Stock Alert: two answers to the world’s climate change prayers?

11th November 2021 |

Has there ever been a more anticipated, controversial, gathering of world leaders in history?

Maybe, but there’s no doubt that for the last week the world’s eyes have been focused on Glasgow (of all places).

It’s due to the 2021 United Nations Climate Change Conference of the Parties, also known as COP26

It has seen world leaders from more than 120 different countries meet to discuss ways to urgently tackle the issue of climate change.

As we speak, talks have one more day left to go.

Whether you agree with climate change or not, the key fact is these are the world’s decisions makers and the magnitude of this event cannot be downplayed.

A deeper dive into COP shows the track record of outcomes from the 25 previous iterations of it have often been lacking.

Meetings have often been fractious, with world leaders seeking to protect domestic interests rather than global ones.

Former US President Donald Trump’s comments regarding the 2015 COP21 meeting in Paris exemplifies this. In 2017, Trump noted that the agreement signed by 196 parties as a result of the event was:

‘Less about the climate and more about other countries gaining a financial advantage over the United States.’

Even if Joe Biden appeared to fall asleep during opening remarks, the US still has an important role to play in “green” policy as they’re one of the world’s largest polluters next to China.

China is the world’s biggest polluter of carbon emissions, yet President Xi Jinping is not even bothered to attend the COP26 talks in person.

It shows you where the priorities of some of these world leaders lie.

It also shows you that the “green” agenda is going to be a long, extended and still fractious trend that isn’t going away overnight.

What we do know, however, is that right now, the geopolitical climate for climate change policy action is white hot. And it looks set to continue to see a handful of “green” energy stocks light up the market.

Amid the enormous noise emanating from COP26, a number of points are – it seems – not getting the airplay that they deserve:

- Reduction in CO2 emissions is not the only good thing to come from clean energy solutions.

- The replacement of the world’s conventional, fossil-fuel powered vehicle fleet with electric vehicles (EVs) will require the development of innovative ways to store power.

- (Very) new technology will make possible tomorrow what was, until recently, scarcely imaginable.

It’s these key points and the distinct commitment by policy makers to go “green” that means this must be a focus for us ongoing here at Frontier Tech Investor.

This is why, we have two new recommendations for you in this edition of Frontier Tech Investor.

Transforming waste into green energy

EQTEC (LSE: EQT) is a developer of clean energy infrastructure that sustainably reduces waste.

It is an AIM-listed company on the London Stock Exchange. It has a market cap of £102.61 million and a current share price of 1.2 GBp.

The company has locations in Cork (Ireland), London (UK), Barcelona (Spain) and was founded in 2005.

EQTEC designs and supplies gasification plants that convert waste into synthesis gas (syngas), which is then used to power applications in the generation of green energy.

The syngas is used as fuel to generate electricity and heat, or to produce transportation fuels and green hydrogen.

The gasification technology is highly versatile and can process up to 50 different types of feedstocks, including municipal waste, agricultural waste, biomass and plastics.

What’s impressive is that EQTEC makes the gasification happen without combustion.

In the absence of combustion, they are able to reduce their harmful environmental impact.

Relative to other companies in the Frontier Tech Investor portfolio, EQTEC is unusual in that it is in the waste management industry – a big business.

According to EQTEC, the world is projected to increase its waste production by up to 70% by 2050. In addition, the global waste management market is set to be worth $485 billion by 2025.

Ignoring the hard sums, landfills impose significant environmental cost on the Earth.

This is because organic waste emits high levels of methane gas when it is left to rot at landfill sites. Methane is a major contributor to global warming, and can be up to 86 times more potent than carbon dioxide in trapping heat in the atmosphere.

EQTEC’s technology provides a cost-effective and sustainable solution to this problem.

What’s interesting is that in the current COP26 talks, 103 countries have signed a deal to reduce global methane emissions by 30% by the end of the decade.

This automatically brings EQTEC’s technology into focus.

Of course, EQTEC is also in the energy business.

According to EQTEC, electricity production will triple by 2050 and renewable energy will make up 50% of global energy by 2035, up from around 20% today.

In fact, the global renewable energy market is predicted to be worth $2 trillion by 2025.

Our view is that its EQTEC’s technology that could play a key role in helping to fulfill the world’s insatiable demand for electricity, which is growing in line with the world’s transition to greener energy alternatives.

But also due to their innovative approach to energy generation, they fit perfectly in with global “green” energy policy and we believe they are poised to capture a sizeable share part of both the waste management and energy generation markets.

With the shift to decentralised energy grids, which are helping to take the pressure off overstretched national energy grids, EQTEC’s technology could become an attractive option for policy makers.

Importantly, EQTEC’s gasification process is protected by two patents.

The early stage of technology commercialisation

Currently, EQTEC has one gasification plant in operation. It is situated in Movialsa, Spain, and has been running for around ten years. It has an output of around 6MWe (six megawatts or six million watts of electric capacity).

To give an idea, one megawatt equates to the same amount of electricity consumed by approximately 650 households in a year, on average.

EQTEC also has nine collaboration agreements in which it is currently developing its very own gasification plants.

The projects span across the world, including the United States, Greece, Italy, Croatia, and the UK.

Notably, its Billingham project in the UK will provide a capacity of 25MWe once completed. It will become the UK’s first sustainable waste-to-energy plant.

Financials and risks

EQTEC makes money by licensing and selling its technology to customers in the waste management and green energy infrastructure sectors.

Some of its current partners include giant energy conglomerates EDF Energy and Siemens.

For the year ended 31st December 2020, revenues were €2.23 million – a 33% increase compared to 2019.

However, operating losses almost doubled, going from €2.46 million to €4.65 million.

We acknowledge the losses, but right now as EQTEC is in the process of commercialisation they’re not a major worry for us. As demonstrated, the company is scaling up production and injecting large sums of cash into its actual and potential projects.

In its most recent figures, the company recorded revenues at €481,720 for the six months ended 30 June 2021, down from €770,308 over the same period in the previous year.

They also reported an adjusted net loss of €2.6 million, up from €1.3 million in the previous corresponding period.

As ever, though, the future is more important than the past. Indeed, 2021 could well be the year in which EQTEC really starts to shine

For the year ending 31 December 2021, the company is projecting its revenues to be in the region of €15 million; a 700% increase on its revenues from calendar 2020.

Interestingly, the company has revealed that its current pipeline of projects, which includes non-contracted tender opportunities, are worth €657 million.

That said, it’s important to consider the risks that the company faces.

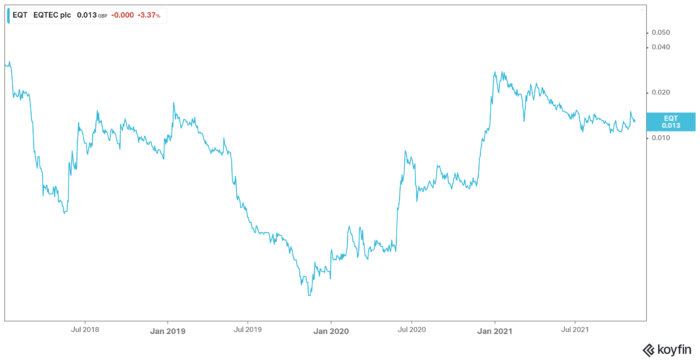

At least some people consider the risks to be very significant: the company’s share price has been on a downward trajectory for the entire year.

It closed on a yearly high of 2.77GBp in January 2021 . Now it’s 1.2 GBp at the time of writing.

However, we can attribute part of this decline to the broader sell off in clean energy stocks by institutional investors at the start of the year.

In addition, its failure to turn a profit thus far may have been a problem. However, we expect that this sell off is a shorter-term opportunity to enter a quality stock with promising technology potential perfectly aligned with policy and direction of governments and the move to greener technologies.

Another risk is that COP26 disappoints in terms of what is agreed by governments.

If history is anything to go by, this could well be the case.

Also, demand for EQTEC’s sustainable technology may fall short of its projections, which could be reflected in its share price.

Finally, the green energy market is becoming increasingly crowded. As more governments look to deploy green energy alternatives, private companies are being pinpointed to deliver them.

However, with its two patents, we believe that EQTEC will be able to mitigate this and provides investors with an element of inherent value in the technology EQTEC has on offer.

EQTEC is unquestionably a speculative investment, but trends are moving in its favour and we believe now is an opportune time to enter the stock.

Action to take: BUY EQTEC (LSE:EQT). Current price is 1.2 GBp. Buy up to 1.40 GBp.

Name: EQTEC plc

Ticker: EQT.L

Price as of 11/11/2021: 1.2 GBp

Market cap: £102.61 million

52-week high/low: 3.168/0.46 GBp

Buy up to: 1.40 GBp

Source: Koyfin

Source: Koyfin

Making EVs relevant and range abundant

Your second recommendation is Ilika (LSE: IKA), a producer of solid-state battery technology, which is targeting the industrial internet of things (IIoT), medical, electric vehicle (EV), and consumer electronics industries.

It is an AIM-listed company on the London Stock Exchange, and has a market cap of £216.49 million, and a current share price of 138 GBp.

The company was founded in 2004 and is based in Romsey, in the south of England.

Ilika is developing and producing solid-state lithium batteries, meaning that the interior is comprised of solid electrodes, rather than liquified electrodes that you see in conventional lithium-ion batteries.

Ilika produces and is developing two different types of solid-state batteries.

The first and most promising is the development of the Goliath battery, which is targeted for use in the production of electric vehicles (EVs) including cars, bikes, even flying cars (also known as e-VTOL, vertical take-off and landing vehicles)!

Ilika is part of the EV battery market that, according to Fortune Business Insights, is projected to reach a value of $154.9 billion by 2028, more than a fivefold increase on 2021’s $27.3 billion.

Crucially, Ilika’s solid-state batteries have several advantages over conventional lithium-ion batteries.

One is the rate at which they charge applications. Solid state batteries can charge up to six times faster than conventional lithium-ion batteries.

Another is the temperature at which they operate. Ilika’s solid-state batteries can operate at temperatures of up to 150 degrees Celsius. Usually, traditional lithium-ion batteries can only operate at a maximum temperature of 60 degrees Celsius.

Ilika’s solid-state batteries also have twice the energy density of traditional lithium-ions. This means that they take up half the volume and weight for a given electrical charge, allowing for greater efficiency.

Ilika is already working with giants of the automotive sector, such as McLaren, Honda and Jaguar Land Rover in the development of their Goliath batteries.

The Goliath batteries are currently in pre-pilot development with views to scaling up their capacity.

There are plans to increase the capacity from 1 to 10 kWh/week by the end of 2022.

In addition, Ilika is seeking to deliver a manufacturing line at the UK-Battery Industrialisation Centre (UK-BIC), a mega-scale, government funded battery production facility.

Not just supplying EV manufacturers…

The other battery in Ilika’s range is the Stereax battery.

This is a miniature, customisable solid-state battery that is used to power implanted medical devices and industrial internet of things (IIoT) sensors.

In the IIoT space, which can be defined as the interconnection of sensor-based machines and people, the sensors are used to monitor the condition of infrastructural assets.

Notably, Ilika’s batteries power sensors in wind turbines that monitor the condition of the blade.

Currently, it has a collaboration with wind turbine engineering company WindTak, in which it is creating a generator that increases the efficiency of turbine operation by 1-3%.

In this sense, Stereax gives Ilika another route into the green energy market.

The Stereax batteries are currently manufactured on a pilot line. However, as we speak, Ilika is establishing a new manufacturing facility that could expand production capacity by 70 times.

In total, Ilika has 25 patents globally which covers battery composition, battery architecture, and the process of making the batteries.

Financials and risks

For year ended 30 April 2021, turnover (comprised of revenues and grants) was £2.25 million. This is down from £2.8 million over the previous corresponding period.

Operating losses for the period rose to £3.84 million from £3.34 million.

We acknowledge the losses, and mainly attribute this to the fact the company is investing heavily in expanding output and that it’s still in development R&D phase with the progress of the Goliath batteries, which is where we see the big long-term potential with Ilika.

With this in mind, it is important to consider the risks of investing in the company.

Ilika is very much in the pre-commercialisation phase. It is yet to generate a profit; most turnover comes from grants and it’s still only planning to expand its production capacity. This will likely widen losses in the short-term, without guarantee that it can recoup them through its sales longer term.

However, we would expect that as it begins to commercialise its technology it quickly moves towards a profit position, especially thanks to the commercial interest it is receiving from major automotive OEMs who are seeking to transition away from combustion-engine vehicles, towards EVs.

It’s also fair to question how feasible some of Ilika’s plans are.

For example, considering that it is currently operating on third-party pilot lines, a seventyfold increase in its Stereax production capacity is a stretch.

Another risk is the growing competitiveness of the EV battery market. The market is constantly evolving and coming up with new innovations that challenge the existing technology.

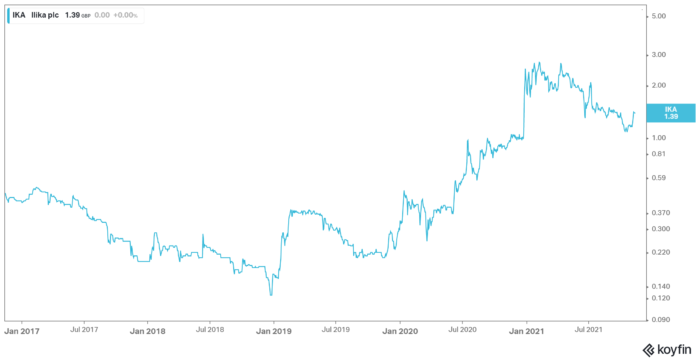

Another thing to consider is the notable decline in Ilika’s share price. After reaching a yearly high of 271.36GBp in February, it is currently at 138 GBp at the time of writing.

As was the case with EQTEC, we attribute this to headwinds in the green energy sector, investors looking to clip profits from a strong rise and waning investor sentiment towards green energy. We don’t think it’s indictive of a structural issue within the company and believe the market will provide a great entry point to a company that’s developing game-changing technology.

We are excited about Ilika’s long term potential to develop and commercialise solid-state battery technology and become a major player in the battery market.

Action to take: BUY Ilika (LSE:IKA). Current price is 138 GBp. Buy up to 158 GBp.

Name: Ilika

Ticker: IKA.L

Price as of 11/11/2021: 138 GBp

Market cap: £216.49 million

52-week high/low: 284.33/92.78 GBp

Buy up to: 158 GBp

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor