Your January issue of Southbank Growth Advantage

31st January 2025 |

- How to profit from Britain’s New AI Railroad

- Big breakthroughs

- Buy List update

- Crypto Corner

- What else we’ve been looking at this month

How to profit from Britain’s New AI Railroad

Thirty-five minutes from Oxford, nestled in the tranquil countryside, lies a site shrouded in secrecy and protected by military-grade surveillance and a 24-hour armed guard.

At first glance, it might seem unremarkable – just another quiet corner of rural England.

But this unassuming location is set to become the beating heart of Britain’s AI revolution, a hub of innovation that promises to redefine industries, reshape the economy and place the UK firmly on the global technology map.

Here, under tight security, the groundwork is being laid for a technological transformation of historic proportions.

This site, located just outside Culham, Oxfordshire, will soon house the first of Britain’s so-called AI growth zones, powered by some of the most advanced supercomputers the world has ever seen.

These machines will drive breakthroughs in healthcare, logistics, climate modelling, and countless other fields, setting the stage for the UK to emerge as a global leader in artificial intelligence.

Although it doesn’t look like much right now, the site in Culham will soon be ground zero of a £39 billion investment in Britain’s new AI railroad.

The world’s largest and most powerful AI companies are already piling in…

Amazon is investing £8 billion in Britain’s new AI railroad.

Microsoft is in for £2.5 billion.

Three other major tech companies, that aren’t yet household names, have invested a combined £14 billion.

In fact, since July 2024, private capital has flowed into Britain’s new AI railroad at a truly incredible rate – £200 million a day.

This massive investment in Britain will create tens of thousands of new jobs…

And give the economy a much-needed double shot of espresso.

I’m not the only one saying this…

The International Monetary Fund estimates Britain’s new AI railroad will grow the economy by £47 billion per year, every year, for the next decade.

Carsten Jung, head of AI at the Institute for Public Policy Research, predicts a best-case scenario could see it boost the UK economy by up to £306 billion a year.

The government predicts the economic impact will be even bigger…

Adding £400 billion a year by 2030.

And it all starts in this secure location a 35-minute drive from Oxford.

The UK government’s ambitious AI Opportunities Action Plan has set the stage for this transformation, catalysing unprecedented levels of investment and collaboration.

But as the nation races to build its “AI railroad” a critical question looms: how can this future be powered? The answer lies in low carbon energy – a cornerstone of the AI revolution that is as essential as the algorithms themselves.

After weeks of research, I have pinpointed a leading renewable energy producer with a growing focus on powering data centres.

As it prepares to enter the UK market, the company is uniquely positioned to become a key player to help build the “tracks” for Britain’s new AI “railroad”.

The AI boom: Britain’s next great economic opportunity

Artificial intelligence is rapidly transforming the world. From diagnosing cancer faster than human doctors to revolutionising industries like logistics and entertainment, AI has become indispensable.

The UK government’s AI Opportunities Action Plan aims to harness this potential by establishing the nation as a global AI leader.

At the heart of this plan is the development of powerful supercomputers capable of running complex AI models. The first of these, to be built just outside Culham, Oxfordshire, will launch with an initial capacity of 100 megawatts (MW). That’s double the power consumption of Elon Musk’s Colossus supercomputer in Memphis.

Over the next two years, it’s expected to become five times more powerful. Additional AI growth zones are set to be announced in summer 2025. This isn’t just a technological marvel – it’s a massive economic catalyst.

The government projects that this “AI railroad” could add £400 billion annually to the UK economy by 2030, creating tens of thousands of jobs and attracting investment from global tech giants like Amazon, Microsoft and Google. But scaling AI infrastructure to this level requires an equally ambitious commitment to low carbon energy solutions.

The AI Opportunities Action Plan: key highlights

The AI Opportunities Action Plan is the UK government’s blueprint for leveraging AI to drive economic growth. It outlines several key initiatives:

- Massive Investment in AI infrastructure: the government has pledged billions to build state-of-the-art supercomputers and data centres, ensuring that the UK remains at the cutting edge of AI technology. This includes £900 million specifically allocated for the development of supercomputing infrastructure. These funds will be used to create high-performance data centres capable of supporting advanced AI research and industrial applications, including climate modelling and autonomous systems.

- Research and development funding: over £1 billion has been earmarked for AI research, fostering innovation in areas like healthcare, logistics, and energy efficiency. This funding will support initiatives such as the establishment of research hubs focused on ethical AI development, advanced robotics and next-generation machine-learning algorithms. Universities and private-sector collaborations will play a pivotal role in driving these advancements.

- Workforce development: to address the growing demand for AI talent, the plan includes funding for education and training programmes aimed at creating a pipeline of skilled professionals. This includes grants for AI-focused PhD programmes, as well as funding for reskilling initiatives to help workers transition into AI-related roles.

- Sustainability commitments: recognising the energy-intensive nature of AI, the plan prioritises investments in renewable energy to power AI infrastructure sustainably. Government incentives will be offered to encourage private companies to adopt renewable energy solutions for data centres and supercomputers.

The funding for these initiatives includes contributions from both public and private sources.

- Private investment: a staggering £14 billion will come from private firms such as Vantage Data Centres, Nscale and Kyndryl. Each of these companies has specific plans:

- Vantage Data Centres will construct and operate large-scale data centres powered by renewable energy.

- Nscale is focusing on modular data centre solutions to enable rapid deployment of AI infrastructure.

- Kyndryl will provide managed services and technology integration for supercomputing projects.

- International Investment Summit announcements: at the 2024 International Investment Summit, an additional £25 billion in AI-related investments was announced, including funding for advanced AI research facilities, workforce development programmes and cross-sector partnerships to accelerate AI adoption.

Why clean energy is essential

AI and clean energy are two sides of the same coin. The massive computational power required to train and run AI models demands enormous amounts of electricity.

AI’s massive computational demands require equally massive energy consumption. For context, Elon Musk’s Colossus supercomputer uses 50 MW – enough to power every home in Cambridge. Britain’s upcoming supercomputers will dwarf this, creating unprecedented energy needs.

It’s no coincidence that the UK’s AI supercomputer site was chosen for its access to renewable energy infrastructure. Culham, Oxfordshire, is strategically located near renewable energy sources, including solar and wind farms, and benefits from robust grid infrastructure that facilitates the integration of clean energy.

AI data centres require rapid access to abundant, uninterrupted, low-cost power. High electricity costs can erode profit margins, particularly for colocation centres. Secure, reliable energy insulated from geopolitical risks is critical. Baseload power sources like nuclear, geothermal, or solar and wind paired with batteries ensure stability and scalability.

Major tech firms are prioritising renewables, with Google, Microsoft, Amazon and Oracle pledging 100% clean energy for their data centres by 2030 or earlier. Google and Microsoft have committed to round-the-clock matched renewable energy via the 24/7 Carbon-Free Energy Compact.

In fact, the leading AI companies are proactively addressing this challenge by investing heavily in renewable energy. For instance, Google had already invested $3.5 billion in renewable energy projects by 2022 globally and is pioneering innovative solutions like geothermal power in Nevada. Similarly, Microsoft announced a landmark purchase of 10.5 GW of clean energy from Brookfield Renewable Partners, marking the largest deal of its kind to date.

The countries that can provide rapid access to clean, stable, low-cost energy will become true AI superpowers. The UK is well positioned for this challenge.

Compared to many nations, the UK benefits from a relatively low-carbon grid. Furthermore, the government’s ambitious plans to decarbonise the grid by 2030 and accelerate low-carbon technology development make the UK a prime destination for AI-driven investments.

Of course, fossil fuels are not just dirty but politically contentious, as shown by the backlash against Musk’s use of gas power in Memphis. Clean energy offers a scalable, reliable alternative – critical for powering Britain’s AI future sustainably.

This is where companies like our latest recommendation – Solaria Energía Y Medio Ambiente SA (XMAD:SLR) – come into play.

Our latest recommendation: Solaria Energía (XMAD:SLR)

When it comes to renewable energy innovation, few companies shine as brightly as Solaria Energía.

Founded in 2002 and headquartered in Spain, Solaria has become one of Europe’s leading renewable energy providers, leveraging its expertise in photovoltaic solar energy.

Initially focused on solar panel manufacturing, the company pivoted to large-scale renewable energy production to meet the rising global demand for clean power.

Over its impressive journey, the company has expanded its footprint across Spain, Portugal, Italy, Greece and Uruguay.

Most recently, Solaria has taken bold steps to diversify into wind and energy storage projects, alongside launching infrastructure and – importantly – data centre divisions.

These strategic moves have positioned Solaria as a formidable player in meeting the rising energy demands of AI-driven data centres. Its entry into the UK market, a hotspot for clean energy investment, has only added to the buzz.

A snapshot of Solaria Energía’s journey

From humble beginnings, Solaria has undergone a significant transformation.

After going public in 2007, the company embarked on a growth journey in 2019, multiplying its installed capacity by 20 times in just five years – from 75 MW in 2018 to an impressive 1,658 MW today. This was achieved without raising additional capital, a testament to the company’s exceptional execution and cost efficiency.

By keeping its capital expenditures (CapEx) per MW lower than its peers, Solaria has earned a reputation as one of the most efficient players in the renewable energy space.

Solaria’s growth strategy is ambitious. With new projects in development and construction, the company expects to reach over 3 GW of installed solar by the end of 2025 as it moves towards a 14.3-GW goal from its pipeline of solar, wind and storage projects for 2028.

Although this goal may be challenging to achieve fully, even partial success could deliver substantial returns for investors.

Business model: built for the future

Solaria’s business model is built on three pillars:

- Renewable energy production (IPP Business): Solaria operates 1,658 MW of solar energy assets, primarily (right now) in Spain. About 75% of its capacity is secured under long-term Power Purchase Agreements (PPAs), which provide stable cash flows. Recent projects, such as the 476 MW Trillo park, reflect Solaria’s shift toward large-scale solar developments.

- Infrastructure division (Generia): Generia focuses on acquiring, managing and leasing land for renewable energy projects. By offering long-term leases with inflation-protected returns, this division provides a steady revenue stream while mitigating the risks associated with land acquisition.

- Data centres: this is where Solaria’s growth story becomes particularly exciting. Recognising the growing overlap between renewable energy and the data centre industry, Solaria has strategically pivoted to serve this high-demand sector. This pivot represents a significant growth opportunity. The company’s “Powerland” solution offers turnkey packages for data centres, combining land, grid connections, permits, and renewable energy supply. With a growing pipeline of data centre projects under negotiation, Solaria’s innovative approach promises significant returns.

Let’s linger on its data centre strategy a little longer as this is where the real growth lies.

Data centre strategy: a game-changer

Solaria isn’t just dabbling in data centres – it’s going all in with its so-called “Powerland” solution.

Think of this as the ultimate plug-and-play setup for data centres.

Solaria’s high-capacity solar installations are designed to deliver consistent, large-scale energy outputs, ideal for powering energy-intensive data centres.

As well as offering flexible PPA terms, the company deploys advanced solar tracking systems and integrates battery storage to ensure uninterrupted power supply, even during periods of low solar output.

It’s a dream package for data centre operators: 24/7 grid connection, self-consumption options and backup power.

Solaria has got 1.7 GW of power capacity already ready to go, paired with fully permitted land and existing infrastructure, including over 900km of electrical lines and 97 substations in Europe.

Last year Solaria announced it got approval from Spain’s power grid operator to supply 155 MW for data centres, and it’s now seeking to expand that capacity to 1 GW.

Solaria has got two ways to cash in on this:

- Straight-up sales: Solaria can sell its Powerland or Powershell solutions, which gives the company quick cash while locking in PPAs.

- Joint ventures (JVs): this is where it gets exciting. Solaria plans to team up with Tier 1 data centre giants. Solaria brings the Powerland to the table, the DC player brings its expertise, and together they create some serious recurring revenue streams. Oh, and the returns? They could be four times higher than a typical solar PV plant.

The company has already signed an agreement with the Japanese technology company DataSection for a 200 MW AI-focused data centre in Puertollano in Spain (40 MW is already planned for phase one).

But it is also negotiating with US and European companies to set up joint ventures for the development of cloud and artificial intelligence data centres, with a combined capacity of 1.2 GW. These comprise:

- 400 MW: in talks with a Tier 1 US hyperscaler for cloud and AI data centres at two sites.

- 300 MW: working with a top US data centre operator across three locations.

- 500 MW: teaming up with a major telco for projects at four sites across the EU.

The takeaway? Solaria isn’t just dipping its toes into the DC world – it’s aiming to dominate.

Big UK ambitions

Now, here’s where it gets even juicier. Solaria is planting its flag in the UK.

It’s set its sights on 1 GW of solar and wind capacity in the UK by 2030. Why the UK?

Well, the government is rolling out the red carpet for renewables, with plans to double onshore wind to 35 GW and triple solar to 50 GW by 2030.

Moreover, the UK’s favourable regulatory environment for renewable energy projects and its increasing demand for green data centres provide an ideal backdrop for Solaria’s entry. It’s a match made in heaven for Solaria’s expertise and ambitions.

By focusing on hybrid projects that combine solar and wind, Solaria can maximise energy generation and efficiency, ensuring a reliable power supply for AI workloads.

In November last year, the company announced it had opened offices in Birmingham, a strategic move aligned with the UK’s ambitious AI and clean energy goals.

Solaria will now be actively eying up the major data centre operators to secure PPAs, with plans to supply energy to new AI growth zones like those in Oxfordshire.

CEO Arturo Díaz-Tejeiro emphasised the need to “move fast” in the UK, noting that initial projects could be under construction in 2026 and operational by 2027, providing clean energy directly to AI growth zones.

The company’s success in securing partnerships with top-tier data centre operators will further bolster its position in this lucrative market.

Financials and outlook: strong foundations for growth

Solaria has experienced significant growth over the years, though it has faced recent challenges.

Solaria’s energy production in the first nine months of 2024 was up 15%, hitting 2,120 GWh (compared to 1,845 GWh in the same period in 2023).

Even though energy prices dropped by 32% (€72 down to €49 per MWh), its sales only dipped by 8%, thanks to increased production and steady infrastructure revenues. That’s some solid damage control.

But the company reported a profit decline in the first nine months of 2024, primarily due to higher costs associated with scaling its operations and entering new markets. Despite this, Solaria remains profitable, with total revenues for the period exceeding €150 million.

Here are the highlights:

- Total revenue: €157.4 million (down 9% year-over-year).

- Earnings before interest, taxes, depreciation and amortisation (EBITDA): €131.6 million, a 14% drop, partly because Spain brought back its 7% energy generation tax.

- Net profit: €57.1 million, down from €86.4 million last year.

Despite these dips, Solaria’s financial health is solid.

The company’s EBITDA margins exceed 85%, reflecting its operational efficiency. It’s on track to hit an EBITDA of €205–215 million by end-2024, or about 5% more year-on-year, before jumping another 20% this year to €245-255 million.

Although delays in bringing new capacity online have impacted earnings, electricity prices in Spain – its main market – are recovering, providing a positive tailwind.

Additionally, Solaria has secured favourable financing agreements. This includes a significant partnership with Banco Santander and the European Investment Bank, which ensures funding for its ambitious projects.

Solaria’s average debt cost is just 3.7%/ Its net debt sits at €1,057 million, which included €153 million in financial leases for land. Solaria’s debt profile is well-structured, with 88% of its debt at fixed rates. The use of project finance – where loans are tied to specific projects rather than the company’s overall balance sheet – further reduces financial risk.

During the Q3 2024 earnings call, CEO Díaz-Tejeiro highlighted the company’s focus on securing PPAs, which now account for over 80% of projected energy output for the next decade. This strategic focus ensures predictable revenues, a critical factor for navigating market volatility.

Risks to consider

As with any investment, Solaria is not without risks.

Firstly, recent policy changes in Spain, such as new taxes on energy generation, have created challenges for renewable energy companies by creating regulatory uncertainty. However, Solaria’s diversification into international markets helps mitigate this risk.

Secondly, another key risk often associated with renewable energy companies is the potential for changes to subsidy regimes in Europe. However, for Solaria, this risk has significantly diminished over time. While the company historically relied on government subsidies for some projects, its current business model demonstrates a strong focus on financial independence and adaptability.

Solaria has transitioned away from subsidy dependency, with recent projects funded through long-term financing agreements, such as a €59.45 million deal with Banco Sabadell. The company also relies on stable revenue streams from PPAs and direct market sales rather than government support. Large-scale projects, like the 626 MW Trillo development, were secured without any reliance on subsidies, underlining Solaria’s evolving approach.

While Solaria does benefit from supportive European policies and financing initiatives like the European Investment Bank’s InvestEU programme, these are not direct subsidies but rather favourable financial mechanisms aligned with the European Green Deal. This distinction underscores that Solaria’s growth strategy now centres on project-specific financing, cost efficiencies through in-house development, and diversification into energy storage and hybrid technologies.

As such, changes to European subsidy regimes pose far less risk to Solaria than they once did, reflecting its resilience and adaptability in the evolving renewable energy market.

Execution delays, thirdly, are another important risk to be aware of. The company has faced delays in bringing new capacity online, impacting investor confidence. While these delays are common in the sector, timely project delivery will be critical for Solaria to regain trust.

Fourthly, market sentiment has largely turned against renewable companies amid high interest rates and supply chain challenges. Solaria’s stock has declined significantly, reaching a five-year low. While this presents an attractive entry point for investors, it also reflects market scepticism that the company must overcome.

Finally, we can’t ignore the big news this week surrounding DeepSeek, a Chinese AI model, which has disrupted some power and energy infrastructure stocks.

According to reports, DeepSeek’s servers consume 50-75% less power than Nvidia’s GPUs, a reduction in electricity intensity that could lead to substantial shifts in electricity demand. While this is a concern for companies deeply leveraged to the data centre boom, history – and economics – suggest otherwise.

Technological efficiency gains often simply result in increased demand – a proposition known as the Jevons paradox. As DeepSeek’s energy-saving tech lowers operating costs, data centres are likely to scale up their capabilities, driving even greater energy demand to power AI innovation.

This is where renewable energy might emerge as the true winner. Solar and wind energy, already cheaper and more modular, may continue outpacing nuclear and natural gas. Wind, solar and battery technologies can be deployed in phases, offering faster returns and more flexibility than the long timelines required for nuclear reactors.

For Solaria, this dynamic creates a significant opportunity. Its ability to provide scalable, low-cost solar solutions positions the company to capitalise on the growing energy requirements of the AI revolution.

DeepSeek’s innovations may lower energy consumption per unit, but the overall demand for data processing – and clean power – should only increase. By focusing on renewables, Solaria is perfectly positioned to thrive in this evolving landscape, ensuring AI growth aligns with environmental and economic goals.

Remember, too, that electricity demand isn’t going away. The world’s shift to electrification – from electric vehicles to renewable grids – ensures that energy needs will grow regardless of AI trends.

This is likely why, in contrast to some other energy stocks, including those in the uranium space, Solaria shares were unruffled.

Why Solaria Energía is an unmissable investment opportunity

Despite these challenges, the case for investing in Solaria is compelling.

Solaria is no longer just a renewable energy player – it’s becoming a driving force in the data centre revolution.

With the rise of AI and cloud computing fuelling unprecedented demand for clean, reliable power, Solaria’s strategic pivot into this booming sector is a game-changer. Add to that its expansion into the UK market, and you’ve got an investment opportunity that’s hard to ignore.

Solaria’s track record speaks volumes. It’s consistently delivered large-scale renewable energy projects with impressive efficiency and cost leadership, making the company a standout in the sector. Its expertise positions it perfectly to meet the surging energy demands of AI-driven data centres – one of the fastest-growing industries today.

Solaria’s innovative Powerland solution provides sustainable, scalable and cost-effective renewable energy to power these digital infrastructure hubs. This is a market with enormous growth potential, and Solaria is perfectly poised to lead the charge.

What’s more, the UK, with its advanced energy grid, strong clean energy policies and aggressive AI infrastructure goals, offers fertile ground for Solaria’s growth.

The UK government’s focus on net-zero emissions and AI-driven economic transformation creates the perfect environment for Solaria to establish itself as a market leader. By entering early, it has a chance to shape the future of renewable-powered AI infrastructure in the region.

Of course, what makes Solaria even more exciting for investors is its solid financial foundation. With secured financing agreements, stable cash flows from PPAs and a focus on reducing financial risk, the company is navigating market challenges with resilience. And with its stock trading at a five-year low, the upside potential is enormous as the company executes its growth plans.

Remember, Solaria is at the intersection of two transformative forces: clean energy and artificial intelligence. By combining its renewable energy expertise with cutting-edge solutions for data centres and expanding into high-potential markets like the UK, it’s setting the stage for long-term success.

For investors looking to align with the future of sustainable innovation, Solaria Energía is a name to watch – and invest in – today.

Action to take: buy Solaría Energia Y Medio Ambiente SA

Ticker: XMAD:SLR

ISIN: ES0165386014

Market cap: 929.63M EUR

52-week high/low: 13.82/7.30 EUR

Buy up to: €9

Source: Koyfin

Big Breakthroughs

While the world has been obsessing over DeepSeek, another groundbreaking development has quietly emerged from China.

And, believe it or not, in the fullness of time, this one might actually end up overshadowing all the buzz about AI.

We’re talking about nuclear fusion, specifically China’s experimental nuclear fusion reactor, nicknamed the “artificial sun”, which has just smashed a world record.

For the first time ever, it sustained a temperature exceeding 100 million degrees Celsius for over 17 minutes. Let’s unpack why this milestone could mark a significant turning point in fusion research and the energy landscape.

China’s “artificial sun”, officially called the Experimental Advanced Superconducting Tokamak (EAST), is designed to replicate the nuclear reactions that power the sun.

In its latest experiment, EAST managed to sustain plasma at over 100 million degrees Celsius for 1,056 seconds – about 17.6 minutes. For context, that’s six times hotter than the core of the actual sun. Achieving such extreme conditions is a feat in itself, but keeping the plasma stable for that duration marks a new frontier in fusion research.

As you know, fusion – the process of fusing hydrogen atoms to create helium – releases massive amounts of energy without the long-lived radioactive waste associated with fission.

However, it’s notoriously difficult to sustain the conditions needed for fusion to occur. EAST’s achievement isn’t just a demonstration of extreme heat; it’s a crucial step toward proving that sustained, stable fusion reactions are possible.

As is often written, fusion represents the holy grail of clean energy – virtually limitless, relying on hydrogen isotopes abundant in water, and free of greenhouse gas emissions. Unlike wind or solar energy, it offers a stable, continuous power source, making it a potential game-changer in the global transition away from fossil fuels.

But fusion remains one of the most complex scientific and engineering challenges humanity has ever undertaken, and the recent achievement at EAST, while exciting, is still far from proving commercial viability.

In fact, as groundbreaking as the EAST experiment is, it’s crucial to maintain a realistic perspective.

Certainly, we shouldn’t expect fusion power to become commercially viable any time soon. EAST’s achievement, while monumental, is still very much a proof-of-concept. Although some experts predict that commercial fusion reactors could be operational within the next 20 to 30 years, even this timeline is contingent on continued breakthroughs in energy efficiency, materials science and cost reduction. Fusion’s path to commercial reality is likely to be incremental.

Hopefully, of course, EAST’s success will catalyse further investment and innovation in fusion research. International efforts like ITER are making strides, and private companies in the US and Europe (including the UK) are exploring alternative approaches. The global race for fusion dominance is heating up, and the competition is driving progress faster than ever before.

EAST’s milestone is significant, but it’s not the finish line – it’s a promising waypoint on a very long journey.

Buy List update

CleanSpark (NASDAQ:CLSK)

Thanks to China releasing DeepSeek on the world last weekend, tech stocks took an almighty battering in trading this week.

So much so that a bit like 5 August 2024, when the “Japan carry trade” unwound sending the market into a selling frenzy, the volatility in a number of our positions skyrocketed this week too.

It was so severe that CleanSpark traded from a high of $12.20 last Friday to a low of $9.66 on Monday, sinking 20% in one session. It was so dramatic that it sent the stock through the stop exit we’d put in place back in November. We lifted the stop exit on both CleanSpark and Hut 8 to our entry price to counter any future wild volatility in the bitcoin market.

That way if things really moved against us, we’d be out of the position for a 0% outcome.

Well, that’s what happened, and it means we’re stopped out of CleanSpark at our entry (and now exit) price of $10.49 for a 0% outcome.

Thankfully, Hut 8 was coming back from a higher price and is still in profit. It didn’t trigger its stop exit, so we remain in that position.

MPAC Group (LON:MPAC)

MPAC Group has now been in our buy list for three years. Frankly, the stock hasn’t really performed. This is the timeframe when we want to at least see some indication of a trend higher, and a more sizeable profit position.

In short, with a 6% gain at current prices for that period of time, the decision has been made to exit the stock and reallocate the capital to more explosive potential opportunities.

Action to take: SELL MPAC Group

Recursion Pharma (NASDAQ:RXRX) (formerly Exscientia)

Exscientia completed the Recursion merger late last year and it’s been trading as Recursion Pharmaceuticals since. The stock is continuing to show great promise in AI enhanced drug development, and we continue to hold the stock.

Our portfolio has been adjusted to reflect the merger conversion rate of 0.7729 RXRX stock per one EXAI stock – which based on current prices at the time of writing, equates to a small overall loss with the stock of 1.2%.

Oklo (NYSE:OKLO), NANO Nuclear Energy (NASDAQ:NNE) and Centrus Energy (NYSE American:LEU)

We’re grouping these together this month because all three have been highly volatile, both before the release of DeepSeek and after!

All three of these had been running up in price after the continued momentum behind nuclear energy stocks as the power source for AI infrastructure in the near future.

Oklo has reached as high as $43. NANO Nuclear has reached up to $48 and Centrus up to $99. This represented paper gains of over 300%, 180% and 140% respectively. Volatility works in your favour sometimes.

And then it doesn’t.

With the release of DeepSeek, AI stocks tanked. AI-related stocks fell with them, including “AI energy” stocks. All three of these headed south. By quite a bit, but not enough to hit our 50% trailing stop exits.

That’s good because I expect the DeepSeek overreaction will die down, US AI stocks will get back to business, and the nuclear energy plays (these three) will head forward to new all-time highs.

Volatility is scary and it sees stocks like these swing wildly around. But that can also be a good thing. And my expectation is that we will continue to see all of them be standout performers in the coming months.

Arm Holdings (NASDAQ:ARM)

Arm continues to be a crucial part of the rollout of AI infrastructure in the world. This was shown as fact when just last week President Donald Trump, along with Sam Altman of OpenAI, Larry Ellison of Oracle and Masayoshi Son of Softbank, announced the $500 billion Stargate project.

Stargate will (over time) invest $500 billion into the buildout of AI infrastructure in the US, creating “hundreds of thousands” of jobs. It will start with $100 billion and scale up from there.

This was relevant to Arm because it’s Arm that will also be a key partner in Stargate. News of this sent Arm’s stock price 17% higher in a single day and up to a high of $182. That took us right into a nice little profit position (of 12.5%) after a number of months with the stock in the red.

Then the DeepSeek thing happened and the stock went back under $150. Either way, Arm is here for the long haul, and so are we with this position. But what you saw with Stargate is a preview of what we expect to come in the coming months and years. We still consider it to be the most important company in Britain and quite possibly in the entire AI infrastructure supply chain.

One more thing. Arm and Qualcomm had been in a legal spat that went to court in December. The court sided with Qualcomm in the main, but one point was still in contention. That will go to appeal, but it’s not expected to make a huge difference to either stock. With this little spat finally clearing up, it’s full steam ahead for Arm, with Qualcomm still as a major partner.

Sprott Global Uranium Miners ETF (LSE:URNM) and Yellow Cake (LSE:YCA)

There’s nothing major to report for these two. The play here remains long-term demand for uranium. There’s no indication that’s going to let up. If anything, it’s expected to still increase in the coming years, particularly as small modular reactor (SMRs) begin to gather momentum.

They’re not shooting the lights out. But for direct plays into uranium and uranium mining these two make excellent lower volatility plays into the most important commodity for the future of AI.

Aura Energy (LSE:AURA)

Aura has been a disappointing performer so far for us. At just over 50% down from our initial buy-in, it’s one uranium play that so far hasn’t worked out. But we still expect the company to seriously turn things around in 2025.

The Tiris project continues to expand and provide even more valuable resource. But it’s the potential unlock of Sweden’s uranium ban this year that’s really going to see the company realise greater value.

With the government now having officially concluded that they should regulate uranium as a “concession mineral” like other natural resources, we think legislation will pass this year that will allow uranium mining to commence. For us, there is only one listed company right now that stands to profit from that: Aura Energy.

For that reason, we stick with the stock.

Clean Power Hydrogen (LSE:CPH2)

Developmental companies are always a risky bag. Sometimes they will reflect their future value before the revenue flows through the door. Then sometimes the market waits, and waits and waits for that moment of commercialisation.

Well in 2025, CPH2 is expecting commercialisation of its MFE220 unit. That means the first meaningful revenues are expected to flow. After a recent capital raise, it’s cashed up and it’s expected to get to commercialisation. That means 2025 will essentially be a make-or-break year for the company.

We do believe the company can turn things around and emerge from development to revenue generation. We think this will help to minimise some of the losses the stock currently sits on.

We stick with the stock.

Global X Lithium & Battery Tech UCITS ETF (LON:LITG)

Global X Lithium & Battery Tech UCITS ETF has traded flat around £6 over the last month, keeping it around 33% below our £8.96 entry price.

The ETF allows investors exposure to the lithium and battery sectors.

It seeks to provide returns similar to those of the Solactive Global Lithium Index by holding shares in a broadly diversified cross-section of industries that range from lithium miners to battery producers, all the way to the producers of electric vehicles (EVs).

By owning mining, refinery and battery production companies in the fund, Global X has its fingers in multiple parts of the lithium industry.

As you’ll know, the lithium market has been on a rollercoaster over the last few years. After a massive price drop – down about 80% from peak levels in 2023 – things finally seem to be stabilising.

The issue? A supply glut, thanks to booming production from Australia and China, combined with weaker-than-expected EV sales in the US and Europe.

But 2025 looks more promising. Analysts expect global lithium demand to jump 26%, hitting 1.46 million tonnes of lithium carbonate equivalent (LCE). China is leading the charge, with EVs now making up over half of its new car sales. Plus, the rise of plug-in hybrids, which require larger battery packs, is pushing demand even higher.

On the supply side, production is still increasing – it’s forecast up 16% in 2025 – but the surplus is expected to shrink. This should mean some price recovery, especially with producers cutting output and some mines shutting down.

So while it’s unlikely lithium will skyrocket overnight, a more balanced market is on the horizon. For investors, the worst may be over, and for EV makers, stability is finally in sight.

The ETF remains a HOLD in the portfolio while the market finds its feet.

Central Asia Metals (AIM:CAML)

Central Asia Metals has lost around 1% over the last month to 158.80p at the time of writing, still leaving it around 45% underwater in the model portfolio.

The company operates Kazakhstan’s Kounrad copper mine and the Sasa lead-zinc asset in North Macedonia. The Kounrad mine, in particular, remains one of the lowest-cost copper producers globally, with C1 cash costs of $0.78 per pound (C1 costs being the standard metric in copper mining to denote the basic cash costs of running a mining operation).

Central Asia Metals recently released its 2024 production results, and it was a mixed bag.

The Kounrad copper plant hit the mark with 13,439 tonnes, nicely within guidance. But its Sasa mine in North Macedonia saw a bit of a stumble with zinc and lead production falling short. Despite that, CEO Gavin Ferrar remains confident about 2025, with production guidance set at 13,000-14,000 tonnes of copper.

As for the wider copper markets, prices have been on a bit of a rollercoaster, but overall, they’re looking up. Since the start of 2025, copper’s jumped by over 7%. China’s economy, the Federal Reserve’s interest rate decisions and US tariffs remain factors to watch.

On the last point, Goldman Sachs has indicated that the market is pricing in a 50% chance of a 10% US tariff on copper by the end of the first quarter, which could certainly shake things up.

Despite these potential headwinds, copper prices have shown resilience. This uptick is encouraging for producers like CAML, suggesting a favourable environment for its operations.

Remember, copper supply’s still tight, and demand’s growing, especially in the energy sector. This should mean higher prices ahead, both for copper and for related stocks such as CAML.

Let’s keep the stock as a HOLD for now.

Volt Lithium (TSXV:VLT)

Volt Lithium, which entered the Southbank Growth Advantage on 2 August at C$0.37, has gained by 14% over the past month to trade last at C$0.33, though it’s still 11% down in our model portfolio.

The company has developed proprietary direct lithium extraction (DLE) technology aimed at extracting lithium from North American oilfield brines, contributing to a secure critical minerals supply chain for the region.

Volt Lithium has been making significant strides lately, particularly in Texas. In December 2024, the company scaled up its US field operations in the Permian Basin, processing over 2,500 barrels of lithium-infused oilfield brine daily. This move is a big deal, as it positions Volt among the industry’s leaders in DLE technology.

But it’s not stopped there. Volt plans to commission its Generation 5 Field Unit this month, aiming to process up to 10,000 barrels per day, marking a pivotal step toward commercial lithium production. With all equipment on-site and storage facilities ready, Volt is poised to start stockpiling lithium for future sales.

Financially, Volt’s been active too. In November 2024, the company announced a $5.4 million marketed public offering of units, bolstering its capital for these ambitious projects. In short, Volt is charging ahead, scaling operations and securing funds to solidify its spot in the North American lithium production scene.

The stock remains a BUY under its buy limit of C$0.50.

Newmont Corporation (NYSE: NEM)

Newmont Corporation, the world’s largest gold miner, has gained 12% over the last month to 41.59%. The stock is now 36% below our $65.39 entry point.

Newmont continues to make strategic moves. On 27 January, it announced plans to sell its Porcupine operation in Ontario, Canada, to Discovery Silver Corp. for up to $425 million. The deal includes $200 million in cash at closing, $75 million in Discovery shares, and a potential $150 million in deferred cash.

This sale is part of Newmont’s broader strategy to shed non-core assets, aiming to generate up to $4.3 billion from these divestitures.

On the gold market front, prices have been on a rollercoaster. After a stellar 2024, where gold prices surged by 28%, 2025 could see more modest growth. Analysts predict prices could reach around $2,795 per troy ounce, about 7% higher than current levels. Factors like central bank purchases, potential US interest rate cuts and geopolitical tensions are key drivers.

Newmont remains a BUY under $100.

Prysmian Group (IL:0NUX)

Prysmian Group is now nearly 30% up in the model portfolio after rising 9% over the past month to €67.18 at the time of writing.

The Italian cable manufacturing powerhouse is making some strategic shifts in its US operations. Back in 2021, the company announced a $200 million plan to build a state-of-the-art offshore wind cable factory at Brayton Point, Massachusetts – a former coal power plant site. It was seen as a major win for the renewable energy sector and local job market.

However, as of January 2025, Prysmian has decided to halt this project. The company cited a strategic reassessment, noting that its substantial €18 billion backlog of subsea transmission projects is concentrated in Europe.

Consequently, Prysmian plans to focus its US efforts on burgeoning sectors like data centres and the increasing energy demands across the country.

So while the Brayton Point project is no longer moving forward, Prysmian continues to adapt its strategy to meet global market dynamics, balancing its European commitments with targeted US investments.

Let’s raise the buy limit on the stock to €85.

SilverCrest Metals Inc (TSX:SIL)

SilverCrest Metals, recommended in the May issue of Southbank Growth Advantage at C$12.55, has gained 14% over the last month to C$14.70, leaving it 17% up.

SilverCrest Metals has reported strong Q4 2024 and full-year operational results from its Las Chispas Operation in Mexico.

In Q4 2024, the company recovered 13,993 oz gold and 1.38 million oz silver, generating revenue of $85.2 million, a 6% increase from Q3. Treasury assets rose to $193.4 million.

For FY 2024, SilverCrest exceeded sales guidance with 59,804 oz gold and 5.75 million oz silver sold, generating record revenue of $301.9 million, a 23% increase from 2023. The company achieved a 15% beat on tonnes mined versus budget and exceeded budgeted silver equivalent processed grades by 7%.

The company’s pending transaction with Coeur Mining remains on track to close in Q1 2025, with a special shareholder meeting scheduled for 6 February 2025.

The stock remains a BUY up to C$16.

Ashtead Technology Holdings PLC (AIM:AT)

Ashtead Technology Holdings was last seen at around 564p, 3.6% up on the month, leaving it 4% below our recent entry point of 590p.

Ashtead has a history supplying subsea services to the oil and gas sector but has diversified into the fast-growing offshore wind market, specialising in renting out equipment crucial for the operations of installations throughout their lifecycle.

The company’s technology offerings include surveying equipment, sensors and robotics essential for installation, operation, maintenance and decommissioning of assets.

Ashtead Technology has been making significant strides lately. The group has said that its unaudited full-year revenues for 2024 are projected to be around £168 million, with full-year adjusted EBITA (earnings before interest, taxes and amortisation) of £65.7 million expected to be “ahead of consensus”.

This success is attributed to a surge in demand for subsea rental and services, especially towards the year’s end.

The company’s growth strategy includes strategic acquisitions. Notably, Ashtead completed its ninth acquisition in seven years by acquiring Seatronics and J2 Subsea for £63 million. This move not only expanded its workforce by 100 but also enhanced its rental fleet by 30%, strengthening its position in the subsea market.

Looking ahead, the outlook for 2025 appears promising. The recent lifting of restrictions on offshore US exploration is expected to further boost demand for Ashtead’s services. With a strong trading finish in 2024, ongoing market demand and record customer backlogs, the company is optimistic about continued growth in the coming year.

Certainly, Ashtead Technology’s strategic acquisitions and robust market demand have positioned it well for sustained success in the subsea equipment rental and solutions sector.

The stock remains a buy under 700p.

AirJoule Technologies (NASDAQ:AIRJ)

AirJoule Technologies recommended at $7.92 in the November issue of Southbank Growth Advantage, was last seen at $7.77, putting it 2% down in the model portfolio.

The company’s proprietary AirJoule technology is designed to extract water from the atmosphere efficiently. The current prototype, P5, produces up to 200 litres of water daily, consuming 130Wh per litre, and boasts a cooling coefficient of performance (COP) exceeding 10 – surpassing typical peer technologies with COPs between 3.0 and 3.5.

Looking ahead, AirJoule plans to launch a pre-production unit in 2025, aiming to produce 360 litres per day at an improved energy consumption rate of 60-90Wh per litre. When focused solely on water harvesting, this system is expected to generate up to 1,000 litres daily.

Financially, AirJoule is in a solid position, holding more cash than debt and maintaining liquid assets that exceed short-term obligations. The company anticipates commercialising its technology by 2026, positioning itself as a key player in sustainable water solutions.

With a strong financial foundation and a clear focus on innovation, AirJoule Technologies is well positioned to make a significant impact in the atmospheric water harvesting industry.

The stock remains a buy below $11.

Crypto Corner

I was too early. You are right on time.

It’s 2011, I’m sat at an Indonesian café on Swanston Street, Melbourne, with a work colleague.

I’m working as a financial adviser at the time. My mate, Daryn, a mortgage broker within the same business.

We’re chatting about macroeconomics, the aftermath of the GFC, how the market had bounced hard from 2010 to now and what we liked in terms of investments, stocks, property…

Then Daryn asks me about bitcoin.

He knew I’d been kicking around this digital currency thing called bitcoin for a little while. We’d chatted briefly about it on and off for a few months.

I had first stumbled on it in deep web (or dark web it’s also known by) internet forums. A guy online had even used it as payment for someone to go get him some Papa John’s pizzas.

So, it had some utility a purpose as a digital payment. What got Daryn and I talking about it that lunchtime was the fact it had a price, and that price was moving up. Volatile, yes, but moving up in price.

In fact, it had gone from a few cents to a few dollars and was marching on past $10, $20 what at that time was about a 4,000% gain from when I first saw it on the deep web and internet forums.

That kind of return was unheard of in the stock market in such a short space of time. With a finger on the pulse in the stock market, and a keen interest in this bitcoin thing, we toyed around with what to do, how to buy, where to buy, mine it, all the different things you could do.

Meanwhile, as this is taking place, bitcoin starts to get some not-so-friendly notoriety. That’s because the mainstream media picks up on an article about an illegal decentralised marketplace on the deep web, called Silk Road.

This marketplace allows anyone, anonymously to buy any drug imaginable. The currency used on this site… bitcoin.

Side note: the guy who started this site went to jail for life. But this week he was fully pardoned by Donald Trump – which is the first major signal that we’re about to see bitcoin and crypto explode higher like never before. More on that in a moment…

Anyway, by now, the price of bitcoin explodes to over $30. I’m watching a 10,000% gain unfold right in front of my eyes. But to me, that’s insane. This is magical internet money, created by computers online. It’s rising higher, faster and bigger than any asset I’ve ever learned about in school, at university, or through all my life experience.

It looks too good to be true. And we all know because it’s drummed into us time and time again by our parents and grandparents, that if it looks too good to be true, it probably is too good to be true.

Also, that I shouldn’t take on too much risk, it’s dangerous and not good for you long term. And this thing is RISKY.

Well, you know what. In my book that’s utter nonsense.

Yep, I’ve said it. Total bull****. With the benefit of hindsight, I wish I’d never been taught any of that. It set me back about five years. Common sense is all you need, and a healthy appetite for risk. I’ve got plenty of that now, and I’m flying. It’s all I think you need too to maximise the full potential of this market.

The time is now, and you’re right on time

I’m going to jump ahead a bit now, because this isn’t supposed to be a history lesson on bitcoin.

But in the 14 years I’ve been involved in bitcoin and the crypto markets now, I’ve had to completely reprogram my brain. It took a few years to strip it all back, then a few to build it back up, and then to really maximise the fullest potential of what’s happening right in front of our eyes.

It was barely two years old when I found it, a time when no one really knew about it, let alone that inside of 15 years the world’s largest economy would be on the verge of buying $100 billion (or so) of it to add to their treasury.

That did come, and the longer I spent understanding it all, learning, experiencing everything you could think of in the crypto markets the more I was convinced this was the future of global finance and global economics. I’ve got over a decade’s worth of research, writing, two published books to prove that.

But my point is I was too early. Sure, hindsight says I should have bought 2,000 bitcoin for $2,000 in 2011. Today I’d be sitting on $210 million in bitcoin.

A very rare few had the ability to achieve that. And if they did, good chance they just forgot about it for a long time and got lucky. Some did it intentionally, but there’s no way back then I had the brain capacity to hold for that long.

As I say, I was built in a world of traditional finance. That was my career at the time. So even if I had 2,000 bitcoin, no way I would have held past maybe five or six thousand percent. 10,000% maybe if I’d been slow and lazy. One million percent gain, 10.5 million percent gain? No bloody way.

I have still made plenty from bitcoin and the crypto markets over the years. And it’s been a fun, wild ride. And thankfully I’ve got to share my knowledge, experience and rewired deep understanding of bitcoin and crypto with tens of thousands of people in the last decade.

Register and join me

But I want to emphasise a couple key things.

I’m nothing special. I’m not some hedge fund quant, no City banker, the only silver spoons in my family are literally the ones in the drawer (and they’re not real silver are they). I’m just a regular guy, who had a curious mind, and with some rewiring understood the gigantic asymmetric risk opportunity that crypto markets present.

I’m no different to you. I don’t really like being told what to do, I don’t much like the establishment, I want to make my own informed decisions, and I know a BS artist when I see one. You can make your own mind up on that last point if you think that’s me or not.

Also, I’ve done a few laps of this crypto thing in the last 14 years, so yeah, I do know a thing or two. And in that time, I’ve made some wild, bold predictions.

Not everything has been a winner. This market is volatile and fraught with higher risks. Prices have gone way up, but that doesn’t mean they won’t go down in future. You could lose everything you invest – so don’t bet the house. But I’ve been right about bitcoin from the outset, and how that impacts the rest of the crypto market.

I’ve also been dead right about how crypto is going to permeate through every fibre of global finance over the years. We’re not there yet, but I believe it’s coming, in a BIG way.

And for bitcoin, well, it will become the world’s global reserve currency. First, online, and eventually, everywhere. Again, we’re not there yet, but I believe it is coming too.

All of this is to tell you that right now, I’ve never seen such potential in the bitcoin and crypto markets. EVER.

I believe that you’re lucky to not be as early to all this as I was.

Because you don’t have to worry about learning the hard way like I did in this market.

You can capitalise quickly and easily with trusted, in-depth information. And that’s what I want to talk to you about.

I have a briefing that lays out:

- Why the market right now is the best time I’ve seen arguably in 14 years to invest.

- Why it’s never been as exciting to be in this market.

- And why I think this cycle is going to be bigger, and far more lucrative for you than any cycle we’ve seen previous.

I’ll give you a little hint…

It involves Donald Trump, a “crypto dream team”, and a game changing bill, S.4912 that’s set to shake the foundations of the global financial system.

I also explain three ways I think investors just like you get to profit from this absolute once in a lifetime moment in the bitcoin and crypto markets.

I know not everyone thinks crypto is a good idea, but for 14 years, I’ve got a fair idea of how this market moves and I’d like you to see what I’m saying is coming next.

If you’re interested, you can register here and check out my primer videos. I look forward to helping you maximise every ounce of opportunity from this exciting market.

What else we’ve been looking at this month

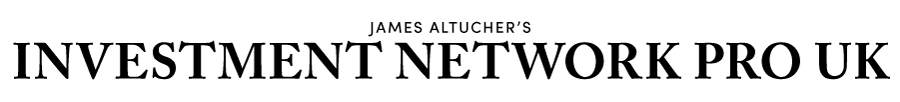

Signs of stress in the physical silver market

I’ve been keeping a close eye on the silver market, where traders are currently swapping futures contracts for the actual physical asset at record levels.

Source: Bloomberg, GoldBroker

Traditionally, investors engage in silver futures contracts without intending to take physical delivery. However, recent trends indicate a surge in traders opting to convert these contracts into actual silver holdings, leading to substantial withdrawals from vaults.

What’s behind this? Well, right now, there’s a notable disparity between COMEX futures prices and London spot prices. The premium for New York futures over the London spot price has broken higher to record levels, which has undoubtedly incentivised traders to exercise delivery, leading to large bullion shipments from London.

If this is primarily an arbitrage strategy, then we can expect to see the transferred silver re-entering the market once the price gap narrows, potentially stabilising or even suppressing prices.

What’s more, some commentators are also suggesting the current silver market action is driven by US president Trump’s threat of tariffs potentially increasing silver’s import price, causing market participants to import and secure silver before such tariffs take effect.

This is certainly plausible, but there could be something bigger going on. As we’ve written about before, a persistent silver supply deficit continues to stalk the market, heightening concerns about the availability of physical silver.

If that’s what’s really prompting traders to take physical delivery, emptying what’s in the vaults, then any anticipated scarcity could lead to a possible “silver squeeze” where demand significantly outpaces supply, driving silver prices much higher.

It’s one to keep an eye on.

Prototype jet breaks sound barrier for first time

A lasting regret of mine is that I never got the chance to fly on Concorde.

The speed, the elegance and the ability to cross the Atlantic in under four hours – what a way to travel.

But maybe, just maybe, I’ll get a chance to fly supersonic one day after all.

Earlier this week, a US company’s prototype broke the sound barrier in a demonstration it hopes will pave the way for a successor to the British-French supersonic airliner.

Boom Supersonic’s XB-1 successfully exceeded Mach 1, about 770 miles per hour, after reaching an altitude of 34,000 feet above the Mojave Desert in California.

Supersonic commercial flight ended in 2003 with Concorde’s retirement – too loud, too costly, too inefficient. But Boom Supersonic, founded in 2014, wants to change that. The Denver-based company, backed by investors like OpenAI’s Sam Altman, aims to launch its Overture airliner by 2029.

Overture is designed to carry 64-80 passengers at Mach 1.7 – twice the speed of today’s commercial jets. Though slightly slower than Concorde, it could still slash flight times: London to Miami in under five hours, LA to Honolulu in three.

Unlike its predecessor, Overture is built for efficiency, using carbon fiber materials and engines capable of running on sustainable aviation fuel.

Airlines are betting on it – American, United and Japan Airlines have already pre-ordered 130 jets. If Boom delivers, it could reshape long-haul travel, making fast transatlantic and transpacific trips routine once again.

For investors, the opportunity is big, but so are the risks. Supersonic flight still faces regulatory, infrastructure and cost hurdles. If Boom can overcome them, early backers could see major returns. If not, it’ll join the long list of failed supersonic dreams.

Either way, this could be the start of a second supersonic era. Maybe, at last, I’ll get my chance to fly faster than sound.

You can watch a video of the test flight here.

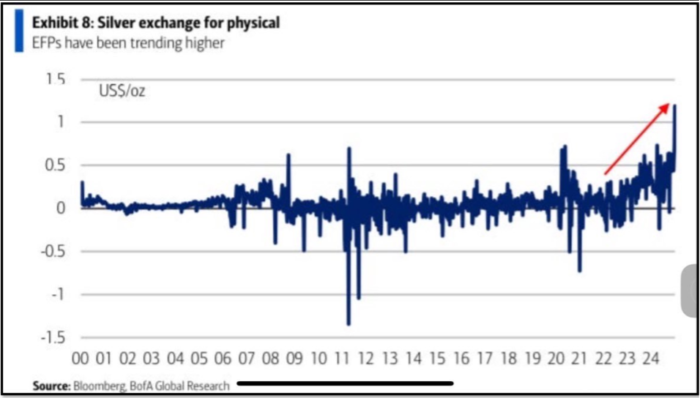

How one AI giant outshines the entire mining industry

Take a look at this treemap featuring just one AI stock – albeit the biggest one, Nvidia – stacked up against the world’s 50 most valuable mining companies.

It’s almost like a solar system, with Nvidia as the blazing sun, dwarfing the smaller planets orbiting around it.

Source: Mining.com

This stark visual highlights the massive gap in how the market values cutting-edge chipmakers versus the more old-school, down-in-the-dirt mining industry.

But here’s the twist: this snapshot was taken after China’s DeepSeek AI model triggered a $600 billion wipeout in Nvidia’s market cap on Monday.

Even so, Nvidia investors who bought in a year ago are still up 111%, while those who saw the AI boom coming three years back are now sitting on a staggering 465% gain.

Meanwhile, over in the mining world, it’s a different story. By the end of 2024, the Mining.com Top 50 ranking showed the combined market cap of the world’s biggest miners at $1.28 trillion, down $126 billion for the year after a rough final quarter.