Your September issue of Small Cap Investigator

28th September 2023 |

- The meeting that led to Southbank’s leading investment advisory

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

The meeting that led to Southbank’s leading investment advisory

Let’s get straight to the point: there’s not going to be a stock recommendation this issue.

But that’s not to say we don’t have an opportunity on the hob, bubbling away.

In fact, I’ve just recorded an interview with a hugely impressive figure behind a very exciting investment opportunity in the China/clean energy nexus.

That’s a market I’ve long wanted exposure to.

After all, China is incomparable when it comes to clean energy.

Consider this:

- China already generates more power from solar energy than every other country in the world combined.

- In the first four months of 2023, nearly three times as much new solar capacity was installed than in the same period in 2022.

- In fact, China’s new solar capacity installed this year will exceed the entire total of installed capacity in the US.

And that’s just in solar.

Similar developments are also taking place in the wind and battery markets.

Indeed, the progress China has made in renewable energy just this year makes the entire rest of the world look like it’s standing still.

Saying that, up until now investing in the Chinese clean tech space has been nigh on impossible for most retail investors. Most brokers just don’t offer a market in all but a few Chinese stocks.

But the investment opportunity I’ve been researching has no such issues. It’s set to be listed in London and accessible for European retail investors in mid-October, though that date is still not fully confirmed.

I plan to send you full details of the recommendation as soon I know for sure it’s good to go.

So this month I’d like to present another opportunity to you, though this one won’t go in our model portfolio.

Instead, it relates to a company meeting I had with my colleagues at the start of this year.

Back in early February, you see, I found myself sitting in the main boardroom at Southbank HQ in London discussing the company’s plans for the year ahead.

But it wasn’t just any old meeting.

In attendance were all Southbank’s top brass and decision-makers, including the publishing, marketing and compliance chiefs and our newly installed investment director, as well as two managers from Fat Tail Investment Research, our sister company in Australia.

Two executives from our ultimate bosses, Agora Inc., had also flown over from Baltimore for the meeting that was slated to set the priorities for the year ahead and map out how Southbank should navigate our readers through an increasingly difficult and uncertain macro environment.

I was there in my humble position as an editor, along with all the other editors in Southbank’s stable.

The backdrop to this meeting was that 2022 had been a difficult time for most UK investors and many of our model portfolios, at least in part, reflected that. In any given year, you would normally find at least one market or investment strategy that obviously outperformed, but 2022 was the year where, on the surface, everything went down.

After all, in 2022, most global stock indices were a sea of red as high inflation forced major central banks to ratchet up interest rates at the fastest pace in decades, denting the allure of many asset classes and ending a bull market run that began in early 2020.

Russia’s invasion of Ukraine acted to increase uncertainty and contributed to a cost-of-living crisis in the UK that left most retail investors looking for the exit doors.

One of my model portfolios – Exponential Energy Fortunes – Private Reserve, or EPR for short – targeted high-potential microcap stocks in the clean energy sector, so it was hit particularly hard.

Yes, I’d had a couple of wins and some of the stocks I recommended for EPR in 2022 are still in positive territory – like 79.45% on one clean energy stock and 45.45% on another (of course these are live positions so these gains could down as well as up) – but overall, like all assets in that horror story year, the portfolio was down -26.26%.

Ouch.

But it wasn’t just stocks that suffered.

Last year was also the worst for bond markets in more than a century and marked the end of a four-decade-long “golden age” for the asset class.

Global bonds lost 31% in 2022, the worst annual performance for fixed income in data stretching back to 1900. UK bonds fared even worse, returning minus 39%. By some accounts this was the worst performance for UK bonds in 400 years!

So, as we all sat around the large rectangular boardroom table, we set about answering one over-riding question: where should Southbank’s loyal band of readers put their money or, to be more precise, how could we help them through the next year – a year that currently showed precious few signs it would be much better than the last?

To this vexing question there was certainly no consensus.

One wise head said that, with both the trajectory of inflation and the overall economic picture still unclear, investors may want to prioritise fixed income in their portfolios.

Another suggested that, given that they are cheap relative to their own history and to developed market equities, we may want to look at emerging markets.

Tech should be due a comeback, my fellow Small Cap Investigator editor wisely (and, it turns out, correctly) proffered.

Commodities… alternative asset classes… crypto… all the major asset classes were put forward as the sectors our readers would be able to invest in profitably this year.

But for every idea put forward, someone else put forward at least one counter argument, meaning we were in danger of going around in circles and failing to grasp the point of the meeting: we wanted a semblance of a roadmap to offer readers as to where they should put their money.

Up until this point, I hadn’t really contributed though when someone mentioned commodity markets, I knew I couldn’t hold my silence any longer.

Where investors should be really looking, I said, was just not in the commodity markets per se, but specifically in the energy markets.

But, I added, I didn’t just mean oil and gas, which is what most investors think of when “energy” is mentioned, I meant every form of energy.

And I didn’t mean investors should just buy any type of energy and forget about it.

I said we should be taking advantage of the unprecedented volatility in the energy markets by offering them shorter-term investment opportunities to capture whatever energy form was in vogue at any one particular moment in time.

After all, we were still in the midst of huge swings in the natural gas, electricity and oil markets. This had put everyone on edge and meant countries, companies and investors alike were doing everything they could do to shore up energy supplies, both for now and in the future.

Certainly, what we shouldn’t do, I added, was cheerlead any particular form of energy over others. We needed to put our pom-poms down – perhaps me more than most – and understand that the whole energy landscape had shifted beneath our feet.

And with it the opportunity presented to red-blooded investors.

A new way for Southbank readers to profit

By way of explanation, I said that back in early 2021, clean tech markets were riding high, coming off the back of a remarkable few years that saw investors pile into green energy with near-frenzied enthusiasm.

The economic slump brought on by the Covid-19 pandemic hit electricity demand around the world, with non-renewable generators of all sorts reducing their output and countries loudly stating their ambitions to press the accelerator down on the great green transition.

Back then, undoubtedly, the fossil fuel industry was on the back foot after several years of lacklustre financial returns and growing concerns about climate change.

Oil prices even briefly entered negative territory as demand dried up.

But in 2022, I said, traditional energy market had re-asserted itself towards the centre of financial markets.

Off the back of the biggest threat to global peace since the Second World War, countries the world over started to rewrite their rulebooks in order to secure their energy supply chains.

As Russia weaponised its oil and natural gas exports, energy prices started to spike and most of the planet scrambled to cope with the resulting chaos.

Increasingly, this meant countries upped investment in fossil fuels in return for security, under the premise of not going dark before going green.

In fact, throughout 2022, the top ten highest returning stocks on the S&P 500 were all what you might call traditional energy companies.

But the opportunity in the clean energy transition hadn’t gone away, I maintained.

In 2023, not only would the green energy sector begin to feel the force of Joe Biden’s Inflation Reduction Act, but other regions would also adopt a state-led industrial policy in an attempt to accelerate a huge, global and long-term renewables build-out.

Clean energy, dirty energy – money was hitting the market at a shocking scale. In 2023, energy would become the centre of the financial universe.

But, up until now, Southbank hadn’t had a service that could properly target some of the shorter-term swings in momentum in specific energy sectors and stocks, I said.

Although many energy market sectors had seen violent swings over the last few years, we’d not been able to fully capture the range of opportunities both on the upside and downside.

Hence, we needed a new service, I repeated, one that was 100% focused on where the money flow was heading in the energy sector at any particular moment in time.

And buying in, ahead of it, gunning to make our readers big profits.

One month we may be in solar. The next we may be in natural gas. The next it could be nuclear.

With the energy markets in a state of flux with competing agendas, there were opportunities on the table to profit in many different ways, I said.

We just needed to make sure the service was “market agnostic” without any pre-conceived or ideological alignment, I continued.

This service wouldn’t discuss the pros and cons of fossil fuels… or the virtues or vices of net zero. It wouldn’t be about politics or culture wars.

Remember, too, I said, that energy was no longer an isolated sub-sector of the economy – it affects everything.

We were seeing a global restructuring of the world energy order, with one of the biggest levers in the global economy being shifted.

The service should look to aim to stay on top of all the regional issues with actionable signals for investors to take advantage of the fast-moving markets.

A team effort brought the service together

At this point, my little speech over, almost everyone in the room had an opinion on what any new service should look like and how we could refine it further to the benefit of our readers.

One of our Australian colleagues suggested we should look to incorporate a momentum-seeking algorithm, which would help us clearly identify the energy stocks or sectors on the move.

Our Australian sister company had developed such a system to great effect for one of its services, which had really allowed the service’s editor to squeeze as much juice out of each investment opportunity as possible, he added.

This, he said, would allow readers to capture the extreme volatility that was currently a mark of nearly all energy markets.

Not that we should be wholly reliant on the algorithm, he cautioned. The ideal approach would be to use the system as a timing tool, though ultimate discretion on what stocks to buy and sell should remain with the editor.

As such, I would still use my 15 years’ experience in the energy markets and employ deep fundamental analysis to decide whether any stock move has legs or whether it is just a move that will likely burn out before it really gets started.

Eoin Treacy then said he could help refine the applicable stock universe to make it easier to run any algorithm, while Paolo Cabrelli, Southbank’s top publisher, said he knew exactly who we should speak to in order to help us build the algorithm itself: Trendsignal.

After all, Trendsignal was the award-winning team of computer scientists and traders who had been developing and honing market-beating algorithms for the last 20 years.

Paolo said I should speak to Adrian Buthee of Trendsignal – and the editor of Daily Profit Alert – to see if he could help us develop such an algorithm for the energy markets.

In a nutshell, during this meeting it was decided that, considering Exponential Energy Fortunes – Private Reserve and its energy focus, we should change direction. So we readjusted its focus to be an “energy agnostic” service and rebranded it as Strategic Energy Alert.

What followed the meeting was nearly two months of frantic work that comprised refining the stock universe with Eoin, speaking to Adrian about the algorithm, backtesting and writing – lots of writing – to put the concept in front of as many readers as possible.

The leading investment advisory of 2023

Why am I telling you all this?

Well, it’s certainly not to boast, even though I’m told, six months after the rebranding, it’s on track to be Southbank’s leading service this year.

Since the rebranding, we have recommended nine stocks, closing out three winners and one very marginal loss. Three of the current five stocks in the portfolio are nicely in the black.

We’ve been able to capitalise on the recent bull run in uranium and some of the volatility we’ve seen in natural gas markets.

We’re now also positioned to take advantage of the bullishness in crude oil – a market that looks set to remain strong until at least the end of the year – as well as in the market for renewable fuels and lithium.

We took a 29% gain in just three weeks in an Australian natural gas company called Strike Energy. This, in fact, perfectly encapsulated the entire investment approach of Strategic Energy Alert, marrying a top-down approach with a combination of fundamental and technical analysis to determine what to buy and when. In other words:

- We identified that gas producers in the Perth Basin were in prime position to address a gas shortage in Western Australia.

- We concluded that Strike Energy, specifically, could re-rate higher amid a consolidation of producers in the region.

- We put our momentum-seeking algorithm to work to buy the stock when momentum was clearly on our side.

- We sold when it looked like the possibility of a takeover was becoming increasingly priced in to a stock that was trading 60% lower just two months prior.

But this is just a taste of things to come.

You see, the real reason I’m telling you all this is to let you know that there are many other similar opportunities on the table right now.

By way of explanation, here’s a snapshot of what is on the radar for my current readers at the moment:

1) Russian gas still accounts for nearly 15% of EU gas demand. And there is not really enough liquified natural gas (LNG) to replace it. I’ll be looking for a carrier stock that could profit if Putin targets pipelines.

2) Cash in when China’s chips are down… there’s a potential Black Swan event that could prove a fantastic boon for US sources of the battery/electric vehicle supply chain.

3) THE big news for a renewable boom: with over 2,000 GW of proposed solar, wind and battery storage projects now on a fast track to come online in the US, I’ll be seeking out the electrical infrastructure investments that are about to explode onto the grid…

4) Solar power surge: with investment in this sector set to outstrip spending on oil production for the first time, is now the time to go long on solar? (Yes, in my opinion).

5) “Yellowcake” – so much further to run! Prices for uranium have jumped to their highest level in 12 years but show no signs of stopping. I’m looking at further ways to play this.

6) Oil hike: if black gold hits $120 by the end of the year, this will generate a lot more cash flow in the coming quarters. There are plenty of stocks on my radar that could really deliver for you here.

7) How you could profit when wind energy gets blown off course: wind energy is having a tough time of things lately, and there are ways investors can take advantage…

As you can see, there is certainly lots for strategic energy investors to get excited about.

After all, energy is a theme that should be flashing on all investors’ radar screens.

I work night and day to identify the very best investment opportunities across the board in the ever-changing and sometimes volatile energy markets.

My aim is to hunt for stocks that show statistically significant momentum that we can ride for as long as it lasts.

The punchline – this issue’s recommendation if you like – is this: if you’d like to check out the service, with no obligation to join, all you need to do is click here. We have a very special offer for you to join on a longer-term basis.

Now, I appreciate that is not an official stock recommendation. As I said earlier, you can expect to hear about a new opportunity in mid-October, outside of the normal issue schedule.

But the fact is there’s enormous opportunity on the table for you in the energy markets and I wouldn’t want you to miss out.

The energy sector – all of it – is coming to the boil.

And by learning how to take advantage, you yourself could becoming a strategic energy investor yourself.

Once again – here is the way to join.

As I said, keep an eye on your inbox for your next Small Cap Investigator opportunity, which, as things stand, should be with you in the week commencing 9 October.

Until then,

James Allen

Co-editor, Small Cap Investigator

Big breakthroughs

What is “blockchain” and why should you care?

I’ve been involved in the crypto industry for 13 years. As an investor, researcher, advisor and educator, I’ve taken on many roles and heard just about everything you could imagine said about the industry.

Even now, 13 years after I first got into this wild world, the same things are said today by people who don’t understand what’s going on that were said way back then.

To me, that says while a lot of people are more aware and understanding now than they were at the turn of the decade, there’s still a long way to go.

It’s why this month I decided to explain in more detail what “blockchain” is and why it is important. Also, why is traditional finance now starting to prick their ears up at the idea of using these technologies in their own systems and with their own clients?

For example, just last week, banking giant Citigroup announced, “the creation and piloting of Citi Token Services for cash management and trade finance.”

Citigroup went on to explain this pilot:

…uses blockchain and smart contract technologies to deliver digital asset solutions for institutional clients. Citi Token Services will integrate tokenized deposits and smart contracts into Citi’s global network, upgrading core cash management and trade finance capabilities.

For all the sceptics still out there, you must ask: what business does Citigroup have using these technologies? Perhaps they’re not just a fad after all?

Let’s dive in and explore why an institution like Citigroup might finally be waking up to the power of blockchain technology.

The blockchain unveiled

Imagine a digital ledger that records every transaction, creating an immutable chain of blocks. Each block contains a set of transactions, and once a block is sealed, it cannot be altered or deleted. This is the essence of blockchain technology: a decentralised and tamper-resistant system that has the potential to reshape traditional finance.

At its core, a blockchain is a distributed digital ledger, and its real beauty lies in its decentralised nature. Instead of relying on a single central authority, such as a bank or a government, blockchain relies on a network of nodes (computers) that validate and record transactions. This decentralisation ensures transparency, security, and trust in a system that operates without intermediaries.

The birth of bitcoin

Blockchain technology made its grand entrance into the world with the advent of bitcoin in 2009. Satoshi Nakamoto, the mysterious creator of bitcoin, introduced the concept of a peer-to-peer electronic cash system that transcends traditional financial institutions. Bitcoin’s blockchain, the first of its kind, has since served as the blueprint for countless other blockchain projects.

Bitcoin’s blockchain is open source, meaning its code is publicly available for anyone to review, use, and contribute to. This open nature not only promotes transparency but also fosters innovation within the blockchain ecosystem.

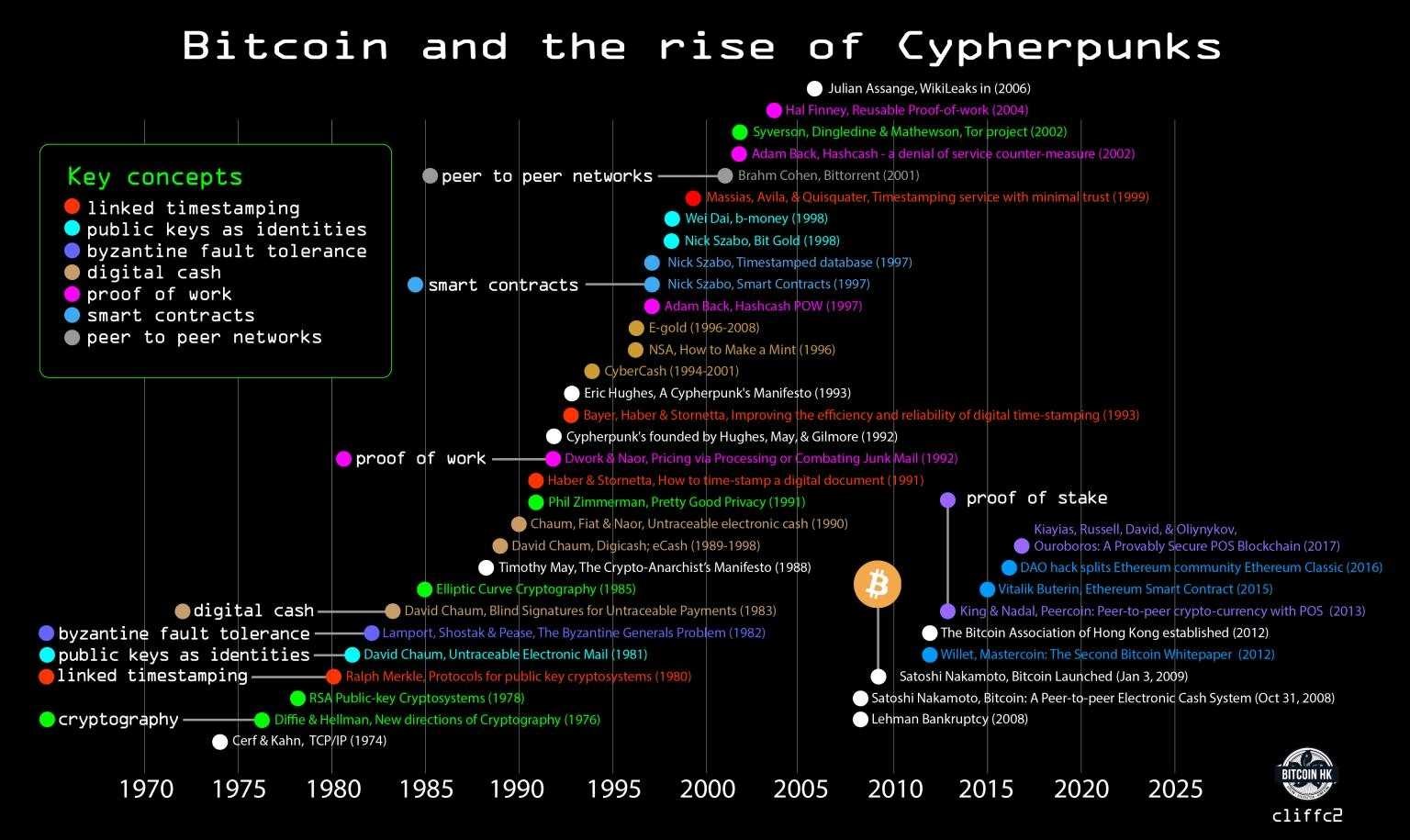

What’s crucial is that bitcoin was not some kind of immaculate birth. In fact, bitcoin’s origins can be traced all the way back to the 1970’s and the ongoing work around the idea of using cryptographic techniques and developments to build a new kind of digital currency system.

The chart below tracks all the work that predated bitcoin around peer-to-peer (P2P) networks, digital signatures, and even digital currency like DigiCash (Chaum, 1989), Cybercash (1994), Bit Gold (Szabo, 1998) and b-money (Dai, 1998).

Source: Twitter

Source: Twitter

Put simply, what you’re seeing now with the likes of Citigroup looking to incorporate these technologies into traditional banking, has really been a technology revolution some 50 plus years in the making.

Underlying most of this pre-bitcoin work are the ideas around transparency, decentralisation, trust and security, and a system outside of the manipulations and controls of centralised authority. It’s the importance of the ethos of decentralised networks like bitcoin that gives rise to the underlying blockchain technology that underpins it.

However, for a technology that’s so against the grain of legacy institutions, particularly in finance, why would it ever consider something like this?

Public, open-source blockchains in traditional finance

Public, open-source blockchains have evolved from what we saw with the proliferation of bitcoin and its blockchain. They are now many in number and have functionality that enables a lot of innovation to take place. However, it’s still important that they stick to their core principles of transparency, security, trust, and decentralisation.

By their nature, open-source blockchains are transparent and open to scrutiny. This transparency builds trust among participants in the financial ecosystem, a quality that traditional finance has struggled to maintain in recent years. This presents an opportunity for leading institutions to rebuild trust in their organisations with customers and the public.

Where there’s more internal opportunity is in the potential for cost reduction. Traditional financial systems are laden with intermediaries, each layer adding cost to transactions. While you might not notice that at the check-out, there are fees built into merchant hardware, processing, even moving money through different banking institutions. These fees are sometimes direct through the process, and sometimes they’re built into the cost of the good. Either way, you pay, sometimes you see, and most of the time you don’t.

An open-source public blockchain has the potential to reduce a lot of these costs and streamline a lot of legacy processes in finance.

Public blockchains are also borderless. It doesn’t matter where you live, as long as you’ve got access to the internet, you can connect to a blockchain. This inclusivity has the potential to provide financial services to unbanked and underbanked populations as well as those who are blocked from participation in the legacy financial system.

However, what is really getting the interest of major institutions like Citigroup is the capacity to build and deploy smart contracts. Public blockchains like Ethereum introduced smart contracts, self-executing agreements with predefined rules that are built into the programming code. These contracts automate processes, reduce human error, and eliminate the need for intermediaries in various financial transactions.

Another aspect of what blockchains can deliver is the potential to digitise and “tokenise” all kinds of assets, be it physical assets or already digital assets. Real estate, stocks and even artwork can be represented as digital tokens on public blockchains. This allows for fractional ownership, increased liquidity, and easier transfer of assets. It opens new opportunities for financial institutions to widen their offering of services to clients.

Put simply, blockchain technology, especially public, open-source blockchains, will turn traditional finance on its head. At first the scepticism was rife, but over time, and particularly in the last couple of years, the demand for these institutions to offer some kind of service in this space has been clear.

There are push and pull factors to it. Some institutions simply wanted to test and try to innovate using blockchains (push) and there was increasing demand from clients to offer services and innovate, otherwise they’d lose business (pull).

However, the core principles of decentralisation, security, transparency, and accessibility are all important for legacy institutions to remain relevant in the future of finance.

While many investors may still be sceptical of much of the “crypto” space, to ignore its facets completely would be a mistake. Keeping close tabs on developments and innovation from both disruptors and incumbents is a smart approach to take when looking at ways to profit from this technological shift.

Buy List update

Ashtead Technology Holdings PLC (AIM: AT)

Subsea equipment rental company Ashtead Technology Holdings, recommended at 374p in the July issue of Small Cap Investigator, has risen around 8% over the last month to trade at 424p at the time of writing, putting it 13% up in the model portfolio.

Ashtead has a history of supplying subsea services to the oil and gas sector but has diversified into the fast-growing offshore wind market.

The stock hasn’t released much in the way of news since early September when it released an excellent H1 report that saw gross profit surge by almost 69% to £39.3 million, prompting management to upgrade its full-year profit guidance.

Although shares have surged over 70% in the last year, earnings-per-share upgrades imply it is trading on a forward price-to-earnings (P/E) ratio of 14 – so it certainly doesn’t look overbought.

The stock remains a HOLD while it trades above 395p.

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings is trading around 36p, over 9% up in the model portfolio, although the stock has fallen 8% over the last month.

Earlier this month, European Metals’ Cinovec lithium project in the Czech Republic received a strong endorsement from Czech Prime Minister Petr Fiala, who said it should start ideally by 2026.

In announcing lithium as one of the six pillars of vision and strategy for the future of the Czech Republic, Fiala said that the government was “working to start mining as soon as possible… 5% of global lithium reserves are located in Cinovec… success would be a huge boost for our economy.”

Cinovec is being developed by Geomet, a 51/49% joint venture between state-owned CEZ and EMH.

CEZ has said it would decide by the end of the year whether it wanted to go ahead with the project, but has indicated that it looked likely given the outlook for demand for lithium.

Cinovec will be a significant pure-lithium producer in the EU – a region where there is little domestic raw material production and a region with huge demand as it battles to achieve a carbon-neutral future.

As such, towards the middle of September, EMH received further good news after the European Union voted in a plan to secure more of the critical materials, such as lithium, fundamental to the green transition.

According to The Guardian, the European Parliament agreed to diversify its supplies of critical raw materials and cut red tape for mining companies. In an attempt to reduce its dependency on China, it plans to ensure that by 2030 it does not rely on a single country for more than 65% of its supply of any strategic raw material.

The EU’s goal is also to secure 10% of lithium consumption within Europe by 2030, with 40% sourced from mining and 40% from processing within the region – which certainly aligns with European Metals’ business model.

The details of the Critical Raw Materials Act, which aims to provide funding as well as expedite permitting for critical raw material projects, will now be negotiated between the parliament and the council.

What’s more, according to EMH chairman Keith Coughlan, Cinovec’s definitive feasibility study (DFS) remains on track for completion in the final quarter of this year and is likely to be published in November.

In an interview with RK Equity, Coughlan said the company is currently working on aligning various aspects of the project, which include test work and holding conversations with potential investors, financiers and off-take partners, to coincide with the DFS completion.

While there are still uncertainties regarding the timeline for the final investment decision (FID) due to permitting, Coughlan said EMH aims to have all other project aspects in place, which will allow for a swift transition to the construction phase once the final permits are obtained.

The stock remains a BUY below its 45p buy limit.

Central Asia Metals (AIM: CAML)

Central Asia Metals (AIM: CAML), a mining company with operations in Kazakhstan and North Macedonia, has risen 8% over the last month to 196.4p at the time of writing, still leaving it 29% underwater in the model portfolio.

The group’s principal business activities are the production of copper at its Kounrad operations in Kazakhstan and the production of lead, zinc, and silver at its Sasa operations in North Macedonia.

Earlier this month, the AIM-traded firm said its gross revenue for the six months ended 30 June totalled $99.3 million – a decline from $119.5m a year earlier.

Net revenue stood at $93.6 million, compared to $113.8 million in the first six months of 2022, while earnings before interest, taxes, depreciation and amortisation (EBITDA) fell from $74.9 million to $48.9 million. Its EBITDA margin slid to 49% from 63%.

Adjusted free cash flow came in at $24.1 million, a considerable drop from $52.2m year-on-year.

On the operational front, the company said that there was a slight increase in copper production at Kounrad with 6,716 tonnes produced, compared to 6,617 tonnes a year earlier.

However, sales saw a marginal drop to 6,315 tonnes, down from 6,406 tonnes in the previous year.

The Sasa facility reported zinc concentrate production of 9,764 tonnes and sales of 8,382 tonnes.

Both figures were slightly lower than the first half of 2022’s production and sales, which stood at 10,465 tonnes and 8,761 tonnes, respectively.

Lead concentrate production at Sasa was 13,734 tonnes, with sales amounting to 12,416 tonnes. That too marked a slight decline from the prior figures of 13,827 tonnes and 13,608 tonnes, respectively.

Lower year-on-year EBITDA was primarily due to deteriorating base metal prices and ongoing inflationary cost pressures, the company said.

However, CAML confirmed its debt-free status, adding that, as of 30 June, it had a robust cash position of $50.6 million in the bank, down from the $60.6 million it held on 31 December.

The company added that it is on track to meet its 2023 copper production guidance of 13,000-14,000 tonnes, zinc concentrate production of 19,000-21,000 tonnes and lead concentrate production of 27,000-29,000 tonnes.

CAML also declared a dividend of 9p per share for its first half on Wednesday, down from 10p in the same period last year.

The stock remains a BUY under 310p.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company (LON: FSF), which invests in UK forestry and afforestation assets, has fallen 15% over the last month to 81.80p, putting it around 24% down in the portfolio.

In the absence of any news, FSF, which has built up a forestry portfolio of about 12,000 hectares across 65 properties, has struggled in the face of challenging macro conditions.

But forestry assets are in demand and the long-term outlook is sound. The weak price should certainly appeal to new investors.

As such, it remains a BUY under 150p.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF (LON: LITG) has declined by 1.9% month on month to around £7.87 at the time of writing, 12.23% below our £8.96 entry price.

There are currently 40 holdings in the Global X Lithium ETF, with Albemarle Corporation being the top holding with about 8.14% of the fund’s total share currently.

The underlying Solactive Global Lithium Index tracks the performance of the largest and most liquid listed companies that are active in the exploration and mining of lithium, or the production of lithium batteries.

Overall, the fund is designed to mostly react to the global electric vehicle (EV) growth trend, though it is not tied specifically to the fate of miners, but rather a mix comprising the entire EV supply chain.

Lithium prices continue to fall amid concerns over Chinese demand and growing inventories, though the long-term growth of the entire industry remains intact.

The Global X Lithium & Battery Tech ETF remains a BUY.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation (NYSE: NEM), the world’s largest gold miner, was trading around $40.48, up 2.8% on the month. The stock is now 39.75% below our $65.39 entry point.

The continuing suspension of operations at its Penasquito mine in Mexico, which has been shut since 6 June, continues to weigh on the stock, with Newmont saying it is losing millions of dollars a day due to the ongoing strike.

According to Mining Weekly, “Newmont pegged the financial impact of the dispute at its Penasquito mine at $1 million a day in maintenance costs and $2.7 million a day in lost revenue in a statement posted to the mine’s Facebook page…

As a result, the mine will not turn a profit this year, the company said.

The Penasquito mine shuttered in early June when about 2,000 unionised workers stopped work over a profit-sharing agreement and alleged contract breaches. The company has since declared force majeure on products. Top executives visited Mexico in August to meet with government officials to lobby for a resolution”.

The timing of any restart remains uncertain.

In other news, Newmont also said it has received clearance from Australia’s Foreign Investment Review Board to proceed with its proposed A$26.2 billion takeover of Australia’s Newcrest Mining.

The company also recently received clearance from Australia’s competition regulator as well as Japan’s Fair Trade Commission last week, allowing the transaction to be closed anytime post-September-end.

As reported by Reuters, if the deal goes through, Newcrest shareholders would receive 0.400 Newmont shares for each share, with an implied value of A$29.27 per share.

The deal still awaits the crucial Newcrest shareholder vote, scheduled for 13 October, as well as green lights from regulators in the Philippines and Papua New Guinea.

According to the Newmont CEO, the Newcrest acquisition will deliver $500 million in annual synergies.

Newmont remains a BUY under $100.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has fallen 3.5% over the last month from 283p at the time of writing, now just around 10% below our entry price.

In an update, DS Smith said that trading since 1 May has been in line with its expectations despite “challenging” end markets, amid continued resilient pricing and strong cost control measures.

The company said like-for-like performance in corrugated box volumes has improved since the start of the financial year, with clear signs of reduction in customer de-stocking, although it remains below the prior-year comparative.

Chief Executive Miles Roberts said:

While the economic environment in which we operate remains challenging we have started the financial year well. We continue to work closely with our customers, meeting their evolving needs and are pleased with their positive feedback and the progress we are making. This, together with our ongoing focus on cost and operational efficiencies and our robust and flexible supply chain, positions us well for the remainder of FY24 and beyond.

The company also said €1.5 billion in inaugural green bonds were issued in July, which has significantly extended its debt maturity profile at attractive terms.

In other news, DS Smith said it had now sold four of five UK recycling depots under review to Veolia.

The stock remains a BUY though we continue to watch market dynamics closely.

Rockfire Resources

Our most recent recommendation, Rockfire has already had an eventful few weeks since our recommendation.

Notably the company has arranged a deal to acquire two “cash generating and profitable companies”: 100% of Emirates Gold DMCC and 99% of Emperesse Bullion LLC.

In order to complete this deal, the company undertook an institutional capital raise of 0.5 pence, a 36% premium to the last traded price.

The stock is currently in suspension until the deal is complete and appropriate regulatory steps are taken around admission documents, and the acquisition of the shares of Emirates and Emperesse.

While it’s not the primary focus of why we brought Rockfire into the buy list, we did note there were other aspects to the company that could deliver bonus potential. Well, this looks exactly like bonus potential – and if they were easily able to raise £3.5 million at 0.5 pence, then we would expect the stock upon relisting to reflect that raised price.

Time will tell, but it’s an added string to the bow of Rockfire that we’ll gladly take if it puts investors into an early, healthy profit.

EQTEC

EQTEC’s stock price was hammered last week on the news that its flagship Billingham Project in the UK would cease activity.

They claimed that due to “…increasingly challenging market conditions in the UK and following recent setbacks with the Project…” it was not feasible to continue the project.

A few days later, the company also published some better news: the Biogaz Gardanne project in France has successfully completed a technical and commercial feasibility study.

These two incredibly contrasting announcements highlight the state of play with energy, in particular green energy, projects in the UK right now.

In short, utter shambles. It can’t get a UK project off the ground, but a French one is full steam ahead. No doubt it’s issues around funding, cost of materials, energy costs and just simply “the cost of doing business in the UK” are cutting companies off at the knees.

The stock price was smashed, and then bounced back on the France announcement. However, the facts are clear that without Billingham, the material view of EQTEC isn’t good. It’s a significant loss for us, but the path forward is as unclear now as it’s ever been. It may even threaten the company as a going concern in the near future, regardless of other developments overseas.

As such, we’re exiting this position regrettably with a hefty loss.

Action to take: SELL EQTEC

Entry price: 1.20p

Current price: 0.057p

P/L: -95.25%

Velocys, Saietta, Clean Power Hydrogen, Hydrogen One Capital, PodPoint and Ilika

In the last couple of weeks any stock related to “green” tech in the UK copped an almighty whack.

The reason is the current UK government’s softening on green energy and its much beloved “net zero” goals. The overall appetite and overall environment for green tech are certainly in a different space than they were a year ago.

The biggest shift was pushing the ban on diesel and petrol new car sales from 2030 to 2035. Then there were more delays for boiler-related net zero policies and the removal of changes to landlord requirements for greener rentals.

The expectation is this probably won’t be the end of it either. There’s a good chance that things like the ban on “dirty” cars might be scrapped altogether.

As such, a lot of related stocks around new green fuel sources, green transportation all took a hit. It’s certainly enough of a change to warrant the question: do we stay with these positions?

The short answer is yes.

Here’s why.

First, the car industry is moving ahead with or without government support. The electrification of cars is an inevitability. It might not happen tomorrow, but it will happen. As improvements in range, charging and overall technology come, as will improvements in price, then the EV revolution will continue.

While I personally have a deep love for the internal combustion engine and have issues currently with available EVs today, that doesn’t mean in five years’ time we’ll be in the same spot.

While people like me might not want to get an EV, if there’s nothing else to buy, then the choice is already made. For example, head to the Renault website to see if you can find its petrol and diesel models…

They are there, but the overwhelming choice is either hybrid or EV, and soon enough it will be only EV.

Here in the UK, these policy changes might slow things down and stall investment, but they won’t wind things off or back. Hydrogen for long and heavy haulage is coming, EVs for consumer vehicles are only going to grow, and the electrification of all kinds of transport and mobility is not stopping.

Hence the long-term story for these areas of investment and the companies around them will continue, but it is a long-term play. Right now, the environment is such that it’s volatile – but therein presents an opportunity for every one of these companies to build an even stronger base to launch off as the tide and winds change.

Make no mistake, the policies around net zero were and are flawed, and things will change. However, there are aspects of it all that aren’t stopping, because the underlying developments are improvements in technology and efficiency and over time, lower costs to the consumer.

For that reason, we stick with Velocys, Saietta, and both Hydrogen plays, as well as PodPoint and Ilika, which are all linked to the long-term shift to more efficient, high-technology solutions in energy, automotive, transport and infrastructure.

Inside the lives of James and Sam

James:

Here’s a sentence I never thought I’d write: my name is James and I enjoy spending time in allotments.

A city boy at heart, and never known for my green fingers, I’ve visited my friend Gary’s allotment twice over recent weekends and started to get a sense of what the so-called “good life” is all about – growing and then picking your very own fruit and vegetables.

Admittedly, I’ve spent most of the two visits to Gary’s rented little patch of land in Nunhead, South-East London, watching other people – namely mine and Gary’s kids – excitedly pick a various assortment of tomatoes, apples, sweetcorn, beans and grapes than actually do too much of the labour myself, but I’ve certainly started to see the appeal of allotment life, nonetheless.

Soaking in the late afternoon sun, cold beer in hand, at once a stone’s throw from the streets of South London yet seemingly a million miles away, there wasn’t much to dislike.

Allotment gardening certainly offers an escape from city life and seems to offer a quiet sense of community – evidenced by the occasional murmur of chatter and the odd friendly nod – shared with the owners of the neighbouring plots.

It was also lovely to hear the children see – and ask questions about – where exactly their food is coming from.

So I wasn’t surprised to learn that allotment plots aren’t easy to come by, especially in the major cities.

According to the latest stats, there are a total of 111,566 people on a waiting list for one of the 120,000 council plots across the country.

Indeed, bolstered by the pandemic and the cost-of-living crisis, there had been huge growth in demand for allotments in recent years, with waiting lists for council allotments stretching to an average of three years, while the number available has dwindled, by 65% in urban areas over the last 50 years.

Predictably, according to council figures, London has the highest demand, with the average waiting time of nearly six years across 14 districts in the capital. The London borough of Islington’s waiting list stretches to 12 years, the most in-demand location to seek an allotment in the country.

Gary told me there was now around a ten-year waiting list to get a plot at his council-run allotment.

No wonder, then, that councils have begun splitting up their plots in recent years.

Rents, predictably, are also rising.

Glasgow is reportedly planning to increase its prices by 500% from next year, from £34.50 to £170. However, the average annual cost in the country remains at just £45 – which really is superb value when you think about it.

Although private companies have started leasing space to desperate gardeners in recent years, I can’t see there’s much of an investment angle to play the growth in allotment demand.

However, if I had to draw a somewhat cheesy investing metaphor that I could learn from my new found – and hopefully lasting – interest in allotments it’s probably this: as with investing in stocks, you need to give plants time to grow, get rid of the weeds, seek a variety of vegetables and occasionally dig up the soil to ensure the garden remains healthy.

With that, I’ll leave you with a photo of Gary and my daughter Ivy picking some apples.

Sam:

The Volkering household popped down to our local shopping mall the other day. It was a Friday and we needed to do some grocery shopping. I figured we may as well grab some dinner, do the grocery shopping and let the boys play on the playground – all the normal stuff you’d expect to do with a two- and four-year-old.

So, we finish up at the playground, and in a moment of weakness generosity, I said to the boys, “Let’s pop to the toy shop. You can both pick something each, but only one thing.”

Parker is currently obsessed with trucks, so he picks a toy tow truck from the shelves. Great, that’s one down. Max takes some more time, and then comes to me with a Rubik’s Cube.

I almost cried. I am so proud.

We get home and Max plays with it for a while. Then it’s shower and bedtime, so the Rubik’s Cube goes on the shelf while we get the boys into bed.

After that, there’s nothing on the telly. I’m looking at the Rubik’s Cube, looking back at me, looking back at it. I know what’s going to happen. I’m going to grab it, and I’m going to spend far too much time trying to solve it.

But I can’t resist.

I’m also not going to cheat. No YouTube videos or websites to guide me. Just me vs. Rubik’s Cube. I have not yet solved it. I’ve got very close, and I’m getting better at it. And I will solve it.

Max will too at some point. But what was a toy for him, has kind of become a toy for me.

But as I’m spending my evenings solving the Rubik’s Cube, I’m also wondering to myself, “Geez, I bet there’s a lot of these in the world.” In fact, I’d be surprised if every household didn’t have one kicking about somewhere.

Then I got thinking about who owns Rubik’s Cube. I know it was invented by some guy with the surname Rubik. But I didn’t know who profits from these wonderful little colourful cubes.

Mattel? Hasbro? They’re the two you think of first when you think of giant toy companies. But no, neither of those two has Rubik’s Cube in the brand suite. What I discovered is that one of the world’s largest toy company’s does own Rubik’s Cube, but not one I’m guessing most people are familiar with.

Spin Master (TOR:TOY) owns Rubik’s Cube. It also owns a lot of other toy brands.

Aerobie, Batman, Etch-a-Sketch, Kinetic Sand, Meccano, Monster Jam, PAW Patrol, Tech Deck, Sago Mini – these are just some of the brands under Spin Master.

I could go upstairs right now and grab the Kinetic Sand out of the cupboard, a few Monster Jam monster trucks from the toy basket, a bunch of PAW Patrol toys that are kicking around, and I still have Tech Decks from when I was a kid that have lasted the test of time.

I didn’t realise but my household is a Spin Master household!

This is a company that has a firm grip on the world’s big toy brands. And with some of the world’s most popular toys and brands, it might make sense to look at it further as it’s the kind of stock that I might want to add to my boys’ portfolios… or mine.

Either way, thanks to Rubik’s Cube, I now know a lot more about a very interesting toy company.

Crypto Corner

I’ve said for a while that I believe at the end of 2023, we will see the crypto markets start to properly wind up into a full-blown fifth bull market cycle.

Today I’m more convinced of that than ever before.

Why?

It’s simple. The scammers are back and they’re back in (annoying) full force.

About six or seven weeks ago, on a Friday, I was having a drink with my wife in a pub nearby where we lived in the UK.

My phone rang and it was an “Unknown Number”.

I should have let it ring out. I don’t’ know why, but for some reason I decided to answer it.

The caller said they were from the UK Financial Conduct Authority (FCA). It was a British voice and it was quiet in the background. Usually with spam or scam callers you can hear all kinds of noise in the background and almost every single time the voice on the other end is clearly not British.

The one I got was different. They proceeded to go on about something to do with risk applications made in my name to the FCA. They suspected these things were suspicious and they wanted to confirm with me my involvement with the applications.

It was convincing (sort of). I know the FCA wouldn’t call me. So right off the bat my red flags were up. However, I wanted to go on, because I wanted to hear what the scam was so I could warn people.

They went on to talk about two risk applications, and then used some random amounts with two companies. A multi-thousand-pound application with Amigo Loans and then a multi-thousand-pound amount with Coinbase.

Again, red flags are popping off everywhere for me. I listened on. They then asked about my involvement with these companies. They wanted details of my relationships with them both. I didn’t give them anything. In fact, I asked them for their FCA details, their registration numbers, any information I could get from them. I flatly refused to confirm or deny any involvement with the companies they mentioned.

They quickly then cottoned on to the fact that I was on to them and knew they were trying to scam me. Then it took a darker turn…

The caller then changed tone, fast, and said to me, “We know you’ve got a Coinbase account ‘Sammy’ we’re coming for you, we’re coming for your ledgers.”

I’ll be the first to admit it. That was pretty hard to hear. It was a legitimate threat to me. I knew it was a scammer. I know they clearly had my name, and they had my number. What else did they have?

Well, from what they said to me, that’s all they actually knew. I didn’t enjoy having to tell my wife about the call. As soon as I hung up, she knew something was up.

Nonetheless, it wasn’t the first call I’ve ever had from scammers. Also, this is not the first threat I’ve had, but it’s been a long time in between threats like this. I’ve also since moved, changed my phone number and any and all my assets aren’t even in the same country anymore.

This isn’t my first rodeo. However, it does tell me that if these kinds of things are happening to me, there’s a good chance they’re happening to lots of people.

Also, there’s at least two scammers impersonating me on Instagram, there’s definitely at least one on LinkedIn too. I’ve gotten more messages from friends asking, “Is this you?” in the last three months than in the previous three years.

The last time this level of scammers, imposters and flat-out scumbag degenerates was like this, was around 2018. It all dropped off during the 2019/2020 bear market, it weirdly didn’t’ really pick up in 2021’s bull market, but now it’s all getting going again.

It’s clear that these lowlifes are making money scamming people, and that it’s working.

That’s scary because more people now have crypto assets than ever before. There’s a legitimate risk to holding these things, because of scammers, or phishing emails, of even long-term OGs in this market making one silly mistake and losing all their assets to a hacker or scammer.

This edition of Crypto Corner is not designed for any sympathy. It’s designed as a warning. Scammers are back and you may find yourself targeted.

These scams may involve people cold-calling and pretending to be an authoritative body, like the FCA or a bank. They may be imposters trying to pretend they’re someone like me, or another reliable crypto industry expert. They may be a fake email, a phishing email, or they may be a “pig butcher” (the phrase used for the pig butchering scam, where it’s a long con trying to build a personal relationship with someone only to then scam them).

You have to be on your toes.

You should self-custody your assets and get them off exchanges. That alone is a point of risk for your crypto assets. In my view, store any and all hardware devices in a safety deposit box somewhere. Preferably in another country, but at least not at your home. Seems extravagant I know, but it will give you peace of mind.

Also, keep in mind the basics, all the time:

- Never give out any passwords, information, seed phrases, recovery codes, or anything like that either online or over the phone.

- Use two-factor authentication (like Authy or Google Authenticator) for log-ins.

- Also use the “anti-phishing” phrase (if available) for emails from your exchange. But even then, try avoiding clicking on any links from an email to an exchange. Just go to it yourself with the URL you type in.

- Avoid clicking on any “Sponsored” or advertising links from Google searches, these can often be malicious phishing links or spoof sites.

- No one with any reputation will ever ask for money, crypto, personal information, codes, seed phrases or anything. Never, ever. Anyone who asks for any of this is a scammer.

- Beware of spoof accounts – for what it’s worth, my Twitter account is @samvolkering my Instagram is @samvolkering my LinkedIn is https://www.linkedin.com/in/samvolkering/

- Spoofers or scammer will try to change the ‘L” to an uppercase “i” or add a number or some variation. But again, refer back to point 5: I’ll never ask for anything. If you find “I” do then it’s not me, it’s a scammer. Report and block. Same goes for anyone else, always refer back to point 5.

- Self-custody your assets.

- Use safety deposit boxes for hardware.

- If you’re getting lots of scam calls, change your number (it’s easy these days) but remember to update your number, particularly for anything you use as additional security. Also note that phone text security isn’t secure, and “SIM swaps” are also ways for scammers to get that extra info. I don’t really know how it works but refer to point 2 for extra security approaches.

- There’s a lot of fake/scam trading sites still in operation. Don’t forget to refer to the guide, How to spot and avoid crypto scams, the information is still relevant and these sites haven’t changed their spots.

That’s a good set of principles to apply to help stay safe and keep your assets safe out there. Not the happiest or brightest of updates this month, but vital information nonetheless and basic principles you should apply all the time when investing in the crypto markets.

What else we’ve been looking at this month

James:

Learning when to sell

Knowing when to sell is perhaps the most difficult question investors face. So I enjoyed this thread on Twitter by investing guru Matthew Cochrane, who summarises key parts of a chapter in a book that Warren Buffett called one of the best books on investing: Common Stocks and Uncommon Profits by Philip Fisher. According to Fisher, there are three reasons for investors to sell a stock and three reasons not to sell. As Cochrane states, there are few things more important for investors to get right, so the thread is certainly worth five minutes of your time.

Two great resources every uranium investor should know about

No doubt you’ve noticed the recent bull run in uranium stocks, where prices have hit 12-year highs as utilities race to lock in fuel supplies amid a global renaissance in nuclear power. Hopefully, with a couple of uranium plays in the Small Cap Investigator model portfolio, you’ve even participated in the rally yourself. If you’d like to keep tabs on the uranium price yourself then you’ll find live prices at Numerco’s uranium spot price indicator available here. What’s more, to see a pretty complete list of all the stocks in the uranium universe – all 140-odd of them – then check this link out. Hopefully these resources will help any investors eager to deploy capital in uranium to navigate the sector.

How’s this for a very “lucky” trade

Talk about – ahem – good timing. Last Thursday, Cisco Systems announced it was acquiring Splunk, a California software data company, for around $28 billion, or $157 a share. Splunk’s stock traded over 20% higher on the day following the news of the acquisition. However, the day before, one lucky trader bought $22,000 worth of out-of-the-money call options with a strike price of $127 on Splunk that were set to expire on the Friday. At the time, the stock was trading around $120 a share. This means the trader was betting the stock would increase dramatically in a span of just a couple of days. The call options were trading for just $0.04 on the day of the purchase but shot to $18.30 after Cisco announced the acquisition. That makes the trader’s options worth more than $10 million in less than 24 hours, not bad on a $22,000 bet. As this article on Decrypt states, social media observers have speculated that the move was an insider trade. Bloomberg Intelligence analyst James Seyffart told the site “that this person is either the dumbest or luckiest person in the market.”

Sam:

If AI turns on us, this is a good example of what that might look like

This is a lengthy read. Allocate at least a good hour or two to read it but also understand it. It’s a detailed look at the hypothetical situation of how AI could look to wreak havoc in society. It does a great job of providing a baseline scenario that we should consider when looking to ensure that artificial intelligence (AI) is deployed safely and ethically in our world. It’s a heavy piece, but worth the effort and time.

Global payments in the fax era

It’s early December 2013. I’m in Paris. It’s cold, really cold. However, I’m at the LeWeb conference listening and meeting with the movers and shakers in the world of tech. One of the headliners at that conference was David Marcus, the then president of PayPal. By 2019, he had moved on to Facebook and was the lead of its “Libra” (renamed to Diem) cryptocurrency program. At a US Senate hearing on the subject, he says:

If America doesn’t lead innovation in digital currency and payments area, others will. If our country fails to act, we could soon see a digital currency controlled by others whose values are dramatically different from ours. I believe that Libra can drive positive change for many people and can provide an opportunity for leadership consistent with our shared values.

He’s not wrong and he’s also not changed his views. He’s now CEO and co-founder of Lightspark which is working on bitcoin and lightning network innovations. Recently he was on CNBC talking about it all and he had some very interesting things to say that are well worth listening to.

I’m still not buying an EV

You have to love the comedy of politics, particularly “green” politics. This story is worth a read even just for the laughs. However, it does also point out some epic flaws with the idea that by the end of the decade, we’ll all be happily zooming about in our electric vehicles (EVs). I doubt it. Also with some changes coming from the UK government, I doubt it’ll ever be a world solely dominated by EVs. But check this comedy out anyway!

James Allen and Sam Volkering

Editors, Small Cap Investigator