Making the science of email “smart” and “intelligent”

4th May 2023 |

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- Reader Questions & Answers (Q&A)

- What else we’ve been looking at this month

Over the course of my years on this planet, I’ve tried and tested plenty of technologies. I’ve been involved with several technology businesses and have tried first hand to launch my own business when I was (quite a bit) younger.

I’ve had a patent approved, I’ve been involved in some game-changing technologies like crypto, 3D printing and autonomous cars well before the mainstream ever caught wind of these breakthroughs.

But what I’ve found over the years is the exponentially increasing difficulty in being seen, heard and reaching people. Whether you’re starting out in business or even if you’re a long-established, reputable stalwart of industry, it’s very hard to reach your ideal customers.

Maybe you’ve experienced this frustration yourself. But in an online, digital world, reaching people is insanely hard.

Many (many) years ago, I set up a small technology business importing accessories and devices for smartphones and tablets. One of our lead products was (in a nutshell) the Apple Pencil – well before the Apple Pencil ever existed. It allowed you to write and draw on an iPad, or any compatible tablet.

The problem wasn’t the technology itself (although had I still been doing it when the Apple Pencil came out that probably would have ended things anyway). The problem was reaching customers – trying to get the technology in front of people and businesses, who once they could see, use and understand the product, were always very impressed and often placed orders.

When you’re starting out in business, whether it’s a product you’re selling or a service you’re delivering, scaling up is hard. And with so much noise and “shouting” online, how can you reach an audience that’s relevant to you in the right, professional way?

Pre-internet, you’d pound the pavement, network and maybe even do something like a letterbox drop. Maybe, if you had the stomach for it (which I never did), you’d cold call potential customers.

While that’s still workable today, it’s labour and capital intensive. Believe it or not, but well before Southbank Investment Research ever existed, the earliest iteration of our investment newsletter business was sending actual physical newsletters in the mail.

But that all changed when the internet came along. The internet changed everything – however, as much as the internet changed our world, something else the internet enabled changed the very fabric of communication… email.

Email has changed how the world communicates and reaches each other. Time and time again there’s the promise of some kind of tech – the next big thing that will “kill email” – but it never eventuates.

That’s not a jab at lack of innovation in our world, it’s testament to the importance and immovable object in our lives that is email.

Email is perhaps the most significant communications tool in history. And yes, I’m including the radio and telephone in that conversation.

While it’s by no means the only way we communicate anymore, it’s still, arguably, the most important. And if you can “master” email communications, you can get your business into the homes and minds of a greater reach of people.

Your latest recommendation is a company that has mastered email for the last 20 years. It has built its business of the foundations of email communications and now is one of the most exciting marketing companies on the London Stock Exchange.

This high-growth, high-octane, UK born-and-bred gem is now trading at a price (thanks to the tech market capitulation of 2022) where we think it’s the perfect time to bring it into our Buy List.

And it all starts at the turn of the millennium…

From mail to digital

Back in 1999 as the global tech market was booming – and yet about to implode – a small company called Dotmailer was born in London. Its founders initially focused on providing web development services. However, they soon identified a significant gap in the market for a user-friendly email marketing platform and launched a mail provider for the BBC.

The specialisation and evolution in mail and its marketing and data services has seen the company grow, winning multiple business awards, listing on the AIM market and eventually rebranding to Dotdigital in 2019 to reflect the more comprehensive marketing and data services and platforms the company now delivers.

Fast forward to today and Dotdigital has transformed into a leading global provider of omnichannel marketing automation solutions (that means marketing strategy that provides an integrated experience for customers across channels, including email, SMS, social media, mobile apps, websites and more).

This helps its customers reach, engage with and market to customers to help grow businesses.

With a presence in over 150 countries and serving more than 4,000 clients, including giants like DHL and British Airways, Dotdigital has come a long way since its humble beginnings.

Dotdigital’s evolution can be traced back to the early days of email marketing. Back then, marketers were still figuring out the best strategies and tools to engage customers effectively through this new channel. The company recognised the potential of email marketing and built a simple platform that allowed businesses to create and send professional-looking emails with ease. The company has continued to innovate, integrating new offerings into its platform, expanding the business internationally and bringing in the latest technologies to offer a comprehensive and valuable marketing platform for customers.

It is a market leader, with some exciting, high-tech, “smart” growth potential in a constantly growing industry.

Market opportunity

Marketing automation is an industry projected to be worth $15.7 billion by 2032, growing at a compound annual growth rate (CAGR) of 12.3% between 2022 and 2032. As one of the pioneers in this space, Dotdigital’s Engagement Cloud platform stands out with its user-friendly interface and extensive range of features, including email marketing, SMS, social media and more.

Dotdigital’s subscription-based business model means a level of predictability in terms of revenue. The company’s total reoccurring revenues are 95% which highlights the value its customers derive from its offerings and their loyalty to the company. This model also allows Dotdigital to continuously invest in innovation and improvement, ensuring it stays ahead of the competition.

One of the key aspects of Dotdigital’s business model is its focus on providing an exceptional customer experience, of which it continues to win awards for. The company invests heavily in customer support and services, which it has done for several years. This ensures that clients can make the most of its marketing automation platform through integrations such as live chat. This focus on customer satisfaction has been a critical factor in customer loyalty and long-term revenue commitments.

Dotdigital has forged strategic partnerships with some of the biggest names in e-commerce, including CRM, as well as marketing technology, including Adobe, Salesforce and Shopify. These integrations enable its customers to seamlessly connect their existing tools and systems with Dotdigital’s platform, providing a better overall marketing automation experience.

Furthermore, these partnerships expand Dotdigital’s potential customer base, as businesses already using partner solutions can easily adopt Dotdigital’s platform. This strategy has helped the company to grow its market share and increase its brand visibility in its industry.

AI finds its way into another online, digital platform

One of the growth opportunities we see for Dotdigital comes in the improvements and efficiencies we believe artificial intelligence (AI) will deliver for industries globally.

Dotdigital is continuously investing in AI to enhance its platform’s capabilities and deliver more value to its customers. The company acquired the Compai group of companies, a leading messaging and automation platform, in 2017, which helped to boost its AI capabilities. And more recently in 2023, it began integrating GPT-3 into its email marketing systems, calling it “WinstonAI” – its very own AI assistant.

By leveraging AI, Dotdigital’s platform can analyse customer data more effectively, enabling more insightful and targeted marketing campaigns. This investment in AI positions Dotdigital at the forefront of marketing technology, ensuring it stays competitive in an ever-evolving landscape. It’s also an example of the different ways in which AI is infiltrating industry and will impact the different ways in which we communicate.

Much in the way we recommended CentralNic to you for its potential to integrate AI into its offering, DotDigital is also exciting to us for its progressive approach to the integration of AI into its platforms as a tool for its customers.

Financials, risks and the path forward

Dotdigital’s latest set of interim financial reports for the half year ended 31 December 2022 were promising.

The company has made good progress in the first half of the year, with revenue growth of 9% to £33.8 million, which was in line with management expectations. The group’s revenue growth was driven by improved customer retention, increasing revenue per customer and new customer wins. The group’s net cash balance of £49.6 million shows strong cash generation, which provides the chance to invest in growth opportunities.

The company is seeing growing interest in sectors such as not-for-profit, utilities, financial services, construction, media and healthcare, which are all potential areas of focus for new contract and business wins.

Its global expansion has resulted in international revenue growth of 19% to £11.5 million in the period, with international sales contributing 34% to total revenue. Diversifying revenues from multiple countries puts the company in a strong position moving forward.

The company’s operating profit of £7.5 million is down from the same period a year prior, but importantly, the gross profit was higher than 2021, as was the overall revenues numbers. The increase in costs mainly came from administrative expenses which can suggest greater capacity for growth moving forward.

Overall, the financial results suggest that the company is on solid footing, with strong revenue growth, high levels of recurring revenue and strong cash generation.

Growth opportunities are supported by the growing demand for digital marketing and the integration of AI which we believe will be an attractive proposition for customers.

However, we must consider that the development of technology and product offering is crucial for the company’s success. Cost, data insights and effectiveness of its products are crucial factors for growth. Failure to innovate and deliver a useful platform at a valuable cost to customers will be a drag on the stock.

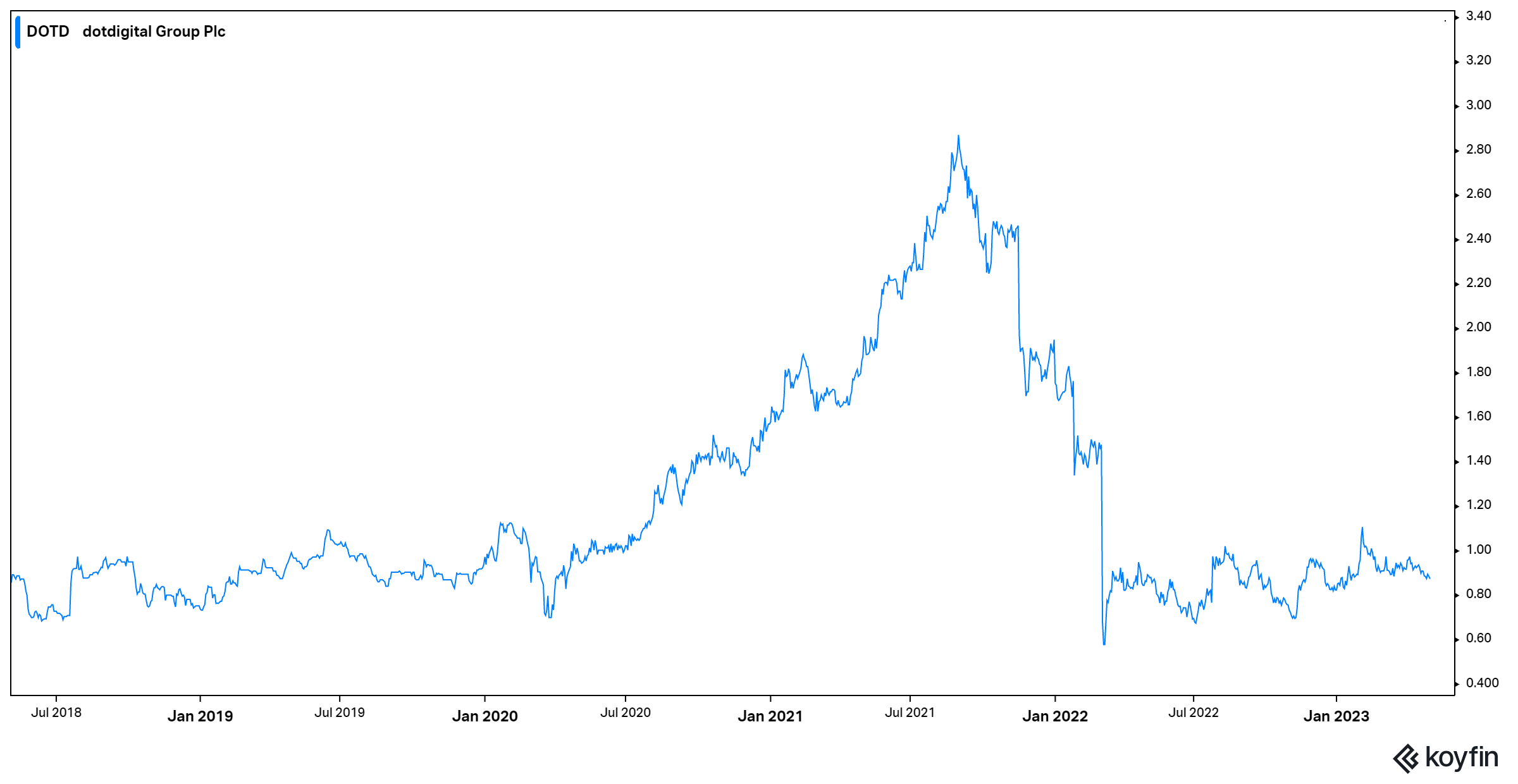

Worth noting is that the company rocketed higher in 2021 (with pretty much every other market on earth) but came crashing down as high-growth tech companies came off the boil and liquidity dried up in the market.

This saw the Dotdigital stock price drop from a high of around 295GBp in September 2021 to a low of around 52GBp in early March 2022. This put Dotdigital closer to a true valuation, albeit oversold at that point.

This kind of volatility is something you should prepare for in the stock. Should we see similar conditions in 2023, we may very well see valuations fall lower still.

Today at a price of around 89GBp, the company is profitable, trading at a forward price-to-earnings (PE) ratio at 21x. This is still a little high, but it is not wildly overpriced for a tech/software platform company.

To give that some perspective, a company like HubSpot – a CRM tech platform and not too dissimilar to DotDigital – trades at a forward PE ratio of over 95x. It should also be noted that HubSpot isn’t currently profitable.

Companies in this industry are also highly valued and aren’t isolated from a potential acquisition. In November 2021, Inuit acquired Mailchimp for over $12 billion in cash and stock. Mailchimp’s revenues were $800 million at the time of the acquisition which indicates a PE ratio of 15x.

Compare that to DotDigital’s 2022 revenues of £62.8 million (US$78.5 million) and current price-to-sales (PS) ratio around 4.27. If you apply the same PS ratio that Mailchimp was acquired for, theoretically DotDigital could be worth US$1.17 billion (£935 million) – that’s 4.3x more than its current market capitalisation.

In short, we see DotDigital as great value in its industry, but with great growth prospects up its sleeve.

However, you also need to consider that all these valuations are still grossly overvalued. The market may also revert closer to average FTSE All-Share PE ratios of around 14.4x – then again, we may see the stock price head lower.

As noted, the industry is highly competitive from all over the world so it’s crucial for Dotdigital to maintain reoccurring revenues and look to bolster that with new contract wins. A tail-off on reoccurring revenues and a reduction in earnings may drag the stock price lower.

Providing some relief from volatility, the company does pay a dividend – not much of a dividend, but one nonetheless. We would expect that to continue with ongoing profitability.

Overall, considering the risk, but also the potential of the company in an important industry known for growth and innovation, it’s at a position where we see great long-term growth potential.

Action to take

Dotdigital’s impressive financial performance, market leadership and unique business model make it a great play for us now. The value is fair, but momentum has got the company moving in the right direction, it’s profitable and still has a lot of growth potential under the hood as it expands its global footprint and invests in cutting-edge technologies like AI. As such, its growth prospects appear promising.

Furthermore, strategic partnerships, a strong management team and a focus on data security add to Dotdigital’s appeal as a potential investment.

Buying instructions: BUY Dotdigital (LSE:DOTD).

Market cap: £270 million

52-week high/low: 117p/67.10p

Buy up to 95GBp

Big breakthroughs

For years automobile executives and specialist research companies have been projecting that electric vehicles (EVs) will be powered almost entirely by lithium-ion batteries.

But those forecasts are starting to look increasingly shaky.

In late February, Chinese automaker JAC unveiled a test version of its Sehol E10X electric car that used sodium-ion battery cells and not their better-known and more widely touted counterpart.

Supplying the cells was HiNa Battery Technologies, a small and relatively unknown player founded in China in 2017 with a focus specifically on sodium-ion batteries.

HiNa is among a host of players in the emerging battery space racing to create a new generation of lower-density cells that use cheaper raw materials than lithium-ion cells.

Despite being chemically very similar, sodium, found all over the world as part of salt, sells for just 1% to 3% of the price of lithium.

The demonstration car had a range of about 250 kilometres (155 miles) per charge and it supported fast charging – so certainly acceptable to most EV drivers today.

Although sodium batteries, just like lithium-ion batteries, can be recharged daily for years, they also come with two big advantages: they keep almost all of their charge when temperatures fall far below freezing and are also non-flammable – both of which can’t be said for lithium batteries.

The major challenge for sodium-ion cells is their lower energy density, which mean that cars packing these cells today would have to use heavier batteries for the same amount of kilowatt-hour capacity.

The cells in the Sehol E10X use sodium-iron-manganese-copper cathodes and have an energy density of 140 watt-hour per kilogram, which reduces to 120Wh/kg at the battery-pack level.

This is 25% lower than current lithium iron phosphate (LFP) battery packs, the most common lithium-ion battery chemistry presently.

But the fact that sodium is chemically so similar to lithium means the former can leverage the same manufacturing processes (i.e. certain materials and components such as electrolytes, separators and aluminium current collectors are the same for both) and advances the latter has made over the last decade, helping it to benefit from existing economies of scale and lowering costs.

In July 2021, in fact, Chinese battery giant CATL unveiled the first generation of sodium-ion batteries and announced that it would establish a supply chain for the tech by 2023.

This in turn could result in material savings and energy-density improvements that could result in sodium-ion cells costing half what LFP battery packs costs today.

Of course, if sodium-ion batteries could take even a small portion of share from lithium-ion batteries, it could help alleviate lithium supply issues and lower overall battery prices for EVs.

You might think that just as petrol and diesel have co-existed since the origins of the internal combustion engine, lithium and sodium will evolve similarly in the EV space.

Of course, an EV with a sodium battery that’s the same size as a standard lithium-ion battery is unlikely ever to be able to travel as far on a single charge as a lithium-ion battery car.

When sodium-battery tech is fully developed, it should certainly be able to power light-duty EVs – a huge market in its own right. In reality, of course, most people are going to accept that 250km, say, is certainly enough range – especially if coupled with fast charging and a lower sticker price.

But what I think we’ll see is that the smaller, cheaper EVs with lower range will be based on sodium-ion; and the more expensive cars with slightly better performance will be lithium.

The two battery types might even co-exist in a single electric car’s battery pack.

For instance, CATL, the world’s largest manufacturer of electric car batteries, says it has discovered a way to use sodium cells and lithium cells together, combining the low cost and weather resistance of sodium cells with the extended range of lithium cells.

Of course, while HiNa may have been first out of the gate making headlines this year, sodium-ion batteries still have to compete with improving lithium-ion batteries and a recent fall in lithium prices, meaning nothing can be assumed.

Sodium-ion batteries are still at least a few years away from meaningful scale.

But we can expect more advances and more companies entering the space. Interestingly for us, Frontier Tech Investor recommendation AMTE Power has been developing sodium-ion battery cells for specialist markets over the last few years so has a clear head start on most competition.

Sodium-ion hits the holy trinity of being affordable, feasible and scalable. Analysts have been slow to realise that sodium-ion is different, but it is emerging from the pack as the next best alternative to lithium for EV batteries.

Buy List update

Central Asia Metals (AIM: CAML)

Copper producer Central Asia Metals (AIM: CAML), recommended at 276p in January’s issue of Frontier Tech Investor, rose to 292p in early February but has subsequently trended lower, trading at around 203p at the time of writing.

The company runs the Kounrad copper operation in Kazakhstan and the Sasa zinc and lead mine in North Macedonia.

The company’s 2022 results, released on 29 March, showed gross revenue totalling $232.2 million – a slight decrease from $235.2 million in 2021. Meanwhile, its group EBITDA (earnings before interest, taxes, depreciation and amortisation) totalled $131.6 million, down from $141.5 million, while its EBITDA margin was 57%, a decrease from 60%.

Group free cash flow totalled $89.7 million compared to $103.8 million in 2021.

The firm’s adjusted earnings per share, excluding a non-cash impairment, was 48.15 cents, while reported earnings per share was 19.1 cents, compared to 47.69 cents a year earlier.

However, the balance sheet looked strong, with cash at bank on 31 December totalling $60.6 million, up from $59.2 million at the end of 2021.

The company also fully repaid its $187 million corporate debt facility during the year, but it also incurred a non-cash impairment charge for Sasa of $55.1 million, hitting the bottom line, after a review completed last year, which took the mine’s life out to 2039, resulted in a higher discount rate and lower throughput forecast (the amount of ore fed into the processing plant).

The company is also spending $12 million this year as part of its shift to a new style of underground mining at Sasa.

Looking ahead the firm provided production guidance for 2023 of between 13,000 and 14,000 tonnes of copper, 19,000 to 21,000 tonnes of zinc-in-concentrate, and 27,000 to 29,000 tonnes of lead-in-concentrate.

Chief executive officer Nigel Robinson said the company’s priority was maintaining the dividend – the total dividend of 20p for the year was flat on the year before – while also growing the company’s asset base. CAML has been on the hunt for another big deal for some years, after buying Sasa in 2017.

The board said the final dividend would be paid on 23 May, to shareholders on the register on 28 April.

In a subsequent update on its first quarter operations, CAML said its Kounrad plant produced 3,336 tonnes of copper in the first quarter – a slight increase from the 3,024 tonnes produced in the same period in 2022.

Meanwhile, the Sasa mine produced 4,917 tonnes of zinc-in-concentrate and 6,618 tonnes of lead-in-concentrate in the first quarter of 2023, compared to 5,240 tonnes of zinc and 6,736 tonnes of lead in the same period a year ago.

The stock is mainly a play on expected tightness in the copper market, where a supply shortage is likely to emerge in a few years leading to a rise in copper prices. Copper is a key component in electricity-related technologies and, by extension, a linchpin in energy transition projects.

Given the positive copper price outlook and management’s keenness to hold onto the dividend, the stock remains a BUY under 310p.

Fortescue Metals Group Limited (ASX: FMG)

Australian iron ore giant and green hydrogen hopeful Fortescue Metals Group Limited (ASX: FMG) is currently sitting around AU$20, putting it around 16% up in the model portfolio at the time of writing.

The stock has found support as from a stronger iron ore price, which is currently sitting at around $120 per tonne.

Fortescue is also close to production for the multibillion-dollar Iron Bridge magnetite project in the Pilbara region of Western Australia. It is now set to start first production and commissioning of key infrastructure in the second half of April, a slight delay from a previous slated start of March.

The project is one of the few large-scale iron ore growth projects under construction worldwide. It is an unincorporated joint venture between Fortescue’s subsidiary FMG Magnetite and Formosa Steel IB.

This could add millions of tonnes to its total output, which would boost earnings.

Of course, one of the core reasons of our investment was Fortescue’s decarbonisation plans, which include the production of green hydrogen, green ammonia and high-performance batteries.

The business is working on a global portfolio of potential green energy projects, pursuing possible locations in Canada, the US, New Zealand, Australia, Europe, Egypt, the Kingdom of Jordan, Brazil and more.

As we wrote last month, the company is due to make a decision this year on five green hydrogen projects that it plans to develop.

The stock remains a BUY up to A$25.

Rize Sustainable Future of Food UCITS ETF (LON: FOGB)

The Rize Sustainable Future of Food UCITS ETF (LON: FOGB) has inched up over the course of the last month, trading at the time of writing at around 345p, down from our entry price of 378.48p.

The ETF currently has 52 holdings involved in the production of sustainable food and packaging, with plant-based foods, precision farming and fertiliser manufacturers among the targeted sub-sectors.

Sales of plant-based foods across 13 European nations amounted to €5.7 billion in 2022, a 22% increase since 2020, according to the Good Food Institute Europe (GFI Europe).

Vegan meat alternatives, dairy-free cheese and vegan seafood products all saw significant growth from increased consumer demand, GFI Europe said.

During the same period, animal-based meat and milk sales dropped by 8% and 9%, respectively, the group added.

With the outlook for new food products and systems remaining positive, the ETF remains a BUY.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company (LON: FSF), which invests in UK forestry and afforestation assets, has inched up to over 105p at the time of writing, marginally below our entry price of 108.92p.

The London-based investment company made three acquisitions during March, deploying a further £9.9 million into three properties in Scotland.

The firm bought Newnoth Farm, an asset directly adjacent to Newnoth Forest, an existing mature forestry property within its portfolio. Together, these properties create a combined area of around 234 hectares, around 2.3 square kilometres.

Foresight has also bought Balnagowan, a mature forest neighbouring its existing Coull Woodlands asset, and High Auldgirth, a sizeable property with existing forestry on around 60% of the land.

The acquisitions have been funded from cash on the balance sheet. To date, the company has also not used its revolving credit facility, although it expects to draw on the facility soon for planned capital expenditure.

As we wrote last month, the long-term qualities of forestry investment to continue to shine, despite prevailing economic headwinds that include a recessionary economic environment, high inflation and a rising cost of capital. The trust remains a BUY.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF (LON: LITG) has fallen from over $10 at the start of February to $8.37 at the time of writing, just below our £8.59 entry price.

There are currently 57 holdings in the Global X Lithium ETF, with Albemarle Corporation being the top holding with about 8.04% of the fund’s total share currently.

Aside from mining companies, it provides a wide range of electric vehicle exposure, ranging from Tesla and BYD to battery producers such as Samsung Electronics Co., a major electric vehicle (EV) battery producer.

Overall, the fund is designed to mostly react to the global EV growth trend, though is not tied specifically to the fate of miners, but rather a mix comprising the entire EV supply chain.

That’s perhaps just as well. Prices for lithium are down more than 30% this year, ending a two-year run that pushed up the value of the key battery material by a factor of 12, according to Benchmark Mineral Intelligence.

The falling prices are due to slowing demand for EVs, particularly in China, and after Chinese battery giant CATL offered rare discounts to automakers. Saying that, prices for other metals that go into batteries, such as cobalt and nickel, are also sliding.

However, the long-term trend is still extremely favourable and we would expect lithium prices to resume their uptrend soon enough.

In any case, the Global X Lithium & Battery Tech ETF tracks stocks right across the lithium cycle, offering us protection no matter the way the lithium price move.

Aurubis AG (DE: NDA)

Germany-based copper smelter and recycler Aurubis AG (DE: NDA) has risen from €78 in early April to around €83 – still 24% up in the model portfolio.

On 21 April, the company reported better-than-expected preliminary earnings in the first half of the year as it raised its operating core profit guidance for 2023.

Increased treatment and refining charges for concentrates, a significantly higher copper premium and strong demand for wire rod at higher prices were the reasons for the good results, the company said.

The company now anticipates operating earnings before taxes (EBT) of between €450 million and €550 million for the current year, compared to an earlier forecast of €400 million to €500 million.

EBT came in at €291 million for the first half of the 2022/23 fiscal year, compared with analyst estimates of €260 million in a company-provided poll.

For the second quarter, operating EBT was €166 million, down from €168 million a year ago.

Aurubis is not a miner, but it refines and recycles copper into wire and other components. It is Europe’s biggest copper smelter and producer.

The broader copper market was generally healthy and noted that Aurubis is reporting strong demand, especially for cable and other products for the green energy transition, according to Aurubis CEO Roland Harings.

The stock remains a buy up to €100.

Newmont Corporation (NYSE: NEM)

Newmont Corporation (NYSE: NEM), the world’s largest gold miner, has risen from under $42 on 9 March to trade around $48 at the time of writing, down from our $65.39 entry point.

Newmont’s stock price has gained in line with a rising gold price, which has moved from around $1,830 per ounce in early January to a little under $2,000 currently amid stress in the banking system and worries about the global economy.

In its Q1 2023 earnings report on 27 April, the firm is expected to report revenues for the quarter of around $3.62 billion, an increase of about 20% versus last year. For 2023, the company has guided it will produce between 5.7 and 6.3 million gold ounces, compared to about 6 million ounces for 2022.

Margins could also potentially see some improvement due to cooling energy prices.

Newmont laid down a best and final offer for Australia’s Newcrest Mining Ltd at A$29.4 billion to close a deal that would extend Newmont’s lead as the world’s biggest gold producer.

In early February, US-listed Newmont launched an all-share bid for its Australian rival Newcrest that valued the smaller company at almost A$24 billion, though the offer was rejected by Newcrest’s board.

If successful, the deal would lift Newmont’s gold output to nearly double Barrick Gold Corp, its nearest rival.

Newmont remains a BUY up to $100.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith is now trading below our 317p entry price, at around 309p at the time of writing.

The firm announced it will be investing €145 million in an upgrade programme for its kraft paper mill near Viana, Portugal.

The investment, to be made over a number of years, will see the mill’s paper machine rebuilt and a recovery boiler installed, upgrading the plant from an annual capacity of 400,000 tonnes to 428,000.

Acquired by DS Smith in 2018, the Viana mill underwent a previous modernisation programme in 2017.

The plant employs 260 people and is one of two kraftliner mills DS Smith operates. The firm runs a further 12 recycled paper mills in Europe and one in the US.

The stock remains a buy up to 400p.

Watsco Inc (NYSE: WSO)

Heating, ventilation and air conditioning (HVAC) distributor Watsco Inc (NYSE: WSO) has risen from under $300 in late March to around $340, 15% up from our entry point.

Shares gained after the company posted first-quarter 2023 sales of $1.55 billion, a 2% increase over the same quarter in 2022.

On the bottom line, the industrial company reported earnings of $2.83 per share, up from prior expectation of $2.35 per share.

Watsco attributed this growth to solid unit growth, higher selling prices, a richer mix of high-efficiency systems, and technology-driven gains in market share.

Watsco is still reasonably valued and remains a buy.

Yara International (OL: YAR)

Yara International (OL: YAR), one of the world’s largest producers of nitrogen-based mineral fertilisers, has fallen from its NOK 456 level and now sits around NOK 432, putting it 7% up in the model portfolio.

Yara said on 31 March that its clean-ammonia unit had signed a letter of intent with Canadian pipeline and energy company Enbridge to jointly develop and construct a low-carbon blue ammonia production facility.

If confirmed, total project investment is expected at between $2.6 billion and $2.9 billion, with production start-up in 2027-28.

The proposed facility, which will be located at the Enbridge Ingleside Energy Center in Texas, will have an expected capacity of 1.2 million-1.4 million tonnes a year once it is operational, Yara said.

Blue ammonia is produced using natural gas, with the carbon-dioxide byproduct captured and stored. The ammonia can be used as a low-emission fuel for shipping and power, fertiliser production and for industrial applications.

Around 95% of the carbon dioxide generated from the production process is anticipated to be captured and transported to nearby permanent geologic storage, the company said.

Yara said it expects to contract full offtake from the facility, with the Enbridge Texas Eastern Transmission Pipeline providing the transportation for feed gas that will be used for the production process.

The construction of any facilities will be subject to receipt of all necessary regulatory approvals.

The stock remains a buy up to NOK 500.

AB Dynamics (LON: ABDP.L)

One of our best performing stocks over the last year, AB Dynamics released its half-year results on 25 April, for the six months ended 28 February 2023.

Overall, the results were good, and this turned the momentum back in the stock price’s favour.

The company saw growth in revenues, operating profit and, importantly as a shareholder, earnings per share. Furthermore, the growth in key sectors of the business, driving robots and simulation are a strong indicator of the ongoing growth potential of the company.

This shows its focus on simulation with the AB Simulation division is paying off. Overall, we expect continuing demand for its products and services, in a world with increasingly high-tech vehicles, which requires the highest degree of safety and certainty as laws and regulations adapt to this step up in vehicle automation and connectivity.

A current 65% gain in under a year is a great result on paper so far. At this stage, we see no reason to adjust our position on the stock and continue to like its longer term prospects.

AMTE Power (LON: AMTE)

Year to date, the stock price has been volatile, but over the time period, relatively steady. The company continues its push towards full commercialisation and ongoing development of its battery cells, and it’s expected this quarter to be supplying samples of the Ultra High-Power cells to customers.

AMTE Power recently signed an MoU (memorandum of understanding) with CalPac Resources. According to the release:

The MOU is intended to see AMTE Power explore the use of CalPac Resources’ recycled copper technology to produce the anode material in its Ultra High Power, Ultra Safe and Ultra Prime products, thereby contributing to delivering the UK’s net zero goals.

This should please the net-zero fanatics no end. But ultimately, whatever the outcome, using recycled materials to produce new high-tech products can never be a bad thing so long as there’s no compromise on quality and performance. We see it overall as a positive for the company.

We maintain our long-term view on the stock and are excited about the shipping of the Ultra High-Power samples to customers this quarter.

Argo Blockchain (LON: ARB)

The company has been teetering on the brink of extinction during the last so-called “Crypto Winter”. And not all that long ago it was close to bankruptcy.

For now, that has been avoided. The company has just released its 2022 full-year results. There is some positivity in the results. Notably, it mined 2,156 bitcoin in 2022 – up 5% from the year prior.

This comes as the bitcoin network difficulty increased along with the global hashrate shooting higher. At today’s prices, that’s the equivalent of $61.8 million mined in bitcoin. Apply the last cycle’s all-time highs and that’s the equivalent of almost $150 million.

Consider this… there are notable investors around the world, such as Tim Draper who has publicly come out and said he is, “100% sure” bitcoin will hit $250,000 in 2024. Take that price to 2,156 bitcoin and the full-year value of bitcoin mined would be $539 million.

Now that’s the kind of money that a bull cycle could bring. But it’s certainly no guarantee. And we know that this current quarter, with increasing hashrates and network difficulty, that mined bitcoin is down from the previous quarter. So, 2023 will continue to be tricky for the company. And as per its results, a lot of change and restructuring has taken place.

This isn’t for every investor’s risk appetite. However, in short, our play into Argo is solely based on the next boom cycle of the crypto market taking shape at a value multiple times higher than the last cycle peaks. Are we looking at $250,000 per bitcoin? Possibly. The cycle peaks are always difficult to pinpoint – but when we do enter another cycle, which we expect will take shape later this year, then a stock like Argo we also expect to fly higher coming home with wet sails.

It’s volatile and super high risk, but we stick with Argo for the longer term recovery and expectations of strong profits. It’s still one of our preferred plays on the London Stock Exchange (LSE) into bitcoin.

CentralNic (LON: CNIC)

CentralNic released its quarterly update recently too, and the outcome was great.

Gross profit of $45.8 million and adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) of $21.3 million. All double-digit increases on the same period a year prior. Cash increased, debt decreased – in other words, the company is in an even more robust position than it was this time last year, which is exactly what we want to see from a stock in the current market environment.

What’s exciting about the company’s announcement though is the comment on integration with Microsoft Bing and AI capabilities, which is exactly why we wanted to move into this stock. The company said:

Teaming up with Microsoft Bing and leveraging our existing Artificial Intelligence capabilities with ChatGPT, complements our existing relationships with Google and Yahoo, and we are excited for the potential revenue growth opportunities that this strategic partnership could bring.

We like this stock long term for its sound footing, growth potential in implementing AI capabilities and its important position in the domains market.

Volex (LON: VLX)

It’s been a strong couple of weeks from Volex with positive announcements and the stock price has seen some strong momentum higher.

From a price of around 200GBp in mid-April, the stock is up from that level by around 35% and is showing in our Buy List with a marginal loss of around 5%.

The reason for all this is two key releases. The first being its full-year trading update released on 18 April, and then a recent EV contract win released on 27 April.

The full-year update noted expected revenues of $710 million and an operating profit of $66 million, both well up from the previous year. This also came with an improvement in margins (9.3% up from 9.1%) and a reduction in net debt of $22 million, now at $76 million.

This set the stock price racing higher. And then just a week ago, the company announced a new contract win with, “a leading, global North American-based automotive manufacturer to supply advanced Electric Vehicle (“EV”) power products from its manufacturing facility in Tijuana, Mexico.”

Realistically, looking at North American-based car companies that produce EVs, our take is that this is likely GM or Ford. While the announcement doesn’t name names, it would make sense to be one of these.

Ford is moving heavily into EVs. It currently has the Mustang Mach-E and F-150, but new EV models are hitting the range imminently, like the Puma EV. Meanwhile, GM is dropping production of the Bolt EV and it’s ramping up a new model called the Equinox. And then there’s the GMC Hummer (a GM brand), with more to come online in the next few years, such as the Cadillac LYRIQ.

The other possibilities could be Tesla or Stellantis, which is arguably not North American-based. Anyone else isn’t really a global player yet. Either way, Ford, GM, Tesla, Stellantis – any of these is good news. And whichever way it plays out, it’s a great result from Volex, considering it’s worth $30 million a year to the company.

The stock has now some positive news and momentum behind it, which we expect to continue. We look forward to the stock moving into a profit position for us.

Inside the lives of James and Sam

James:

My family and I took a few days off over the Easter break to go skiing in France.

We actually stayed in a small apartment we purchased with my twin brother’s family in Avoriaz in February 2020 – just one month before the resort, like the rest of the French Alps, closed for nigh on two years amid sweeping Covid-19 lockdown measures.

As well as not being able to enjoy the property as much as we’d hoped since we bought it, the lockdowns have also meant that we’ve fallen well behind the eight ball when it comes to renting it out – which was a key reason for the purchase.

So this Easter, to maximise rentals, our respective families decided we would holiday in the apartment together, meaning we had four adults and fours kids all squeezed into a two-bed apartment for the week.

It was tight but we certainly made it work: my family all in the larger bedroom that comprises a double and single bed (with my little daughter Ivy squeezed next to us in a travel cot), my brother’s two boys in the twin bedroom, and my brother and his wife on a pull-out sofa bed in the main room.

Of course, the lack of space in the apartment didn’t matter at all when we were out experiencing the main focus of the trip: enjoying the late season snow on the slopes.

Although Leo, my 13-year-old stepson, spent each morning in ski lessons, Ivy, at just two-years-old, was a bit too young to accompany him, so my girlfriend, Deborah, and I relayed a lot of her childcare (largely spent building snowmen and pushing her down and around some very gentle slopes either on a sled or her very own rented pair of extra small skis).

So, although it wasn’t the most hardcore of ski trips I’ve experienced, it was certainly up there as one of the most enjoyable, not least because of seeing how much the kids enjoyed themselves and watching Leo’s skiing improve at such a rate of knots.

Of course, you might think, as someone who writes about clean tech investing, I am certainly exposed to climate risk by part-owning a ski apartment in the Alps.

Earlier this season, half of France’s ski slopes had to close because of unseasonably warm temperatures.

Lower-altitude resorts were particularly affected, with slopes turning green instead of snow-covered, due to rain and sleet. However, the closures didn’t affect Avoriaz, the highest mountain resort in the vast Portes du Soleil ski area.

The resort, located in the commune of Morzine, halfway between Chamonix and Geneva, sits at an altitude of 1,800 metres – so you’d hope we’d be ok from an investment perspective for the foreseeable future.

I spoke to a few rental agencies about exactly this while I was there over Easter. They said Avoriaz had so far avoided the worst of the impacts of climate change that are becoming evident on piste in certain low-level resorts in the Alps. In fact, rents at the beginning and end of the seasons were, if anything, benefitting from shorter ski seasons elsewhere, they said.

They also spoke somewhat proudly of Avoriaz’s green credentials, pointing to how the resort has launched projects to revegetate slopes, protect natural snow and keep snow-groomer emissions to a minimum.

In fact, one of the reasons we fell in love with Avoriaz was the fact that cars have never been allowed in the resort, which adds a distinct charm to the place as well as keeping emissions low and the air clean.

What’s more, I was told that the whole resort now runs on biofuel, thanks to a dual energy wood heating system backed up by electric. Snowmobiles are also electric powered. There’s even an eco snowpark, The Stash, built from fallen trees.

So, fingers crossed, we’ll get to enjoy skiing in Avoriaz (and, of course, renting the apartment out) for many years to come.

The family on the slopes

Sam:

Every Sunday, I take my eldest son swimming. I’m teaching him how to swim, having taught kids to swim before back in Australia. I’ve also had my fair share of 4am mornings training for swimming and water polo – so I know a thing or two about being in a pool and swimming the right way. While I’m no Olympic coach, I reckon the best swimming education my boys will get until they’re good enough for a real coach, is me.

After swimming, we usually pop to Sainsbury’s, grab a drink, a bite to eat and something for dinner later that evening.

However, we also always end up buying a Hot Wheels car. And on the rare occasion, a Hot Wheels Monster Truck. My boys adore Monster Trucks right now. We’ve got more Hot Wheels Monster Trucks at my house than anything else. Little ones, big ones, remote-control ones.

So, when earlier this year we saw tickets were available for the Hot Wheels Monster Trucks Glow Party – with real-life Monster Trucks – I jumped at the chance and bought two tickets for myself and my son Max.

Well, after weeks and weeks of waiting, our time finally came. When we got there in the morning, we were able to walk into the arena before the show started to see the trucks up close, meet the drivers and get some great pictures with them all.

Then the show kicked off and it was incredible. You can see a picture that I took at the start of the show below.

Source: editor’s own photo

While the show was amazing, it was also very loud. Even with ear defenders on, it got a bit much for the boy, so we did an exit-stage-left and got out of Dodge. It was loads of fun regardless – we got souvenirs and great photos on top of being able to meet the drivers and see the cars up close.

But all of this got me thinking.

You see, I’ve slung a fair bit of cash the way of Hot Wheels over the years. And by no means was this Glow Party event and everything it entailed particularly cheap.

Everyone knows about Hot Wheels. It’s an iconic brand and one of the most popular (if not the most popular) toy brands in the world. So, it clearly generates a big chunk of change for its parent company… Mattel Inc. (NYSE:MAT).

I’ve always been an advocate that when it comes to my boys and their investments, to buy what you know. And considering how much I spend on Hot Wheels, now I’m thinking that maybe it’s time to look closer at Mattel. It’s a big company, has a $6 billion market cap, is profitable, with a price-to-earnings (PE) ratio of just 15 times – maybe this is a great defensive-style stock to have in a portfolio.

But I don’t know yet. I need to think more about its growth prospects. However, it’s certainly something to think about. And it’s a good reminder, that everywhere we go, there’s always a company somewhere that’s profiting from the fun we have and the things we love to do.

Crypto Corner

As you’ll see in the “What we’ve been looking at” section this month, there’s a video all about financial and crypto scams.

When I saw it, and I suggest that you should too, it reminded me that a lot of people still don’t know the basic things about crypto – what it is, how to use it, how to get it, how to protect it and how to operate safely in crypto so that you don’t end up getting scammed.

This reminder was amplified when I got a couple of emails from readers this month asking questions that made me realise that I can take the basics for granted having been in this space for so long now.

Which is why this month’s Crypto Corner is important because we’re going to wind everything back to first principles.

I want to cover a few of the most basic things – what I would consider the crypto fundamentals.

So, we’re not covering things like central bank digital currencies (CBDCs), regulation, the imminent collapse of the US banking system or all the other things that are driving bitcoin’s price and adoption at the moment… I’ll save that for May and June (we’ve got time).

But now, the important thing is that when you see price action and you’re maybe thinking about what to do, you’ll at the very least know how to go about it all.

Here’s a snippet of some of the questions I received…

How do I get bitcoin?

Can I spend it anywhere?

Is it backed by any asset?

How do I keep it?

What can I do with it?

To me, these are simple questions. But I know for many people it is not that simple – it’s terrifying, confusing and ultimately it is often a barrier to getting started in crypto.

I should add that all this (and much, much more) will be covered in my upcoming book, The Crypto Handbook, which will be released on 4 July this year.

You will see me shamelessly plug the book over the coming months, but if you do want to pre-order it, you can now. Physical books can be bought through pre-order at Harriman House or WHSmith. There will also an e-book version available which will be free – so if you don’t want to buy the book, you can still get it for free!

We decided to make the e-book free because of how important learning about crypto is. But if you’re keen on the physical version for yourself, or as a gift for anyone, head on over and pre-order now. Also, for transparency, I do get a (small) royalty for every physical copy sold.

With that imminently on its way, but the crypto market still moving fast, I decided it would be best to answer those questions and get back to the fundamentals of bitcoin and crypto for you this month.

How do I get bitcoin?

Question, have you ever set up a bank account? Or a stocks and shares account?

If the answer to either of those is yes, then you’re in for a treat.

Setting up an account with a crypto exchange is just as easy. In fact, it’s easier than you might think.

I will admit, some are harder than others. However, if you want ease, there are two that I think are worth your time: Coinbase and Kraken.

Both have apps on Android and iOS, so all you need to do is go to your app store on your phone and download their apps.

In doing that, you will need an email address to register with. You will also need to verify your identity with them. They abide by the same kind of KYC (know your client) and AML (anti-money laundering) rules that banks and brokers adhere to.

That means you will need to provide things like a driver’s licence or passport to verify your ID. You may also need to upload a proof of residence document, which is typically a utility bill, phone bill, internet bill, etc.

The good news is that you can do all this through your phone. And it only takes a few minutes.

Kraken is particularly easy because once you’ve set up an account and verified your ID, buying crypto is super slick easy too. That’s because you can do it through payment tech, such as Apple Pay.

That means you can search for the crypto you’re after – bitcoin, for instance – and decide how much you want to buy – let’s say £20 worth – then choose to pay with Apple Pay, wait for confirmation, and it’s done.

It really is very easy with an app like Kraken. With Coinbase, you have to register a payment method, but again, it’s very easy to do.

I recommend these two because they are easy to set up, easy to use when finding the major crypto you’re after and they’re easy to buy through. It’s also easy to withdraw to your own self-custody wallet, which I’ll get to in a minute.

The other fantastic thing that Coinbase has is its Coinbase Card. Which leads me on to the next question…

Can I spend it anywhere?

In short, the answer is yes. There are many platforms now that provide debit cards or pre-loaded debit cards that allow you to spend your crypto.

The Coinbase Card, for instance, is a Visa debit card linked to your Coinbase account. With the card, you can choose which crypto you want it to draw from. For example, you could choose your bitcoin wallet to draw funds from.

Then, let’s say, you’re at the pub and you want to buy a pint. You would simply use your Coinbase Card as you would any other bank card – contactless payments too if you want – and it will deduct the necessary amount of bitcoin from your account balance.

In the background, Coinbase converts the crypto to fiat currency, so that the merchant is paid in GBP, for instance, but you’ve still effectively paid in crypto.

You can do it with any crypto you hold on Coinbase – be it bitcoin, DAI, USDC, ETH or any crypto you choose. So, if you’re using something like the Coinbase Card, yes, you can spend your crypto anywhere that accepts Visa as a payment card.

Note: selling crypto is considered a taxable event in the UK. So, if you’re going to use something like this, you really need to ensure you’re up to scratch with your tax responsibilities and make sure you’re getting good advice from a tax accountant.

Is it backed by any asset?

Of course, you may not want to sell your crypto, because you’re in it solely for the investment side of things or you’re using it as a store of value.

If that’s the case, that’s great too. Crypto is many things to many people, all at once. But if it’s a store of value, is it backed by anything? What gives it value?

In short, no, there’s no physical asset as such that “backs” crypto. Having said that, it can get a little complex. Take bitcoin, for instance. While it’s not a physical asset per se, the network carries value in the mining hardware used to secure the network, the energy that is used to mine, the security of data the network provides and the time cost that’s needed for the network to function.

These are just some of the assets that do back the network and hence the bitcoin that are a part of the network. This is a topic that deserves a book in itself, and there’s not enough time to explore everything here today. But for anyone that suggests it’s backed by nothing, take that as a clear indicator that they lack the knowledge of how it all works.

How do I keep it?

While I’ve mentioned things like using exchanges and cards to get and spend crypto, if you’re going to hold it long term, you really need to self-custody your assets. That means having a crypto wallet that you and only you control the private keys to.

That helps to eliminate third-party risk, such as an exchange suffering a hack or going bust. The best way to store crypto long term is to use a hardware device – typically something you get from Ledger or Trezor.

These are industry-leading hardware device makers that enable self-custody of your crypto.

You really should hold all your crypto in self-custody wallets. It’s only if you intend to buy, sell or trade your crypto that you will likely need the services of an exchange and their wallets. But where possible, get your crypto off the exchanges and self-custody those assets!

What can I do with it?

And finally, with all that in mind, what can you do with it? Well, you can keep it, hodl it, spend it, gift it, send it to friends and family, travel with it, use it as a hedge against the collapse of the traditional financial system – you can pretty much do anything you want with it.

That is the power of crypto. It’s a lot of things, it has a lot of use cases; it is not one thing to everyone, but many things to many. And that’s what makes it so fun, so exciting and, as I say, so powerful.

Reader Questions & Answers (Q&A)

The new format of this publication is… interactive.

That means that we both encourage you to send in your questions.

Questions can be to either or both of us. They can be about stocks, a particular technology or industry, crypto, or a “boots on the ground” research mission.

Questions & Answers is a key part of the publication.

Given that we publish towards the end of each month, it may be difficult for us to tackle time-sensitive questions. It should usually be possible for us to address questions that are not time sensitive.

Please bear in mind that we can’t give personal advice. Also, if your question is related to anything operational, like how to change a password on your Southbank login or where to find a report, please get in touch with our wonderful customer services team.

When sending in your questions, please acknowledge you’re happy for us to republish it. Don’t worry: we won’t be using any names or initials, just the questions.

We can’t guarantee to answer all reasonable questions – particularly if we receive a huge number: however, we will do our best, and may follow up directly with you.

Please send them in: [email protected].

Question: What do you really think about the long-term viability of electric vehicles? Apart from the small matter of insufficient copper (maybe at a realistic price?) in the world for a fully electric future, there is also the massive ecological damage that the mining of rare metals and other necessary commodities causes to the planet. As far as financials are concerned, we are told that electric vehicles only start to be better for the planet if they are kept in use for 6 years (until that time ICE vehicles appear the better ecological bet). How does that stack up with peoples’ desire to change their vehicle rather more often? And what about the range problem? We hope this will be solved with better battery technology but there is also the problem of battery flammability which is presumably likely to increase with higher energy density. Fire brigades may need better technology to control battery fires. And then we face the fact that electric vehicles are more expensive, at least so far. You have also raised the issue of efuels facing a headwind. It seems to me that these very practical problems point elsewhere except for vehicles which exist solely for short (town) journeys.

Answer (James): You may or may not be surprised to hear that, as a long-time driver of an EV and with another one on the way, I’m a fully paid-up member of the EV fan club. I find them superior in almost all ways to drive and am certain they’ll win out eventually as the de facto passenger vehicle of choice for most of us in time.

Already they are far cleaner than internal combustion engines cars – even accounting for the mining of metals such as lithium. While mining the material inputs required for an EV battery – and the process of making it – emit more carbon dioxide, the direct emissions from driving an internal combustion engine vehicle over its lifetime far outstrips the total lifecycle emissions of an EV.

According to research, EVs save between 50% to 70% CO2 equivalents and that the period required to offset the additional emissions generated during the production of the EV’s battery is between one to two years. The more miles you drive your EV, the quicker you will recover those emissions.

Of course, that’s not to deny that surging demand for EVs and batteries won’t require a significant expansion in mining. They will, and this will result in accompanying environmental disturbances and waste. That’s why it will be important to develop and deploy mining and processing innovations that reduce mining waste and toxicity. Most EV manufacturers are also looking into or already trialling battery recycling. For example, Volkswagen opened its first battery recycling plant at the beginning of 2021.

As for range, as I’ve said elsewhere in these pages, in reality I think most people are going to accept that 250km, say, is certainly enough range for most journeys. Saying that, range is improving all the time. The most recent EVs offer around 500 miles of range, which is suitable for almost all journeys one is likely to make.

Prices are also falling. In fact, with Tesla’s recent price cut round, the starting tag of its Model Y bestseller has now fallen below the average new vehicle price in the US for the first time. EVs are also generally much less expensive to maintain and operate in the long run.

Battery flammability is indeed a concern, though research into actual cases has shown that EVs are much less likely to combust than their petrol or diesel equivalents. That’s not to say that all those pictures on social media of burning Teslas never happened; you just don’t see an equivalent number of photos of petrol cars on fire!

But circling back to your very first point: copper supply is certainly an area that threatens to put the brakes on EV adoption. An EV requires 2.5 times as much copper as an internal combustion engine vehicle. But at the moment, there simply aren’t enough copper mines being built or expanded to provide all the copper needed to produce the 27 million EVs that S&P Global has forecast will be sold annually by 2030.

As a new copper mine takes around 14-16 years, on average, to get off the ground, it’s highly likely increased utilisation at existing mines and ramping up recycling will fulfill some of the higher demand. This is a key concern, not just for the expected growth in EVs but also for electrification elsewhere in the energy transition – hence why I think it’s good advice to hold a good copper miner in your portfolio, just as we recently recommended.

What else we’ve been looking at this month

James:

A brazen plot to rig Venezuela’s oil auctions

A mysterious trader infiltrated Venezuela’s oil auctions using secret chatrooms, offshore shells and inside men. Then perhaps America’s best-known lawyer got out his laptop and, together with a couple of fraudsters and a pariah government, launched a wild lawsuit against the world’s largest commodities trading firms. Although the evidence is explosive, a series of missteps has meant that the lawsuit has so far come to nothing.

This Bloomberg report, which draws on previously unseen documents and more than a hundred interviews, essentially supports the lawsuit’s central claim: that for many years, Venezuela oil auctions were rigged to benefit a handful of people. This is an incredible feat of reporting – and one hell of a tale about oil corruption you won’t want to miss.

Here’s why the energy transition has got so messy

Having recently launched an investment service in part predicated on the recent resurgence of fossil fuels, I’ve been reading a lot about the current trials and tribulations of the energy transition over recent weeks. This crackerjack of a piece (subscription required) from Columbia University’s Jason Bordoff and Harvard University’s Meghan O’Sullivan is perhaps the best article I’ve read that explains why the transition has got so messy.

The authors point out several problems that are surfacing, including rising petrostate power, a new risk of climate-provoked trade wars and rapid electrification that leaves consumers exposed to a fragile grid. However, there is still much to be hopeful for, and the authors eloquently argue what can be done to tidy up the transition.

The weakest claim to fame

I’m a twin. My girlfriend is a twin. My girlfriend’s twin sister recently wrote in to the Christian O’Connell radio show with a rather weak claim to fame relating to my own twin brother’s wife’s father as part of a segment on such matters on the radio show. That’s despite having never met, at that stage, either her twin’s sister’s boyfriend’s sister-in-law or her twin’s sister’s boyfriend’s sister-in-law’s dad. The results are hilarious, with O’Connell taking the proverbial. Listen here from 42:04. (Quick postscript: my sister-in-law says her dad did once perform to over 100,000 people in Paris – so have that O’Connell!)

Sam:

The 90s – a time of the “information superhighway” and mo-dems

A bit of nostalgic news reel footage helps keep perspective about the world today. When we look back, we can compare what things were like then to what they are like now. That’s helpful. Why? Because trying to look forward into the future from today is hard – really hard. It’s hard to think about what might come, whereas looking back at what has come is easy. So, when I see footage like this, I love it, because it means you can think about all the cutting-edge “crazy” stuff today and realise that perhaps it’s not that crazy after all.

What scams look like

For a long time, we’ve been writing about scams. How to spot them, how to avoid them, what they look like, and how you can operate safely across both traditional and crypto investing.

We will probably never stop writing about it because we know that so many people still, sadly, fall victim to financial scammers. If you’ve not yet seen our report on scams, particularly in the crypto space, then make sure to check it out.

I highly suggest that you also check out this video report from the BBC World News Service about one of the biggest scams in the world. It shows exactly the kinds of things we’ve been writing about all these years and puts it right in front of your eyes.

Coinbase seeks to compel the SEC to do something!

Ok, so this isn’t the most thrilling thing, but it’s certainly something I have read this month. I suggest you do too. It’s easy to read.

In short, Coinbase is seeking (through the courts) for the US Securities and Exchange Commission (SEC) to do something in terms of rulemaking and regulation in crypto. As of today, the SEC has done nothing – even after Coinbase has asked the SEC to. This move of filing a petition for a writ of mandamus is a smart move and one that will (hopefully) compel the SEC to just do something.

This right here should help give clarity about how bad the SEC has been at doing nothing.

James Allen and Sam Volkering

Editors, Frontier Tech Investor