This “recommendation” might end up as my most profitable yet

23rd March 2023 |

James:

In my early days in the energy industry, long before I joined Southbank Investment Research, I worked for a company called Platts.

S&P Global Platts, as it’s now known, is a provider of energy and commodities information and a source of benchmark price assessments in the physical energy markets.

My role, as a young price reporter, was to assess the prices in European gas, coal and electricity markets, the vast majority were traded “over the counter”, away from exchanges and through brokers. The benchmarks reported by the major international agencies such as Platts are used for settlement by exchanges and in OTC contracts.

The process of assessing the prices was not entirely straightforward.

Twice a day, I’d have to call my roster of contacts – traders at some of most of the major energy companies and specialist trading houses – and ask them about the deals they’d seen or heard about, getting as much information as I could on the price, volume and the specific counterparties.

When I started, traders were not always keen to speak to me. They were often busy and could be grumpy if the market had moved against them.

But, with perseverance, and trading in the commodity traders value above everything else bar cold hard cash – gossip – I earnt their trust.

I ended up with an extremely valuable collection of contacts in the energy industry that I still tap into to this day.

Back in the mid noughties, of course, renewable energy wasn’t such a thing, meaning most of my contacts from these days are from what you might consider the dirtier side of the industry. (In 2007, in fact, renewables generated less than 5% of all electricity generated in the UK. That compares to around 38% today.)

In the intervening years, the fortunes of this group of trader contacts have swung up and down, in line with the vagaries of the markets. Some years have been good, some bad and many sort of in-between.

But over the course of last year, it was impossible not to detect an increasingly chipper tone when I spoke to them.

You see, while most of the country grappled with an energy crisis that at one point looked like it would spiral out of control, these traders weren’t just having a good year, they were having a great, almost unmatched year.

The volatility in natural gas, electricity and oil prices caused in part by Russia’s invasion of Ukraine allowed a lot of these traders and many of their peers to make significant margins on the sharp price moves.

Although they wouldn’t give me exact numbers, most, with a little pressing, would somewhat sheepishly admit that their annual bonuses were looking extremely juicy indeed.

You might think this is anecdotal evidence, but it certainly chimes with information in the public domain.

Just think that trading house Vitol made more profit in the first half of 2022 than in the whole of 2021, while its rival Trafigura handed more than £1.4 billion to its top traders and shareholders after the energy crisis led to a surge in profits, as reported by The Guardian.

And no wonder. Singapore-headquartered Trafigura ended up reporting net income of $7 billion for its fiscal year ending to the end of September — more than the previous four years’ profits combined.

It was the same with London-listed Glencore, which ended reporting net income of $17.3 billion for 2022, more than triple the previous year.

The spoils were shared with both smaller energy trading firms, too – a Danish gas and power trading company by the name of Danske Commodities made profits of more than $1 billion last year – as well as the Big Oil companies, of course.

For instance, Bloomberg reported that BP’s natural gas division racked up an “exceptional” third quarter, with sales more than tripling after prices for the fuel soared.

Adjusted third-quarter profit for the major’s gas and low-carbon energy division jumped to $6.24 billion, which is more than the business made in the first nine months of 2021. The result was BP’s second-highest quarterly profit on record.

Meanwhile, Shell Plc’s gas unit reported a record adjusted profit in the fourth quarter of 2022. This was thanks in part to “significantly higher” earnings from trading.

Overall trading gross profits in the sector – including banks, hedge funds, independent traders and asset-backed traders such as energy majors – soared to $115 billion in 2022, up 60% from the previous year, according to a study from Oliver Wyman.

It’s clear as day:

Old energy trading remains highly lucrative

Indeed, despite moves by some fossil fuel firms to decarbonise, it’s clear that oil and gas trading remains highly lucrative.

Of course, speaking to my contacts and seeing which way the wind is blowing makes me think that we should be grabbing a slice of these profits too.

After all, whether we like it or not, the energy markets have rapidly evolved since Russia invaded Ukraine.

As Russia weaponised its oil and natural gas exports, energy prices started to spike and most of the planet scrambled to cope with the resulting chaos.

Increasingly, this meant countries upped investment in fossil fuels in return for security, under the premise of not going dark before going green.

This acted as a major tailwind right across the traditional energy sector.

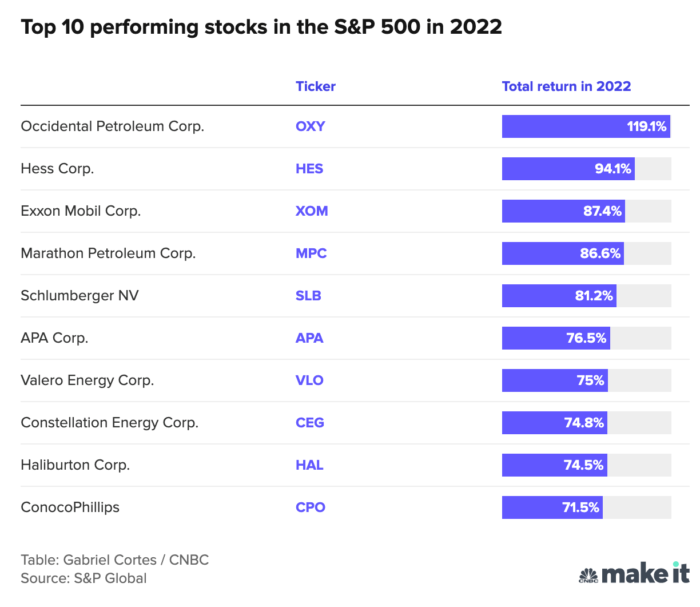

In fact, throughout 2022, the top ten highest returning stocks on the S&P 500 were all traditional energy companies.

Last year, whether we like it or not, oil and gas stocks trounced clean energy stocks, as investors fretted about war, inflation and broken supply chains.

Of course, a three-year look tells a far different story and gives long-term investors a different picture of what is developing, but it’s impossible to ignore – and nor should we – fossil fuels’ comeback.

The Energy Select Sector SPDR ETF (XLE) versus the iShares GlobalClean Energy ETF (ICLN) since 2020.

The Energy Select Sector SPDR ETF (XLE) versus the iShares GlobalClean Energy ETF (ICLN) since 2020.

Source: Yahoo Finance

So what will happen next?

The price action we’ve seen recently could be just a taste of what’s to come.

Fossil fuel spending is expected to jump by more than $100 billion this year, to levels not seen since oil’s heyday in 2010.

- ConocoPhillips is committing billions of dollars to drilling projects in Qatar… AND the largest proposed oil project on US public land IN HISTORY.

- Shell has signed a multi-billion dollar deal with Qatar to develop the largest liquified natural gas field EVER.

- And Total Energies is planning to start 30 oil and gas projects by 2026.

There’s a torrent of new capital piling into the sector.

And I believe we are just starting to feel the early tremors of a bigger market run-up to come.

We’re now seeing traditional energy stocks make the type of moves that, since 2008, have usually been reserved for racy tech stocks.

Consider NGL Energy Partners (NGL), a diversified midstream energy partnership engaged in the transportation, storage, blending and marketing of crude oil, natural gas liquids and refined products.

On 6 January, NGL was trading at £1.31 By mid-March, it was up at £3.84 – a 193% gain. Enough to turn a £2,000 stake into £5,860.

Now consider Permex Petroleum, a junior oil and gas company with assets and operations across the Permian Basin in the US.

On 3 January it was trading at around CA$2.3.

Just over a month later, it rose to CA$8.26.

A 259% gain. And a chance to turn £2,000 into £7,174.

But these moves aren’t just happening on North American stock markets.

As an example, London-listed Star Phoenix Group (LON: STA), a company with an oilfield services business in Trinidad and an oil and gas project in Indonesia, has gained a huge 260% from the start of the year to early March.

But, let’s be clear, the clean energy sector now has the wind behind its sails too.

Hence, we have a powerful “collision” of forces at play.

In 2023, not only will the green energy sector begin to feel the force of Joe Biden’s Inflation Reduction Act, but other regions are now also adopting state-led industrial policy in an attempt to accelerate a huge, global and long-term renewables build-out.

Just consider that:

- The US has earmarked $369 billion for green tech through the Inflation Reduction Act

- The EU is to provide $270 billion to green tech

- Germany is targeting 80% renewables by 2030

- China targeting 33% renewables by 2025.

As a result, interest in clean tech companies has surged to what Forbes calls “never before seen heights”.

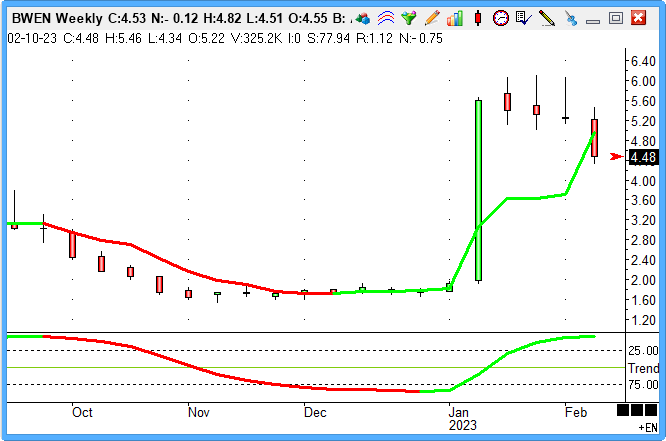

Consider Broadwind Inc (BWEN), one of the first producers of 100-metre wind turbine towers in the US.

On the 16 December, last year, it was trading for $1.85. Six weeks later, it was trading at $6.10. A 229% gain. Enough to turn £1,000 into £3,290 in the space of just six weeks.

Indeed, at the time of writing, the number one stock on the S&P 500 over the last year as a whole is a clean tech company – First Solar.

The International Energy Agency forecasts clean energy investment will surpass $2 trillion by 2030, meaning we can expect another fresh annual investment records this year.

Last year, in fact, the world invested a record $1.1 trillion transitioning to clean power, exactly the same as the amount spent producing oil and gas.

So you could say we’re seeing a two-pronged system develop as competing agendas of energy security and decarbonisation battle it out.

No wonder, then, that since the start of 2023, 26 separate energy stocks that span the spectrum of clean and dirty energy have already doubled.

We now live in a world where clean energy gets $369 billion of investment one day and BP posts annual profits of nearly $28 billion the next.

Right now, clean or dirty – it doesn’t really matter.

This collision of investment into green energy and fossil fuels, all at once, has created a true golden age for energy investors… and specifically, the perfect hunting ground for shorter term opportunities to take advantage of the ensuing volatility.

And it is an opportunity I’d like to walk you through.

My recommendation is a free invite to the 2023 Power Play Summit

You see, starting this coming Monday, I am holding – together with our new investment director, John Butler – a special event exclusively for subscribers here at Southbank Investment Research…

It’s called the 2023 Power Play Summit.

And it is exclusively dedicated to helping you make a potential killing from the colossal amount of money being channelled into the energy sector right now.

It’s taken a lot of work behind the scenes to put it together – many weeks of planning and research.

There’s a lot going on here, so we have divided the event into four episodes to walk you through it, starting on Monday 27 March.

As I said, the summit is open to all Southbank Investment Research readers. And it’s completely free to attend.

But as one of my current readers, when you sign up to the summit, you will get an extra special bonus.

Something that could give you a crucial advantage over everyone else.

I can’t say too much for now but, rest assured, I think you’re going to like it.

To lock in your very special bonus…

And to secure your free viewing pass for the summit…

So with that said, my recommendation to you this month…

Is to sign up to the 2023 Power Play Summit.

Now, I appreciate that this is not an official stock recommendation.

But the fact is, energy markets have re-asserted themselves at the centre of the financial world.

Last year showed how regional issues can quickly turn into global problems.

If you’re invested in the markets right now, you have a vested interest in energy markets whether you like it or not.

The good thing is, if you play it right, there’s enormous opportunity on the table for you.

The energy sector is coming to the boil.

And by learning how to take advantage of it could be my profitable recommendation of 2023.

By signing up to my 2023 Power Play Summit, you’ll learn which mechanisms really drive the energy market…

Which sectors are primed to soar next…

And you’ll get the details on the top three “Power Plays” that could soon reap big, fast returns.

Big breakthroughs

E-fuels and ICE: a budding romance?

Synthetic fuels, also known as “e-fuels” or carbon-neutral fuels, are a relatively new concept in the automotive industry. But given recent moves by the German automotive industry, they could play a crucial role in the transition away from fossil fuels and strike a significant blow to the current obsession with electric cars.

First, when we talk about e-fuels, what exactly do we mean?

E-fuels are fuels that are produced from non-fossil sources and are designed to work in internal combustion engine (ICE) vehicles. They can be made using a variety of processes, including the electrolysis of water to create hydrogen, which can then be combined with CO2 captured from the air to make synthetic gasoline (syngas), diesel or other liquid fuels.

One of the massive upsides to e-fuels is that they can be used in existing ICE vehicles with little or no modification.

Compare that to the rise of electric vehicles (EVs) which require an immeasurable number of metals to be mined for battery manufacture, of expenditures on new charging infrastructure, and huge changes to vehicle design and maintenance.

E-fuels can also be produced using renewable energy sources such as wind or solar power, making them a viable carbon-neutral alternative to fossil fuels without really needing to change the world’s infrastructure.

The next question people often have is how do e-fuels work in ICE cars? If I start using these e-fuels, am I going to knacker my car?

The good news is, no. They work much like traditional gasoline or diesel fuels, but with some key differences. Most of the development in e-fuels is through the use of clean energy technologies, be it hydrogen, or from solar and wind energy sources, which have the potential to be much more environmentally friendly than fossil fuels. They also have a higher-octane rating than regular gasoline, which means they can be used in high-performance engines without causing knocking or other engine problems.

The current drawbacks though are primarily economies of scale. They are currently more expensive to produce than traditional fossil fuels. The e-fuel being developed by Porsche is estimated to cost around €10 per litre at the moment. And the company expects that to reduce to €1.55 per litre by 2026 through efficiencies or scale and technology.

That’s a rapid improvement in the cost of e-fuels. One of the reasons that companies like Porsche believe e-fuels will be a success is that they can be “dropped in” as an additive to existing fuels.

The e-Fuel Alliance expects that over the years, e-fuel additives will start small (around 4%) and increase to 100% by 2050. Doing this helps keep the cost at the pump affordable for everyone.

Another factor currently working against the adoption of synthetic fuels is the “net zero” obsession and move towards electrification. Banning sales of new diesel and petrol cars in the 2030s is a massive handbrake on the e-fuel world.

But we must remember that electrification isn’t really an option for all transport.

Heavy-duty trucks, ships, and airplanes are all examples of vehicles that are likely to continue using ICE technology for the foreseeable future. For these vehicles, e-fuels could be a valuable tool for reducing emissions and moving towards a cleaner, greener world.

E-fuels aren’t some pipedream either. Porsche has already committed over $100 million in the development of e-fuels and it’s behind a big push in Germany to have synthetic-fuelled cars exempt from a proposed ban on ICE cars in 2035 in the EU. Italy, mainly through Ferrari, is also opposed to the EU ICE ban, and it looks like some adjustments to this policy may come pretty soon.

In which case, the world will be talking a lot more about e-fuels and it will be a topic you’ll already have the inside track on.

Buy List update

Aura Energy / Yellow Cake / Sprott Global Uranium Miners

We’ve bundled these three into one update because of the significant changes in the UK around the domestic nuclear industry.

In the 2023 Spring Budget, the government announced a new industry body: Great British Nuclear. This has been designed to help bring down energy costs, increase reliance on nuclear energy and push forward developments in the industry.

That includes more funding and assistance in development. A competition will also run in 2023 for the development of small modular reactor (SMR) technology, of which Rolls-Royce is a major player.

The aim of the government is for the UK to have 25% of electricity generated by nuclear power by 2050. Yes, that’s 27 years away – but it’s a concerted effort to (finally) push the nuclear energy agenda back into focus.

Furthermore, nuclear energy has been determined as an “ESG” appropriate industry (as in meeting environmental, social and governance guidelines). That means all those funds and investors that are either mandated to only invest in ESG or choose to only invest in ESG can now add nuclear to the checklist.

That unlocks a lot of capital for the industry, again, designed to help push and accelerate the opportunities in development forward at a faster rate.

Company specific, Aura released its half-year results last week. The company reported a loss of $3.3 million, which of course resulted in a decrease in its cash balance. None of this is unexpected – shifting from exploration to producer comes with costs. However, importantly, this year the company has locked in security and tenure at its Tiris Mauritania site for 30 years with the Mauritanian government.

The company expects to complete an optimisation feasibility study this month, which we expect will help bump the stock price back up into a healthier profit position.

Yellow Cake’s quarterly update released in February highlighted the net asset value (at the end of 2022) of the company at £4.15 per share – which the stock was roughly trading at in February. It’s since undertaken an institutional capital raise at £4.12 per share at the implied net asset value per share price.

In other words, with the stock trading under £4, the stock is trading at a discount to the net asset value. The uranium spot price has been muted in 2023. Other than a small spike in February, the price is consistently around the $50 mark. We don’t expect it to stay that way for long.

In fact, we strongly believe in the price shifting higher as existing nuclear comes back online around the world and the increase in demand puts greater pressures on supply, pushing the spot price higher.

We only see that benefiting a company like Yellow Cake and associated uranium miners like Aura and the basket of companies the Sprott ETF has exposure to.

That said, the other week we spoke with the CEO of Sprott Asset Management, John Ciampaglia, about the uranium market and the nuclear industry. John is the person in charge of the Sprott funds, including the Uranium Miners ETF, so it makes sense to pay attention to his thoughts.

You can find that video here:

Simply put, we like our current exposure to nuclear energy, having got ahead of most of the incoming changes to the industry that are underway. We remain in these positions. We also like Rolls-Royce’s exposure through its SMR developments – and we remain in that play for a number of reasons, but particularly due to the SMR potential.

CentralNic

Our most recent recommendation hasn’t had a whole host of news to cover in the weeks since we introduced it to you.

The company did show a bump in value not long after our recommendation, but it is now trading around our entry, at the time of writing. That’s all fine, this is a long-term play into the importance of domain identity online and what we expect to be the integration of AI into its offering.

However, just a week after our report, the company did highlight that is has been ranked in the Financial Times’ annual FT 1000 report.

Furthermore, CentralNic was amongst the fastest 50 growing technology companies in Europe. Across all industry CentralNic ranked at 247 in the top 1,000. You can find the full list here.

We know the company is growing, we know a big part of that is an aggressive acquisitions strategy. We think that puts the company in a strong position, particularly in the current market environment for tech companies. As such, we expect more acquisitions and more growth in the coming years.

Blancco Technology Group

Blancco released its interim results in late February for the six months ended 31 December 2022. Across the board, good news: double-digit increases in revenues, gross profit, operating profit, profit before tax, operating cash flow, and earnings per share. Every region the company is in saw similar double-digit growth.

All signs are positive for the future of the company. And its focus on data erasure technology is of the highest importance in today’s world. We only see the opportunity for the company continuing to grow.

Nonetheless, we are aware that the stock has been in our Buy List for some time. Hindsight suggests that we should have clipped out for profit in early or late 2021. Since then, the stock has trended downwards. However, the outlook is still strong and we expect the company will return to those heights. Hence we stay with Blancco, as in the last six months the trend has been higher, which we expect to continue.

IQE

IQE is somewhat of an enigma relating to its poor performance. The company issued a trading update on 9 March expecting a decline in revenues of £30 million for H1 2023. The market crushed the stock price. It has almost halved in the last month, mostly due to that trading update.

The company explained this as weaker demand, build-up of inventory and supply chain issues. It also reported that semiconductor industry sales globally were down 18.5% year on year in January 2023.

This somewhat flies in the face of the expected increase in demand and limited supply of semiconductors. But at the same time, it does fit in with the major setback in general that technology companies have been facing since 2022.

While the hit is a big one to IQE and the stock is trading around 66% below our entry at the time of writing, we still see this as a long-term play into the semiconductor industry. For while the industry might temporarily be in a rut, in the long term, much like the demand for uranium, we expect demand for semiconductors and semiconductor components to increase.

This uncertainty, however, means that we keep IQE as a HOLD in the Buy List. Until we see a trend higher in its stock price, it will stay that way. But again, fundamentally the underlying investment thesis is sound and we expect the current poor performance to turn around.

EQTEC

EQTEC’s technology development is excellent. The biggest issue with this company is that it’s a bit like a miner in a transition from explorer to producer. It’s arguably one of the most difficult things to do: going from technology concept and design, to product, production and commercialisation.

That requires funding, investment and momentum. These are all things that as a green technology company in a major market and economic slowdown are really hard to achieve.

And the performance of EQTEC shows it. The issues with funding for the Deeside Project are a perfect example of this. Had it been 2019, the company would likely have got its investors in a heartbeat. But then again, the company wouldn’t have needed it.

And you only need to see what the company did in 2020 (albeit in very unusual market conditions) to see that when the dominoes are falling in the right order, in the right places, this stock can fly.

The development of synthetic gases and fuels is going to be one of the big stories to develop this year and next. We’re already seeing the green-shoots of this sprouting through. For example, the pushback on the “electrification” of the passenger vehicle industry by the biggest car makers in the world is significant.

In Germany, the entire government is now getting behind a renewed push to exempt synthetic fuel vehicles from the proposed EU ban on internal combustion engine cars by 2035.

On top of this, BMW has pushed deeper into the development of hydrogen-fuelled cars. As the company rightly notes, not all countries have enough electric charging points and electric cars simply won’t work in some countries.

Therefore, why should electric vehicles (EVs) be the only option for people? Another valid point is in a world of diversity and individuality, why shouldn’t that apply to mobility too?

The forced push by governments into EVs is something we don’t anticipate will eventuate. We see other alternatives, like hydrogen and synthetic gases and fuels, becoming the norm as well as EVs.

In that sense, we think the work that EQTEC is doing is highly relevant and necessary in our future. This is why, again, we stick with the position. However, until it begins to show a trend higher, it’s prudent that we switch the position to a HOLD in the buy list.

We expect that as economic conditions improve, so will the fortunes of the company and the stock price. It is then that we may look to re-open the position.

HydrogenOne Capital Growth

Synthetic fuels and hydrogen are indeed something that we will see get more traction and coverage in 2023. Particularly if the Germans are able to bring these fuels into an exemption within the EU Parliament’s push for an EV-dominated world.

This is where we see the importance of an investment company like Hydrogen One come into play.

While the company has small exposure to listed companies, 83% of its portfolio is dedicated to unlisted companies. That’s effectively getting you access to potential champions of tomorrow of which you’d otherwise not be able to get a slice of.

While the overwhelming focus of HydrogenOne is towards hydrogen-related companies, some of the companies within its portfolio are involved in the development of technologies like syngas and processes which help produce e-fuels (synthetic fuels) that work in internal combustion engines.

Two examples of these companies are SunFire GmbH and Elcogen Plc. These also happen to be the two highest weightings of HydrogenOne’s portfolio with a 17% and 16% net asset value allocation.

Both are developing syngas and e-fuel technologies. We see both as important contributors to the success of HydrogenOne, particularly if we see a continued push, particularly from Germany, towards e-fuels.

It’s easy (and arguably lazy) to expect that our future will only be electric cars. Practically, as we mentioned earlier, that just doesn’t work for the world. But the possibility of a mix of electric, hydrogen and synthetic fuel cars is certainly a more realistic outcome.

In that scenario, it’s some of these smaller, private companies that HydrogenOne has exposure to that stand to benefit most. We retain our BUY guidance on HydrogenOne Capital Growth.

Velocys

Continuing on the topic of sustainable fuels, we must also look at Velocys and its development of sustainable fuels, with a focus on heavy industry and aviation.

The company is similar to others in that it’s still early stage, considering the market it’s focusing in on and the only more recent market realisation of the importance of synthetic fuels and sustainable fuels suitable for existing infrastructure and technology.

We remain really positive on Velocys not just because of its sustainable aviation fuel (SAF) developments at Altalto, but its quiet development of e-fuels at the Altalto plant too.

The government grant of £25 million in December for the ongoing development of the SAF technologies also came with a £2.5 million grant for the development of the e-fuels project. That somewhat older news is positive, but it’s the more recent push by governments for e-fuels that give us expectations of a more successful 2023 for the company and its ongoing development.

Velocys isn’t expected to announce its full-year 2022 results until May. We’re not expecting miracles then. But we are expecting momentum behind e-fuels to continue – coming first from the Germans and the Italians, and then filtering through the market as this becomes a much more significant issue this year.

We remain with the position, as we believe momentum will again build behind this unique play on the London Stock Exchange.

Central Asia Metals (AIM: CAML)

Copper producer Central Asia Metals (AIM: CAML), recommended at 276p in January’s issue of Frontier Tech Investor, rose to 292p in early February but has since fallen below 260p.

CAML produces low-cost copper from Kounrad project in central Kazakhstan, but also owns a lead-and-zinc-producing asset in North Macedonia. It has an impressive record of production, beating output estimates again in 2022 at Kounrad after another record year.

The stock is mainly a play on expected tightness in the copper market, where a supply shortage is likely to emerge in a few years leading to a rise in copper prices. Copper is a key component in electricity-related technologies and, by extension, a linchpin in energy transition projects.

Although copper prices witnessed a rally at the beginning of the year, prices have subsequently lost a little steam amid worries over tepid demand in China, one of the world’s biggest copper consumers. Overall, the Copper Monthly Metals Index (MMI) fell 4.33% from February to March.

However, with the company offering an 8.5% dividend, we can certainly afford to be patient. The stock remains a BUY under 310p.

Fortescue Metals Group Limited (ASX: FMG)

Australian iron ore giant and green hydrogen hopeful Fortescue Metals Group Limited (ASX: FMG) rose to over AU$23 in late February though was last seen at just above AU$20, putting it around 17% up in the model portfolio.

The stock has felt pressure from some weakness in commodity prices, though investment bank Goldman Sachs recently upped its prediction for iron ore prices for 2023 from $100 per tonne to $120 per tonne. The three-month expectation is $150 per tonne.

In Fortescue’s core mining business, its Iron Bridge magnetite project in the Pilbara region of Western Australia is nearly complete, requiring fewer employees to oversee the work, resulting in the company laying off more than 100 workers.

The layoffs come at a time when a lot of major global miners – not just Fortescue – have reported lower profits as unprecedented lockdowns in China previously pressured iron ore prices.

Of course, one of the core reasons of our investment was Fortescue’s decarbonisation plans, which include the production of green hydrogen, green ammonia and high-performance batteries.

The business is working on a global portfolio of potential green energy projects, pursuing possible locations in Canada, the US, New Zealand, Australia, Europe, Egypt, the Kingdom of Jordan, Brazil and more.

The US is a particularly attractive market. Fortescue boss Andrew Forrest recently pointed to the huge opportunities available to the company in the US thanks to the US Inflation Reduction Act (IRA), which has introduced substantial tax incentives for a variety of low-carbon emissions projects.

The company is due to make a decision this year on five green hydrogen projects that it will develop and one of those is likely to be in Texas, according to Fortescue Future Industries CEO Mark Hutchinson.

Fortescue has also commissioned its first two big battery storage installations at its Pilbara iron ore mines, and begun construction on its first big solar farm.

The stock remains a BUY up to AU$25.

Rize Sustainable Future of Food UCITS ETF (LON: FOGB)

The Rize Sustainable Future of Food UCITS ETF (LON: FOGB) has fallen further below our 378.48p entry price, trading at the time of writing at around 345p.

The ETF currently has 51 holdings involved in the production of sustainable food and packaging, with plant-based foods, precision farming and fertiliser manufacturers among the targeted sub-sectors.

The plant-based food market is back on the up after a torrid 2022. For example, the share price of Beyond Meat – a core holding in the ETF – has now gained 37% so far this year, with the company recently posting fourth-quarter results and a financial forecast that analysts considered a positive surprise.

Similarly, last week Oatly – another holding in the ETF – announced better-than-expected annual figures, promises of a future profit and $425 million of new financing. CEO Toni Petersson said the group was now “well-positioned to start playing offence in 2023”. Its shares surged as a result.

The outlook for new food products and systems remains positive and, as such, the ETF remains a BUY.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company (LON: FSF), which invests in UK forestry and afforestation assets, continues to trade around 105-106p, putting it around 3% under water in the model portfolio.

The trust hasn’t released any news over the last month, though we’re confident that the long-term investment fundamentals of forestry should ensure both the trust and the wider asset class shines in 2023.

As global decarbonisation gather speed, people are waking up to the part sustainable land management and forestry must play in achieving net zero. This doesn’t just encompass growing trees to produce sustainable construction materials and other traditional timber-based products, but also the sequestration of carbon, the ability of forests to deliver enhanced biodiversity and the development of rural communities and amenities.

As a result, we expect to see ever-increasing demand and requirement for more afforestation and a rapidly expanding universe of investors looking to support and benefit from this process.

Although we can’t ignore prevailing economic headwinds – which include a recessionary economic environment, high inflation and a rising cost of capital – we expect the long-term qualities of forestry investment to continue to shine.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF (LON: LITG) has fallen from over $10 at the start of February to $8.75 at the time of writing, just above our £8.59 entry price.

LIT holds companies such as Tesla TSLA and Albemarle ALB, which are involved in the global mining and exploration of lithium, or in lithium battery production.

Lithium prices have recently fallen back after Chinese battery giant CATL offered rare discounts offered to automakers, but to us this is a blip – the long-term trend is still extremely favourable and we would expect lithium prices to resume their uptrend soon enough.

Lithium supply and demand determines price: EV demand is real, while new supply is slow to emerge.

Of course, the Global X Lithium & Battery Tech ETF tracks stocks right across the lithium cycle, from mining and refining the metal, through to battery production, offering us protection no matter the way the lithium price move.

But we certainly remain long-term bullish lithium as an industry as a whole. Lithium will remain the predominant metal in most battery applications for the foreseeable and many countries – including the US – are looking to develop domestic lithium industries from scratch.

Aurubis AG (DE: NDA)

Germany-based copper smelter and recycler Aurubis AG (DE: NDA) has fallen from over €100 in early February to around €80, still 20-odd percent up in the model portfolio.

The firm recently began construction of a construction of plant in Belgium to extract copper and nickel from recycled material.

The new hydrometallurgical recycling facility, Bleed treatment Olen Beerse (BOB), will increase the site’s recycling capacity by processing electrolytes, known as bleed, more quickly to recover higher amounts of precious metals.

Both copper and nickel are metals key to energy transition and electrification.

The stock remains a buy up to €100.

Newmont Corporation (NYSE: NEM)

Newmont Corporation (NYSE: NEM), a mining company that primarily produces gold and copper, rose above $55 in late January though fell below $42 on 9 March, before paring losses to trade around $48 at the time of writing, around 26% down from our $65.39 entry point.

Late last month, Newmont, one of the largest gold producers in the world, reported an increase in its gold Mineral Reserves, with reserves totalling 96.1 million attributable ounces for 2022, up from 92.8 million ounces at the end of 2021.

Also, the company’s reserves grew by nearly 4% in 2022, primarily due to new additions at Pueblo Viejo and exploration at Newmont’s managed operations.

To us, NEM is more attractive than ever, trading more than 80% lower than its 52-week highs while yielding over 3.8%. With a cash balance of $3.7 billion, supporting the dividends shouldn’t be a problem.

The outlook for gold remains positive. Factors including geopolitical tensions, inflation and dollar weakness amid a recessionary scenario should add support to gold, putting Newmont in an excellent position to deliver strong free cash flow numbers and take advantage of its excellent proven resources.

In early February, US-listed Newmont launched an all-share bid for its Australian rival Newcrest that values the smaller company at almost AU$24 billion.

Although Newcrest rejected the takeover bid in mid-February, the two companies are to discuss a potential deal, according to reports.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has slipped 3% below our entry price after falling from 369p at the start of February to 306.4p at the time of writing.

Shares fell after the company issued a trading statement on 9 March that said it was seeing lower corrugated box volumes in its fiscal year third quarter, which ran from 1 November 2022 to 28 February this year.

The London-based group, which supplies packaging and paper products to the likes of Amazon and Brewdog, said that volume sales were due to “market weakness”, with businesses de-stocking over Christmas and New Year.

However, the firm said it is continuing to trade in line with profit expectations and stressed that its “robust and flexible” supply chain had offset the lower volumes.

“We have continued to perform well in the second half of the year despite the volatile macro-economic conditions. As expected, profitability and returns have grown strongly and cash generation remains good,” said Miles Roberts, group chief executive.

“We continue to stay very close to our customers and their evolving needs, which, together with a relentless cost focus and robust supply chain, positions us well for the remainder of the year and into our next financial year.”

Although its share price fall is a setback, DS Smith has previously coped well with a difficult economic environment that includes the impact of rising paper, energy and labour costs.

The growth of e-commerce means demand for its boxes should keep climbing, while its decision to move away from plastics is a very prudent long-term move.

At the time of writing, the firm trades on a price-to-earnings (P/E) ratio of 9.6 times for 2023 and boasts an impressive 5.9% dividend yield.

It remains a buy up to 400p.

Watsco Inc (NYSE: WSO)

Heating, ventilation, and air conditioning (HVAC) distributor Watsco Inc (NYSE: WSO) has fallen from $324 in mid-February to $299.63 at the time of writing, still 2% up from our entry point.

The firm, which continues to generate attractive sales, profits and cash flow growth, should benefit from favourable industry dynamics, such as various rebate and incentive programmes in the US that should drive demand for higher-value products in the HVAC industry.

Watsco is still reasonably valued and remains a buy.

Yara International (OL: YAR)

Yara International (OL: YAR), one of the world’s largest producers of nitrogen-based mineral fertilisers, has fallen from NOK 493 in early March to around NOK 438, putting it 10% up in the model portfolio.

The company has been quiet on the news front though remains a good long-term play for investors looking to invest in the agriculture and fertiliser sectors.

Yara’s products are used by farmers to increase crop yields and improve soil health, while the company has a strong commitment to sustainable agriculture – a huge growth area.

The company is also coming off a banner year in 2022, when sales increased from $16.6 billion to $24.1 billion.

It remains a buy up to NOK 500.

Inside the lives of James and Sam

Sam:

Admittedly, I haven’t done a great deal in the last few weeks. A fairly sizeable chunk of my time was spent either a) being sick, b) looking after sick people in my house.

What must have been norovirus spread through our house. This resulted in probably one of the worst (or, at least, grossest) weeks I’ve ever had as a parent. At one point, I’d put on ten loads of washing within a 24-hour period – with each cycle clocking in at about one hour and 50 minutes long… you get the gist of things.

That said, there’s been a bit of time when we haven’t been sick. In those moments, we’ve been able to spend time hanging out with the boys, work and, where possible, catch The Arnold Palmer Invitational and The Players Championship on Sky Golf.

However, rather than bore you too much this month with my thoughts on the dominance of Scottie Scheffler, I actually want to perform a little public service announcement.

You see, I might have been intermittently sick and house bound for much of the last few weeks, but I didn’t switch off. That’s both literally and figuratively.

In a literal sense, the smartphone is a handy thing when you’re in bed, feeling like garbage and you just want to stay in touch with the world. That means a lot of messages sent back and forth between those you know.

But I also got two unexpected and unwanted messages. On first glance they would seem to be perfectly legitimate text messages. But if you’re at all switched on to the depths of depravity that scammers will go to, then you’ll see these for what they really are…

Source: editor’s own screenshots

It’s worth being very direct here: if you ever get text messages like these, delete them immediately. Never click on these links.

I know that text message scams aren’t new. And I know that a lot of people are able to recognise them immediately, like myself. But I also know that billions are lost to these kinds of phishing scams every year.

In the US alone, more than $40 billion was lost to phishing scams in 2022. Again, you might easily recognise these scams. But $40 billion in the US alone suggests that there’s a hella lot of people that don’t.

So from me to you, and from you to anyone else you know, share it around that any time you get an unsolicited text, email or phone call from someone you don’t know, ignore it.

Never click on links that you’re not expecting. Never give out any personal information over the phone, never give away passwords, pin codes, seed phrases, anything that could compromise an account.

Even if the message or person claims to be reputable, always hang up the phone or delete the message – and then search out the organisation yourself to certify if they need your attention.

And as I’ve done in the past, if you’re ever unsure about something like this, be it a text message or an email, you can write in to me and ask for my view on it. I’ve seen enough of this stuff over the years to pick it up every time – so I’m willing to help where I can.

Be safe out there!

James:

My family and I are on the hunt for a new car.

Our current car, a 2018 battery electric BMW i3S, has been a loyal servant but it’s increasingly impractical to drive a family of four around. It’s just a bit too small.

The boot is tiny and the back seats are seriously cramped, especially as one of only two seats in the rear is taken up with a large child seat for the two-year-old.

There’s also an issue with the doors in that the i3 has no central pillar. This means that the rear door hinges at the back so they open the opposite way to most cars. So to get into the back seats, you also have to have the front doors open. This juggling of doors is a massive pain when trying to extract a screaming kid from a child seat when parked in a tight spot, let me tell you.

But I suppose the other issue here – the elephant in the room, I guess – is range.

The i3’s real-life range is a little over 100 miles. There is a small petrol-powered “range extender” – which effectively keeps the battery topped up – that adds another 80-odd miles. But, without going all Giles Coren on you (subscription may be required), it’s still not really suitable for long journeys.

We charge the car at home so we no longer need to use any public chargers in the city, but extended motorway journeys can often result in repeated visits to service stations to top or fuel-up.

Saying that, though, overall we’ve loved the car.

As an electric car, we love how it drives. It’s smooth, with punchy acceleration. We love how quiet it is. We’ve not really had an issue with it maintenance-wise since we got it in November 2018.

Unlike Coren, we’ll certainly never go back to getting an internal combustion engine car.

So as the i3’s lease is now expiring (it’s actually a company car arranged via my girlfriend’s work) we’re in the market for a new electric car with more room and more range than the i3.

Of the choices available to us, we’re deciding between the new Polestar 2 Long Range Single Motor, which is set to have an impressive 394 miles of range when it’s released in a few months, and the Audi Q4 Sportback e-tron, which has 300-odd miles of range.

The Polestar 2 is the clear favourite at the moment, not least because we took it out for a test drive a couple of Sundays ago and loved it.

For starters, it’s a real-looker, both inside and out. We particularly loved the full-size panoramic glass roof that opened up the already roomy space inside even more. What’s more, and unlike the i3, the boot was massive.

I’m easily impressed by modern vehicular technology so I loved the wireless phone charging and heated steering wheel, as well as the lane assist, parking assist and all-around cameras that made parking a breeze. Just like in the i3, the Polestar has one-pedal driving that adds both enjoyment to the drive and miles on the battery.

As for acceleration, even if it wasn’t quite as nippy as the i3, it was certainly more than zippy enough to make it fun getting around the city and on the A-roads we drove on. It certainly had more poke than I knew what to do with.

Seeing as how much we loved the Polestar 2, the question now is whether we go ahead with booking a test drive for the Audi or just proceed with a car we know we love, especially as the range on the new Polestar 2 is that bit more impressive. If you have any thoughts or experience on either car, or just on electric cars in general, then I’d love to hear from you!

What a beauty

Source: Polestar

Crypto Corner

Last month, the very first sentence in our crypto update was:

What a wild month we’ve had in the crypto markets (so not much changed then!).

Well, this month, what a wild month we’ve had in the TradFi markets (so not much changed then!).

Actually more specifically, what a wild month we’ve had in banks (which is TradFi) and crypto markets.

So let me wind all this back a couple of weeks for some context.

First off, Silvergate Bank decided to enter voluntary administration at the start of the month. Silvergate was one of the “crypto-friendly” banks in the US. In effect, it would wind down the bank and liquidate its assets, repaying all depositors.

As CoinDesk reported, at the time the company IPO’d in 2019, it said it had some 750 crypto clients on its books.

This was a reasonably big domino to fall in the ever-increasingly tense relationship between TradFi and crypto – and also lurking in the corner, the US regulators and crypto.

The murmurings of Silvergate’s impending doom started early in March, and then as the company announced its liquidation, it sent serious shockwaves through the crypto markets.

Bitcoin’s price (swiftly followed by everything else) headed south on Friday 3 March, and then on Thursday 9 March as all of this was unfolding.

A bigger part of why Thursday’s price action saw nothing but deep red was the additional collapse of Silicon Valley Bank (SVB). This was a massive deposit-taking institution, with huge exposure to the technology industry in the US and globally. There were fears that SVB wouldn’t be able to repay all its depositors.

In addition to this, Signature Bank was forcibly put into administration as the US regulators shut its doors for it, taking over the bank and also now processing its swift liquidation/takeover by another bank.

Now this is three large, significant banks that provide a lot of TradFi services to the crypto industry being liquidated, shut and failing.

All of this, in particular the SVB collapse, sent the global banking industry into a tailspin.

There’s more to it, which we’ve covered in Fortune & Freedom last week (if you don’t receive that, you can sign up above – make sure it’s on your whitelist too, by following the instructions here). So I’d go ahead and make sure you catch up on our view there.

All of this triggered a number of bank runs on regional banks in the US. And that’s now reverberating not just on US domestic soil, but to other global banks. Credit Suisse was reportedly on shaky ground, which turned out to be correct. It was sold to UBS for the bargain basement price of £2.6 billion last week (it was worth over £65 billion at its peak) to ensure Credit Suisse didn’t completely fail.

And that’s exactly what happened in the US too.

As the threat of depositors losing access to all their deposits started to become a reality, the US Federal Reserve pitched in to provide extra liquidity to the banking industry to ensure that doesn’t happen.

In short, the Fed’s hovering its finger over the money printer button again and propping up the banking sector (once again).

All this is important, because it once again highlights the issues of a fractional banking system, notably the threat of bank runs. If you don’t understand how that all works, then I would highly suggest you read my book, Crypto Revolution (which you should still have access to in your Special Reports section) and learn why fractional banking sucks and how bitcoin and the crypto revolution relates to that.

That’s because since the very first day I discovered bitcoin and the years since I’ve continued to research and understand this industry, I’ve always stood by my view that bitcoin in particular is the hedge against financial crisis and calamity.

It is your risk policy for the collapse of the banking system. A panacea to the uncertainty of the convoluted and corrupted global financial system.

So when the entire global banking system once again is on shaky ground, we would expect bitcoin, and then the rest of the crypto market, to counter that risk and shoot higher.

Which is exactly what has happened.

When bank after bank began to implode, the initial shock of it all sent the values lower, which was expected, but the realisation of the benefits of a decentralised monetary system then started to bubble back to the surface.

And while bank stocks around the world cratered, bitcoin went from around $19,500 to over $26,000 over the space of three days. In fact, bitcoin began trading at highs not seen since July 2022.

In short, while the TradFi banking system was imploding in on itself, bitcoin and crypto proved exactly what it was designed for: to be an alternative to the centralised traditional banking and financial system.

TradFi is pushing back hard (as expected)

In the wash of these bank collapses, there’s some suggestion that with Signature Bank in particular, there was actually no reason for the regulator (in this case, the Federal Deposit Insurance Corporation) to shut the bank. Signature Bank believed it was able to avoid the run and continue operations.

Regardless, the FDIC closed the bank and it’s done. But the belief is that the push to close Signature Bank was more about a statement to the crypto industry that regulators would be pushing back hard and making traditional banking relationships near on impossible to maintain – at least in the US.

Whether or not that’s true is one thing. But there’s some ammunition to support it.

For example, if you’re a Binance customer, you may have got an email in the last week explaining that Binance would no longer be facilitating GBP deposits and withdrawals.

While this is widely reported, and a few of you have written in to me about it, I actually haven’t received or seen the email yet myself.

At any rate, it appears that on 22 May, Binance will no longer allow GBP deposits or withdrawals thanks to its banking partner, Skrill.

This might seem like a big problem, but it’s not. According to Binance, it’s only GBP – which suggests the UK regulators are really not liking Binance – so fiat deposits and withdrawals in other currencies are ok.

All other Binance operations that are allowed in the UK are still operational. So if you wanted to trade crypto, and send it into and out of Binance, that’s all fine still too.

But it should also be noted, Binance is one of many exchanges you can use. There’s Kraken, Coinbase, Bitpanda and Gemini available too, where you can get money in and out of exchanges if you so wish.

There’s so many exchanges and fiat on-ramps and off-ramps that this isn’t really an issue at all. And if you’re keeping funds on Binance and this is going to cause you problems, then I ask, have you been listening to us at all?

We will remind you that you should never keep fiat money or crypto on exchanges unless you’re making a trade. If you do, we’ve repeatedly warned for many years about the third-party risks that entails. If you continue to do so, then that’s a risk you must accept.

All in all, it’s been another wild week in markets, with volatility in crypto prices. But overall, the way in which the market has been behaving is exactly what we’d expect in these conditions. And it further emphasises our view of the set-up that we’re seeing for 2023 as it takes us towards the next big bull market cycle.

As it stands, things are heading where we’d want them to. And that’s exciting for what comes next.

Reader Questions & Answers (Q&A)

The new format of this publication is… interactive.

That means that we both encourage you to send in your questions.

Questions can be to either or both of us. They can be about stocks, a particular technology or industry, crypto, or a “boots on the ground” research mission.

Questions & Answers is a key part of the publication.

Given that we publish towards the end of each month, it may be difficult for us to tackle time-sensitive questions. It should usually be possible for us to address questions that are not time sensitive.

Please bear in mind that we can’t give personal advice. Also, if your question is related to anything operational, like how to change a password on your Southbank login or where to find a report, please get in touch with our wonderful customer services team.

When sending in your questions, please acknowledge you’re happy for us to republish it. Don’t worry: we won’t be using any names or initials, just the questions.

We can’t guarantee to answer all reasonable questions – particularly if we receive a huge number: however, we will do our best, and may follow up directly with you.

Please send them in: [email protected].

Question: I’ve recently read about how gravity batteries could solve many of the problems that today’s batteries face today. The storage solution is complex, but this method is cheap, simple, uses no expensive rare minerals, and is ready to go. I think some research into available investment options will prove worthwhile. Over to you.

Answer (James): Gravity batteries work by using power from renewable energy projects to lift a heavy weight into the air or to the top of a deep shaft. As energy is required, winches are used to lower the weight, producing electricity from the movement of the cables. This means that intermittent energy from renewable projects can be stored in an alternative way from traditional battery power for use during peak demand times.

This all sounds fine in theory, but I’m sceptical whether gravitational storage/batteries will ever work in practice. Over the last decade, multiple gravity startups have launched, failed and then reappeared in different forms. Things might change but up to now gravitational storage has required too much metal, concrete, too much land and too many moving parts to make sense. I’ll keep an eye on how the market develops though.

Question: Much has been written in journals including those from Southbank, regarding the impending shortage of copper verses expected increase in demand, together with how long a new mine takes to get from initial discovery to production. This must be widely discussed and accepted within industry, so do you see any evidence within the tech or industrial world that alternatives to copper wiring are being researched or trialled/developed. How do you guys see industry tackling this copper shortage issue?

Answer (James): I touched on this in January’s issue. Aluminium is a common alternative to copper for electrical wiring, especially in long-distance lines where the lower cost and weight of aluminium offer advantages to copper. Aluminium is only about 60% as conductive as copper, but just one-third the price and weight, meaning that it is ready and waiting to take market share if copper prices rise too much. There could certainly be some interesting investment implications on the back of this.

What else we’ve been looking at this month

Sam:

We peak at six and it’s all downhill from there

I’m fascinated by the brain. Without it, we’re nothing. If we mistreat it, we get messed up. If it starts to fail us, life gets exceptionally hard.

Also somewhere in there is “us”. Who we are, why we are, every fibre of our existence is controlled by the grey matter in our noggins. It is part robotic, doing things for us we don’t even know we’re actively doing, yet it also lets us have control about things that for some reason it determines we should have control over. We are at the same time under the control of our brain and also in control of our brain.

Do you see why I’m fascinated by it? We know a lot about it, but also so little. We endlessly research it and discover what it’s about and what it can do. That is why when I come across articles like this (it should be free) then I’m all in from start to finish.

I highly recommended giving it a read for further insight into how our brains work and how they change over time.

Everything is weird at first, until it isn’t

I remember a school fête one year when I was a kid, where a company had brought in this really big, weird-looking machine. It was very futuristic. It was a virtual reality (VR) game. You could jump into this large enclosure, put on a (massive) VR headset and explore this platform “world”. I don’t exactly recall the maker of the machine, but I suspect it was Virtuality as the machine was identical to this:

Source: Virtuality Inc.

Source: Virtuality Inc.

Anyway, it was awesome. I loved it. And it’s part of my lifelong fascination with all things digital and the ongoing evolution of our ever-more digital world.

That’s why in more recent times when the idea of existing in a metaverse has started to gather more momentum and coverage, I’ve not seen it as some “out-there” thing that no one will ever do – I’ve seen it as an opportunity.

Granted, for a lot of people the idea of doing anything in a metaverse is still a weird, strange concept. But you must realise that for a lot of people, it’s quite a sensible thing. And I think it’s something that we’ll see a lot more of in the coming years – so that soon enough, it won’t be weird, it will just be a part of the fabric of society. And here’s the proof of what’s coming…

What would you do if the world went “dark”?

Here’s an article I was reading this month that gave me some pause for thought. What would I do if I were to go “dark”? If overnight the internet was unavailable and for months, maybe years on end, it was inaccessible, how would I manage?

It’s something to think about. Is it something to prepare for? Maybe. There’s certainly something to be said for a few “internet down” redundancies. But what better way to think about what to do, than to read about what happens in the real situation.

There’s a lot to talk about and consider when reading this, and it is something I might look to cover in the near future. But for now, this article (again, it should be free) is well worth a read.

James:

An empire of BS

I’ve got to confess, up until a few months ago I’d never heard of Andrew Tate, the ex-kickboxer, social media influencer and self-professed misogynist who’s now holed up in a Romanian jail. He just wasn’t in my middle-aged orbit. But then, somehow, he started appearing in my Instagram feed in suggested reels or videos for me to view (maybe because I once clicked on a suggested Joe Rogan reel?) and then I couldn’t stop noticing him everywhere.

There was something fascinating about how he had become so ubiquitous so quickly. I found this deep-dive Rolling Stone investigation into how we built his so-called empire a superb read.

Put some trunks on!

As Warren Buffet once said: “Only when the tide goes out do you discover who’s been swimming naked.” The latest example of this is Silicon Valley Bank (SVB), which collapsed earlier this month as it struggled with losses on bonds that were issued before interest rates rose.

What is incredible is the extent of its skinny-dipping. It amassed a $124 billion bond portfolio and then somehow didn’t think it should hedge against the swelling interest rate exposure. The bank reported virtually no interest rate hedges on its massive bond portfolio at the end of 2022, terminating or let expire rate hedges on more than $14 billion of securities throughout the year, according to this Wall Street Journal article (subscription required).

A good friend of mine worked at Bulb Energy, the failed retail energy company that was bailed out by the UK government the previous year at enormous expense to the taxpayer. At the root of their troubles also laid a wholesale lack of hedging – this time against rising energy prices. Both SVB and Bulb previously boasted about their hedging strategies but, whilst frolicking in the water, later shamelessly disposed of their trunks.

Did I tell you the story about being invited into a cult?

Once upon a time, back when I was living in New York, I was invited… sort of… in a roundabout kind of way… into… ahem… a cult – specifically the Nxivm cult/pyramid scheme that covered up as a self-improvement company.

When I say invited, it was actually more that I was given the hard sell by my then girlfriend’s former flatmate and her friend to attend a workshop Nxivm was holding to recruit new members. They were fully signed-up members already and were quite preachy about it. Obviously, I said no. It was quite obvious even then that it wasn’t what it seemed (I remember saying to my then girlfriend: “If it looks like a duck, swims like a duck, and quacks like a duck, then it’s probably a duck”). So it’s fair to say that I’ve been an interested party into the demise of the cult and that of its founder, Keith Raniere. I watched Seduced: Inside the NXIVM Cult a couple of years ago but not, until the last couple of weeks, the other documentary series on the saga: The Vow. Definitely recommended.

James Allen and Sam Volkering

Editors, Frontier Tech Investor