Your September issue of Southbank Growth Advantage

30th September 2024 |

- The most exciting area of AI is deep in the world of drugs

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

Let’s take a second bite at not one but TWO energy market stars of the future

This month’s issue takes a slightly different form, in that it doesn’t contain just one buy recommendation, but two.

You see, today we are recommending you purchase two stocks that operate at entirely different ends of the energy market spectrum yet offer similarly exciting growth opportunities.

Both stocks will be extremely familiar to Southbank Growth Advantage subscribers of even recent vintage.

Not long ago, both companies – one listed here in the UK and the other in the US – were valued members of the Southbank Growth Advantage model portfolio.

However, we sold out of the two stocks either side of the summer for markedly different reasons and for markedly contrasting results.

In May, we recommended you sell the smaller UK stock at a hefty profit, timing the sale close to perfection just a few months before the stock collapsed – for reasons we will explain below – by nearly a quarter in the space of a fortnight.

In contrast, the sale of the second stock – the larger US company – was forced on us after it crossed beneath our stop loss earlier this month.

This was a bitter pill to swallow, undoubtedly made worse as we then watched from the sidelines as the stock bounced strongly off its lows on the back of news that we largely predicted in the original buy note.

But the news – again explained below – has only strengthened our conviction in a stock that now has momentum on its side.

Although we had to take our medicine at the time, we are sure the news and resulting resurgence in belief in the company’s sector means the stock again merits a place back in our model portfolio.

So our recommendation today is to take a second bite at the cherry at both these stocks that, separately, provide investors with enormous upside potential.

Let’s dig into the details.

Re-enter position #1: Ashtead Technology Holdings (LSE: AT.)

The first position we want to re-enter – Ashtead Technology Holdings – hardly needs an introduction.

Back in May, we sold the subsea equipment specialist from the model portfolio at a superb 125% return in less than ten months.

The stock had risen from 687p on 16 April to around 840.50p when we decided to sell on 9 May, putting it around 125% up in the portfolio – a fantastic return on a stock that only entered the model portfolio at the end of July 2023.

As you’ll recall, the firm leases undersea equipment to businesses in the energy sector, serving both the offshore renewables and oil and gas sectors. It also provides equipment for infrastructure decommissioning.

The company hires out everything from seabed inspection cameras to winches and dredging systems.

It works with global blue-chip customers as they focus on the energy transition, both in offshore wind and the decommissioning of oil and gas infrastructure. Many of these are increasingly opting to rent equipment to lower capital expenditure.

What I’ve always liked about the company is that the majority of its rental fleet can be seamlessly deployed across oil and gas projects and the wind sector, thereby maintaining consistently high utilisation rates.

Oil and gas accounts for around 70% of its sales, with the balance coming from renewables.

The company is certainly on an ambitious growth journey and making ongoing investments in its subsea equipment rental fleet that has in excess of 23,000 assets.

Such a strong run in such a short space of time meant that the stock had started to look quite expensive, which was the key premise of our sale. At the time of our sell alert, the stock was trading on a forward price-to-earnings multiple of 23.

Today, the stock is much better valued at a forward price-to-earnings (P/E) ratio of 13.97 at the time of writing.

That’s because Ashtead Technology crashed from 780p at the end of August to under 600p less than two weeks later.

We can take advantage of the share price fall

The reason for the fall was quite clear: the publication of the firm’s half-year results in early September.

The results saw Ashtead report strong growth in revenue and profit, driven by high demand in both the offshore renewables and the oil and gas sectors.

But the market instead focused on the large portion of growth arising from acquisitions, which raised questions over whether the growth rate is sustainable, especially as organic growth slowed a touch.

In the first half of the year, the company grew sales 61.4% to £80.5 million, with organic growth of 16% and the rest from the acquisition of ACE Winches completed in the second half of 2023.

Rising costs also resulted in a fall in Ashtead’s gross profit margin to 75.8%, down from 78.8% in the same period last year.

However, for such a small drop in gross margin you might think the market reaction was overblown.

You see, despite the fall, the underlying business remains extremely strong.

Offshore renewables revenue increased 42% to £23.1 million and offshore oil & gas by 71% to £57.3 million.

Underlying profits (EBITDA) swelled 48.6% to £31.4 million, while statutory profit before tax was up 33.3% to £17.6 million.

By any measure, these were excellent results.

Indeed, the company isn’t shying away from the fact that acquisitions are a fundamental part of its growth outlook.

Ashtead, in fact, still sees an opportunity to grow and scale its technology through M&A by consolidating what remains a fragmented market, expanding both geographically and across its range of products and solutions.

In fact, CEO Allan Pirie was at pains to attribute success to the £53.5 million acquisition of ACE Winches that was completed in November 2023. This bolstered Ashtead’s already vast offerings of offshore rental equipment.

“M&A is also a key element of the strategy as we focus on broadening our product and services offering, and geographic exposure to build a platform to sustain medium-term double-digit organic revenue growth,” said Pirie.

Certainly, the CEO is confident in the continued success of his company as he sees growing demand for Ashtead Technology’s services.

“Customers continue to increase the size and quality of their backlogs which are extending in duration to 2026 and beyond as evidenced by published backlogs from our larger listed customers,” added Pirie.

Bearing all this in mind, the outlook looks extremely encouraging. The portfolio is well diversified, which could offer new M&A opportunities.

Last month Ashtead also opened a new equipment rental hub in Norway’s energy capital, Stavanger, offering the company a new Nordic base where it offers a suite of ROV tooling and subsea survey technology.

The company plans to further expand its Norwegian team and service offering over the next year.

Certainly, I still like the fact that the firm’s profits have been growing nicely alongside a surging top line.

There are some key risks

Of course, there are some risks investors should be aware of.

As we saw in the aftermath of the recent results, Ashtead’s reliance on acquisitions to fuel growth is risky, not least because the strategy is underpinned by debt.

The company’s net debt has increased over the past few years, which we certainly need to keep an eye on.

Additionally, it’s worth underlining that any growth through acquisitions can be costly, not least because there is always a risk of overpaying, which can harm shareholder value.

That said, Ashtead has a solid track record in this area, with a return on invested capital (ROIC) of a very healthy 28%. And, as said above, I believe the fragmented nature of its favoured markets offers further acquisition opportunities that the company can take advantage of.

Another risk worth noting is that about half of Ashtead’s oil and gas revenues have come from decommissioning projects, which are one-off in nature and don’t generate repeat sales. That means future growth will need to come from other areas.

One challenge the company faces is the slowdown in activity in the North Sea, due to concerns about the UK’s fiscal policies and their potential impact on the oil and gas sector. However, let’s remember that Ashtead operates globally and is not dependent on a single market.

Ashtead is now looking good value

With Ashtead Technology’s share price falling so much over the last month, the stock now trades at a P/E ratio of under 20 based on the most recent earnings.

This is certainly looking much more attractive for such a high-growth business.

But even the lower P/E ratio doesn’t quite tell the whole story.

Ashtead’s net income has been affected by costs linked to its recent acquisitions of ACE Winches. When adjusting for these expenses, as the company does in its reports, earnings per share (EPS) rise from 30p to 38.3p. Based on this, the implied P/E ratio drops below 15, making the stock appear even more attractively valued.

Looking ahead, analysts predict Ashtead’s EPS could reach 50p and revenue to nearly double to £200 million by the end of 2026.

If and when the company meets these targets, then its stock starts to look very cheap at current prices.

Remember, the company remains supremely well-positioned to benefit from the growing shift to renewable energy, with the expansion of offshore wind infrastructure likely to drive strong demand for its equipment.

But as well as seeing structural growth in offshore wind, Ashtead should also benefit from ongoing demand in oil and gas for both maintenance and decommissioning, especially as companies are increasingly opting to rent equipment to reduce capital expenditures

In short, Ashtead is extremely well set up to succeed.

Its share price has already started to recover and I’m fully expecting it to get back to where we sold it in May – and beyond.

Of course, before you invest, please re-familiarise yourself with the original thesis of the recommendation from the first buy recommendation here.

Action to take: buy Ashtead Technology Holdings

Ticker: LSE:AT.

ISIN: GB00BLH42507

Market cap: £476 million

52-week high/low: 893p/418p

Buy up to: 700p

Re-enter position #2: Oklo Inc. (NYSE: OKLO)

The second position we want to re-enter is nuclear stock Oklo Inc.

The situation here is very different to Ashtead Technology in that we only recently sold out of Oklo after the stock fell below our $6 stop loss, meaning we had no choice but to take our medicine and exit the position at a disappointing 44% loss.

This was – to put it mildly – frustrating as the firm remains perhaps the most exciting way to play the small modular reactor (SMR) theme.

As you’ll recall, Oklo is the nuclear power startup backed by OpenAI head Sam Altman. Its developing scalable nuclear power plants ranging from 15 MWe to 50 MWe based on liquid metal reactor technology that can run on both fresh and recycled fuel.

Nuclear and uranium stocks have been extremely volatile and, as we pointed out in the sell note, Oklo found itself on the front-lines of the then-downward shift in market sentiment.

As we wrote:

This was a shame as almost everything else at the company is pointing in the right direction as it pushes towards its target of building its first SMR by 2027 at the Idaho National Laboratory (INL).

It has received non-binding interest for the construction of over 50 reactors, totalling more than 700 MWe of capacity.

Earlier this month, Oklo entered a preferred supplier agreement with Germany’s Siemens Energy to provide power conversion systems for its Aurora powerhouse at the INL – a significant milestone that enhances the case for Oklo’s production scalability, c

Oklo has also entered into an agreement with the Southern Ohio Diversification Initiative at the DOE Piketon Site to establish its second and third commercial plants, while, in May, it agreed to supply data centres being developed by Wyoming Hyperscale with 100 MW of power for the next 20 years.

In April, Oklo signed another non-binding LOI with Diamondback Energy to collaborate on a separate 20-year PPA to provide power for shale-oil operations in the Permian Basin.

The company says more deals are in the pipeline and it has “tremendous uptake of customer interest”.

But you know this already.

The reason we are recommending you take a new position in Oklo is down to two important pieces of news that have caused a seismic shift in attitudes towards nuclear since our forced sell note on 4 September.

It’s official: Big Tech is going nuclear

Firstly, on 20 September, it was announced that Microsoft had signed a deal to revive the shuttered Three Mile Island nuclear power plant in Pennsylvania. If approved by regulators, the software maker would have exclusive rights to 100% of the output for its AI data centre needs.

Constellation, the owner of the Three Mile Island plant, announced a power purchase agreement with Microsoft that should see the site coming back online in 2028, assuming regulators approve it.

This is huge news.

The reactor that Microsoft plans to source its energy from was retired in 2019 for economic reasons. It is located next to a unit that was shut down in 1979 after the worst US nuclear accident in history.

This would be the first ever restart of a nuclear power plant in the US after shutting. It shows how utilities are benefiting from a massive surge in demand from data-centre operators looking to ride a boom in AI.

Microsoft has agreed to purchase power from the plant for 20 years in a first-of-its-kind deal for the software giant.

The plant that Constellation plans to reopen can generate 837 MW of energy, demonstrating the huge amount of power needed for data centres and Microsoft’s AI ambitions.

A spokesperson for Constellation said it plans to invest $1.6 billion to reopen one of the Pennsylvania plant’s two reactors.

Remember, back in March, we wrote that Amazon’s then-purchase of a massive data centre under construction at one of the US’ largest nuclear plants meant that uranium can now be viewed very much as an AI play.

Under the $650 million deal with US power generator Talen Energy, Amazon Web Services (AWS), the tech giant’s cloud computing unit, will siphon somewhere between 480 and 960 MW of capacity from the 2,500 MW Susquehanna nuclear power station under a ten-year power-purchase agreement.

If that was big news, then the latest announcement involving Microsoft is bigger by an order of magnitude.

In fact, make no mistake, this is one of the biggest power deals ever.

With Microsoft rumoured to be paying over $100 per MWh, the deal is worth around $800 million per year, or $16 billion in total for the duration of the deal – all from one 40-year-old nuclear reactor.

If you consider that South Korea was recently picked to build two new reactors in the Czech Republic for $17.3 billion, then you can see why the Microsoft deal suddenly reinforces the growth case for overall nuclear demand.

This spells good news for Oklo, certainly.

Certainly, Constellation’s decision to reopen the Three Mile Island plant should lead to greater interest and investment in new power plant designs across the board, including Oklo’s.

The case for SMRs has now never been stronger, after all. Quite simply, nuclear power and AI data centers are made for each other. AI data centres want hundreds of megawatts of power in one place, 24/7 (or thereabouts).

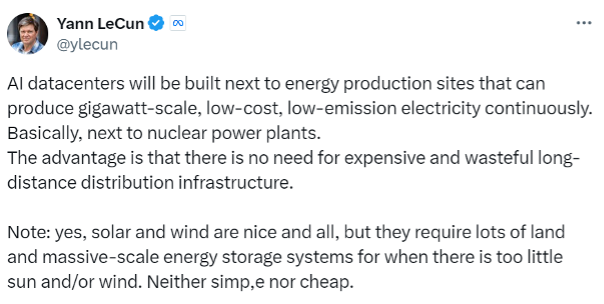

As Meta’s chief of AI was quick to point out on X:

Source: Yann LeCun on X

Following on from this, Google and Alphabet CEO Sundar Pichai namedropped SMRs specifically as a potential energy source as it confirmed it was developing data centres that will consume more than 1 GW of power.

“I see an amount of money going into SMRs for nuclear energy,” said Pichai.

This, of course, is the dream set-up for SMR companies such as Oklo.

But Big Tech is not the only sector getting excited about nuclear power.

In the second piece of good news hitting the nuclear sector over the past week, it’s clear Wall Street now wants a piece of the action too…

World’s biggest banks pledge support for nuclear power

Indeed, just this week, banks and funds totalling $14 trillion in assets signed an unprecedented statement in support of nuclear power.

Fourteen of the world’s largest financial institutions, including US giants Goldman Sachs, Morgan Stanley, and Bank of America, announced they would throw their support behind an effort to triple the world’s nuclear energy capacity by 2050.

Although the banks have not said what steps they will take to help achieve this goal, their involvement will be crucial in helping meet the emissions target laid out in last year’s COP28 climate conference and help revive the nuclear energy sector.

The announcement saw the financial institutions express support for growing nuclear power generation and expanding the broader nuclear industry.

In recent years, many large financial institutions refused to finance nuclear projects, believing they were a dirty form of energy and too risky. Discrimination against nuclear by financial institutions remained a barrier that put nuclear at a significant disadvantage.

In fact, a fall in market support for start-ups developing SMRs and other advanced nuclear facilities have hindered progress across the sector.

But these banks have now made clear they understand that nuclear is not only good for the planet, but also potentially good for the bottom line as well.

Be clear: it’s a huge step in the right direction when financial institutions like these recognise nuclear’s potential to be economically viable. This move will surely unlock finance for a new wave of power plants, including, potentially, SMRs such as those being developed by Oklo.

Although Oklo is aiming to build its reactors for under $60 million, a fraction of the cost of the larger utility-scale projects that make up the existing US reactor fleet, industry-wide finance concerns have dented investor and customer sentiment towards the cluster of start-ups in the sector, including Oklo.

Although Oklo has enjoyed some success in attracting funding from the US government, the company, like many of the new generation of nuclear start-ups, still has to work hard to raise funds, so the news this week is extremely timely.

Please consider these risks

However, before you take a new position, please be aware of some key risks.

Remember, the status of future nuclear power supplies is highly changeable and remains uncertain.

Oklo’s Aurora powerhouse project still needs to gain approval from federal regulators, which is the great unknown at this point. In 2022, the US Nuclear Regulatory Commission denied the company’s application to build and operate its Idaho project, saying it did not provide enough information on its reactor design.

However, Oklo remains confident it will gain approval and that it is on track to first deploy energy in 2027.

Remember, too, that developers of small modular reactor technology such as Oklo are still trying to prove that their technologies provide value for money and have battled to convince naysayers that they can generate electricity at affordable prices. These concerns have diminished somewhat this week but they haven’t gone away entirely.

Licensing and fuel supply also remain potential bottlenecks for Oklo, just like for other developers of first-of-a-kind reactors.

And, of course, despite the positive news over the last few days, we can’t forget that Oklo remains a speculative investment with little or no revenue to its credit and plenty of need for investment as it finalises its designs and seeks government approvals and customer contracts.

Let’s not stay on the sidelines a moment longer

You won’t be surprised to read that, with such good news hitting the nuclear sector this week, Oklo’s stock has been on a tear alongside other nuclear/uranium names, rising to over $8.

Although this has been extremely hard to watch, prices are still below our original $10.65 entry price from late February.

But it stands to reason that if we liked the stock at nearly $11, then we still like at nearly $9 – especially as the case for nuclear and SMRs has just strengthened enormously.

We’re adamant that, with such good news hitting the entire nuclear sector this past week, it’s time to take a new position in Oklo.

Again, just like with Ashtead, please re-familiarise yourself with the original thesis of the recommendation from the first buy recommendation here.

Action to take: buy Oklo Inc

Ticker: NYSE: OKLO

ISIN: US02156V1098

Market cap: $1 billion

52-week high/low: $18.80/$5.35

Buy up to: $11

Big Breakthroughs

Sam:

The one area of nuclear tech we didn’t expect to see in 2024

In the last couple of years, we’ve provided ongoing coverage of one of our biggest, most impactful and important investment themes, nuclear energy.

Amid rampant inflation in the UK economy, coming out of the abhorrent government lockdowns and controls of Covid and the increasingly absurd greenwashing of net zero, one thing was very clear to us.

Nuclear energy was the only way the entire world would be able to provide carbon free, abundant energy in an increasingly high-tech society.

So, we started recommending nuclear investments to you. And we will continue to do so for the foreseeable future, because the direction of this market is clear. Yes, volatility is going to come, and go, and come again as it always does in nuclear, but we need to be prepared for that, and we remain robust in our view that this is one energy market that is only heading in once direction… up.

Reinforcing that view is the incredible news released in the last couple of weeks, as mentioned in our headline essay, that Microsoft will be pumping billions into the restart of the controversial Three Mile Island nuclear plant, to get its reactor one back up and firing again.

It’s worth noting that it was its number two reactor that went through a partial meltdown in 1979… but I’ll get to that in a moment.

This venture not only signifies a monumental shift in the energy sector but also heralds a new era for the tech industry, particularly for artificial intelligence (AI). And that’s because Microsoft is buying all of the energy from Three Mile Island to power its data centres.

In other words, to power its AI.

How hard is it to “restart” a nuclear plant?

The Three Mile Island nuclear plant, infamous for the 1979 partial meltdown of its Unit 2 reactor, has long been a symbol in the world’s largest economy of nuclear energy’s potential and dangers. When the accident happened, while no life was lost, it was regarded as the worst nuclear accident on US soil.

However, the plant’s Unit 1 reactor, which operated safely for decades, was shut down in 2019 due to economic challenges. In short it just wasn’t profitable. Now, with the backing of Microsoft, Constellation Energy plans to revive this reactor, marking one of the first instances of a decommissioned nuclear plant being brought back online.

Restarting a nuclear plant is certainly not easy. But the advantage it has over building something new, or pushing on with SMR technology is that it’s there, more or less ready to go… sort of.

It requires a confluence of advanced technology, meticulous engineering, and substantial financial investment – in this instance to the tune of $1.6 billion it’s said. On top of that there’s suggestion Microsoft will pay a hefty premium for the 20-year energy deal as much as 10-15% above market rates.

But in terms of getting the plant back online, that alone is a modern feat of breakthrough technology, preparedness and regulatory green lights.

Constellation isn’t the first to get a reboot in the US. Earlier this year the Palisades nuclear plant in Michigan was green lit to restart.

According to the Breakthrough Institute:

A restart raises some novel licensing and logistical questions.

[…] Among the challenges of reopening a closed nuclear plant is hiring qualified staff.

[…] The license for the reactor itself isn’t a piece of paper. It’s hundreds or thousands of pages of technical specifications, laying out inspection intervals and test procedures, to ensure continuous operability. Before restart, the condition of all those components must be demonstrated.

[…] In addition, owners have to procure fuel, a multi-month process, and they must line up customers for the electricity.

But it is clearly a trend that is catching momentum, and we expect to see more of. That means more funding, more capital flow, and potentially more profitable companies.

For instance, Constellation, who owns Three Mile Island, just got a stock price upgrade thanks to this Microsoft deal.

Globally, there are approximately 440 nuclear reactors, with many more in various stages of planning and construction. The potential for restarting decommissioned plants is significant, particularly in countries with ageing nuclear infrastructure – it all adds up to the nuclear future I believe the world should already have.

If the Palisades plant and then Three Mile Island are successful, these projects could pave the way for a broader resurgence of nuclear energy. In fact, just the way in which these projects are being pushed forward already is the strongest sign yet that nuclear will be the dominant energy source in the future.

The intersection of nuclear energy and the tech industry, particularly AI, is a fascinating and rapidly evolving frontier. And while Microsoft has caught the attention of the market, it’s certainly not alone in its nuclear-powered data centre ambitions.

As mentioned earlier in this issue, in March 2024 Amazon bought a nuclear-powered data centre in Pennsylvania for $650 million from Talen Energy, signalling its desires to lean on nuclear energy when it comes to its long-term data centre needs.

This, however, has now started to draw ire from other energy companies as these tech giants start “hogging” all the energy for their data centres, and Amazon’s request to buy more energy from the nuclear facility has hit some stumbling blocks.

Again, it matters little. What it abundantly clear is that Big Tech wants, needs and demands nuclear energy in order to meet their insatiable appetite for it.

Nuclear is their only answer because there simply isn’t enough clean, cheap abundant energy elsewhere for them to tap into.

As more plants come back online and new reactors are built, the global energy landscape will be transformed, with nuclear power playing a central role in the future of big tech, AI and energy. It is easily the biggest most important energy story of the next 100 years.

Buy List update

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings is trading at just 8.4, over 70% down in the model portfolio, after the stock shed another 18% over the past month.

European Metals part owns the Cinovec lithium asset in the Czech Republic, one of very few advanced-stage, large-scale lithium projects in the European Union with a mineral resource of nearly 7.4 million tonnes of contained lithium carbonate equivalent.

The project is being developed by Geomet, a joint venture between EMH and Czech-state-owned CEZ.

Shareholders continue to wait for news of the publication of the delayed definitive feasibility study (DFS) for the Cinovec project, which was originally slated for release in the first quarter.

The stock remains a HOLD while we wait for news of the DFS.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF has gained by 15% over the month to trade last at around £5.92 at the time of writing, putting it around 34% below our £8.96 entry price.

LITG is designed to capture the full lithium cycle, encompassing activities from mining and refining lithium to the production of batteries, reflecting its comprehensive investment strategy within the evolving battery technology and electric vehicle market.

It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.

The exchange-traded fund (ETF) maintains significant positions in major players within the electric vehicle (EV) and battery sector, including Tesla, BYD, LG Energy Solution, TSD and Samsung SDI.

By owning mining, refinery and battery production companies in the fund, Global X has its fingers in multiple parts of the lithium industry.

Of course, the ETF is expected to benefit from increased demand for the silvery-white metal from EV, renewable energy storage and mobile device industries.

However, this year, lithium prices have hit their lowest point in three years due to growing fears of excessive supply. Experts predict that global supply could increase by almost 50% this year.

While some lithium supply projects are being deferred, the reduction in supply has so far been insufficient to offset weakening demand.

The ETF remains a HOLD in the portfolio while the market finds its feet.

Central Asia Metals (AIM: CAML)

Central Asia Metals (AIM: CAML), a mining company with operations in Kazakhstan and North Macedonia, has gained around 4% over the last month to 196.60p at the time of writing, still leaving it around 29% underwater in the model portfolio.

The group’s principal business activities are the production of copper at its Kounrad operations in Kazakhstan and the production of lead, zinc, and silver at its Sasa operations in North Macedonia.

The company reported rising revenues for the first six months of the year, thanks to higher sales and better commodity prices. The miner reported revenues up 4.2% year on year to around $104 million.

The copper, zinc and lead producer’s sales and EBITDA were consistent with the first half of 2023, while free cash flow grew by a quarter thanks to lower capital spending.

The company remains debt-free with a cash balance of $56.3 million and has declared an interim dividend of 9p per share.

Copper is increasingly back in favour amid emerging supply concerns, falling inflation and lower interest rates that could see demand improve markedly in the months and years ahead

CAML remains a BUY under 310p.

Volt Lithium (TSXV: VLT)

Volt Lithium, which entered the Southbank Growth Advantage on 2 August at C$0.37, risen by 26% over the past month to trade last at C$0.49, putting it 33% up on our entry price.

Volt is aiming to be North America’s first commercial producer of lithium from oilfield brine from existing hydrocarbon wells. This includes the production of lithium hydroxide monohydrate (LHM) and lithium carbonates.

The company’s flagship project – Rainbow Lake in Northwest Alberta, Canada – spans approximately 430,000 acres and has more than 1,300 fully permitted oil-producing wells with lithium-infused brine. A successful pilot programme and technical report estimate a lithium production life of approximately 100 years.

The shares rallied on 26 August after the company said it has deployed, installed and commenced function testing of its first field unit located in the Permian basin in Texas.

This paved the way for the first lithium production – which it duly announced it had achieved in an announcement on Thursday 26 September.

This is a significant milestone, positioning the company on a clear path to full-scale commercialisation.

“Achieving first lithium production establishes Volt as a leader in direct lithium extraction from North American oilfield brines and marks the Company’s strategic shift from development to production,” commented Alex Wylie, president and CEO of Volt Lithium. “I would like to thank our strategic partner and our dedicated staff that enabled Volt to achieve this significant milestone.”

Underpinned by its low operating cost structure, Volt is now poised for long-term, cost-effective growth as it continues to scale up its US operations.

It has set itself the following targets over the next phase of operations:

- Produce lithium concentrate in the field for the remainder of 2024

- Scale up Volt’s field unit operations to achieve commercial sales by the end of 2024

- Commence cash generation by the end of 2024 with the goal to be cash flow positive in the first half of 2025

- Scale up commercial production to 100,000 barrels per day of brine production during the second half of 2025.

Remember, the project is a partnership with a major Permian Basin operator, following their previously announced strategic investment of $1.5 million, which was allocated for the construction and deployment of the field unit.

The field unit has the capacity to process over 200,000 litres (1,250 barrels) of oil field brine per day, doubling Volt’s previous processing capability of 96,000 litres (600 barrels) per day.

Located in West Texas, the field unit will produce lithium hydroxide monohydrate using Volt’s proprietary direct lithium extraction (DLE) technology, leveraging the advancements made at its permanent demonstration plant in Alberta.

Volt’s field unit is modular, allowing the company to cost-effectively and efficiently scale up to process commercial volumes of brine through several methods, including adding modules to increase capacity, reducing lithium extraction time to boost output, and implementing larger extraction modules.

The stock remains a BUY under its buy limit of C$0.50.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation, the world’s largest gold miner, is trading around $53.90, 3% up on the month. The stock is now only 18% below our $65.39 entry point.

The stock has now gained 48% in the last six months alone.

The company has said it’s on track to raise $2 billion – if not more – from selling smaller mines and development projects.

The metals producer signalled plans to divest assets after closing its acquisition of Newcrest Mining in 2023. The sales are part of plan to focus on so-called Tier 1 assets, which can produce at least 500,000 ounces of gold equivalent for ten years or longer, while boosting the company’s exposure to copper.

Newmont agreed to sell two Australian assets to Greatland Gold Plc for as much as $475 million earlier this month. It’s now pushing to finalise sales of mines and projects in Ghana, the US and Canada by the end of the first quarter in 2025.

The company’s shares have also benefit from a surging gold price that has hit a series of record highs in recent weeks amid concerns around inflation and the US economy.

The spot gold price hit a record $2,622 per ounce last Friday.

The value of gold typically rises as the pricing power of the currency in which it is priced falls, so it’s considered a safe haven investment to hedge against the impact of inflation.

Newmont remains a BUY under $100.

Prysmian Group (IL: 0NUX)

Prysmian Group is now 40% up in the model portfolio after gaining another 2% over the past month to €64.92.

The cabling giant continues to proceed with its share buyback programme that involves a maximum of 8 million shares, equal to around 3% of the company’s share capital.

As of 20 September, the company had purchased a total number of 2,636,480 shares for a total consideration of €157.4 million.

The stock remains a buy under its buy limit of €60.

SilverCrest Metals Inc (TSX:SIL)

SilverCrest Metals, recommended in the May issue of Southbank Growth Advantage at C$12.55, has risen 23% over the last month to trade last at C$13.06, putting it 4% up.

Silver prices have risen to four-month highs $32 per ounce amid strong demand from India and the solar market.

SilverCrest boasts low mining costs, little debt, and a strong cash position, making it a high-margin, financially flexible investment in the precious metals sector.

The stock remains a BUY up to C$16.

Ilika (LSE: IKA), Kanabo Group (LSE:KNB), Surface Transforms (LSE:SCE), Mirriad Advertising (LSE:MIRI)

First off, after all four of these stocks hit our buy list in 2021, we had expected they would each lead to strong performance as we came out of the end of Covid, business restarted, and economies got back into growth mode.

Instead, these four all got crushed in 2022, and have gone on to struggle since. In the case of Mirriad and Surface Transforms, even come close to administration.

When we win, we must celebrate the wins. When we lose, we must take ownership for it and accept that we got it wrong. And in the case of these four, we were wrong. The investment thesis was sound, the execution with these companies not so much.

They all are currently still carrying significant losses and there’s no signs that any are going to provide the gigantic explosive potential to recoup their falls from here.

Add to the mix they’ve all now been in the portfolio for three years, which is right in the wheelhouse for how long we expect to be in a position – there seems to be no way back for these four.

As such, we’re cutting them from our portfolio.

Action to take: SELL, Ilika (LSE: IKA). SELL Kanabo Group (LSE: KNB). SELL Surface Transforms (LSE: SCE). SELL Mirriad Advertising (LSE: MIRI)

Rockfire Resources (LSE: ROCK)

Companies like Rockfire Resources are incredibly annoying. And people wonder why small-cap mining stocks get a bad rap.

Here’s a company with a hugely promising resource in Greece. A resource that on 4 September it announced a 500% increase to, sending the stock price up to 0.22GBp.

Less than two weeks later it announces a pitiful fund raise of £450,000 at 0.1GBp per share. Then a retail offer where you have a day to decide to take it up or not – hence it only raised about £81,754 – just to say it offered something to shareholders.

To have the stock price at 0.22 then to do some weird fundraise at 0.1 12 days later is utterly confounding. If you’re going to raise, do it at the 30-day weighted average of the period prior to the raise. Not at a 54.5% discount to the last traded price.

To us this reeks. We best not sling mud where we can’t substantiate anything, but none of it feels or looks right.

And the tiny amounts raised considering the significant rise in the JORC resource at Molaoi – no, we don’t like any of it.

If this is how shareholders get looked after we don’t think it’s the kind of company that is worth continuing on with. If anything, it suggests it’s seriously battling to raise funds for this project, if that’s all it can raise at such a massive discount to the stock price.

Which then means, the risk of actually getting no value out of Molaoi is a consideration we have to take into account.

We think the management risks here are far too high considering the last month’s activities, and the risk of further falls now outweighs the potential of what Molaoi can deliver.

Action to take: SELL Rockfire Resources (LSE: ROCK).

Inside the lives of James and Sam

Sam:

It’s been a busy month for the Volkering household.

As noted in last month’s update, we upped stumps and left Portugal to transplant and transport the family all the way back in Australia.

The reasons, a myriad of little things that added up to a tipping point. Housing, family, bureaucracy, visas, language… nothing insurmountable on their own, but added together – you get the idea.

We’re now back in my homeland and the upside is that coming from summer in Portugal towards summer in Australia is surely going to ease the transition back to the land Down Under.

I’m also very well aware that I left a country of authoritarian control to move to a country of socialist controls and now back to a country of authoritarian controls. So be it – however, I’ve already got to hang out with my brother and his family more in the last couple of weeks than I did in the last couple of years, so for us, that’s a big win.

Nonetheless, one of the glaringly obvious things that you learn when you move a young family from one country to another and then to another is that it’s actually pretty easy. Stressful at times, sure, expensive too (don’t even begin to ask the cost of importing two pets into Australia), but never impossible.

I’m sure that many of our readers here have lived abroad, moved families around the world, and done similar things. My point there is that if you can, give it a red-hot go. It’s worth it. If things like special economic visas like the golden visa, digital nomad visa, investment visas and things like that are in your wheelhouse, seriously consider it.

Not because the UK inherently sucks. Sure, the government stinks, and the central bank stinks, and yeah, the weather stinks, but it’s a bloody great country to live in and I love it like a home – my boys will still (sigh) always be British before Australian…

However, where you can, or your kids or grandkids or whoever gets a chance, do it – I don’t think anyone truly ever regrets living in another country for a period of time.

I will write a detailed report on just how easy it can be to do, and I might even lean into some stories from our readers as part of that – so if you’ve got some cracking international moving stories, please do send them into me via [email protected] noting you’re happy for me to republish.

Anyway, on the way back we stopped over in Dubai. With two kids under six, we weren’t doing to do that whole Lisbon to Australia trip in one hit.

It was the best decision. But Dubai really is an interesting place. On one hand you feel infinitely poor, and then a minute later when a non-airconditioned bus load of labourers (clearly imported from India) drives on by with nothing but sadness in their eyes, you feel incredibly privileged.

Funnily enough, not long after landing in Australia an infographic from Visual Capitalist hit my news feed. As described by Visual Capitalist:

How many Earths would we need if the entire global population lived like one country?

In this graphic, we’ve visualized data from the Global Footprint Network to see the number Earths required to sustain a world population that lived like Americans, Germans, and more.

Due to licensing, I can’t just lob the image here. But you can see the image by following this link.

When you see it, there’s some not-so-surprising things in there. The US ranks very high; the UK is about where I’d expect too.

The astounding thing here is that according to the data, if we all lived like India, we’d be OK. Just 0.7 Earths if we lived like India. I suspect that’s more an issue with the data. Also, the difference in insane wealth and abject poverty in India is probably a big reason why it ranks so low.

The other surprising thing was that if we all lived like the UAE, we’d need 5.8 Earths to sustain that lifestyle.

Actually, having just been there, on reflection, that’s not surprising at all. The excess, the waste, the insane number of cars on the roads, the insane number of buildings that are always lit up and no doubt highly unoccupied, and the endless running of air conditioning systems makes me think 5.8 Earths probably isn’t enough.

It also makes you very quickly question if I’m very literally washing out yoghurt containers to recycle, what is the point if the real polluters of our world will never change?

It makes you think that if the government had any backbone, they’d not be imposing extra costs and taxes on domestic energy, they’d instead be using all available resources to pressure and punish the world’s real polluters into taking a corrective course of action.

A frustrating place Dubai – fun, relaxing, but then I’m very happy to be out of there.

James:

The last few weeks have been dominated by my daughter starting school for the first time, which, perhaps not unusually, have had an outsized impact on the whole family.

But the reasons for this have been less about how she’s coped with the move from nursery to a reception class or any parental or child worries or nerves at the school gate (she’s long been ready to start school and didn’t look back once at the drop-off on her first day) but more because the start of her school life has meant another change in our living arrangements.

As long-time readers will know, we’ve been renovating our house in south-west London for the last three-plus years after we contracted the dodgiest of dodgy builders to carry out the job that was slated to take only six-to-nine months when they started on site in the summer of 2021.

The good news is that, after we kicked the builders off the job in early February and engaged a new set of contractors a month or two after, we are now on the home straight and should finally be in the house in the next few weeks.

Though we had long assumed the house, which is a couple of hundred metres away from the school, would definitely be ready by September, unfortunately the summer slowdown in the building trade meant that hasn’t proved the case, meaning we’ve been forced to move into my brother’s house nearby to make the school run that bit easier.

That’s because his house is much closer to the school than the house where we’ve been living for the past three years.

But it gets more complicated than that because – to give my brother’s family some space – we’re only with them during the week, returning to our current house for the weekends.

What’s more, though my daughter is at my brother’s house for five week nights, my partner and I take it in turns to accompany her, relaying the childcare of her and our 14-year-old son (my step-son) who has remained at the main house when he is with us and not his biological dad.

If that all sounds remarkably complex, I can assure you that’s not even the half of it, though I can also say that we’re actually all coping really quite well. We’ve all adjusted to the new routine without too much stress, and my daughter has loved spending so much time with her slightly older cousins.

Knowing that these arrangements are only temporary and that soon stability will return when we finally move into our renovated house has certainly made the hassle easier to deal with, too.

But it’s also fair to say that these last three years have at times been incredibly trying and there is absolutely no chance I’ll ever consider doing an entire-house renovation project ever again.

In fact, if anyone ever sees me browsing the soft furnishing section of the local department store in the future, you have full permission to carry out what would be the most merciful of mercy killings.

Crypto Corner

Sam:

Bitcoin’s Big Pump is coming

There’s a bit going on here at Southbank Investment Research in relation to crypto.

In short, we have been somewhat subdued in the last year or so, fighting with one hand proverbially tied behind our backs.

Thanks to flip-flopping government, regulatory bodies, incomplete guidance, a whole “they say one thing and do another” situation it’s not been the most straightforward road.

But every week that passes clarity comes, and clarity we are now right on the cusp of. So much so that we’re coming back, in a big way, with far more detailed, specific and regulatory friendly analysis and action on the crypto industry and specific crypto that we can actually recommend to people.

It won’t be the same as before, it can’t be. But we are working hard on getting that in front of people in the coming weeks. In fact, I’m telling you about this now, and telling you to keep an eye on your inbox, because you’ll hear about it directly from me before your next issue of Southbank Growth Advantage comes out.

That’s because the pieces are all falling into place quickly. And it means if you’re not yet clued up on what’s coming in crypto, then let me just highlight some of the things that are happening in the next six weeks…

First, we’ve just seen central banks unanimously start cutting rates.

That’s a “TradFi” thing, but it means the freeing up of cash into economies that are going to be looking for two things, “risk-on” assets and a hedge against government implosion.

For a long time, bitcoin has been talked about in the mainstream as a hedge against inflation. When you take a long timeframe into account, yes it is. In fact, since its inception the US dollar has lost around 99% of its value against bitcoin.

But that’s not really, and never has been, the real core of what bitcoin is. Since day dot, bitcoin has been a hedge against uncertainty. That means uncertainty in markets, in money, but really in government and central banks.

This is the origin story of bitcoin, and to this day it is the easiest and most robust monetary network on the planet – nothing else is as good. Nothing.

What we’ve seen in 2024 and will continue to see for the foreseeable future is the increasing “TradFi” adoption of bitcoin and the increasing financialisaton of bitcoin. We’re seeing that play out in real time now, with significant events like BNY Mellon – the world’s largest custodian – now finding its way in the US to custody digital assets, starting with bitcoin.

We’re also seeing the progression towards an options market on bitcoin exchange-traded funds (ETFs), starting with BlackRock’s ETF. Jeff Park, head of Alpha Strategies at Bitwise Invest, said about it:

“With today’s approval by the SEC to list and trade Bitcoin ETF options, I shared that we are on the verge of witnessing the most extraordinary upside of vol in financial history.”

It’s a lengthy post, worth a read as it gets complex, but essentially, he also explains:

“For the first time, Bitcoin’s notional value will be “fractionally banked” with ETF options. What do I mean by that? While Bitcoin’s non-custodial, capped supply is its greatest virtue, it has also been a drag, limiting its ability to create synthetic leverage. Despite Deribit’s efforts, it never adequately solved the counterparty vs. capital efficiency matrix for wide adoption, and CME futures options required too much active management.

“Now, for the first time, Bitcoin will have a regulated market where the OCC protects clearing members from counterparty risk. This means Bitcoin’s synthetic notional exposure can grow exponentially without the JTD risks that have kept investors at bay. In a liquidity-driven world, unlocking synthetic flows with leverage represents the greatest opportunity for Bitcoin ETFs, enhancing their financial utility compared to spot markets.”

And in summary he said,

“… the Bitcoin ETF options market is the first time the financial world will see regulated leverage on a perpetual commodity that is truly supply-constrained. Things will likely get wild in such scenarios; regulated markets may not be able to handle.

“But the remarkable thing about Bitcoin is that there will always be a parallel, decentralized market that can’t be shut down, unlike CME—which, as you can imagine, will add even more fuel to the fire.

“It’s going to be unbelievably fantastic.”

These are just two of the significant developments we’ve seen in bitcoin just this month alone. As you’d expect, at the heart of it is BlackRock and, importantly, the man behind BlackRock and (now) one of bitcoin’s biggest supporters and advocates, Larry Fink.

But this all pales into comparison as to what might be instore for bitcoin and the wider crypto market when we hit 5 November.

In my mind, that’s shaping up to be one of the most impactful events in the entire history of money itself.

We’re also seeing how bitcoin’s price is beginning to react to these developments and as we move closer to 5 November you’ll start to really get a sniff of how much fuel is about to dump into the fire. With bitcoin’s price languishing around $53,000 a week into September, as these big Wall St developments have been dripping in one after the other, the price has consistently headed higher, and is now almost over $66,000.

$72,000 is close. I expect breaking through $72k is a fast and direct route up through to $100,000 and the cycle then really kicks into overdrive. But before that takes place, we’re going to be coming at you again, finally, with many more opportunities to ride the next big crypto cycle and Bitcoin’s Big Pump.

Keep an eye out for more of that imminently.

What else we’ve been looking at this month

James:

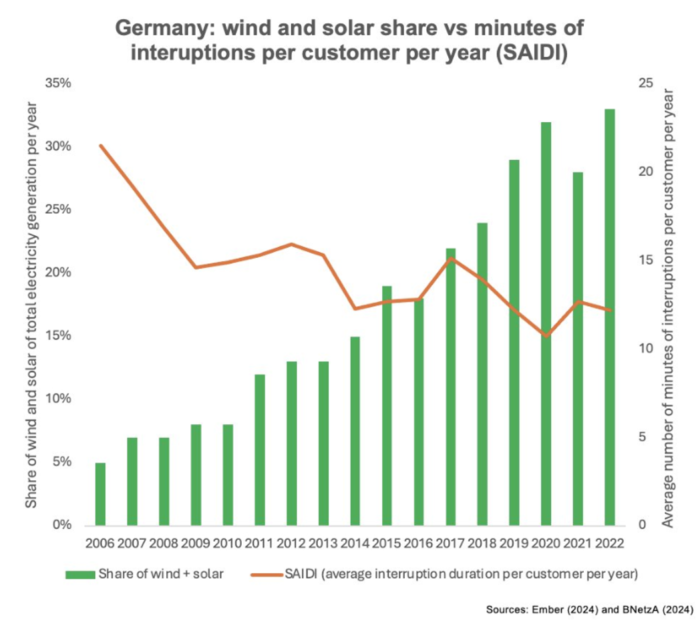

Wind and solar make electricity grids more unreliable, don’t they?

The next time someone tells you that adding more wind and solar to the grid will automatically lead to more power outages, show them this:

Source: Ember

Source: Ember

As the chart shows, in 2022, when wind and solar had a share of 33% of electricity generation in Germany, there were 43% fewer interruptions than in 2006 when the technologies contributed just 5% to the German grid.

The broad trend here is similar to data from other parts of the world, including the US. Indeed, according to studies, there is nothing to prove that European or US grids with more wind and solar tend to become more unreliable. In fact, the evidence indicates the opposite could be true – i.e. that grids with a higher penetration of wind and solar tend to be more reliable.

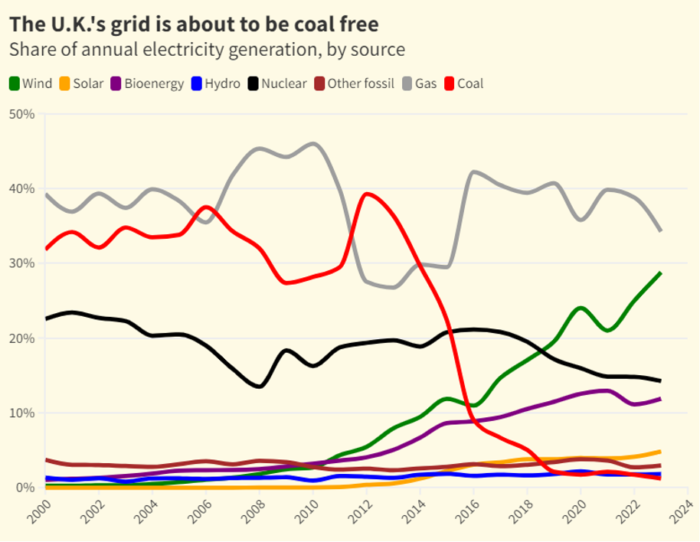

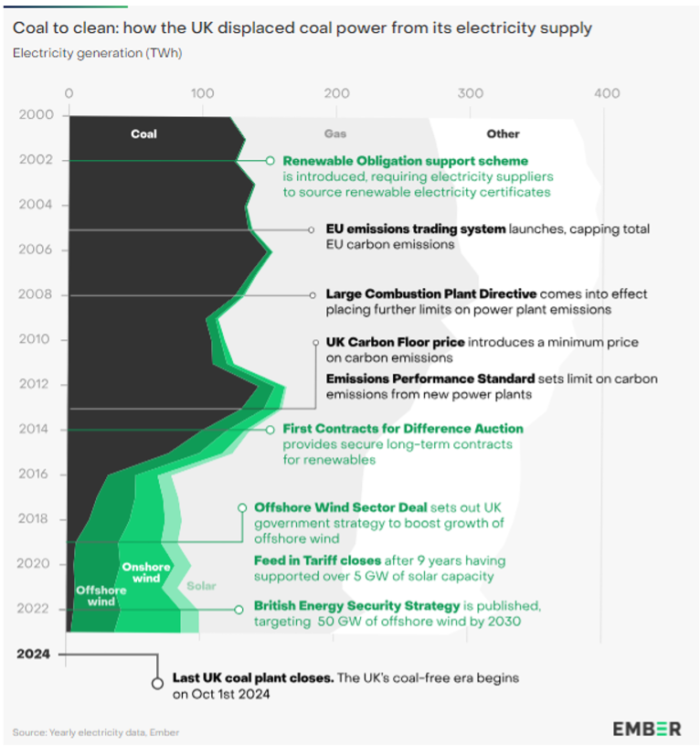

The UK’s era of coal-free electricity begins

Today the UK is shutting down its last operational coal-fired power plant, a major milestone for the country that once boasted the world’s first coal-fired power plant.

At midnight today, the Ratcliffe-on-Soar Power Station will officially close down, marking the beginning of a new era for the UK.

Home to the world’s first coal-fired power station, opened in London in 1882, the UK will be the first G7 country to stop using coal to generate electricity.

Source: Ember

Source: Ember

French-owned energy company EDF and other groups closed their last remaining coal-power stations in 2023, leaving Ratcliffe – built in the 1960s – as the last man standing.

Coal supplied 80% of the UK’s electricity in 1990 – but only 1% last year, when 34.7% came from gas, 32.8% from wind and solar, 11.6% from bioenergy, and 13.8% from nuclear.

In fact, as a result of the UK’s rapidly decarbonising grid and falling electricity demand, overall emissions in the UK have now fallen to the lowest levels since 1879 – three years before that first coal-fired power station was even built.

As this report by Ember explains, it’s a remarkable transformation for a country whose grid has relied heavily on coal for much of its existence.

The report details exactly how the UK managed to displace coal power from its electricity supply, containing charts such as this one:

Source: Ember

Source: Ember

As the report states, the UK is now targeting another ambitious decarbonisation goal – clean power by 2030 – meaning the work to decarbonise the grid is far from over.

The story behind the UK’s fastest growing electricity provider

How can a startup grow to become the UK’s largest electricity provider in under a decade? What is locational pricing, and how might it drive the adoption of renewable energy? And is it realistic to reach a zero-carbon electricity system by 2030?

These are just a few of the questions answered on the latest “Cleaning Up” podcast, where host Michael Liebreich – a market contact who contributed to our Beyond Oil series at Southbank Investment Research a few years ago – sits down with Greg Jackson, the founder and CEO of Octopus Energy, the disruptive energy company with a mission to bring “power to the people” by supplying customers with 100% green electricity at fair prices.

As you might be aware, Octopus has seen rapid growth since founding in 2016 to become an energy powerhouse, directly serving over 7 million households in the UK and with a presence in 8 of the top 10 competitive energy markets worldwide

In this podcast, Greg explains the key drivers behind Octopus Energy’s success, including the use of “elec-tech” software that allows customers to use electricity at the lowest rates possible, as well as talking about the company’s exciting work in areas like locational pricing, electric vehicle integration and the electrification of home heating.

Greg believes, as I do, that electricity is becoming a tech sector – and it’s clear Octopus is at the forefront of the “digital revolution” in the energy space.

This was a fantastic interview between two energy market experts with not just answers but solutions, too.

Sam:

That’s a lot of billions!

Marc Benioff net worth: $9.4 billion. Claim to fame: founder and CEO of Salesforce (NASDAQ: CRM) with a market cap of $255 billion.

Jensen Huang net worth: $101.5 billion. Claim to fame: founder and CEO of Nvidia (NASADQ: NVDA) with a market cap of $2.84 trillion.

Combined these guys have been the catalyst for over $3 trillion of value (countless more really when you look at how widespread their companies reach). So, when they both sit down together on stage and chat about the future of AI, it’s worth sitting up and paying attention.

This is something I recently covered in my free bi-weekly AI-specific e-letter, AI Collision. If you’ve not seen that yet… boy, are you missing out!

Anyway, the video with Huang and Benioff is great, and absolutely worth your time.

That’s a lot of drugs!

From one set of billionaires to another billionaire… Mark Cuban. Cuban is a different cat, which is probably why he’s a billionaire (show me one rationally sane billionaire).

And he certainly gets his fair share of criticism (not least from another billionaire, Elon Musk).

Nonetheless, Cuban is highly successful, and he’s highly controversial. But he’s also trying to be highly disruptive to a market that is in desperate need in the US for reform, and a true-blue shakedown.

This longform piece/interview is a great insight into how Cuban is trying to change the prescription medicine business in the US – and maybe, just maybe, he might actually do it.