Urgent BUY Alert: two new “Bounce-back Belters”

16th April 2020 |

Originally published under Growth Stock Network on 16th April 2020.

It’s time for the stock pickers to go to work.

That’s what these kinds of markets deliver in spades. When volatility is rife, when prices have plummeted, the approach to take is not a passive one.

The time to be active is now. This is where you can become a hero or a zero. This isn’t trading off the misfortune of others. It’s looking at the reaction markets have taken to global events and making smart long-term decisions based on the situation presented to you.

And it’s what makes the small-cap markets so god damn thrilling. It’s the kind of market where a bit of “punt money” can set you up. It’s where you can move in and out of positions in a matter of days and cash out big, tasty profits.

But it’s also the kind of market where if you’re not able to balance your risk tolerance with the actions you take, it can be a devastating market.

You can lose the shirt off your back if you play this the wrong way. You need to be confident in how you manage your capital allocations, how you manage your entry positions, how you cover the downside and where you decide to take some cream off the top should it come.

This is what it means to be active in a rollercoaster market.

With that said, as mentioned over the last couple of weeks, we’ve been preparing and watching and waiting for the right time to enter a number of stocks that we think have immense bounce-back potential once we come out the other side of this coronavirus crisis.

We’ve been to-ing and fro-ing as to whether we release them all to you at once or look for the right time to bring them.

The decision we decided on was that we must play each one as its own unique delivery.

The time will be right for some, wrong for others, each week, each day. So continue to keep an eye out at the close of market (we’ll usually send any alert or update at 5pm) as there’s no certainty as to which day we might release a new stock.

But today we think the time is right to bring you some new recommendations that we believe are primed to be some of the UK markets best “Bounce-back Belters” from this crisis.

Before we crack on and introduce these new recommendations, I want to emphasise something…

These are as high-risk plays into the market that you will possibly ever see.

Such is the current uncertainty of this situation that there’s still no guarantee these stocks will even survive. You MUST understand the severity of that as an outcome.

While it’s not something we expect, it stands as a real concern. Hence it’s vital that you manage your capital allocations to these recommendations accordingly. You don’t need to bet the house on them if the upside delivers as we expect.

You must only be using capital you can really afford to burn if it all goes belly-up. Again, that’s not an outcome we expect, but it’s one you need to weigh up.

With that said, let’s just rip into one of the most controversial and risky stocks we’ll maybe ever bring to you…

Bounce-back Belter #1 – Aston Martin Lagonda Global Holdings (LSE:AML)

Aston Martin is one of the most iconic names in British manufacturing over the years. I don’t need to go into massive detail about what the company does, you’ve likely heard of Aston Martin and you know it makes cars – specifically high-end luxury and performance cars.

But as one of the most iconic names in British manufacturing it’s also one of the most tragic stories of 2018 and 2019. And thanks to the market capitulation in 2020, just when you thought things were bad for Aston Martin, it gets worse.

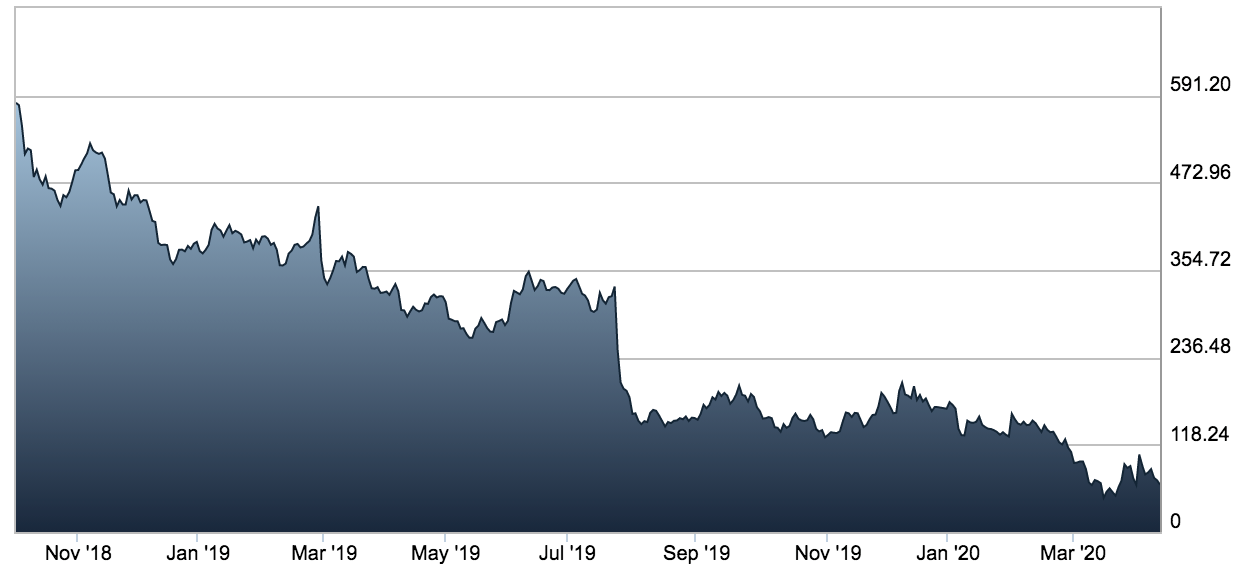

It’s an historic British car marker which since listing in October 2018, has been smashed from pillar to post.

And rightly so.

It’s struggled to maintain cost competitiveness, struggled to deliver growth, brought on debt and looked like it was heading into oblivion (again).

The company published its full year results to 31 December 2019 at the end of February 2020.

It reported a 9% fall in revenues to £997 million. Adjusted operating profit was down to just £5.4 million from £146 million for the full year in 2018. Its diluted earnings per share fell 60% to a loss of 49.6p and it increased net debt to £876.2 million.

Makes for pretty dire reading.

Since listing in October 2018 the stock price sailed down from £19 to a fraction of its listing value by the start of 2020. Then coronavirus hit. And it got worse because its big market opportunity was… you guessed it, China!

Trading during the “Market Mayhem of March 2020” saw AML plummet even further. And on 16 March 2020 it hit an all-time low since its October 2018 listing. The stock has been volatile since bouncing around and it’s not uncommon to see double-digit daily gains… and losses.

But the downward spiral before coronavirus and the subsequent hammering of the stock has ripped Aston Martin’s market cap down to just £170 million at the time of writing and now believe it or not, Aston Martin – the historic, iconic British name – is a small-cap stock!

Many have written off Aston Martin. And there’s a good case to continue to do so. But we don’t think so.

You see, not all hope is lost for Aston Martin.

Canadian luxury brand billionaire Lawrence Stroll picked up a huge chunk of Aston Martin in January. He injected around £182 million to help turn the flagging British car maker around. Stroll will take on the role of executive chairman too.

Hindsight is a wonderful thing. He could have picked up the whole company if he’d held out a few more months. But, what are you going to do?

The question is, however, who is Lawrence Stroll? The Stroll family had already minted a small fortune before Lawrence ramped that up. His father had brought Polo Ralph Lauren and Pierre Cardin to the Canadian market. And then Lawrence helped take it to the European market, making Polo Ralph Lauren one of the world’s biggest most well-known fashion brands.

Lawrence also was instrumental in the building of Tommy Hilfiger globally and also the growth and explosion of Michael Kors. So he knows a thing or two about luxury brands and making them a global success.

Now he hopes to be a critical part in doing the same thing to Aston Martin.

Stroll also owns the Racing Point Formula One team. That’s important because in 2021, Stroll is rebranding Racing Point. For the 2021 season onwards the team will be the Aston Martin F1 Team.

You’ve now got a luxury brands billionaire leading a new strategy for a struggling, yet iconic British car maker. It’s also aiming to hit the heights of Formula One, taking head-on Ferrari, McLaren and Mercedes-Benz.

My view is that Stroll’s given himself a red-hot chance to turn this brand around. Make Aston Martin more like Ferrari. Not a car company, but an aspirational luxury brand.

With his position and stake in Aston Martin and his track record and strategy for Aston Martin, we think there’s a real opportunity to get an entry to this beaten-down iconic British brand and ride the potential upside.

Of course, Aston Martin does still need to shift cars as part of its success. And a big part of that rests on the success of its new DBX SUV. This will be particularly relevant in big markets like China and the US.

Right now Aston Martin has shut its manufacturing facilities in the UK, so at the moment DBXs or any Astons aren’t getting built. So it’s not selling much, or any, for the short term. But coming out of the back of this crisis, and with the reopening of trade, we think it will spark Aston Martin back into life.

While we think there’s a good opportunity here to invest in an iconic British Brand as it looks to rebuild itself globally, we think there may also be a good opportunity as Aston Martin may become an attractive take-over target.

Of course, that’s speculation on our part, but you’d have to consider this with the likes of Volkswagen Group, Daimler or a number of Chinese car makers looking to regain lost momentum out of this crisis. With Aston Martin at these kinds of levels, it wouldn’t take much to acquire the whole company.

Risks

Now let’s just put this on the table. Aston Martin has battled before changing ownership hands multiple times over the years. We’ve lost count. Ford once owned it, then divested its holding. There’s been technical partnerships and part ownership from Daimler. And more recently, technical partnerships with Red Bull Racing.

But as a public company the brand has struggled. The DBX SUV, while late to the SUV party, may help turn around sales, and the Valkyrie (partnership with Red Bull) adds a hyper-car to the mix of its line-up (albeit it’s yet to be delivered to anyone).

Still, car design, brand aspiration and sales will be the making of this company. We think the Formula One constructor strategy will help and we think that the DBX will be a success.

However, if it’s not, and if the Formula One team is an endless money pit that doesn’t deliver results, the stock could easily drag lower.

The proposed ban on all new sales of petrol and diesel vehicles by 2035 is also a material risk to the company. It has to develop electric vehicle (EV) technology in its car line-up. Without it, it won’t be able to sell any cars.

Right now, there’s no EV or hybrid Aston Martin – it had been developing the Rapide E, an EV version of its Rapide, but that was paused indefinitely. And any development of the Lagonda brand, which caused great excitement just last year, has been shifted back to at the earliest 2025, which was originally 2022.

These pushbacks are a risk to the reinvigoration of the brand. The development of an EV has to fire back up. We expect it will as it recognises the risk, but should its EV development falter or not deliver the expected performance and design that customers desire, again, it would lead to struggles for the company.

Also, the company was carrying net debt of £876 million as of the end of 31 December 2019. It also had property, plant and equipment valued at around £738 million at the end of 2019. Taking off depreciation (for accounting purposes) that’s a net book value of £350 million.

What this all means is that in terms of raw physical assets, the company isn’t worth much. But add on the brand value, development technologies, IP and the market value of the assets the company owns and there’s some value there. In fact, with its current market cap, we’d say it is quite undervalued.

But this is a beaten-down, market-hated stock. It’s a bit of a roll-of-the-dice play, in that even if there’s a market turnaround and the crisis ends, that’s no guarantee Aston Martin will bounce back to great glorious heights.

It may still flounder. But we think the risk for further falls, and even complete capitulation, is balanced out by potential upside if Stroll can help turn it around and the company can get operational again out of the crisis.

It’s a high-risk, very contrarian play. But one we think is worth taking at current prices.

Action to take: BUY Aston Martin Lagonda Holdings

Ticker: LSE:AML

Price as of 16.04.20: 51.15 GBX

Market cap: £173.43 million

52-week high/low: 353.13p/1.44p

Buy-up-to: 73p

Use a trailing stop/loss on your entry set 50% below your entry price. While the stock is volatile, we want to use some more downside protection here just because of the extreme high-risk nature of this recommendation.

Bounce-back Belter #2 – Hyve Group (LSE:HYVE)

Hyve Group is an event and events management business that puts on industry-leading events across the globe. It has a team of 1,200 spread across the globe that puts on in excess of 120 events per year, such as Bett – an event focused on learning and education technologies, otherwise known as “EdTech”. Bett holds events in Asia, Europe, the UK and Latin America.

It covers all kinds of industry and trade events from fashion and beauty, to oil and gas, advanced technologies, trade and logistics, food and beverage, and retail (just to name a handful).

You’ll often find its events at major function centres such as the London ExCel.

And as you’d expect with the world on lockdown, Hyve and its events are all either cancelled or postponed. There’s certainly no short-term potential it to have a few thousand people in a large events centre.

This means the company has effectively ground to a shuddering and devastating halt.

It is one of the potential casualties that we could see if this lockdown continues on for six to 12 months. But we don’t believe the company will fail. In fact, we think that once the world moves over the peak of infections, finds access to treatments and a vaccine, and we exit lockdown, Hyve could become one of the best rebound boom stocks on the London Stock Exchange.

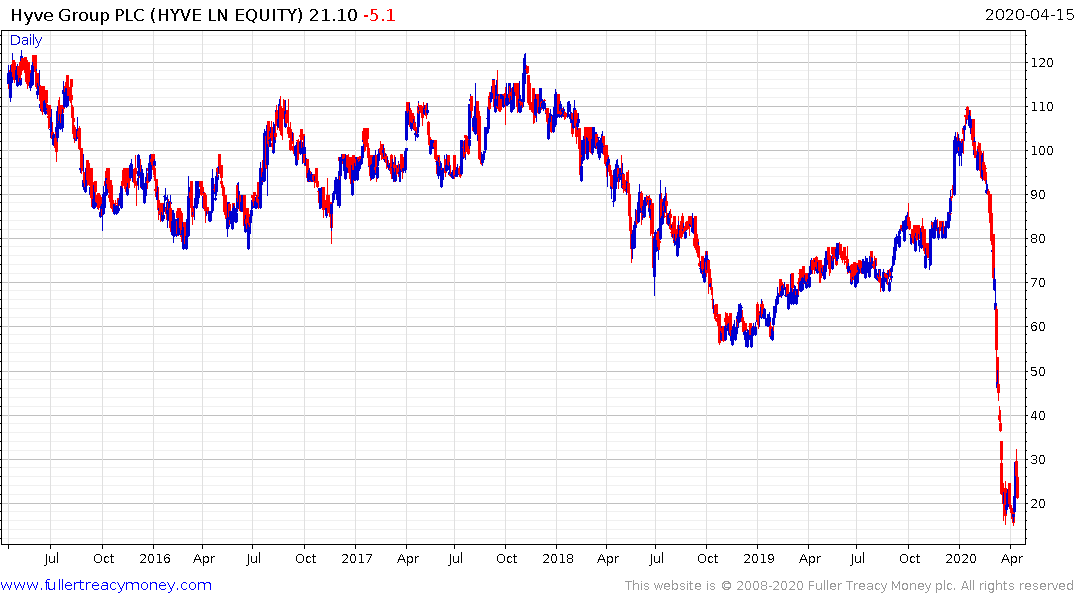

Hyve Group is traded on the main market of the London Stock Exchange, with a current price of 24.45 pence and a market capitalisation of around £200 million.

On 15 January 2020, just a couple of months ago, the stock was trading at 109 pence. And on 14 January 2020 the stock had even entered the FTSE 250 Index, leaving the FTSE SmallCap index behind.

This came off the back of successful financial results from 2019, the acquisition of Shoptalk and Groceryshop (two US-based events companies) and a successful share placement announced on 19 December 2019 raising gross proceeds of £63.9 million.

Before the coronavirus crisis hit, Hyve was flying along. It’d had a few years of net losses, but in 2019 had turned this around to record a pre-tax profit. The company explained in its annual report:

The Group reported a profit before tax of £8.7m (2018: loss before tax of £3.7m), after including adjusting items of £41.7m (2018: £39.1m). The return to a statutory profit before tax is attributable to the acquisitions of Ascential Events and Mining Indaba in 2018 combined with strong underlying trading growth.

However, as noted, the lockdown of the world and the banning of gatherings and public events has seen Hyve’s stock price (rightfully so) tank.

It hit a 52-week low of 15.4 pence on 6 April 2020. To give that some perspective, the stock has never traded this low. But that’s because of the crazy uncertainty involved in global events.

The company noted on 5 March 2020 that it expected an adverse impact on revenues up to around £19 million and up to £18 million impact on profit in the current financial year. This was due to the fact it was expecting most events would be postponed and it had £200 million in forward bookings for the year.

That was before global lockdowns went into full effect.

Its most recent update from 23 March 2020 gives a more accurate picture of expectation for the full year. While it didn’t put figures on it, as it’s nearly impossible to do so at this point, it noted, “… we are activating a large-scale postponement plan per region. This is larger than had been anticipated at the time of our March 5 coronavirus update.”

It also noted it will cease to be giving forward guidance as the situation is uncertain and as we note, nearly impossible to accurately forecast considering the speed at which things are changing day to day.

Now a major events company is going to carry immense risk in this climate, hence in recommending this stock we see a potential bounce-back that could deliver multiples higher, even just to get back to what would be fair value in normal trading conditions.

That means you don’t need to and shouldn’t pile loads of capital into this recommendation. If it does survive and bounce back to its January price of around 109 pence, we’d be looking at a possible 340% rise.

Risks

The risk that you carry in entering this stock is the uncertainty around the length of these restrictions and public gathering bans.

Should there be a prolonged ban on large gatherings and public events for longer than six to 12 months, it’s going to really impact Hyve’s stock price.

Make no mistake, if lockdowns and bans on large public events and gatherings of people are prolonged – a year or more – then we anticipate Hyve will struggle to maintain itself as a going concern. That would mean no revenues from booking, massive disruption to its financial position, and it would cause immense strain on the company’s debts.

However, we don’t think these lockdowns and bans on events will last that long. Having said that, even if we start to see these restrictions lifted, it will be a gradual return to “normalcy” and will be a hit to Hyve this financial year, and a possible lag into the next year.

One of the positives (of the few you can take from this situation) is the following comment from Hyve in relation to its latest update. It explains,

We are in constructive dialogue with our lenders in relation to covenant headroom and facility flexibility. We have access to total committed debt facilities of £250m which we have fully drawn in order to maximise flexibility in terms of short-term liquidity, providing the Group with significant cash resources at hand.

Yes, it’s leveraged up to the hilt. And yes, that’s no confirmation it will make it through all this. But we think with the funds from the capital raising as well as the debt drawdowns, cost cutting and capital management, Hyve will survive.

And once the market realises it will, and that we will return to a normal world again, we could see its stock price pop.

From its current stock price level we are taking a long-term view on the company. We’re looking really at a 12-month to 18-month window to see the company realise its potential and return to its previous level.

Of course, we anticipate the time frame may be shorter, sharper and faster, but we think that taking the long view on this helps to also mitigate some of the short-term volatility that we may see in the stock from here.

Like we say, there’s a real risk it can’t sustain such a shutdown of the business longer term. And it may have to look at ways of managing that. That could be a serious negative to the stock. But if it makes it through, which we expect it will, the potential upside form here, regardless of the short-term volatility, could be multiple-times higher.

With that potential on the table, even with the high risk considered, we think this could be one of the best Bounce-back Belters on the London Stock Exchange right now.

Action to take: BUY Hyve Group Plc

Ticker: LSE:HYVE

Price as of 16.04.20: 24.45 GBX

Market cap: £199.47 million

52-week high/low: 110.00p/14.96p

Buy-up-to: 28.5 GBX

Set a trailing stop/loss at 50% below your entry price due to the wild volatility in the market and very uncertain nature of the outlook for Hyve Group.

That’s it for now – we’re sitting on a couple of others that we’re just finding the right moment to release.

These could come as soon as tomorrow, or early next week, or later next week or even the week after. We’ll know when we believe the time is right and get them out to you, which may come outside of your regular weekly updates, so just be aware.

Until then,

Sam Volkering

Editor, Growth Stock Network