Stock Alert: the only LSE-listed miner in the new gold rush

9th September 2021 |

In early 1848 some gold flakes were discovered in the American River near Coloma, California, at Sutter’s Mill.

Attempts to keep this on the down-low were futile. By March, newspaper reports were circulating of riches to be made mining for gold in California.

At the time, the population of California was around 157,000, of which about 150,000 were native Americans.

Gold fever and the change of riches, however, kicked into overdrive. A gold rush was well and truly underway by mid-1848.

According to History.com,

Throughout 1849, people around the United States (mostly men) borrowed money, mortgaged their property or spent their life savings to make the arduous journey to California. In pursuit of the kind of wealth they had never dreamed of…

This didn’t slow down for a number of years.

The initial surface prospecting evolved into deeper mining and the industry and economy around the gold rush flourished and boomed.

But it wasn’t without its issues either.

As explained also on History.com,

… towns grew ever more lawless, including rampant banditry, gambling, prostitution and violence.

However, the gold industry matured over the course of the next few years. It went from speculators and prospectors seeking fortune (and maybe a bit of fame) to an established mining industry.

By the early part of the 1850s the prospectors had cleared out – rather than luck being a key determinant of fortune, it was skill, hard work and technological progress that mattered far more.

Hydraulic mining was a perfect example of this. It was a brand-new technology, and it brought enormous profits for the miners able to deploy it. Yes, it also ravaged the landscape, but in the 1850s that issue was of little concern for those miners.

California’s population would balloon to around 380,000 at the height of the gold rush, more than double its pre-gold rush numbers.

Today we’re in the midst of another gold rush. Whether or not there’s an end to this gold rush is up for debate. In our view, this gold rush doesn’t have an end like the California rush.

And arguably the California rush served to kick off a global gold mining industry that today helps to fuel a gold market worth in excess of $9.6 trillion as of the end of 2019. Add to this the creation of global gold mining giants like Newmont, Barrick Gold and AngloGold.

Combined those three gold mining giants are worth in excess of US$80 billion. But it’s tomorrow’s mining giants – the new gold rush miners – where we see huge opportunity here at Frontier Tech Investor.

And if the value of this “new gold” surges to highs we’re expecting over the next few years, then we could once again be on the cusp of one of the biggest market opportunities the world has ever seen.

The new gold rush

The new gold rush is the rush for digital gold… for bitcoin.

The parallels to the early gold rush in California are quite astonishing.

Early on, bitcoin was a market for individual speculators and early prospectors.

In its earliest years, you could “mine” bitcoin with a simple home computer, albeit one with a decent graphics card. But, over time, as more miners came to bitcoin, understanding the opportunity to “prospect” for it, it became harder and harder to get.

Soon enough the technology advanced to a point where the humble home computer wasn’t enough any more. Soon, application-specific integrated circuit (ASIC) hardware devices were needed to mine for bitcoin.

The cost of these “mining rigs” started to explode in price as much as the price of bitcoin itself. The companies selling these proverbial “picks and shovels” themselves turned into giant corporations (although they were mostly private companies).

This did also help fuel the stock price of some global giants like AMD and Nvidia whose graphics cards were integral to helping miners mine for bitcoin.

Today, the realm of individuals mining bitcoin are long gone. It is simply not feasible for an individual to mine for bitcoin. Instead it has become the domain for large companies with the capital and economies of scale.

Companies like the one we’re introducing to you today.

Your latest recommendation is a miner. Some would even suggest that it is a commodities miner.

Except there’s nothing physical about the commodity it mines. Its sole focus is the mining of bitcoin.

In fact, it’s the only pure-play bitcoin mining company on the London Stock Exchange (LSE).

This makes it pretty easy to figure out which company we’re talking about…

Your latest Frontier Tech Investor recommendation

Argo Blockchain (LSE:ARGO) is a cryptocurrency mining company. As noted, its sole focus is on the large-scale mining of cryptocurrencies like bitcoin.

The reason we’re recommending Argo now is because we believe that the bitcoin market is primed for explosive growth. And, as the value of bitcoin rises, this directly impacts the revenues and future profitability of Argo.

Argo is the perfect company to invest in, being listed right here on the LSE, if you want exposure to the potential growth in value of bitcoin, but aren’t comfortable investing directly in bitcoin itself.

Furthermore, Argo is a company that you can hold in investment ISAs, SIPPs, and other stock trading accounts here in the UK. That also means indirect exposure to bitcoin in these accounts, with Argo as the proxy.

It should be stressed, though, that Argo is not a bitcoin exchange-traded-fund (ETF). It is a bitcoin miner, meaning that the company mines bitcoin, obtains it, sells it, and usually keeps some on its balance sheet.

All this raises an important question: what is bitcoin mining?

Bitcoin mining 101

The intricate technical explanation of mining bitcoin and how bitcoin’s code works, is somewhat irrelevant here. This isn’t a report on “how to mine” bitcoin.

What you need to know is actually relatively simple…

Bitcoin is fundamentally a network consisting of nodes (peers).

This network is known as bitcoin’s blockchain.

For a blockchain to exist (and continue to exist) it requires blocks (of data) to be added in perpetuity which records and validates all transactions on the network during the time taken to “mine” each block.

In bitcoin this process is done by “miners”.

By adding blocks and verifying transactions, they are also providing security and certainty to the network.

The process in which bitcoin’s miners do this is known as “proof-of-work”.

That means they expend energy and computing resources to complete an algorithm, and the miner that solves the algorithm first adds a new block to the blockchain.

The reason miners do this, competing to add blocks, is because they receive a “block reward” for their work.

The block reward comes in the shape of bitcoin “coins” – a virtual representation of coins that exist on bitcoin’s blockchain.

So, for every block added to the bitcoin blockchain, the miner that added the block collects the block reward. This currently stands at 6.25 bitcoin per block added.

At current fiat (i.e. conventional) currency-converted prices (around $45,000 per bitcoin) that means that a miner gets the equivalent of $281,250 for every block they mine. Historically a new block is added roughly every ten minutes.

So, every day (roughly) bitcoin miners are competing for 900 bitcoin in block rewards (about 144 blocks per day x 6.25 bitcoin block reward).

And that works out at $40.5 million in block rewards each day.

Hence, miners with a lot of computing power and resources, that can mine bitcoin with low energy cost have the potential to become very profitable companies.

And the higher the bitcoin price, the potentially more lucrative mining could become.

Should bitcoin for instance hit $250,000 per bitcoin, which is a forecast we’ve speculated about previously, a single block reward could be worth as much as $1.56 million to a miner.

It’s this potential of bitcoin’s fiat-converted price appreciation and Argo’s growing bitcoin mining resources that leads us to recommend the company today.

Our view is that long term, the fiat-currency converted price of bitcoin will continue to rise. In fact, it very well may skyrocket. Our view is that long term it has the potential to even march on to $1 million per bitcoin.

If that plays out as we predict, then for a company like Argo, the sky is equally the limit.

Argo’s mining power

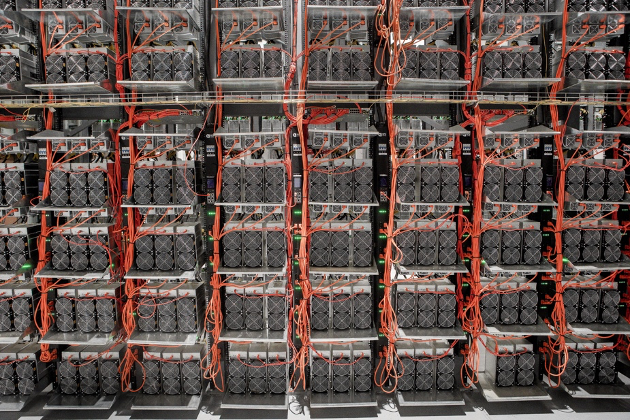

Currently Argo has a fleet of 21,000 mining “rigs” mining bitcoin.

This is what a mining rig looks like:

This one isn’t the kind Argo uses, this is an older version of the ones Argo uses. This one is the one we used to run in 2017 when we took to mining bitcoin with a high-powered mining rig.

Argo’s mining rig arrays look more like this…

Source: Argo Blockchain on Twitter

Source: Argo Blockchain on Twitter

I had one.

Argo has over 21,000, generationally better ones.

The sheer size, scale and computing power Argo has is hard to fathom unless you’ve mined, tried mining or seen how these mining rigs operate.

I have. And I know that 21,000 of them (and growing) is some serious hardware. And it shows.

According to Argo, its total resources allocated to mining bitcoin works out at around 0.6% of the world’s bitcoin mining network hashrate.

That’s off the back of Argo’s mining capacity increasing from 685 petahash on 31 December 2020 to 1,075 petahash on 30 June 2021.

The hashrate measures the speed of bitcoin mining. The hashrate is the rapidity with which a computer can convert any set of data into letters and numbers of a specified length. A petahash is equal to one quadrillion (one million billion) hashes per second.

So, Argo has been scaling up its bitcoin mining power. And we expect to see it scale up more. But the company also operates its mining facilities with a commitment to sustainable energy.

For example, it operates a facility in Quebec (Canada) that runs off the Hydro-Québec power grid, using 100% hydro and wind energy.

A new Texas facility will source mainly wind and solar energy for its operation too.

It has also signed the “Crypto Climate Accord” stating,

Argo commits to being Climate Positive by 2030, supports the adoption & verification of blockchains powered by 100% renewable sources by 2025.

Without doubt, Argo is an important part of the bitcoin ecosystem as a large, and growing bitcoin miner.

And my view is that on the bitcoin mining alone, the company has huge potential tied in with the rise of bitcoin globally.

How much does it make?

According to the company’s first-half results for 2021, revenue was £31 million for the six months ended 30 June 2021 (H1 2021). This is a 180% increase on revenue from H1 2020.

Gross profit also increased from £1.18 million in H1 2020, to £14.53 million in H1 2021.

Total numbers of bitcoin held as of 30 June 2021 were 1,268. On 30 June 2020, the company had 127 bitcoin.

And, in the company’s August operational update released late last week, it announced that the total numbers of bitcoin mined year to date were 1,314: Argo now holds 1,659 bitcoin on its balance sheet.

In sterling terms, using bitcoins price at the time of writing of around £33,335, that’s £43.8 million mined year to date and £55.3 million held in bitcoin on the balance sheet.

The company’s success will rise and fall with the success of bitcoin – at least for the time being.

Should the value of bitcoin skyrocket, then we would expect the company’s stock price to follow suit.

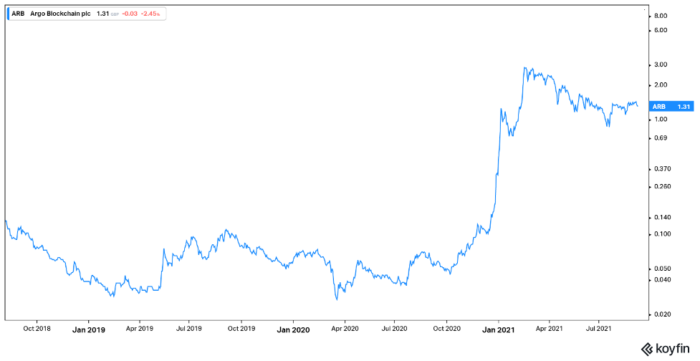

Hence, it’s no great surprise that over the last year the 52-week range of the stock has been from 4.31GBp to 360GBp.

Dear reader, that is not a typo.

There really was an 83-times rise from bottom to peak in the last year. This is all directly linked to the rise of bitcoin.

However, from the peak in March this year (when the intraday price topped 360GBp) the stock has fallen more than 60% from there to its current level around 140GBp.

With the bitcoin market at a point from where we see it charging to new highs, we think Argo makes for the perfect entrée. It is the only bitcoin miner listed on the London Stock Exchange.

For now, the company is a successful bitcoin miner, and that is its primary business.

It also mines ZCash. Down the track there’s a good chance that it will expand into mining/validating other cryptocurrencies and start to get involved more in the decentralised finance (DeFi) space – where FinTechs who are (often) using blockchain technology to engage in business that would otherwise have been handled by traditional financial institutions.

That’s all great, but our sole rationale for Argo is the potential for bitcoin to run higher and harder, ultimately long term looking to the $1 million per bitcoin mark over the coming years.

This is a way for you to get exposure to that through a London Stock Exchange-listed company, and without having to consider the custody risk and other issues that can be associated with investing directly into bitcoin through a crypto-exchange.

Risks

The risks are substantial.

Obviously, a lot of Argo’s valuation and success will be dependent on the price of bitcoin. With this, comes a lot of volatility, which may lead to violent fluctuations in Argo’s valuation and profitability.

For example, if bitcoin’s price were to halve, which has happened several times before, it would – all other factors being equal – effectively cut Argo’s revenues in half as well.

It would also cut the value of the bitcoin held on its balance sheet in half.

But, it could also make them more effective in terms of mining blocks and getting block rewards. This would happen if the network difficulty dropped and Argo increased its share of the bitcoin hashrate.

Nonetheless, dramatic falls in bitcoin’s price will smash the value of your investment in Argo.

Cryptos are volatile. Bitcoin is volatile. The Argo share price is – and will remain – volatile.

There are also regulatory issues that could affect the ability of the company to operate its mining facilities.

Negative changes to mining regulations where Argo operates its mining facilities – such as Canada and the United States – will affect operations.

Also, the continual need to access renewable, cheap, clean energy is essential.

Increasing competition and reducing returns also represent long-term challenges.

Every 210,000 blocks, the bitcoin block reward halves.

At the current overall rate of bitcoin mining, that implies that the reward will fall by 50% every four years or so.

Thus far, the rise in bitcoin’s price has offset the fall in the block reward.

Nonetheless, in the distant future (i.e. around the year 2140), block rewards will cease completely. As you can imagine, that is not really a risk we’re too worried about now – particularly as Argo is likely to diversify away from bitcoin mining.

Taking everything into consideration, I still think that Argo is a great long-term play on a rising bitcoin price.

Buying instructions

Argo Blockchain (LSE:ARB) trades on the London Stock Exchange (LSE), with a current price of 138GBp and a market capitalisation of £526 million.

It’s a strongly traded stock with plenty of volume so you shouldn’t have any problem getting your order in the market.

At this point, due to volatility in the price of bitcoin and of Argo’s stock, we’re not setting a stop loss point. However, we will keep a close eye should the market and the stock price head drastically lower.

Action to take: BUY Argo Blockchain (LSE:ARB) current price 138GBp. Buy up to 165GBp.

Name: Argo Blockchain plc

Ticker: ARB.L

Price as of 09.09.21: 138GBp

Market cap: £526.92 million

52-week high/low: 360.08GBp/4.31GBp

Buy up to: 165GBp

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor