Your May issue of Small Cap Investigator

31st May 2023 |

- The market assumes this EU lithium project won’t be built, but I think it will

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- Reader Questions & Answers (Q&A)

- What else we’ve been looking at this month

The market assumes this EU lithium project won’t be built, but I think it will

Earlier this month, the Czech Republic’s prime minister, Petr Fiala, took a visit to Cinovec, a down-at-heel village situated 100 kilometres away from Prague in the north of the country near the border with Germany.

Surrounded by forests and meadows, Cinovec still shows scars of surface mining for lignite that once employed many people in the area.

The region, which has a tradition of mining since the 14th century, now has a jobless rate among the highest in the Czech Republic.

But it is also sits atop a deposit of a vital battery metal – lithium – that is set to change the fortunes of not just the village and surrounding area, but also the Czech Republic and potentially even Europe, too.

That’s because the site Fiala visited in Cinovec just two weeks ago boasts the largest resources of lithium in Europe and among the top five hard rock deposits of the metal found anywhere in the world.

Indeed, in a statement released on the day of his visit, Fiali described Cinovec as a “globally significant lithium project”:

“Cínovec is the largest European deposit of this raw material. Thanks to this, the Czech Republic has a unique opportunity to contribute to both its own and European raw material security.

“We are on the threshold of a ‘lithium revolution’ as the use of lithium will grow significantly. As a country with a large share of the automotive industry, it is important for us to support it and capture current trends.

“We are offered a unique chance to build the entire chain from mining to the production of electric cars. That is why we need lithium and we are trying to build a battery factory, the so-called gigafactory.”

Czech prime minister Petr Fiala (left) visiting the Cínovec lithium project on 16 March

Czech prime minister Petr Fiala (left) visiting the Cínovec lithium project on 16 March

Source: Twitter

Following his visit to Cinovec, Fiala travelled across the Czech border to Dresden, where he signed a Memorandum of Cooperation (MoC) with Saxon prime minister Michael Kretschmer on the execution of important projects.

The MoC increases bilateral cooperation on raw materials, energy, and fuel security, with a focus on lithium due to the strategic position of the Cinovec lithium deposit on the Saxon-Czech border.

“I believe that this memorandum will help our cooperation on the development of the lithium deposit in Cínovec and, in the future, the creation of the entire production chain for the production of batteries for cars,” Fiala said.

Germany is the industrial powerhouse at the heart of Europe’s bid to build electric cars and develop battery technology, so forging closer ties to the continent’s great demand centre is extremely important for the Cinovec project and its developers.

Of course, more generally, Europe is also one of the great global hubs of global automobile manufacturing, but up to now its ability to source the essential resource for developing a domestic electric vehicle industry has remained distinctly in doubt.

Until now, lithium – crucial for the production of batteries for electric vehicles and renewable energy technologies – has mainly been produced in Australia, Chile, China and Argentina. The EU does not yet have a single lithium mine in production.

But China, specifically, also has about an 80-90% monopoly on refining lithium, meaning it has a stranglehold on the entire lithium supply chain.

Put this all together and it means that, up to now, Europe has had little choice but to import every tonne of lithium it consumes.

This is a potential problem considering European demand for lithium is widely expected to balloon. By 2050, in fact, the EU estimates its demand for lithium will be 57 times what it is today.

Europe has set ambitious goals to electrify its transportation, with proposed legislation looking to ban all internal combustion engine cars by 2035. In fact, the region is behind only China when it comes to projected EV sales growth.

According to Fastmarkets, Europe will make up 25% of lithium demand in 2032, but will only contribute 4% of global supply.

Of course, Europe’s lack of a reliable home-grown supply of fossil fuels has left it dangerously vulnerable in the past year or so, as Russia shut off gas supplies amid the war in Ukraine. The fear in Brussels now is that China could use its dominant role in the lithium supply chain to exert a similar type of pressure in the future.

But the good news is that, this time, European bureaucrats are not leaving it to chance, classifying lithium as a “critical raw material” – one of a group considered vital to the transition away from fossil fuels to cleaner energy.

In March, Brussels unveiled its new Critical Raw Materials Act in a bid to secure the resources needed for technologies such as renewable energy and battery power.

The act aims to make the EU more self-reliant in mining, processing and recycling lithium and other critical metals and minerals, to shield the region from the impact of increasing international competition for these resources.

According to the Commission’s proposal, at least 10% of Europe’s annual consumption of strategic raw materials should come from domestic mining capacity by 2030, with targets going up to 15% for recycling and 40% for processing.

At most, 65% of the Union’s annual consumption of any strategic raw material should originate from a single country by 2030, Brussels suggested.

The act – which could become law by the end of the year – also aims to make it easier for mining companies to obtain permits.

This last point is especially important. In March, one of the six lithium projects in the EU – the Barroso mine project in Portugal – had to reapply for its environmental permit following delays sparked by community opposition.

The move by the EU to secure supply chains for critical minerals such as lithium will certainly increase urgency in the region to develop projects like Cinovec.

Certainly, as Europe’s largest lithium resource, Cinovec sits right at the heart of Europe’s plans to be as self-sufficient as possible in lithium.

Indeed, in January Cinovec received “strategic project status” from EU’s Just Transition Fund, a designation that makes the lithium project eligible to receive up to €49 million in grant funding.

Fiala’s more recent visit to the mining complex is the latest endorsement of the project as it awaits certain key milestones – explained below – over the next few months.

Certainly, Fiala has continued to emphasise the importance of lithium development in the Czech Republic, and it is expected that the recently signed MoC will accelerate Cinovec’s regulatory and development pathway.

Put this all together and it’s clear that the Cinovec project – which is bigger than all the other hard rock lithium projects in Europe combined, as well as being one of the most advanced – is perhaps the most exciting lithium project on the continent.

Today, we are recommending you invest in the small London-listed developer of the project: European Metals Holdings Limited (AIM. EMH).

The latest Small Cap Investigator recommendation: European Metals Holdings Limited (AIM. EMH)

EMH is racing to become the first local EU battery grade lithium producer to deliver to an emerging local industry.

The Australia-based explorer acquired the exploration permit over Cinovec in 2014 and has spent the subsequent years undertaking various verification programmes, scoping studies and pre-feasibility studies (PFS).

Key details of the Cinovec resource:

- Cinovec hosts a globally significant hard rock lithium deposit, with a total measured and indicated mineral resource of 414 million tonnes at 0.47% lithium oxide and 0.05% tin.

- While the resource is of lower grade, EMH has produced high purity (99.99% lithium carbonate equivalent) battery chemicals with metallurgy supporting high recoveries of up to 93%.

- According to a revised flowsheet, either lithium hydroxide or lithium carbonate can be produced on demand.

- EMH aims to produce nearly 30,000 metric tonnes of battery-grade lithium hydroxide per year over a period of 25 years from the start of production.

- According to the updated pre-PFS, Cinovec has the potential to become the producer of the lowest-cost hard rock lithium in the world. The mine could produce at a cost of $5,000 to $6,000 per metric tonne.

- The PFS also confirmed the deposit can produce not just lithium but also high-grade tin concentrate at excellent recoveries, which will help diversify production and also assist in driving down production costs and support revenues.

- The novel extraction process is in its pilot stage and lithium hydroxide and lithium carbonate samples should be sent to potential customers for qualification in the coming months.

EMH is now in the feasibility studies stage of development at Cinovec, working through various studies, permits and funding options all with the aim to reach a final investment decision (FID).

Right now, it is progressing the Definitive Feasibility Study (DFS) for the construction of a 29,386 tpa lithium hydroxide refining plant to be located within 9km of the mine. That will make it Europe’s first vertically integrated battery metal producer.

The company expects the DFS to be completed in Q4 this year ahead of reaching a FID – which, realistically, we can expect in the next couple of years.

As for permitting, the Cinovec deposit is covered by three Preliminary Mining Permits (PMP), though EMH is amalgamating the PMPs into a single permit so that it can then make an application for a Final Mining Permit in time for FID – which is in essence the final permitting hurdle it needs to clear.

EMH is currently working on environmental permitting (EIA) as well as the permitting for the mining and processing of its lithium resource.

This process is likely to continue in the background as EMH gets closer to making FID on developing its project.

Certainly, if we see positive news on the permitting front, we can expect the market to react positively, especially considering how difficult and lengthy the permitting process can be in Europe.

In any case, if all goes to plan, actual mining could start in late 2026 or 2027.

A big-name partner means the project is fully funded to construction

Of course, developing a lithium project all the way to production is expensive (details on that below), which is one reason why EMH brought in a well-capitalised partner in the form of giant Czech utility CEZ in April 2020.

Then, EMH received €29.1 million in investment from CEZ in return for a 51% share in Cinovec’s project company, Geomet, meaning Cinovec is now fully funded up to the point of construction.

Although EMH is now a minority shareholder (49%), operational management is made up of executives from both shareholders. What’s more, EMH has effective operational control through the business plan set out before the EMH-CEZ investment deal.

CEZ, one of the biggest utilities in Europe, certainly has both the financial firepower and strategic need to ensure Cinovec and EMH meets its objectives.

In order to shore up its stake in the emerging battery market, CEZ plans to develop several projects in areas of energy storage and battery manufacturing in both the Czech Republic and elsewhere in Central Europe.

It is also installing and operating a network of EV charging stations throughout the Czech Republic, and heads a consortium to build a lithium-ion battery factory in the country, so there is a clear strategic intent to help steer EMH’s project into production.

What’s more, the utility is 70% owned by the state, which could certainly prove beneficial in terms of the regulatory progression to production.

Potential offtakers on the doorstep

Of course, as said above, Cinovec is located in northern Czech Republic, right in the epicentre of over a dozen new and planned lithium-ion battery factories.

It is also located right at the heart of the continent’s car-building industry, in very close proximity to many major automakers that are all switching to EV production.

That means there are a huge number of potential offtakers for Cinovec’s lithium right on the project’s doorstep.

To us, this would certainly include Czech car brand Skoda and/or its parent company Volkswagen, which is currently mulling building a gigafactory for producing electric car batteries in eastern Europe and potentially the Czech Republic.

In July 2021 the Czech government approved a state intervention package to help attract a factory for EV battery manufacturing, which could certainly be a potential source of future offtake agreements.

Of course, projects such as Cinovec that have lithium in the ground and close to being development ready are certainly attractive offtake options for buyers looking to secure lithium supply.

What’s more, with downstream chemical processing currently heavily concentrated in China, Cinovec’s combination of mining and refining will certainly make it an attractive source of lithium for battery manufacturers concerned about potential geopolitical risks or supply chain issues.

EMH said in March that it remained in discussions with prospective offtakers. We think it’s possible that we’ll see some progress with respect to the signing of offtake agreements soon after the DFS is published in the autumn.

Certainly, any announcement of an offtaker or strategic partner for Cinovec’s lithium would almost certainly re-rate the stock higher. It remains a key catalyst on the table over the next year.

Project financing is a key step

Last year, EMH updated its Pre-Feasibility Study (PFS), valuing the project at up to $1.9 billion (post-tax NPV) with an internal rate of return of 36.3% over a 25-year mine life, while costing $644 million to construct (CAPEX) with a pay-back period of just 2.5 years.

These are certainly compelling economics for the project.

Almost immediately after updating its PFS, EMH put the wheels into motion on its DFS – basically a more accurate financial modelling exercise on its project economics. This will include updated figures based on more recent lithium prices, as well as a more detailed picture of its capital costs.

Considering the updated PFS from January 2022 was based on battery-grade lithium hydroxide prices at $17,000/tonne, compared to current spot prices in the region of $40,000/tonne, we can certainly expect a serious uplift in the financials in the DFS.

This should improve the viability of the project and increase the chance of the stock re-rating.

Importantly, the DFS should also help EMH secure project financing for Cinovec, which is a key step for the company to reach FID.

EMH’s project is expected to cost $644 million, which the company will need to raise through debt funding, equity funding, government grants or a combination.

As said above, the company can expect to receive up to €49-million in the form of a non-repayable grant – i.e. free money – from the EU’s Just Transition Fund.

But there also a slew of further grants, low interest loans and tax credits potentially on offer from the European Critical Raw Materials Act, the EU’s Green Deal Industrial Plan and the European Investment Bank (EIB) that EMH can tap into too.

Certainly, Cinovec’s importance to Europe as it looks to shore up its lithium supplies, as well as the excellent project economics, means EMH is in an excellent position to achieve the financing it needs to fund the project.

On that note, last year EMH contracted German consultancy Luthardt Investment to advocate for EMH and help it secure financing.

Project financing is usually sorted after the feasibility studies are completed, though in reality we can expect news on this at any time up to FID.

There are some notable risks to consider

Of course, investing in early-stage miners such as EMH is always high-risk. Revenue forecasts can tumble and costs can shoot up if development problems occur.

The mining and related commodities industries are extremely volatile due to – but not limited to – commodity prices, cost overruns, project delays, environmental regulations, taxation/royalties changes, cost inflation or lower production.

The timetable for approvals is perhaps the largest risk facing EMH. When or indeed if the project receives the permits it needs to advance to production are the great unknowns.

Of course, while EU governments largely accept the need for greater raw materials self-sufficiency, it is a different story within the European population at large, where there is some hostility towards the metals resource industry, which recently affected the Barroso lithium mine project in Portugal.

There is certainly a risk that Cinovec gets held up in the permitting process and the regulators reject the company’s mining licence applications.

However, this is where investors can take confidence in having EMH’s state-controlled partner, CEZ, on board, as well as planned legislation in the form of the European Critical Raw Materials Act and Green Deal Industrial Plan, which both aim to make it easier for mining companies to obtain permits.

Financing is another key risk. EMH hasn’t secured project financing and there is no guarantee it ever will, at least on terms that it might consider favourable. Certainly, deteriorating market conditions may deter financiers from making a large capital investment, which will mean the project might never move into production.

A further risk relates to the price of lithium, which have been extremely volatile of late.

Lithium carbonate prices rocketed by over 1,000% in two years to reach record highs in November last year, before plunging 70% over the subsequent five months. However, spot prices have now bounced 30% from their lows amid improving sentiment due to falling inventories and softer-than-expected supply growth.

But, of course, if we enter a falling lithium price environment, then project risks will become increasingly unfavourable to EMH, which could pressure the stock price.

Saying that, I think it’s highly likely that the recently oversupplied lithium market is set to become incrementally tighter this year, which should lead to a re-rating of equities across the lithium space.

With some key catalysts ahead of us, this is a good time to invest

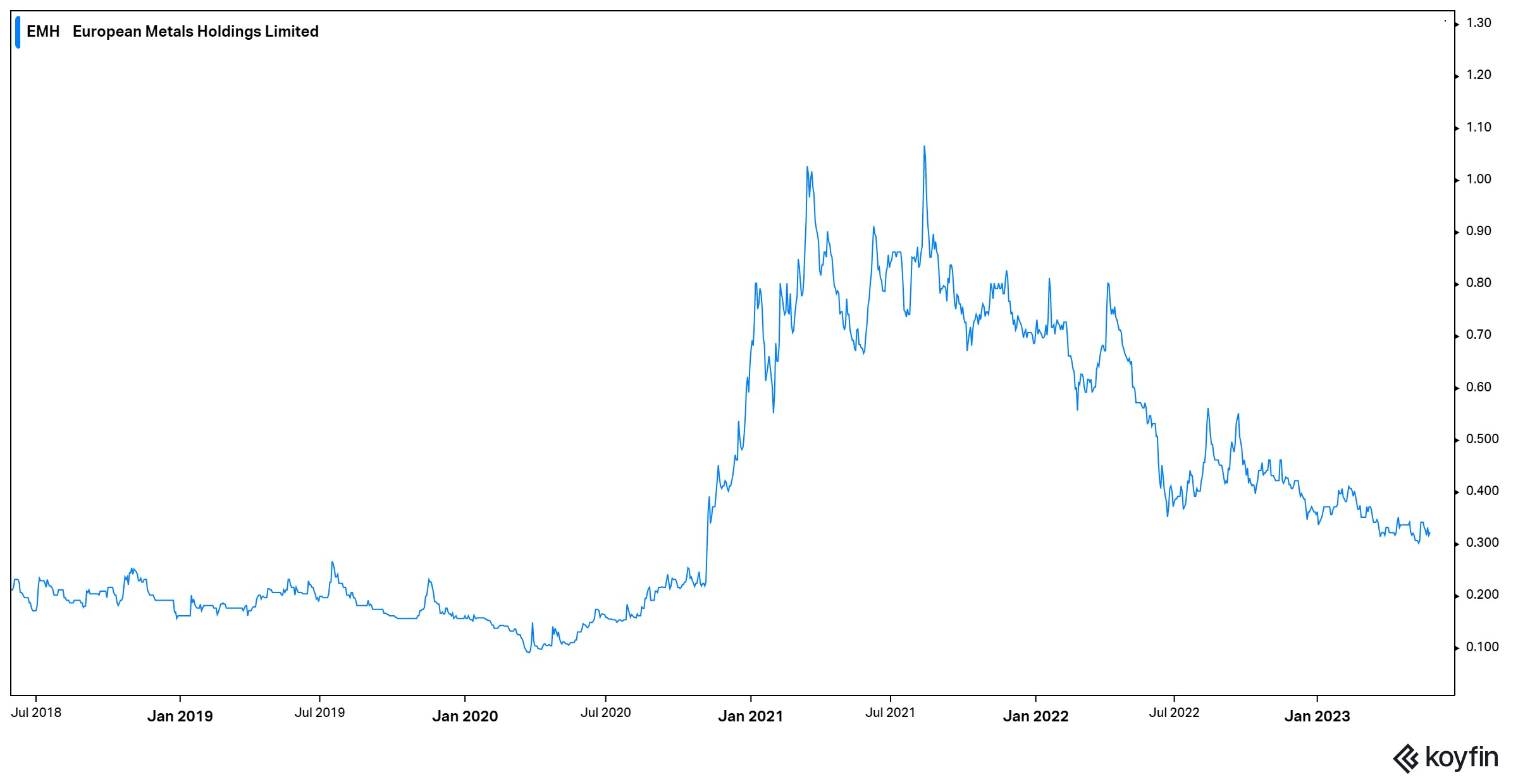

The risks above go some way to explain why the market cap of EMH is relatively small, hovering just above £60 million at the time of writing.

Certainly, at current levels, the market is assuming Cinovec won’t ever be a lithium-producing project. However, the market, in part, is largely disregarding Europe’s ambition to decrease dependence on outside regions for the battery metal vital for energy transition.

Although there are key risks, I think Cinovec has an excellent chance of entering into production over the next few years. This gives us a superb opportunity to get in early ahead of some key catalysts, which includes news on binding off-takes, approvals, financing and the publication of the DFS later this year.

As such, if you’re comfortable with the prevailing risks, recommend you buy European Metals Holdings Limited (AIM: EMH).

Action to take: BUY European Metals Holdings Limited

Ticker: AIM: EMH

Market cap: £63.1 million

52-week high/low: 59p/29.50p

Buy up to: 45p

Big breakthroughs

What is a quantum computer and why should you care?

Right now, you’re likely on a computer or smartphone (which is really a computer) reading this.

Let us ask you, do you know what’s taking place under the hood? Do you know how what I’ve written here ends up on your screen there?

Everything you see is data. But what is data?

Our regular “classic” computers create and read data in binary form. These are known as “bits “ represented as 0s and 1s, which are used to encode and then process information.

The exponential growth of processing power of our computers has increased dramatically over the decades, and this has led to the ability to process gigantic volumes of data. But fundamentally all our data is based on the building blocks of classical bits.

Knowing that helps us to understand quantum computing.

What is the voodoo that makes a qubit?

Quantum computers leverage quantum bits, or qubits. Now, hold on tight because here’s where our head starts to hurt a little the more we think about what comes next…

Unlike binary bits (0s and 1s and nothing else) qubits can exist in multiple states simultaneously!

Ugh, we already feel like we need some paracetamol.

Qubits possess the voodoo ability to be 0 and 1 at the same time. This is known as superposition.

Ed note: for all the Marvel movie fans out there, yes, there’s an element of “multiverse” about all this.

The concept is that with the ability for these computers to be a 0, a 1, and a 0 and 1 at the same time, they can process highly complex computations – that would perhaps take classic computing years, decades, or even millennia – in the blink of an eye.

Complex computations, such as simulating the behaviour of molecules or cracking encryption codes, or predicting outcomes become exponentially simpler than using classical computers.

The aspects of industry this is predicted to impact (to begin with) are things like drug discovery, transportation and logistics – and even things like quantum physics (the irony being it’s physics that builds these things to start with).

Scientists and tech pioneers are tackling the immense challenges of harnessing the unruly nature of quantum particles to get these things into commercialisation.

It’s exciting and there’s an incredible market of opportunities, but it is also crazy high risk, experimental and very early stage right now. Quantum computers also suffer from a big problem… getting things wrong.

Fix the errors, lead the market

One of the biggest challenges facing quantum computing is the issue of errors, or their error rate. Errors can occur at any stage of a quantum computation, and they can quickly accumulate within a calculation, leading to incorrect results.

Scientists have been working on ways to reduce the number of errors in quantum computers for a long time. And the companies that can crack error rate stand a good chance of leading the quantum computing market.

This month a breakthrough was made around errors.

Researchers from the University of California, Santa Barbara, have created a new type of Majorana fermion that could be used to improve the accuracy of quantum computers.

Majorana fermions are particles that are their own antiparticles. This makes them very stable, and they can be used to create error-correcting codes that can protect quantum information from errors.

Now, I’ll be straight with you: this is heavy, technical stuff. Ultimately, you’ll never really know or care about superposition or Majorana fermions. But what it leads to is important.

The development of new, more stable Majorana fermions is a significant step forward for quantum computing. It could lead to the development of more accurate and reliable quantum computers.

If quantum computers can be as accurate as classical computers, but at magnitudes of higher processing capability, then the potential leapfrog forward for humanity is tremendous.

This development in quantum computing has come in line with further hype surrounding AI and related technologies. It’s a big part of why Nvidia’s stock price is pumping – the company is now close to being a trillion-dollar company.

It’s also why several quantum computing-related stocks have been on a tear in the last week as the realisation hits the market that quantum computers are getting to that inflection point where they will start to have a major impact on industry.

It’s exciting times, in a high-tech industry. Like we said earlier, the need to know the detail isn’t high, but the need to know about the impact it could have on several companies and stocks is relevant, and it’s an area we will continue to monitor and look at for those big-winner opportunities.

Buy List update

AB Dynamics (LON: ABDP)

AB Dynamics is a leading provider of advanced testing and simulation systems for the automotive industry. Reporting on its interim half-year results to 28 February 2023, the company experienced positive market and customer activity levels, particularly in track testing and laboratory testing and simulation in Europe. Revenue increased by 30% compared to the same period in 2022, with 14% attributed to organic growth.

The growth in revenue was driven by increases in robots and ADAS platforms for track testing, as well as strong performance at rFpro and the delivery of SPMM systems for laboratory testing and simulation.

Strategically, the company made progress in expanding into new markets beyond automotive. ABD Solutions secured a £1 million contract for a retrofit pedestrian detection system for construction machines. This shows there’s more up the sleeve of AB than just the automotive sector.

The integration of Ansible Motion, acquired in September 2022, also continued as planned and the business performed well. The company focused on new product development for track testing, simulation markets, and the core technology for ABD Solutions.

We like the company – it’s growing, showing it’s of great value and is holding a nice 86% gain for us with no signs of weakness. We stick with the position, noting it’s trading over the buy limit and is therefore now a hold.

AMTE Power (LON: AMTE)

AMTE Power, a leading UK developer and manufacturer of lithium-ion and sodium-ion battery cells, has achieved UN38.3 certification for its sodium-ion cell, becoming the first European company to receive this recognition. This certification is a significant milestone in AMTE Power’s commercialisation plans, allowing them to access global markets.

Additionally, AMTE Power’s Ultra Safe cells have been incorporated into battery packs developed by AceOn, making them the first UK-developed sodium-ion battery packs. This collaboration between AMTE Power and AceOn represents a huge advancement in battery technology and a significant (if barely reported) development for the UK.

This is a company with great importance to the UK battery market, and we see the long-term future for it as being bright. It’s a long play and one we’ll stick with for the foreseeable future.

Argo Blockchain (LON: ARB)

Argo Blockchain, a bitcoin mining company, provided an operational update for April 2023. During the month, Argo mined 144 bitcoin (BTC), which translates to an average of 4.8 BTC per day. This represents an 8% decrease compared to the production rate of 5.2 BTC per day in March 2023. The decline in BTC production can be attributed to an 8% increase in the average network difficulty during April.

As of 30 April 2023, Argo held 83 bitcoin. The company’s total hashrate capacity remained at 2.5 EH/s. However, in the third quarter of 2023, Argo plans to install 2,870 BlockMiner machines from ePIC Blockchain Technologies at its Quebec facilities, which will add an incremental 0.3 EH/s of hashrate capacity, bringing the total to 2.8 EH/s.

In terms of revenue, Argo generated mining revenue of $4.17 million (£3.35 million) in April, representing a 3% increase compared to the prior month. It’s important to note that the current price of bitcoin, at around US$27,000, will determine just how big Argo does (or doesn’t) get. It has got the mining hashrate to continue to be a major global mining player. But the only way the stock will “moon” again is if the crypto market does.

This is the perfect de facto play into bitcoin but traded on a regulated stock exchange. And if the crypto market and bitcoin boom in another cycle, you’ll want to have a slice of action with Argo.

As risky as it is, it remains an open buy for us.

Aura Energy (LON: AURA)

On 3 May 2023, Aura Energy Limited announced the completion of a placement that raised approximately $10 million by issuing shares to sophisticated, institutional and professional investors.

The funds will be used for:

a) Progress of the Tiris Project in Mauritania towards development;

b) Target the growth in uranium resources in the Tiris Zemmour province of Mauritania;

c) Completion of work to enable the granting of the Häggån Exploitation Permit;

d) Cover corporate, offer related costs, and general Working Capital.

To allow eligible shareholders to participate in the capital raising activities, Aura Energy has introduced a Share Purchase Plan. Under the plan, eligible shareholders, regardless of their shareholding size, can purchase up to $30,000 worth of shares at a price of $0.185 per share, the same as the placement price.

The offer is available to shareholders registered as holders of shares on the record date of 2 May 2023, with registered addresses in Australia, New Zealand or the United Kingdom.

The issue price of $0.185 per share represents a discount of 23.6% to the volume weighted average market price (VWAP) of $0.242 over the five trading days before the announcement of the plan.

It is, however, only offered in $2,500 increments. That may be an issue. But it also doesn’t have to be.

The AUD to GBP conversion works out at around £0.10 per share as the offer price. Considering the current market price of Aura, because of the raising, is trading at about 9.86GBp, the market value is under the issue price.

Hence, it doesn’t make sense to apply for more shares when you can buy right now, below the offer price.

If you’re considering topping up on Aura, which considering it’s an open buy position is reasonable to do, then buying on market will get you a better price than a subscription to the SPP, and you’re not tied in to any increment.

If you’re looking at the offer, please ensure you read and understand all information from Aura (you can find it all here).

CentralNic Group (LON: CNIC)

CentralNic Group plc, a global internet domain company, reported its unaudited financial results for the first quarter of 2023.

The company achieved a 24% increase in gross revenue, reaching $194.9 million compared to $156.6 million in the same period of the previous year. Organic revenue growth for the trailing 12 months ended 31 March 2023 was approximately 46%. Net revenue/gross profit increased by 15% to $45.8 million, while adjusted EBITDA (earnings before interest, taxes, depreciation and amortisation) rose by 15% to $21.3 million.

We’re happy to see the company was gaining ongoing market share with its privacy-safe, AI-based customer journeys. The number of visitor sessions increased by 70%, reaching 5.0 billion for the trailing 12-month period, and revenue per thousand sessions (RPM) rose by 12% to $102.

Growth in sessions, and revenues per thousand sessions is a good indicator that the company is heading in the right direction.

CentralNic also made significant announcement: a partnership agreement with Microsoft Bing, which further emphasises our view that this being one of the most promising companies on the London Stock Exchange that is implementing AI and AI capabilities into its business operations.

We like the direction and positive announcements from the company and stick with it for the long term.

Clean Power Hydrogen Plc (LON: CPH2)

CPH2, a company specialising in membrane-free electrolyser technology, released its maiden full-year results for 2022, in late April.

They achieved several significant milestones in 2022. The company successfully listed on AIM, raising gross proceeds of £30.5 million and receiving the London Stock Exchange Green Economy Mark.

CPH2 secured three major licence agreements for manufacturing with Kenera Energy Solutions, Fabrum Solutions and GHFG, demonstrating strong order book momentum. As of 31 December 2022, CPH2 had five MFE220 electrolyser orders, with a combined sales value of £6.5 million, and anticipates further demand for the technology in 2023.

CPH2 made strategic investments, including a £1.5 million investment in ATOME Energy. The company increased its headcount from under 30 at IPO to 55 by the end of 2022. CPH2 ended the year with a net asset position of £25.2 million, with £15.3 million in cash or current assets investments.

CPH2 will continue investing in R&D to enhance operational efficiencies and plans to finalise the design of the 2MW MFE440 in 2024. This is a developmental company, that’s got plenty of cash, and is showing signs of being able to really move the needle on future energy needs.

It’s exciting to see over the next year and a half just where this one can head. We remain in the position.

Team17 Group (LON: TM17)

Team17 Group is a UK-based company that develops and publishes typically indie video games. In April 2023, the company announced that it had acquired Independent Arts GmbH through Team17’s wholly owned subsidiary, Astragon Entertainment.

Independent Arts makes games mainly for the big three platforms: Nintendo Switch, PlayStation and Xbox. Team17 is excited by the potential to brings to Astragon and the overall performance of Team17.

The stock is showing around a 21% loss for us, but we still have conviction in the long-term potential of the company and the overall indie game market. It remains a buy up to 565 GBp.

Velocys (LON: VLS)

Velocys, a leading sustainable fuels technology company, released its unaudited results for the year ended 31 December 2022.

Here are some of the highlights from its announcements:

- Revenue of £0.2 million from engineering services (2021: £8.3 million from licensing and reactor sales)

- Administrative expenses of £16.3 million (2021: £13.3 million)

- Operating loss of £14.5 million (2021: £9.0 million)

- Net assets of £16.7 million at 31 December 2022 (2021: £29.2 million)

- Continued progress on the Altalto Immingham project, with the front-end engineering and design (FEED) study nearing completion

- Awarded a £6 million grant from the UK Government’s Net Zero Innovation Portfolio to support the development of its SAF production technology.

Overall, what we expect from a company moving from development towards commercialisation. The grants are important as is the FEED study nearing completion.

However, notably Velocys is also undertaking a share offer to holders to raise £2 million in addition to a retail offer and placement that was undertaken raising £6 million at a price of 2.5 pence.

The open offer to shareholders will be on the basis of 1 open offer share for every 18 existing shares held. For example, if you own 1,800 shares, you will be entitled to buy an additional 100 shares.

Like Aura Energy, while the stock is an open buy, then it makes sense to add to your holdings. Mainly to ensure that with the sale and issuance of new shares, you’re not overly diluted.

Having said that, the open offer is at 2.5 pence. The stock is currently trading at approximately 2.3 pence. So if you want to add to your holdings, then it makes sense to buy on market. Of course should the stock price be over the offer price, then the offer makes sense too.

Either way, all the details are available at Velocys via its investor centre, and via the circular published on the 22 May – ensure you read all materials, and factor in costs and time before adding to your holdings through either method.

EQTEC (LON: EQT)

EQTEC plc, a global technology innovator in waste-to-value solutions for hydrogen, biofuels and energy generation, has also announced its results for the year ended 31 December 2022.

The company reported revenue and other operating income of €8.0 million, with an EBITDA loss of €4.9 million. Net assets stood at €37.1 million and the company raised £3.7 million through a share placement.

The company strengthened its research and development capabilities for advanced biofuel solutions and its key operational highlights were:

- Italy MDC construction completed and commissioning commenced

- Croatia MDC funding identified for final construction and recommissioning

- France MDC acquired and project buyer identified for sale of the project

- EQTEC France launched as wholly owned subsidiary, with strong pipeline of projects particularly focused on renewable natural gas (“RNG”) and advanced biofuels.

CEO David Palumbo stated that EQTEC is focused on becoming a leading licensor and innovator of clean, baseload energy and biofuels solutions. Despite challenges, the company remains optimistic about its technology and aims to deploy it through well-funded and well-managed projects that deliver sustainable returns on investment.

Again, we like the direction of the company and the tech in development. We think it lays an important role in the development of biofuels and a move towards greener and more efficient fuels. We stick with the position.

Gfinity (LON: GFIN)

Gfinity is a UK-based company that operates an online gaming platform and hosts esports tournaments.

The company released its half-year results in March. The results were ok, showing some revenue growth but the company is thin on cash, and still implementing cost-cutting measures while delivering a 101% increase in losses year on year.

We were anticipating that the stock would get a kick forward from the results, which it temporarily did. But that momentum has fallen away with no further news or updates.

It’s at a point where it has been around long enough for us that it may never fully recover from its price capitulation through 2022. There’s little bumper news coming from the company that suggests it has the huge upside needed to return to breakeven for us.

It means that we’ve lost patience and faith in the ability for the company to deliver value to shareholders and we recommend exiting the position.

Action to take: SELL Gfinity Plc

Entry price: 3.35p

Exit price: 0.1169p

P/L: -96.5%

HydrogenOne Capital Growth (LON: HGEN)

HydrogenOne, the London-listed fund investing in clean hydrogen, has released its quarterly net asset value (NAV) and portfolio update for the quarter ending 31 March 2023.

The highlights of the quarter include a positive industry outlook driven by macro tailwinds in the hydrogen sector, increased valuations in both private and listed hydrogen assets, and strong growth from private portfolio companies.

The unaudited NAV per share of the company at the end of the quarter was 100.00 pence, representing a 2.8% increase from 31 December 2022 and a 3.3% increase from 31 March 2022.

The NAV movement was primarily influenced by valuation uplifts to the company’s portfolio of private investments. The company had net assets of £128.8 million at the end of the quarter.

HydrogenOne also made its first investment in a clean hydrogen production project in Germany, committing £2.5 million. Cash and cash equivalents stood at £12.5 million, with £3.8 million invested in listed hydrogen companies.

With the stock trading currently at 58.19GBp, it is at a significant discount to its implied NAV.

Part of why it’s trading at a discount is that the companies it’s invested in have valuations, but they are ultimately private companies. Therefore, the true value is only reflected in a sale or listing – hence there’s a degree of risk in the valuations until actual exit value is extracted.

We also believe the market is applying a risk discount to the success of the companies in the portfolio, as many are still early-stage development companies in the hydrogen sector.

Still, we believe there’s great potential in the portfolio companies to deliver returns to HydrogenOne holders, and that the NAV gap will close, which means HydrogenOne remains an open buy for us with a buy up to of 100GBp.

Ilika Plc (LON: IKA)

Ilika Plc is a UK-based company that develops solid-state lithium-ion batteries. It’s expecting to release full-year results in mid-July, but it has also released its unaudited results, which is in line with expectations: minimal income, a loss of around £7 million and cash equivalents of £15.8 million.

That gives the company a decent runway to get its batteries further along the development track and into the hands of customers.

While its smaller Stereax batteries and the company now building up commercial orders, it’s the Goliath battery for EVs and consumer appliances that could be the company maker. The company says development is on schedule and it’s been exploring collaborations with strategic partners for the Goliath development.

There’s not much to go on in the update, but we expect the full-year release may dive in a little deeper and give the market some positive news that could bump the stock price higher and get it building some forward momentum.

Again, we like the tech and its importance in the future of energy for devices, transportation and industry. So even though the stock price is struggling, long term we believe the company has the good to bring it back, and then into profit.

IQE Plc (LON: IQE)

IQE is a UK-based company that manufactures semiconductor wafers. Earlier this month, the company announced a placement and retail offer that would be open for a day for shareholders.

Sometimes companies do these placements and offerings on tight timeframes. The offer at 20 GBp was around 13% discount to the trading price of the stock before the offering.

The problem here is that nothing that IQE seems to do moves the needle higher on the stock price. The trend for the semiconductor company continues to head south, and the company is still feeling the impacts from the inventory build-up during the pandemic.

In short, IQE raised funds to keep the lights on when you break down the placing announcement. It wasn’t to develop an exciting new product or accelerate development, but to meet things like “near term liquidity requirements”.

While other larger overseas semiconductor-focused companies are moving into a higher gear in 2023, IQE continues to lag, and we’ve lost faith in the management being able to turn the company around.

Even off the back of a positive announcement last week regarding a new portfolio of wafer products, the company’s stock price took a 2% dive.

We understand the importance of semiconductor products and the long-term demand for semiconductors in our world. But IQE has failed now over time to convince us it can bring the company back from the brink.

Action to take: SELL IQE Plc.

Entry price: 79.20p

Exit price: 22.20p

P/L: -71.97%

Kanabo Group (LON: KNB)

Kanabo Group is a UK-based company that develops and commercialises cannabinoid-based products for the treatment of pain and other medical conditions.

We’ve been quite close to making a call to get rid of Kanabo from the Buy List. However, the company’s recent moves into more patient-facing medical opportunities has given us further excitement about the direction the company could be heading.

Had they stuck with consumer products, such as the vape product, we probably would have cut it away. That section of the market, we don’t anticipate will have shorter term growth in the current cannabis industry environment (which is tough right now).

But we think that the launch of the Treat It platform, for fast and easy access to medicinal cannabis treatments, is a very significant move and really unlocks future value for the company.

We suggest you check it out here.

We are excited by the move into digital health. It is early stage still and the company is still financially a high-growth, high-risk play with big losses, and there will likely be more capital raisings. But there’s enough there for us to see some real growth drivers over the next year, so we stick with the position and keep it as a hold.

ETC Group Digital Assets and Blockchain Equity UCITS ETF (LON: KOIP)

ETC Group Digital Assets and Blockchain Equity UCITS ETF is an exchange-traded fund (ETF) that invests in companies that are involved in the development and use of digital assets and blockchain technology. This ETF will move in sync with the crypto markets and the related stocks involved.

The biggest holdings are Riot Blockchain (bitcoin mining), Coinbase (crypto exchange) and Block Inc (FinTech and bitcoin products). It does have some other diversification through companies like Nvidia and AMD, but the name alone will also mean that the ETF moves up when the crypto market is up and then down when the crypto market is down.

But if the crypto market booms again, as we expect, then we expect the ETF to see huge inflows again and the value rise significantly. It remains in the Buy List as a great way to get crypto stock exposure in one easy-to-trade instrument.

Mirriad Advertising (LON: MIRI)

Mirriad Advertising is a UK-based company that develops and provides in-video advertising technology. Keen observers will notice that Mirriad’s stock price exploded higher on 3 May due to an announcement of a collaboration with Microsoft.

The announcement noted the collaboration would introduce a new API leveraging Microsoft Azure and its AI capabilities.

The details of these “capabilities” is thin. But we can see a future where advertisers simply describe the kind of advertisement they want to build, within video, and the AI API deploys that design and integrates it seamlessly into the video clip.

It’s early stages, and just a collaboration, but it put the rocket under Mirriad’s backside. It went from a closing price of 1.10GBp on 2 May, to an intraday high on the 3rd of 5.6Gbp.

The excitement has worn off since, and at around 2.95GBp it is still in a loss position for us. But we’re confident of the tech, its potential and of Mirriad making meaningful developments with its offering – as we’ve seen.

We are right on the tech, but wrong on our timing of entry. Still, we like it, we have conviction in the company and stick with the position.

Trackwise Designs (LON: TWD)

Trackwise Designs plc has provided an update on its contract with a UK electric vehicle original equipment manufacturer (EV OEM). The company announced a delay in manufacturing and delivering parts to the EV OEM as they undergo a redesign and validation process to meet revised design requirements. The delay has resulted in the extension of Trackwise’s cash runway from the end of May 2023 to at least the end of June 2023.

However, Trackwise remains optimistic about its prospects, with a significant pipeline of identified sales opportunities in the improved harness technology (IHT) sector, particularly in the EV cell-to-pack cable connectivity solutions (CCS) market.

Despite the challenges with the UK EV OEM contract, Trackwise maintains a positive outlook, as it awaits a formal response from the EV OEM regarding the change in design requirements. The company asserts that the responsibility for the delay and its impact on production and price lies with the EV OEM. Trackwise has given the EV OEM until 2 June to rectify the breach.

This is all getting messy and the stock is still teetering on the brink of failure. While we have confidence in some companies to turn it around (see Mirriad as a perfect example of that) we don’t have the same conviction with Trackwise. It’s time to cut the loss and let this one go too.

Action to take: SELL Trackwise Designs

Entry price: 212.90p

Exit price: 0.5090p

P/L: -99.76%

Central Asia Metals (AIM: CAML)

Copper producer Central Asia Metals, recommended at 276p in January’s issue of Small Cap Investigator, rose to 299p in early February but, since then, has fallen below 190p.

The AIM-listed mining producer has seen its share price fall in line with many of its peers in the junior mining space as economic concerns and investor sentiment weigh heavily.

Copper prices fell below the threshold of $8,000/tonne last week, as underwhelming Chinese economic data weighed on the market and investor sentiment.

In May alone, copper prices have fallen by around 8%, with money managers turning increasingly bearish on copper in recent weeks. For the first time since 2020, the number of short positions on copper on the London Metal Exchange now exceeds the longs.

As for CAML, specifically, earlier this month the company announced that non-executive directors Dr Gillian Davidson and David Swan purchased 10,119 and 5,000 shares for a total cost of £19,985 and £10,050, respectively.

The company – which owns a copper mine in Kazakhstan and a zinc-lead operation in North Macedonia – is mainly a play on expected tightness in the copper market, where a supply shortage is likely to emerge in a few years leading to a rise in copper prices.

Copper is a key component in electricity-related technologies and, by extension, a linchpin in energy transition projects.

Given the positive copper price outlook over the long-term, the stock remains a BUY under 310p.

Fortescue Metals Group Limited (ASX: FMG)

Australian iron ore giant and green hydrogen hopeful Fortescue Metals Group Limited has fallen from AU$21 in early May to just AU$19.21 now, putting it around 11% up in the model portfolio at the time of writing.

The stock has taken direction from a weaker iron ore price, which has fallen from over $120 per tonne in mid-April to under $100 amid worries about Chinese demand.

However, Fortescue has now started production from the multibillion-dollar Iron Bridge magnetite project in the Pilbara region of Western Australia, one of the few large-scale iron ore growth projects under construction worldwide. It is an unincorporated joint venture between Fortescue’s subsidiary FMG Magnetite and Formosa Steel IB.

This could add millions of tonnes to its total output, which would boost earnings.

By way of reminder, perhaps the main reason for our investment was Fortescue’s decarbonisation plans, which include the production of green hydrogen, green ammonia and high-performance batteries.

The business is working on a global portfolio of potential green energy projects, pursuing possible locations in Canada, the US, New Zealand, Australia, Europe, Egypt, the Kingdom of Jordan, Brazil and more.

The company is set to make a decision this year on five green hydrogen projects that it plans to develop.

It has already signed up customers such as E.ON, JCB and Ryze Hydrogen to purchase a sizeable amount of the planned green hydrogen production.

The stock remains a BUY up to A$25.

Rize Sustainable Future of Food UCITS ETF (LON: FOGB)

The Rize Sustainable Future of Food UCITS ETF has inched down over the course of the last month, trading at the time of writing at around 327p, below our entry price of 378.48p.

The ETF currently has 52 holdings involved in the production of sustainable food and packaging, with plant-based foods, precision farming and fertiliser manufacturers among the targeted sub-sectors.

With sales of plant-based food rising and sustainable agriculture stocks poised for strong growth as more people become aware of the importance of preserving agricultural resources, the ETF remains a BUY.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company, which invests in UK forestry and afforestation assets, is trading at around 104p at the time of writing, marginally below our entry price of 108.92p.

The London-based investment company announced on 11 May that its net asset value per share had increased since September, driven in part by valuation gains on newly acquired properties.

Foresight Sustainable said its NAV per ordinary share at 31 March rose by 3.3% to 108.5p/share from 105p/share at 30 September 30. Total NAV at 31 March was £186 million, up from £180.6 million on 30 September.

The company said it has delivered a total NAV per share return of 10.6% since its initial public offering in November 2021.

The company attributed the boost in part to mark-to-market valuation gains on recently acquired properties. It made 15 new acquisitions between 30 September and 31 March, bringing its total portfolio at the end of Q1 to 65 properties.

Foresight Sustainable said it had completed planting of approximately 955,000 trees at its Redding Farm, Auchensoul, Frongoch and Upper Bar properties, which are expected to produce an estimated 190,500 tonnes of timber for each 35- to 40-year rotation. The company sold 6,384 tonnes of timber in the period to 31 March.

Foresight Sustainable said the majority of its timber harvesting programme remained on hold while it focuses on biological growth of its timber stock.

“We are pleased to announce yet another NAV uplift as the company starts to build momentum in its sustainable investment mission,” said chair Richard Davidson, adding that successful afforestation development remained “the engine room of FSF’s returns”.

“We believe that with the increasing demand for voluntary carbon credits and 31 further afforestation schemes in development, there is tremendous potential for the company, leaving it well-positioned to deliver further returns for our shareholders.”

As we wrote last month, the long-term qualities of forestry investment to continue to shine, despite prevailing economic headwinds that include a recessionary economic environment, high inflation and a rising cost of capital. The trust remains a BUY.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF has risen from under $8.40 at the start of May to $8.77 at the time of writing, just above our £8.59 entry price.

There are currently 40 holdings in the Global X Lithium ETF, with Albemarle Corporation being the top holding with about 8.76% of the fund’s total share currently.

Aside from mining companies, it provides a wide range of electric vehicle exposure, ranging from Tesla and BYD to battery producers such as Samsung Electronics Co., a major EV battery producer.

Overall, the fund is designed to mostly react to the global EV growth trend, though is not tied specifically to the fate of miners, but rather a mix comprising the entire EV supply chain.

In any case, it certainly looks like the lithium markets have hit a turning point following a brutal sell-off earlier this year.

After plunging 70% over the past five months, lithium spot prices in China are now starting to rebound as sentiment improves due to falling inventories and softer-than-expected supply growth.

Carbonate spot prices have bounced 30% from their lows to around $27.5/kg, while the equivalent hydroxide price has recovered by 20% to around $30/kg.

I think we can now say with some confidence that the bottom for the lithium market is now behind us.

It’s highly likely that the recently oversupplied lithium market is set to become incrementally tighter this year amid signs of improvement on the demand side in the electric vehicle (EV) market.

Chinese EV sales recovered 51% to 1.05 million units in March from January, according to ANZ bank. International demand was also rising, with exports of lithium batteries from China up 94.3% year-on-year as they gained increasing favour among overseas buyers.

Meanwhile, supply growth is off to a slow start to the year, according to investment bank Morgan Stanley. Production of spodumene concentrate in Australia disappointed in the first quarter, with producers reporting cumulative output of 774,000 tonnes, which is flat against the final quarter of 2022.

Morgan Stanley said it still expected the lithium market to be in deficit this calendar year, and believed the market would tighten again for the remainder of 2023.

The Global X Lithium & Battery Tech ETF remains a BUY.

Aurubis AG (DE: NDA)

Germany-based copper smelter and recycler Aurubis AG has fallen from €81 in early April to around €72, still 8% up in the model portfolio.

The stock fell after the company said “a serious industrial accident” at its smelter site in Hamburg caused three employee fatalities. The incident occurred on 11 May with two employees dying that day and the third about four days following the incident.

“A nitrogen leak occurred during regular maintenance at the Primary Smelter Plant East,” Aurubis said. “The three Aurubis employees were directly exposed. Rescue workers and the plant fire department were immediately deployed.”

Aurubis said it was working closely with regional authorities as they conduct a detailed investigation into the root cause of the accident and notes an update will be provided as soon as the investigation is complete.

Earlier in the month, Aurubis confirmed an upgraded core profit forecast for the current financial year as it expects strong business environment and demand momentum to continue.

Aurubis confirmed operating earnings before taxes (EBT) of between €450 million and €550 million for the 2022/23 financial year, up from an earlier forecast of €400 million to €500 million.

The company said the change in forecast comes amid expectations of continued high fees it can charge to process copper concentrate (ore), firm price premiums for the copper it produces and continued strong demand for copper wire rod with high prices.

“Aurubis continued its positive development with a second quarter on par with the exceptionally good previous year,” Aurubis CEO Roland Harings said.

High demand for Aurubis’ metal products showed Aurubis metals are increasingly needed for the mobility and energy transition and for digitalisation, he said.

The stock remains a buy up to €100.

Newmont Corporation (NYSE: NEM)

Newmont Corporation, the world’s largest gold miner, has fallen from under $47 at the start of May to below $41 at the time of writing, down from our $65.39 entry point.

Newmont secured a AU$28.8 billion deal to buy Australian rival Newcrest Mining Ltd., consolidating its position as the world’s biggest bullion producer.

The deal, now unanimously approved by Newcrest’s board but pending regulatory approval, will strengthen Denver-based Newmont’s operations in Australia, Canada and Papua New Guinea.

Newmont chief executive Tom Palmer said the takeover represented “exceptional value” for shareholders. “It creates an industry-leading portfolio with a multi-decade gold and copper production profile in the world’s most favourable mining jurisdictions,” he said.

Palmer also said the opportunity to produce more copper had been a key attraction of the deal to acquire Newcrest.

In fact, Newmont’s increased copper exposure at least in part explains the stock’s recent softness. As mentioned above, copper prices have been weak of late, falling below $8,000/ton amid underwhelming Chinese economic data and souring investor sentiment – a rather unfortunate market backdrop to Newmont’s takeover of Newcrest.

Recent weakness in the price of gold, which hit a nine-week low last week though has perhaps held up better than base metals, has also weighed on the stock.

However, with the longer-term outlook for both copper and gold bullish, Newmont remains a BUY.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has fallen from 326p on 19 April to around 309p at the time of writing, below our 317p entry price.

At the end of April, DS Smith reported strong growth in its profitability and financial performance in line with its expectations.

In the update released 27 April in respect of the year ending 30 April 2023, the packaging giant said expected adjusted EBITA for FY23 was in the range of £850-£860 million.

It said “excellent customer relationships, and our high levels of service, product innovation and sustainability focus have driven resilient packaging prices during the period.”

Combined with good cost management, this had more than offset the weaker than expected volumes to deliver growth in profitability and delivery in line with its medium-term financial targets, the company added.

The stock remains a buy up to 400p.

Watsco Inc (NYSE: WSO)

Heating, ventilation, and air conditioning (HVAC) distributor Watsco Inc has fallen from around $344 at the start of May to around $326 at the time of writing, 9% up from our entry point.

The company hasn’t released any news since it posted first-quarter-2023 sales of $1.55 billion, a 2% increase over the same quarter in 2022, at the end of April.

Watsco remains reasonably valued and is still a buy.

Yara International (OL: YAR)

Yara International, one of the world’s largest producers of nitrogen-based mineral fertilisers, has fallen from around NOK429 at the start of May to NOK426 at the time of writing, putting it 7% up in the model portfolio.

At the end of April, Yara said January-March earnings before interest, tax, depreciation and amortisation (EBITDA), excluding one-offs, fell to $487 million from $1.35 billion a year earlier.

Revenues dropped 30% in the quarter.

The weaker results were due to steep market price declines, impacting both sales volumes and margins, the Norwegian company said, while flagging demand had returned in April.

The company has idled more than half of its European ammonia production capacity due to a steep drop in fertiliser prices, as farmers delayed purchases hoping for even lower prices.

One of the world’s biggest fertiliser makers, Yara last year capped its European ammonia production due to a surge in gas costs. Natural gas is a key feed stock in ammonia production.

In the first quarter, 44% of its European ammonia capacity, and 52% of finished fertiliser capacity, was shut.

However, farmer economy metrics were now very favourable, with food prices in relation to fertiliser prices historically high, indicating higher nitrogen application rates, the company said.

In other news, Yara said it has chosen a site in the UK as the home of its new global production plant for specialty crop nutrition products and biostimulants.

The plant is set to be built close to the company’s existing site in Pocklington, Yorkshire.

Yara said this investment will serve as another sign of its commitment to producing more products that are instrumental in achieving food security and combating climate change.

The stock remains a buy up to NOK 500.

Inside the lives of James and Sam

Sam:

In early May I was in central London for the Cannabis Europa conference.

I was hosting and leading a panel discussion titled, “A gear shift for cannabis in Europe”.

It was a lively discussion, with incredible insight from leaders within the industry about the direction of the cannabis market in the UK, Europe and (because you can’t really avoid it) the US.

The good news is that everyone, while understanding of the current difficulties the market presents, was very optimistic about the long-term future of the cannabis market.

Source: editor’s own photo

Anyway, that whole cannabis discussion is something else for another day. The conference was great, I enjoyed it, and I know all the attendees enjoyed it too based on the feedback received.

However, that’s not what I wanted to talk about in today’s section…

I was in a cab on my way to the conference, just doing my usual gazing out the windows soaking in the wonderful city that is London. I still feel like a tourist every time I’m in central London. I love it and think it’s arguably the best city in the world.

I also take cabs when I’m in central London for two reasons: 1) I hate the Tube; and 2) I hate the Tube.

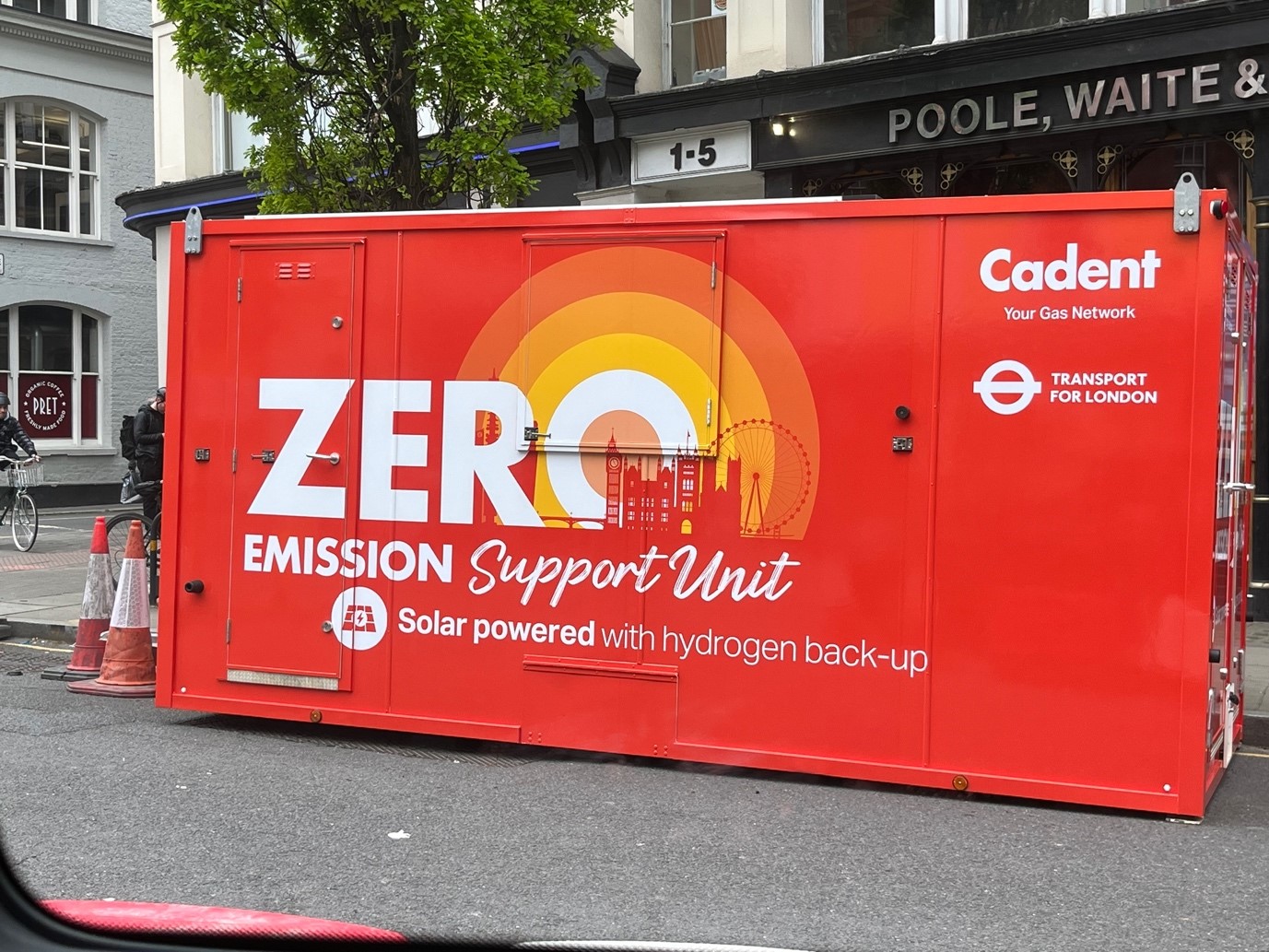

I also get to see everything that’s going on around me above the ground. And as we pulled up to a set of lights around Farringdon on the way to the Barbican Centre, I saw the following.

There’s a couple of things that caught my eye here. Namely, I know Cadent because right now they’re in my neighbourhood digging up the street and pavements to redo all the gas pipes in the area. A massive pain in the backside, but ultimately a good thing.

I was surprised to see that this support unit was solar powered, but its backup was hydrogen. Having seen Cadent’s website, it’s got a bit going on when it comes to hydrogen. This included hydrogen-powered support vehicles and the “Hydrogen Valley” it’s working on in the east-west corridor through the middle of the UK.

There’s more to the hydrogen story than I think most people appreciate. And over time, we’ll see more and more of it around us. It might not necessarily be your car. But it may very well be the heavy industry around you – from building sites to the diggers relaying infrastructure in your neighbourhood, they will be utilising hydrogen as just one of the many choices of fuels we’ll have in the future.

When you’re out and about, I suggest you keep an eye out for hydrogen and alternative fuel technologies too. I think you’ll find there’s more of it around you than you probably realise.

If you do spot anything, like I did with that Cadent hydrogen backup unit, make sure to take a photo and send it in to us so we can share with others just how quickly these technologies move from the fringes into your everyday life.

James:

Over the last couple of weeks, and at the behest of my sister, I’ve been chatting to my GSCEs-taking nephew about his plans for the summer to see if I can help him get a couple of weeks of work experience somewhere, or at least pique his interest at the type of work he could be looking at.

I had been talking to him mainly about trying to find him some experience at a publishing, TV or investment company – all industries I know quite well and which he has, at various times, shown a degree of interest in learning more about.

(There’s a low bar on what constitutes “interest” here by the way – a nod or a mumble in the affirmative suffices.)

But whether any of those fields are the right fit for him, or even the right opportunities in general, is certainly up for debate. Who knows what manner of destruction artificial intelligence will have reaped on such white-collar jobs in a few years’ time when, GCSE results notwithstanding, he plans to enter the workforce?

So when last week I read an article entitled “Who wants to become a heat-pump billionaire?” it certainly got me thinking that we should perhaps take a different tack.

After all, as the article says, a career installing these efficient home-heating contraptions is starting to look very much like a sure thing. Although it’s said there are no silver bullets in the fight against emissions, perhaps the closest thing we have are heat pumps – so it’s easy to conclude industries manufacturing, installing and servicing them will only mushroom from here and be around for decades to come.

Air source heat pumps are flying off warehouse shelves on both sides of the Atlantic as governments ban new gas and oil systems, set ambitious installation targets and offer generous incentives to boost adoption, meaning manufacturers are sitting very pretty indeed.

Of course, this is not a complete dead cert. As the article states, manufacturers may end up getting squeezed by lower-priced competition. And, of course, prices of air source heat pumps, which still mostly remain higher than gas boilers in the UK even after subsidies, will need to come down to truly incentivise mass adoption, which will again threaten manufacturer margins moving forward.

But the efficiency gains (air source heat pumps are at least three times more efficient than gas boilers), coupled with a lack of viable low-carbon alternatives as gas boilers are phased out, surely means the outlook for the air source heat pump industry is very bright indeed.

I’m in regular contact with the company installing my own air source heat pump (it’s now been delivered but not installed due to the slow pace of my house renovation) and I know they’ve never been busier – but whether they’re too busy to accept a PlayStation-loving 16-year-old, we’ll just have to find out…

Source: editor’s own photo

Crypto Corner

One of the most important aspects of owning crypto is understanding how and where to store your crypto.

This is something we’ve covered at length for many years: the whole idea of “self-custody” and why you should always hold your crypto off exchanges and on a device or wallet that you control the access to.

We have a saying, “Not your keys, not your crypto.”

And that means only you should control and have access to the private keys that control the access to your wallets.

On an exchange, for instance, you have wallets in your user account, but you don’t control the private keys to that wallet. You are reliant on the exchange to custody your crypto assets for you.

This is what’s also known as third-party risk. If the exchange for whatever reason decides to drain your account, move your crypto or sell it, they can. They control the keys which gives them ultimately full control over all assets held in that wallet.

You are putting your trust in a third party to do the right thing.

The only problem is, time and time and time and time again, we see exchanges do the wrong thing. Either intentionally, through poor security or simply through poor management, people lose crypto because of horribly run exchanges.

I have experienced this first hand. Fortunately (or unfortunately whichever way you look at it) I learnt this the hard way many, many years ago in 2014 when Mt.Gox (the biggest bitcoin exchange in the world at the time) failed.

I then saw it with Cryptsy and MintPal, two of the biggest altcoin exchanges early on. And you learn really quick that the only way to custody your crypto assets is self-custody.

The most secure way to do that has always been through hardware devices – typically those hardware devices provided by the two biggest and most robust hardware providers, Ledger and Trezor.

While the devices from these companies are exceptionally good, there is increasing and growing concern that they’re not as safe as they make out.

An upcoming product release from Ledger, known as Ledger Recover, has sent a shockwave through the crypto community and everyone who has a Ledger device.

The basic premise is that Ledger Recover would enable users to “shard” (split) their private key to be held at multiple locations. This means that a private key could be recovered if it was lost or destroyed.

It was a private key recovery service. And by sharding the private key, no one single shard would enable access, but all would be needed for actual recovery.

Sharding in this sense isn’t such a bad idea. I can see merit in why Ledger turned this into a product. One of the biggest complaints I’ve seen about hardware devices is the protection problem with a single private key. What happens if you lose that private key and lose the wallet or device?

In short, the assets are gone, forever.

So a private key recovery service works… for some people.

What worried people about this announcement was that it was a firmware upgrade to the devices, which would then be able to extract the private key, shard it and enable the Recover service.

And that means the possibility of a third party – Ledger or a hacker or a government – accessing your private keys.

So here’s the situation with all this. Mainly because there’s a lot of misinformation going around.

Right now, Ledger isn’t rolling out this update. Right now, the most secure way to store your crypto is self-custody on a hardware wallet. The best one on the market for a range of different crypto is Ledger.

Trezor is an alternative. I use both, and both remain secure.

Nothing is 100% fool proof and 100% safe. Nothing. Not your crypto hardware wallets, not your bank accounts. Nothing.

But there is also nothing safer and easier than a Ledger either. The chances of a third-party hacking or accessing your private keys on your Ledger? Bugger all. Is it possible though?

Sure, it’s possible. It’s also possible that the government decides to arrest and jail everyone that owns bitcoin. Likely though? No, not likely.

Did Ledger really miss the mark here? Yeah, it did. But I understand why, and I think there’s a demand for Recover. But perhaps for a standalone separate device, not rolled out for existing ones.

Does this mean that you should bin your Ledger and transfer everything to a Trezor? No, I don’t believe that’s a good idea either. Should you hold your crypto across multiple hardware wallets instead of all on one? Yes, that’s absolutely a good idea.

I store mine across five Ledger devices, three Trezors and eight Coldcard wallets for my bitcoin.

Note: Coldcard is an exceptionally good device for bitcoin, but only bitcoin. Hence why it doesn’t factor into the “crypto” discussion.

And your private keys? Well, I back mine up with several Billfodl metal seed phrase instruments. I would think about doing the same thing.

All in all, this whole Ledger thing is a reasonably large storm in a tea cup. The blow-back has been huge, and there’s been a lot of knee-jerk reactions. So, take a minute, take a breath, and know that in terms of security, Ledger is still a clear winner, and there’s nothing to lose your mind over.

As they say, keep calm and hodl on.

Reader Questions & Answers (Q&A)

The new format of this publication is… interactive.

That means that we both encourage you to send in your questions.

Questions can be to either or both of us. They can be about stocks, a particular technology or industry, crypto, or a “boots on the ground” research mission.

Questions & Answers is a key part of the publication.

Given that we publish towards the end of each month, it may be difficult for us to tackle time-sensitive questions. It should usually be possible for us to address questions that are not time sensitive.

Please bear in mind that we can’t give personal advice. Also, if your question is related to anything operational, like how to change a password on your Southbank login or where to find a report, please get in touch with our wonderful customer services team.

When sending in your questions, please acknowledge you’re happy for us to republish it. Don’t worry: we won’t be using any names or initials, just the questions.

We can’t guarantee to answer all reasonable questions – particularly if we receive a huge number: however, we will do our best, and may follow up directly with you.

Please send them in: [email protected].

Question: What are your thought on European natural gas? It seems to be going lower and lower, then lower again! What are the signs for a price bottom?

Answer (James): The extent of the bearishness in the natural gas market is certainly surprising. A combination of weak demand and high storage levels has now pushed European natural gas prices to their lowest level since November 2021.

In other words, we’re now trading at levels from when the energy crisis in Europe started ahead of the 2021/2022 winter season, before the crisis reached a peak later in 2022 after the Russian invasion of Ukraine.

Although high inventories ahead of the summer and weak demand suggest that the worst of the energy crisis in Europe could be behind us, I still think prices will rise as we get closer to next winter.

Although storage levels are high for the time of year, natural gas purchases needed to refill Europe’s storage sites are currently slower than usual, lagging behind their five-year average after a chilly April across much of the continent.

Europe ended winter with relatively high stockpiles and that has left many buyers waiting to fill inventories ahead of next winter.

But this complacency means we will likely see a race to restock before the cold weather returns in a few months, not least because each European country must fill their reserves up to 90% full before the winter season.

Expected higher LNG demand in China after the reopening and a remaining dependence on Russian gas could also push up prices. But, as ever, much depends on the weather and projections of heating demand this winter!

What else we’ve been looking at this month

Sam:

Uranium vs. everything else

A picture tells a thousand words. Or at least the saying goes. I think when it comes to ideas and concepts that can be explained, and explained well, sometimes you just need to see it for yourself.

That’s not always easy when it comes to things you can’t exactly pop to the shop and grab with your own two hands… like uranium.

People know about uranium but guaranteed none of us have physically handled the stuff. So, in order to get an understanding of how important it is, and how it’s crucial to our future, I think you should check out this.

AI is the utopia of poor people

While we’re taking a look at some of the fascinating work that comes from Visual Capitalist, here’s another one I think you should check out.

To me, and as the data suggests, there’s a direct correlation between attitudes towards AI and wealth. But it might not exactly be the correlation you think.

The brain’s last stand

AI is clearly a huge new trend that’s taken the world by storm. ChatGPT, Google Bard – there’s just so much new information flying at us.

But is it really all that new? Or is this one of those “new” trends that’s really been over a decade in the making?

I know the answer to that, but do you?

Here’s a magazine article… I won’t tell you from which year, you’ll have to check that out yourself. But it gives you some understanding of how long the whole man vs. machine debate has been raging on.

Balancing out the climate narratives