Stock Alert: World War II billion-dollar secret – electronics from Hampstead that saved the world

13th May 2021 |

It’s 1936.

Hitler and the Nazi Party have full control over Germany. They’re incensed that the German people were forced into paying the reparations stemming from the Treaty of Versailles.

In March he begins to send troop into the Rhineland demilitarized zone, thereby breaking the Treaty of Versailles.

Hitler and the Nazis are expanding their power base. In neighbouring Austria, the government has signed on to a pact, aligning that country’s foreign policy with Germany’s and allowing Nazis to hold official posts in Austria.

Hitler also wants full control of Austria. And he orders Austrian Nazis to, “create as much trouble and destruction as possible.”

In the midst of this, an Austrian engineer and inventor, who also is Jewish, is fearful for his life. He realises that he must flee his country to find sanctuary elsewhere, if he is to escape persecution from the Nazis.

Paul Eisler was that engineer. He managed to escape Austria as the political and geopolitical situations deteriorated.

Radical technology comes out of Hampstead

Eisler arrived in England, having been previously offered an invitation to work there following two successful patent applications. One of those patents was for a graphical sound recording, and the other for a stereoscopic television.

Eisler was able to also expand on an early design of what was known as a printed circuit board (PCB) from Charles Ducas. However, Ducas’s work was just a series of designs.

It was Eisler who actually created the world’s first printed circuit board, whilst he was living in a boarding house in the London suburb of Hampstead. The money that Eisler needed came from the sale of his TV patent. The first PCB was born.

Eisler’s time in England wasn’t easy, however. As World War II began, Eisler was declared to be an illegal alien and locked up in 1940 for a year. Fortunately, whilst interned, he still advanced his PCB work.

By 1943, Eisler had developed a more advanced PCB that had been based on his original idea. It was patented, and soon adopted by the US military.

The primary use of this PCB, as developed and patented by Eisler, was for proximity fuses for mines, bombs and artillery shells.

While you hear about great battles and devastating campaigns of World War II, what you rarely hear is that a tiny piece of electronics, a “funny fuse” (as described by US Army Lt. Gen. George S. Patton), was one of the biggest contributors to victory by the Allies.

It was the incorporation of proximity fuses in the Allies’ weaponry at an estimated cost in the 1940s of $1 billion that stunned the Axis forces.

This technology advantage was so significant that it was kept a secret, having been given the same kind of importance as the atomic bomb and the D-Day landing.

The reason why the proximity fuse was so effective and could be manufactured with speed and scale, was the PCB development from Eisler.

Eisler went from fleeing almost certain death to helping turn the tide of World War II. The PCB is arguably one of the most significant technologies ever invented. About 80 years and a technological revolution later, the PCB features in almost all electronic products and has never been more important than it is today.

As was the case in World War II, the PCB technology remains crucial within the defence aerospace industry and for other suppliers of military equipment.

At the forefront of the innovation and development of the PCB today is a small and unassuming company that is listed and based in the UK.

This company’s proprietary technology isn’t headline grabbing. It’s not “sexy” (as not much in electronics is). However, the technology’s importance in industries such as aerospace, defence, electric vehicles (EV) and green energy makes the company arguably one of the most important in the UK today.

From the “Chipageddon” crisis comes opportunity

Understanding the importance and opportunity that are in play with your latest recommendation, it’s necessary to know why a PCB is so important.

PCBs are the base component on which semiconductors function. They act as a platform for the electrical components of a device to be interconnected. Without semiconductors (and PCBs), everyday devices such as computers, TVs, and smartphones, would not function.

Without PCBs, there would be no semiconductor functionality. This is because there would be nothing to connect them to the devices we use and consume.

An important part of the back story of PCBs is the current shortage of semiconductors. This shortage is global and acute. We have discussed the semiconductor shortage previously, calling it “Chipageddon”.

This semiconductor shortage has stemmed from two key factors. Firstly, carmakers that have been shut over the past year due to the pandemic, are now competing with the electronics industry for the semiconductors. This has boosted demand relative to supply.

In addition, consumers have stocked up on laptops, gaming consoles and other electronics in the pandemic. This has been driven by increased home working, and the need for entertainment. Again, this has increased demand for semiconductors.

“Chipageddon”, the shortage of semiconductors, is hampering production and profitability for several businesses. Ford expects 1Q21 production to fall by up to 20% relative to that of 1Q20. Non-carmakers are feeling the effect too, with Samsung delaying the launch of its new smartphone due to the problem.

Nowhere is feeling the effects of the chip shortage more than in the United States.

In a meeting with key business leaders on 12 April, US President Joe Biden stressed the need for urgent investment in semiconductor infrastructure. He is hopeful of generating investment of $50 billion in the semiconductor industry, with emphasis on protecting American supply chains and increasing domestic manufacturing.

The president’s plans are big, but they are unlikely to have a material effect on the shortage in the short term. Indeed, it has been predicted that the shortage will last well into 2022.

Although this seems like bad news for the world, it most definitely isn’t for the company that we are recommending.

As Albert Einstein, a man who knew a thing or two about electricity, once said, “In the midst of every crisis, lies great opportunity.”

The crisis is global semiconductor shortage that has been temporarily shutting down manufacturing facilities for companies such as GM and Jaguar Land Rover.

The opportunity – which is bigger – is that demand for semiconductors will rise.

As go semiconductors, so too go PCBs.

Worldwide demand for innovative, market-leading PCB technology will also grow strongly.

And market leading PCB technology is precisely what is on offer from the company that we are recommending to you today.

In truth, its PCB innovation has been years in the making. It is a piece of ingenuity, that Paul Eisler himself would’ve been proud of.

Introducing your latest Frontier Tech Investor recommendation…

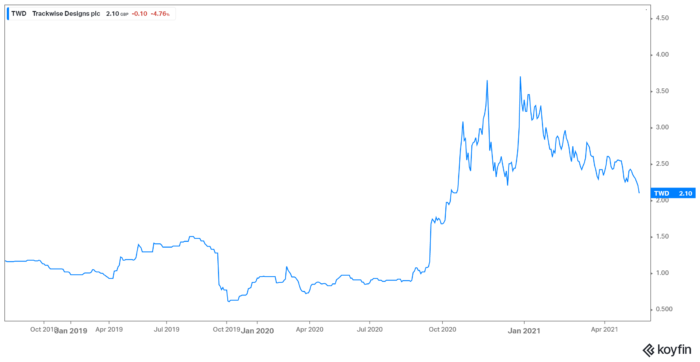

Trackwise Designs (LSE: TWD) is an AIM-listed company on the London Stock Exchange, with a market cap of £60.51 million, and a current share price of 212.9GBp. It first listed on the exchange in 2018.

The company was established in 1989. It is based in Tewkesbury, Gloucestershire, where it has its own production facility.

Trackwise is a manufacturer of specialist PCBs. As described earlier, a PCB is a platform that connects electrical components together using conductive pathways. They are the essential building blocks of many modern-day electrical devices, including smartphones and computers.

In part because of “Chipageddon” – the global shortage of semiconductors – the PCB market is growing steadily. In 2020, the European market was projected to reach a valuation of $75.7 billion by 2025. This implies a compound growth rate of 4.1% from 2020 to this period.

Trackwise manufactures a variety of tailored PCBs for a number of industries, including aerospace, automotive and healthcare. The PCBs are manufactured by two business divisions: improved harness technology (IHT) and radio frequency (RF).

It’s Trackwise’s IHT division that has broken new ground with PCB technology.

Previously, there had been limitations to the length at which PCBs could be produced. Traditional processes meant they were restricted to being a maximum of two feet (61 cm) in length.

However, Trackwise’s IHT innovation has led to the production of multi-layer, flexible printed circuits to any length. In one particular case study, the company was able to make an eight metre-long, flexible, multilayer PCB.

It is a game changer. This is particularly so for the aerospace industry, and it is already attracting the attention of major makers of aircraft components.

In 2019, for instance, Trackwise announced a collaboration with GKN Aerospace. This is a world-class multi-technology “tier 1” aerospace supplier.

The unlimited length, multi-layer IHT process technology for PCBs is patented, and provides users with cost-saving and weight advantages. Trackwise states that it can generate up to 75% in weight savings for aircraft and EVs in comparison with the traditional wiring harnesses that would otherwise have to be used.

Due to IHT’s success, Trackwise announced plans to scale up its supply capacity at the time of its initial public offering (IPO) in 2018.

In order to ensure that it could handle the first order for IHT process PCBs from an EV manufacturer, Trackwise purchased Stevenage Circuits Limited – another PCB supplier – in April 2020.

More recently, on 30 April this year, Trackwise announced the acquisition of a new 77,000 square foot freehold property in Gloucestershire so that it is able to scale up its IHT production capacity.

What appeals to us about Trackwise is its demonstrated involvement with high-value industries that are undergoing rapid growth.

Consider what is going on in the global EV market. Trackwise’s IHT process PCBs provide significant weight-saving opportunities and strong safety features, such as temperature and voltage monitoring.

Another example is its involvement in the expanding 5G market – which is of importance to Trackwise’s RF division. Trackwise currently manufactures specialist PCBs for Wi-Fi wireless broadband base stations in the 5G space. Mobile networks are turning to 5G to help remove data traffic and latency bottlenecks on their overcrowded 3G and 4G networks.

We see great potential in Trackwise. Its IHT process is high quality, innovative and unique. The PCBs are more efficient, lighter and more green friendly. Trackwise has a competitive advantage that it can exploit.

Financials and risks

We are anticipating the release of Trackwise’s 2020 figures in early June this year. Early indications suggest that revenues will be around £6.1 million. That would be a marked improvement from the 2019 year (£2.91 million) but below expectations. The company attributes the lower-than-expected revenues to the impacts of Covid-19 and “nervousness” around Brexit.

Trackwise is also expecting to show an operating loss of £0.2 million.

We don’t see these figures as an issue.

The previous year has been an anomaly across numerous industries – including those, such as aerospace and automotive/EVs, which are most prospective markets for Trackwise.

Also, the newly acquired property in Gloucestershire gives Trackwise the capacity to respond to any fast increase in demand for its PCBs.

However, with that said, it is worth considering are the risks that the company currently faces. In particular, it is far from clear what will be trajectory of recovery in the aviation industry – and, therefore, the aerospace sector where many of Trackwise’s customers and prospects can be found.

The company has also faced challenges in its RF business division. According to the company in its full-year 2019 report, trade disputes between China and the United States, and pressures from Huawei on 5G telecommunications companies in Trackwise’s customer base have halted overall financial progress in this division. It remains to be seen if this will continue to have an impact on the company for the full-year 2020, 2021 and beyond.

Also, it is vital that Trackwise successfully enforces its intellectual property rights on the IHT product. As the company increases its size and market presence, the likelihood that others may imitate the technology will increase.

Protecting this sought-after technology will help to maintain Trackwise’s market share and long-term profitability.

In spite of these risks, the long-term prospects for Trackwise look strong. We think that the IHT process will be one of the main drivers of business growth.

The ability to boost sustainability and efficiency on such a huge scale makes the IHT process attractive to the aerospace and EV industries.

In addition, the RF offering provides Trackwise with diversification across other growing industries. In particular, it gives Trackwise a foothold in the accelerating 5G space.

In spite of the risks, Trackwise has plenty of upside. It has a competitive edge in its technology. Its customers can be found in growing industries. It is a beneficiary of “Chipageddon”. It can expand output.

Buying instructions

Trackwise Designs (LSE:TWD) is an AIM listed company on the London Stock Exchange, with a market cap of £60.51 million, and a current share price of 212.9GBp.

The volume in the stock is relatively small, with an average of 46,652 shares changing hand per day.

As usual we recommend sticking to our buy limits. If the stock trades over that limit, we suggest that you wait for a suitable entry below our buy limit.

We will also be using a 50% trailing stop/loss on this position to ensure that we protect any future gains as well as providing some downside protection if the stock moves against us.

Action to take: BUY Trackwise Designs Plc (LSE:TWD). Current price 212.9GBp. Buy up to 295 GBp. We will set a trailing stop on this recommendation at 50% below the entry price.

Name: Trackwise Designs plc

Ticker: TWD.L

Price as of 13.05.21: 212.9GBp

Market cap: £60.51 million

52-week high/low: 394.28/2.41p

Buy up to: 295p

Source: Koyfin

Source: Koyfin

Sam Volkering

Editor, Frontier Tech Investor

Elliott Playle

Junior Analyst, Frontier Tech Investor