor is no exception.

The second word in the title reflects how pervasive is new and rapidly changing technology in our world.

In fact, in some way, almost all stocks, regardless of how they are viewed in the mainstream, financial and trade media, are tech stocks.

The first word in the title points to the importance of innovation in almost all the stocks that we review in Frontier Tech Investor.

Some are being innovative by developing new technology.

Some are using technology from other sources to do things in an innovative – and better – way.

Innovation usually promises great rewards for investors.

However, those rewards often come with risks.

The risks are particularly important if the rewards will take years to be realised.

What has happened in the stock markets of the United States, the UK and several other markets in the last weeks is that investors’ appetite for the risks has waned somewhat.

That fall in risk appetite is the main reason for the volatility in the prices of many stocks over the last three months or so.

Interestingly, little has changed in the underlying businesses and plans of the companies in the Frontier Tech Investor portfolio.

This is something that we will be looking at this week and next – as we take stock of our positions.

Note: the three-month percentage change in share price will be from the closing price on 19 February 2021, to the closing price on 19 May 2021. As stated, the last three months have been a sometimes turbulent period for the stock markets, in which a number of company share prices have fallen.

We are providing a short-term assessment of how our stocks are currently faring, with the appropriate action to take at this time.

Aston Martin Lagonda Holdings (AML.L)

Three-month share price change: -10.8%

Aston Martin Lagonda Holdings is a manufacturer of luxury cars.

Revenues were up 153% in the 1Q21, compared to 1Q20 at this specialist manufacturer. This was largely thanks to the release of its first ever sport utility vehicle (SUV) model, called the “Lagonda All-Terrain Concept”.

As discussed in our original recommendation, the company is in the process of launching ten new vehicles by 2023. The first vehicle, the Vantage F1 Edition, has already been launched. It has been well received by customers.

In addition, the company has streamlined its manufacturing processes and is boosting efficiency. This is the rationale for centralising manufacture of the sports cars (Aston Martin Valkyrie and V12 Speedster) at the company’s Gaydon facility.

Continue to HOLD Aston Martin. It is already showing what the future might hold post-pandemic, as highlighted by its impressive revenue figures.

AMTE Power (AMTE.L)

Share price change since listing on LSE on 12 March: +11.99%

AMTE Power is a provider of specialist battery technology to the automotive, oil and gas, and energy storage industries.

In particular, AMTE Power is very well placed to benefit from the growth in the electric vehicles (EVs) market. Demand for EVs will continue as the world transitions towards a greener economy and reduced CO2 emissions.

AMTE Power’s high-performance EV batteries are already enjoying rising demand from customers. In response, the company has upscaled its facility in Scotland, and is hopeful of opening a new gigafactory (i.e. a plant that is capable of really large scale production of batteries) in 2023. As discussed in the original recommendation, AMTE’s upside potential looks huge. It is part of a global industry which is projected to reach $82.2 billion by 2026. This is a compound annual growth rate of 6.6%.

AMTE Power remains a BUY up to its 285p buy limit.

Blancco Tech Group (BLTG.L)

Three-month share price change: -6.9%

Blancco’s expertise lies in data erasure software.

Increases in privacy laws and data protection regulations mean that more organisations are beginning to use data erasure software. At the same time, Blancco’s software helps to provide protection against cyber-attacks and cyber-crimes.

Blancco’s data erasure software has earned 36 patents, and certification from 15 governments around the world.

Blancco’s 2020 revenues were up 9% on the previous year. Increased remote working has meant there has been greater spend on IT hardware, and data security software in particular, with more data being stored outside of office environments. The slow easing of lockdowns around the world means that this trend may continue.

In addition, the company announced a recent partnership with ServiceNow, a cloud computing software platform. It will allow Blancco’s data-sanitisation solution to be used remotely by ServiceNow, therefore accomodating the needs of the flexible-working economy.

We reiterate our BUY recommendation up to its 250p buy limit. You can find the original recommendation here.

Corero Network Security (CNS-L)

Three-month share price change: -13.8%

Cyber-attacks are becoming an increasing phenomenon in this age of technology. They can cost businesses millions and at the same time, damage their reputations.

Corero Network’s in-demand cyber-security software helped the company to enjoy a record-breaking 2020.

Revenues rose 74% on the previous year. Losses significantly reduced, more than halving from those of the previous year. Revenue from distributed denial of service (DDOS) contracts doubled. A DDOS is a devastating form of cyber-attack.

Clearly, more organisations are turning to Corero for protection against cyber-attacks. To us, it’s no surprise to hear that Corero now has operations in as many as 40 countries. Corero is still expanding and has great momentum behind it.

We reiterate our HOLD recommendation. You can find the original recommendation here.

City Pub Group (CPC-L)

Three-month share price change: -8.8%

City Pub Group is a pub business that operates 45 properties across the UK.

The outlook is looking positive for the company as we head into summer.

The easing of lockdown is in full swing in the UK, with pubs now being fully open to the public. The industry is currently experiencing pent-up demand from customers.

City Pub Group is no exception.

To deal with this, the company has “invested significantly” in its pubs. It has acquired a 49% stake in the Kensington Park Hotel in central London, which City Pub Group will operate under the terms of the contract with the vendor.

In addition, the company has bought a 24% stake in the Mosaic Pub and Dining Group, which operates a number of pubs in the UK.

We think that the investment case for this innovative company remains intact.

Continue to HOLD City Pub Group. You can find the original recommendation here.

Frontier Developments plc (FDEV-L)

Three-month share price change: -1.4%

Frontier Developments, who specialises in game development and design, has had a successful 12 months. The period has seen the development and publishing of Planet Coaster and Jurassic World Evolution. These flagship games are available on a variety of consoles, including PlayStation, Xbox and Nintendo Switch.

These releases, we expect, will boost revenues in the current year. The company expects it too, anticipating that revenues for the 30 September 2021 fiscal year (FY) will be up to 25% higher than in the 2020 FY.

The attraction of Frontier lies in its sales growth. It is constantly adding to its portfolio of gameplay designs through various innovations and new releases. Because of this, we think that the easing of lockdown won’t affect it too much, unlike other gaming companies.

We reiterate our HOLD recommendation on Frontier Developments. You can find the original recommendation here.

Gfinity (GFIN-L)

Three-month share price change: +4.2%

Gfinity is a market leader in one of the world’s big future trends, esports. The company produces and develops software that hosts major gaming tournaments.

Over the past year, Gfinity entrenched its leadership in the esports market even further. It has hosted major esports tournaments, including the F1 Virtual Grand Prix and the ePremier League tournament.

More recently, global energy drinks giant Red Bull appointed Gfinity as its production partner for a new two-day Street Fighter V (video game) tournament.

This shows Gfinity’s credibility from the point of view of companies with massive and global brands.

We reiterate our HOLD recommendation on Gfinity. You can find the original recommendation here.

HYVE Group (HYVE-L)

Three-month share price change: -16.8%

HYVE Group connects business stakeholders through primarily in-person events and exhibitions.

However, in March 2021, HYVE ran its first virtual meetup, the Groceryshop Spring Meetup. It hosted 8,884 meetings over three days. It linked “retail and grocery” ecosystems and provided opportunities for networking and trading.

HYVE has had to adapt to the virus and adopt new online options for its customers. Its in-person events still face disruption, although HYVE is optimistic that the second half of 2021 will see the importance of these events rise.

The company is expecting strong, pent-up demand once global restrictions are eased further.

The way in which HYVE responds to the post-pandemic economy will provide a more accurate representation of the business and its long-term prospects. With the company now having two revenue streams through its physical and online offerings, we continue to see great bounce-back potential.

Therefore, we maintain our BUY on HYVE for now. You can find the original recommendation here.

Immotion Group (IMMO-L)

Three-month share price change: +8.4%

Immotion Group provides virtual reality technology to tourist attractions.

Immotion is looking forward from a tough year. Its virtual reality (VR) installations are hugely dependent on footfall, which has been restricted thanks to the pandemic.

Now this footfall is returning.

We’re seeing this in key regions for the company, such as Las Vegas in the United States, where capacity is increasing to 80%.

In addition, Immotion opened a new installation at Clearwater Marine Aquarium in Florida in March.

As well as its US projects, Immotion has three sites in Australia where its installations are housed. Australia has been out of lockdown since November, compensating for the lack of footfall in the US.

What’s fascinating about Immotion is that it has also been able to launch a new division, Uvisan. This enables disinfection of rooms and equipment using UV-C light, killing up to 99.99% of bacteria and viruses. This has been a huge help in getting the company through a tough year and also holds an interesting opportunity for them going forward.

We reiterate our HOLD recommendation for Immotion. You can find the original recommendation here.

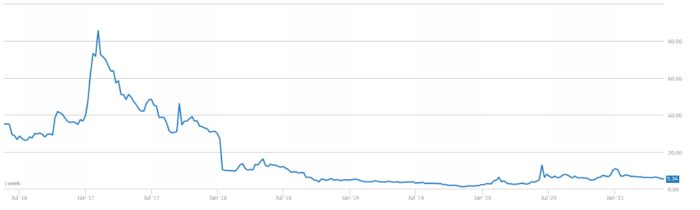

IOTA (IOTA/USD)

Three-month share price change: -25.5%

We are very excited about the potential of IOTA. It is far more than just a cryptocurrency.

IOTA is designed to execute transactions between devices and machines. For example, it will facilitate the use of a built-in car wallet to pay for transactions, such as toll roads.

IOTA is fast developing with a focus on decentralisation and the ability to use its networks for “layer 2” (application level) developments.

The most significant of these is the ability to use smart contracts on the IOTA network. This is a work in progress with a beta release imminent.

In addition, IOTA has recently upgraded its network (known as the Chrysalis upgrade) and created a new specialist wallet called Firefly. At this point we’re still not aware of when Ledger hardware wallet integration will occur with Firefly, but it’s expected to be by the end of the month.

Its next move is to become fully decentralised with Coordicie, IOTA’s biggest upgrade yet. The next step towards this will be made possible through its “Nectar” release. This will improve transparency and autonomy amongst users, which will only add to its appeal.

We are expecting ongoing progress from IOTA and maintain our BUY recommendation. You can find the original recommendation here.

IQE (IQE-L)

Three-month share price change: -38.1 %

IQE is a supplier of advanced semiconductor parts.

The shortage in semiconductor supplies over the past year has been well documented in our updates.

This looks set to persist. And whilst this persists, we see IQE being able to seize the opportunity as global demand for semiconductors and semiconductor materials grows and while there is a constriction in supply.

The company’s 2020 figures were pretty impressive. Revenues rose 27% on the previous year, and operating losses decreased by more than 70%.

IQE is exploring opportunities in the growing 5G market. It is predicting that its GaN on SiC technology (or Gallium Nitride on Silicon), will gain increased attention in the near term, in light of the global rollout of 5G. GaN on SiC is the industry standard for semiconductors used in wireless infrastructure.

We reiterate our BUY recommendation on IQE. You can find the original recommendation here.

And while the stock has retreated over the last few weeks, it is starting to draw closer to our stop/loss on the stock.

What we don’t want is to get unduly stopped out of the position ahead of time. Hence, we’ve decided to remove the current recommended stop loss.

Velocys (VLS-L)

Velocys in our view continues to be a long-term play into the transition to cleaner, greener energy alternatives. Its development of sustainable fuels, in particular for the aviation industry, holds massive potential.

This development in conjunction with British Airways is pivotal to the UK’s progress towards “net zero” energy targets in the coming decades.

That said, Velocys’ stock price has been incredibly volatile. In early January it hit an intraday high of 11.85GBp. This pump higher was very temporary and the stock pulled back to levels around our entry price after the announcement came in that Shell was pulling out of the Altalto project.

This was a setback, sure, but the ongoing development with British Airways is key to this project being a success, and it doesn’t materially change our long-term position on the stock.

Nonetheless, Velocys’ stock price headed lower past 5.92GBp, effectively triggering the trailing stop loss that we had decided to use. That means we were forced from the stock at that exit price, recording a 12.61% loss.

However, this volatility that dragged the trailing stop higher, was so fleeting, that we believe exiting this position is a mistake considering our long-term view on the stock.

That means that while technically Velocys we exit and recorded a loss, we’re now recommending re-entering the stock at the current market price of 5.39GBp.

But being conscious of there being a lot of volatility in this stock, we are setting a hard stop/loss on this re-entry at 25% below this entry price. This means if we are completely wrong about the future potential of the stock, you’re not going to get blown up by it, and there’s still some downside protection.

However, our original view on the stock remains.

This view is further reinforced by the commitment from IAG (IAG-L) (the owner of British Airways) that it will power at least 10% of its flights using sustainable aviation fuel (SAF) by 2030.

Velocys (VLS-L) is a BUY recommendation, buy up to our original entry price of 6.78GBp from here and we will set a hard stop/loss exit point at 25% below our entry price. You can find the original recommendation here.

Action to take: buy Velocys

Ticker: VLS: LN

Price as of 20.05.21: 5.39 GBp

Market cap: £57.38 million

52-week high/low: 16.64p/2.98p

Buy up to: 6.78p

The Frontier Tech Investor “Top Three”

Sometimes it’s hard to decide on which stocks to invest in from our buy list

Below is our Frontier Tech Investor “Top Three” section showing three stocks in open BUY positions. If you’re trying to figure out what to invest in next, these are three that we think are a great place to start.

This doesn’t mean our other stocks are no good: this is just a tool to help you spot the next Frontier Tech Investor stock that could be worthy of your consideration.

Kanabo Group (LSE:KNB) – one of the world’s most controversial investment ideas is around the legalisation of medicinal and recreational cannabis. It’s sweeping across Canada and now the US. Both countries are leaders on the way to legalisation. In Australia a similar path is being followed. And now the UK is on the same track. Kanabo is one of the newest and best plays in this huge investment opportunity. You can find our recommendation here.

IQE (LSE:IQE) – our most recent recommendation, IQE, is a key part of the supply chain getting semiconductors into the world. You can find our latest discussion on IQE here, and a link to the original report here. With a gigantic increase in the demand for semiconductors, the world is facing a “chipageddon”. This is a situation where there simply aren’t enough semiconductors to supply the world’s biggest, most demanding companies. IQE is one of the few UK-listed stocks that are a play on this theme.

Velocys (LSE: VLS) – there’s no doubt that governments will continue to push their “green agenda”. This means that they will do what they can to support industry in ways that will help enable carbon neutral economies. Velocys is a big part of this – developing sustainable fuels for transport and logistics (in particular aviation) with pioneering technology. If you’re looking for a great “green energy” play, Velocys is a very good place to start. You can find the original recommendation here.

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor