Stock Alert: old money and new money’s Medici effect

10th June 2021 |

Frans Johansson is the author of a book called The Medici Effect.

Johansson coined the term “Medici Effect” when he first released the book in 2004. The principle described in the book is based on a famously wealthy 15th century Italian family called the Medicis.

The Medicis bought together artists, sculptors, philosophers and architects through the running of sponsored schools. This amalgamation of experts and ideas helped spark the Italian renaissance, which led to cultural change and modernisation across Europe.

In his book, Johansson gives a beautiful example of the Medici Effect in action. As you will later see, it fits in perfectly with our recommendation.

Johansson writes about the Azores. The Azores is an archipelago of nine islands situated in the North Atlantic Ocean. Although administratively a part of Portugal, it lies at an intersection of the Eurasian, North American and African tectonic plates.

There is a café in Horta, a port city on one of the islands. Here, sailors and travelers from all over the world converge in one small spot for a drink.

Some travellers are there for a quick pit stop, ahead of continuing on to nearby Portugal. Others are recuperating, readying themselves for the long journey west towards the United States of America.

Johansson alludes to a conversation he overhears, in which fishermen discuss the best technique to use when catching marlin, a type of fish with a spear-like snout. One suggests using lure and ragworms as a form of bait, instead of traditional fishing hooks.

Instead of hooking, and causing damage to fish’s mouth, the lure method wraps around the snout of the marlin. The fish doesn’t let go due to the friction, can be easily released, and doesn’t get hurt in the process.

It also means the fisherman doesn’t have to attempt to pull the hook out at the mercy of the marlin’s sharp snout. Ultimately, it is a more efficient and easy way of fishing marlin.

Fishermen from opposite corners of the world discussing ideas, new techniques, in an intersection of expertise and experience to create new ways to fish. As Johansson points out, they go on to discuss further ideas and combine their knowledge. This leads to the creation of even better fishing techniques.

It is this core concept which is of great relevance to our world today and our latest recommendation to you.

Instead of finding itself at an intersection of different fishing techniques, your recommendation today finds itself at a big idea, the result of the meeting of two monetary systems.

This is the convergence between the old, long-established fiat currency system on one hand and the new cryptocurrency and digital assets system on the other.

The coexistence of the two systems has created a new and exciting opportunity, which this UK fintech is currently exploiting.

We believe that it has the potential to become a globally recognised platform for which payments can be seamlessly made using the currency of choice.

Old money described

Fiat means “let it be done” in Latin.

Fiat money – or fiat currency – has the status of money because a government makes laws that let it be money.

Fiat money has no intrinsic value as there is no commodity (such as gold) or asset that underpins every unit of it in circulation in an economy. It is sometimes also known as “paper money” – even if banknotes are actually made of polymer and/or most payments are made digitally.

The modern version of fiat currency dates from the August 1971 decision of US President Nixon’s administration to end the gold standard, which fixed the US dollar to gold at a rate of US$35 per ounce.

Previously, other foreign currencies had been pegged to the US dollar and, through the US dollar, to gold.

The decision of the Nixon administration meant that the global monetary system included a number of fiat currencies that could move against each other.

It was a very major change.

What matters for our purposes is that concentrated control over money in the hands of central banks, commercial banks and (for most of the time) governments.

That control included decisions about:

- The supply of credit – meaning the amount of money lent to particular groups in society or economic sectors.

- Official interest rates – meaning the rates set by central banks on loans to/deposits from commercial banks.

- Market interest rates – meaning the rates set by commercial banks on loans to/deposits from the non-bank public.

- The relationship between money and other currencies. There are a wide variety of options, ranging from the use of another country’s/area’s fiat currency, through a rigid peg to another fiat currency to a currency that floats freely against other fiat currencies.

- The extent to which the central bank finances the government.

Thanks to technology, there have been many small changes to the system over the last 20 years which have generally benefited the customers of traditional financial institutions.

The numerous examples of such changes include: the emergence of fintechs – essentially technology companies that offer payments services or other services normally provided by banks; crowdfunding of projects; micro-lending to (very) small businesses in poor countries; and open banking (which is discussed below).

These changes are almost entirely for the good.

Nevertheless, and in spite of the excitement about how technology can be applied to financial services, the fact remains that power remains very much centralised in the hands of central banks, established financial institutions and (usually) governments.

The centralisation of power has had, and can have, adverse effects which include the following:

- Too much credit being made available to particular sectors of the economy, resulting in asset price bubbles.

- Not enough credit being made available to particular sectors, resulting in the suppression of productive activity.

- Interest rates that are too high, stifling economic growth and/or distorting currency markets.

- Interest rates that are too low, forcing investors to hold riskier assets in order to achieve a real return.

- Management of banking crises for parties other than the depositors.

Right now, though, a big change is upon us – as this old money system meets a new money system.

A Medici Effect is taking place.

Meeting with new money

Cryptocurrencies represent new money.

In complete contrast with old money, decentralisation of power is the central concept underpinning this new money.

Cryptocurrencies are open-source – meaning that anyone can be involved in their development.

They are (usually) designed to be distributed widely – with few or no restrictions on who owns or uses them.

Above all, they are not overseen or regulated by central banks, governments, government agencies or traditional financial institutions.

Cryptocurrencies do, however, take some of the principles of – and some products/solutions from – the old money system.

Cryptocurrencies – new money – bring financial inclusion and new opportunities for all.

Your latest recommendation demonstrates the outcome you get when you combine the ideas from old money and new money.

When the two intersect, the result is novel and functional and – potentially – very profitable.

Introducing your latest Frontier Tech Investor recommendation…

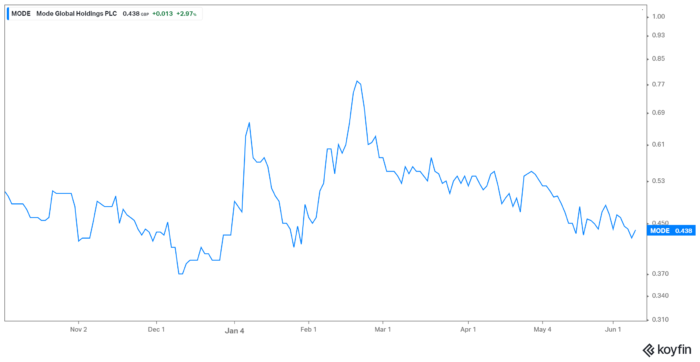

Mode Global Holdings (LSE: MODE) is a financial services business, listed on the London Stock Exchange. It has a market cap of £40.21 million, and current share price of 43.98GBp.

The company was established in 2019. It is based in London and was founded by a group of entrepreneurs and financial professionals.

Mode is building a financial ecosystem, that combines payments, digital assets and loyalty rewards in one platform. Its lead product is the Mode app, which enables purchases of bitcoin as well as the ability to earn interest on bitcoin holdings.

Notably, through the use of open banking, it will provide a payment solution that facilitates transactions in both digital and fiat currency. It will allow the seamless conversion of cryptos into fiat currency, and vice versa.

So, what is open banking?

Coming from the traditional financial system – old money – open banking allows fintechs and other financial technology providers to build new applications through open-source APIs from major financial institutions.

The potential from open banking is limited only by the imagination of the fintechs and technology companies.

Open banking can provides customers with many benefits, including transparency over their finances, available deals, budgeting, and payment options.

It also allows more seamless transition from one financial services provider to another provider.

And in the case of Mode Global, it allows customers to seamlessly integrate traditional fiat (old) money with cryptocurrencies (new money) in their digital asset wallets.

Speaking to Proactive Investors, Mode’s chief investor relations officer, Ariane Murphy, said:

“Bitcoin and Open Banking, two of the most disruptive financial innovations of our time, are changing how people and businesses do financial services. At Mode, we are leveraging the power of these key innovations by building an ecosystem that delivers a cheaper and safer way for businesses to accept instant payments, and gives people the ability to spend smarter and grow their wealth through Bitcoin”

One of the early features of the Mode app is the potential for customers to earn interest of 5% annual percentage yield (APY) on their holdings of bitcoin, with the yields being compounded weekly.

Most high street banks offer high interest current accounts with interest anywhere from under 1% to around 2%. Often the higher rates include complex conditions and caps on how much can actually be earned.

What’s also great about Mode’s offering is the speed at which anyone can get started, set up an account and start buying bitcoin.

Having personally tested this out, starting from scratch, to installing the app, setting up an account, adding £100 from a high street bank account and then buying bitcoin took all of about ten minutes.

That’s the kind of efficiency you expect today from a new money fintech.

Earnings from bitcoin and other innovations

Currently, Mode has two offerings available to consumers and businesses.

The first, as noted, is the Mode app. Essentially, it is a wallet product that allows users to manage their bitcoin and fiat currency easily and safely.

Within the app, you can purchase bitcoin quickly, after going through a simple “know your client” (KYC) process.

It is then stored through your Mode wallet, and it can be instantly transferred to other Mode users. You can also safely transfer bitcoin to any other bitcoin wallet you choose.

What really stands out to us about the app in its early stages of development is what Mode calls the “bitcoin jar”. As mentioned, it allows users to earn interest on their bitcoin holdings (over 0.1 BTC) – and the rate is currently at 5%.

The reason Mode can deliver a higher interest rate is due to how it lends out funds.

Mode operates like a bank. The bitcoin deposits are held with a custodian, BitGo. Through BitGo, it is possible to lend cryptocurrencies such as bitcoin.

The interest charged on the lending is such that it allows for a high rate of return to the lender.

This is passed through to the depositors, leading to a superior APY rate. The rate can of course vary, but it’s these bank-like facilities of lending and deposits that enables people to earn on their bitcoin deposits.

The public facing app is easy, simple and makes getting into bitcoin easy for users. All aspects of the future of finance you’d come to expect from a business at the intersection of old and new money.

Mode’s other current offering is a payment platform tailored to helping UK businesses access the Chinese market. Currently, Mode is a merchant for Alipay and WeChat Pay. Both are major Chinese payment providers.

In other words, it handles the money spent by Chinese customers on UK goods and services. This gives them access to around 1 billion Chinese consumers.

Mode is looking to expand its customer base. According to chairman Jonathan Rowland, its next target is continental Europe, and then finally, the United States.

Mode is also seeking to expand its current offerings.

The company is hoping to introduce a ‘Mode for Business’ app, that is based on the principles of Open Banking. It will allow funds from the customer’s wallet to be spent at participating merchants, through the use of a QR code.

As mentioned, there is huge potential from open banking in the financial services industry. It can, among much else, help consumers improve their money management in a secure way, and give businesses the insights they need to provide the most value to its customers.

With this open banking solution, Mode intends to reduce business transaction fees, and reduce the need for bank cards altogether. At the same time, Mode hopes to introduce loyalty rewards in the application, using data and insights from customer behaviour.

Finally, Mode hopes to combine all of its features into a singular app, known as the Mode Super App. Payments, digital assets, loyalty rewards and fiat currency will all be stored in one platform, allowing the customer to optimise the management of their finances.

To us here at Frontier Tech Investor, Mode is an extremely exciting and unique fintech with huge potential.

Mode is providing a user-friendly bridge for people who want to combine the best of the old and the new money worlds.

The Medicis would be impressed.

Financials and risks

Mode is an early-stage company. So we’re not expecting glowing financial performance from it just yet.

The most recent financial information that Mode has published through the regulatory channels shows losses of £1.9 million in the six months to 30 June 2020, or 62% more than in the previous corresponding period. The company put these losses down to extra spending on technology and marketing.

However, a better indication as to how the company is going currently is from an announcement released on 13 April 2021 in relation to trading volumes.

In Q121, bitcoin trading volumes on the platform were up 316% compared to Q420. This came as the bitcoin price hit a new record of $63,729.5.

However, since then, the price of bitcoin has fallen dramatically, and is now trading at about $36,910

We think that any fall in trading volumes will be small and/or temporary. In fact, we expect rapid growth to resume within months.

Of course, the risk is that this fast growth doesn’t materialise or is slower than we might expect.

This is a growth company of which we will want to see growth in order to maintain a positive outlook for the company longer term.

The intersection of old and new money is a hot place, with a lot of potential.

However, as a provider of cryptocurrency trading applications, Mode faces intense competition.

The main challenge is not to win over new customers, but to keep ahead of the other providers.

Failure to do so may see the stock price fall.

Further, Mode has invested around 10% of its cash reserves into bitcoin. Investors would likely take a negative view if the price of bitcoin is weak relative to the US dollar and other fiat currencies for a sustained period.

Put plainly, if bitcoin skyrockets, we expect to see Mode rise as well. Conversely, if bitcoin crashes, it would also likely see the stock price of Mode fall too.

However, other aspects are more important. Those aspects include trading volumes, the integration of new features and the onboarding of new clients.

All of these will drive the fundamental growth of Mode’s business.

Another risk the company faces is the risk of falling foul to cybersecurity risk as posed by cryptocurrencies.

Traditionally, crypto exchanges have been prone to hacking and theft. Through its bitcoin offering, Mode will be interacting with centralised exchanges as customers transfer bitcoin to and from its app.

As a result, any security breach of Mode’s third-party exchange partners could impact the security of Mode. Sensitive data may be breached and expose customers.

This might cause irreversible damage to the company in terms of its reputation and financial costs.

Finally, you must also be aware that holding bitcoin or any cryptocurrency with a third-party wallet provider, like Mode, does not mean you have outright access to that cryptocurrency.

Should Mode fail, shut down, prevent access to its application, you would not have recourse to gain access to the bitcoin.

As cryptocurrencies aren’t protected by the Financial Services Compensation Scheme, your bitcoin would be at risk in the event of complete failure.

In spite of these risks, we think the long-term prospects of the company are strong. The financial ecosystem that it is hoping to create promises so much, and it will transform the way in which fiat money (the old) and cryptocurrencies (the new) are transacted.

The Medici Effect brings big changes indeed.

Buying instructions

Mode Global Holdings (LSE: MODE)

is listed on the London Stock Exchange. It has a market cap of £40.21 million, and current share price of 43.98GBp.

Average volume in the stock is around 840,000 per day. That’s works out around £369,000 per day in value traded.

It’s what we would call an illiquid stock in that sense.

That means the stock price may shoot higher upon our recommendation. And should we issue a sell alert, it may see the stock gap down as you try to exit the position.

You should be aware of the volatility in the stock that will likely come and that you should stick to our buy limits and any use of stop/loss recommendations.

In setting a stop/loss position, we’re looking to protect downside movement in what is a growth stock that’s early stage and riding a promising, but volatile opportunity. The likely destination is excellent, but the ride is unlikely to be a smooth one.

If you are unable to use stop/loss orders with your broker, use our recommended stop/loss as a guide for where we believe it would be prudent to cut losses should the stock head unexpectedly lower.

Action to take: BUY Mode Global Holdings Plc (LSE:MODE). Current price 43.98 GBp. Buy up to 55.5 GBp. We will set a stop/loss position at 26.38 GBp (40% below the current price at the time of writing).

Action to take: buy Mode Global Holdings Plc

Ticker: MODE.L

Price as of 10.06.21: 43.98GBp

Market cap: £40.21 million

52-week high/low: 86p/33p

Buy-up-to: 55.5p

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor