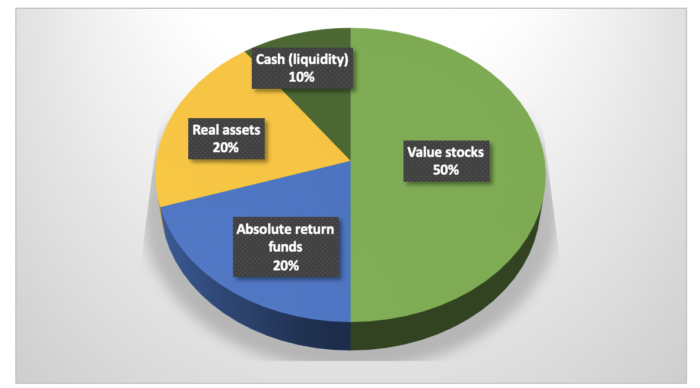

Current asset class breakdown as at December 2020

My model portfolio has more than a little philosophically in common with the late Harry Browne’s “Permanent Portfolio” – a portfolio designed to protect and grow your capital under all conceivable economic circumstances.

The Permanent Portfolio concept advocates an equal split of your assets between cash, bonds, stocks and gold. All you then need to do is rebalance the weightings of this Permanent Portfolio annually, so you are always allocated to each asset type indefinitely.

Eagle-eyed subscribers will have spotted the flaw in this model. What worked in the 1970s (when this investment approach was first conceived) is no longer fit for purpose in 2020, when counterparty risk at banks is higher than ever, when deposit rates are derisory at best, when the risk of financial repression is higher than ever, and when the risk of inflation is also on the rise.

The same arguments hold in the context of bonds, both at a corporate and government level. So fully 50% of the Permanent Portfolio – that is, bonds and cash – is no longer fit for purpose.

So instead I advocate a revised version of Harry Browne’s original conception.

My alternative approach consists of three asset types, namely:

- High-quality value stocks and funds

- Absolute return funds (funds which have the aspiration of generating consistent positive real returns)

- Real assets, notably gold and silver, and related investments.

I’ve included cash in the pie chart above, but clearly I’m not overly enthusiastic about holding meaningful amounts of cash at all, except as a form of “dry powder” that can be put to work following any serious market correction. Don’t view these percentages or specific recommendations as prescriptive, by the way – they’re meant as a general guide, and everybody’s individual circumstances and risk appetite are likely to be different.

Unconstrained value stocks

Within the equity portion of the model portfolio, while I still like everything within the portfolio, my particular favourites today are the Baillie Gifford Japan Smaller Companies fund; Tosei Corporation in Japan; Fresnillo (the world’s largest silver miner); Seaboard (a diversified US agribusiness company); and Wheaton Precious Metals (a precious metals royalty and streaming company).

The Halley/Samarang Asian Prosperity Fund is retained as a “Hold” because the fund is closed to new investors, but I recommend that any investors who already own the fund retain it, as they probably won’t be able to get back in if they sell it in the near to medium term. In the interests of full disclosure, within my own fund, the VT Price Value Portfolio, I have holdings in Fresnillo; Halley/Samarang Asian Prosperity; Seaboard; and Wheaton Precious Metals.

Absolute return funds

While I like all of the holdings within this portion of the portfolio, I have a special enthusiasm for the systematic trend-following funds. These are momentum-based trading funds that can go long or short pretty much everything, typically via futures markets, which are the deepest and most liquid markets in the world.

My favourites include Dunn WMA and Man AHL Diversity, both of which we own for clients in our private client business. I favour the systematic trend-following funds for two key reasons:

- They are typically uncorrelated to either stock or bond markets (and hence good portfolio diversifiers)

- They have the potential to make significant gains during bear markets (because they can happily go short, whereas most institutional fund managers are constrained simply to shelter in cash rather than actually profit from market falls).

It’s important to acknowledge, though, that the regulator isn’t fond of systematic trend-following funds, and neither are most fund platforms or IFAs. That’s probably because even when available in a UCITS format (which makes them available onshore and in a regulated form) they’re still ultimately deemed to be akin to the hedge funds from which the strategy evolved, and are considered unsuitable for retail investors.

It would be fair to say that most IFAs would run a mile rather than recommend a trend-following fund. (Far better to recommend something “low risk” like a government bond fund.) My contention is that the better trend-following funds are actually good at risk management, and position sizing.

Real assets

Last, and by no means least, we come to the real asset component of the portfolio. If, like me, you are concerned about the prospect of messily high inflation, you may wish to allocate even more than 20% of your investment portfolio to real assets. (I do, personally.) The core holding here is the Central Fund of Canada/Sprott Physical Gold and Silver Trust, which invests in gold and silver bullion custodied by the Royal Canadian Mint.

The next holding offers exposure to the next rung up the risk ladder, namely to gold and silver mining companies, in the form of the BlackRock Gold and General Fund. Beyond that, you may wish to take the plunge and consider individual gold and silver mining companies, but that will clearly come with a higher level of associated volatility given company specific risks.

The next thing that will likely feature in the “real assets” portion of the portfolio will be investments in the non-precious metals commodities space, perhaps in the realms of forestry or agribusiness. For the time being, I continue to see huge merit in the ownership of gold and silver.

I’ll be taking a short break over the festive period but will be back to you early in the New Year. Please accept my very best wishes for a Merry Christmas and a peaceful, prosperous and healthy New Year!

Until next time,

Tim Price is director at Price Value Partners and manager of the VT Price Value Portfolio. He is also the author of Investing Through the Looking Glass: a rational guide to irrational financial markets. He welcomes your feedback and any queries. Please email them to [email protected].