Your February issue of Small Cap Investigator

29th February 2024 |

- The leader of the AI boom says AI has no future without this “breakthrough”

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

The leader of the AI boom says AI has no future without this “breakthrough”

Sam Altman is one of the co-founders of OpenAI. He is quite possibly the most important person responsible for the explosion of AI into our lives in the last 18 months.

We’re not saying he’s the be-all-and-end-all of AI. After all, this is a world-changing technology decades in the making. But he did aggressively push OpenAI to release ChatGPT to the world, which has since resulted in an acceleration in AI technology that maybe we would still be waiting for if not for Altman.

Altman has been a part of OpenAI now for eight years, going all the way back to when it was founded in 2015.

But what if I told you that OpenAI wasn’t where his true technology passion existed?

What if OpenAI was just his side project. Just a means to an end for a technology even more game changing than what AI is currently unleashing?

And what if you could invest in his true technology vision right now, before anyone knows how?

That’s what we’re diving into this month with your latest recommendation. A way to invest in Sam Altman’s vision for the future. A future that is heavily dependent on AI but requires a technology of magnitudes more importance.

And a technology company of which Altman is currently still president, that you can invest in through the Nasdaq right now, ahead of the masses, before it even lists on the market.

This is stealth investing at its finest and could end up being one of our most exciting recommendations ever.

Energy is everything in the AI race

In March 2022 we began recommending nuclear energy stocks. Stocks that were related to the quite obvious need for a global strategic move towards the cleanest and greenest and most efficient energy source we have on the face of the planet… nuclear energy.

Oil and gas were skyrocketing, wars were being fought and the idea of “energy security” was about to hit the lips of every politician in every country around the world.

This had of course seen the domestic energy prices explode higher. No one was spared from this energy onslaught.

Energy is cheaper than it was at the height of energy panic in 2022 and most of 2023. But it is still significantly more expensive than 2021 and years prior.

The thing about energy is that like most markets it comes down to a demand and supply relationship.

Prices hike when demand exceeds supply and prices retreat when supply exceeds demand.

So what do you think happens to your energy bills when there’s not necessarily a supply shock in energy, but a definitive demand shock?

Not a surge in demand from the household. But a surge in demand from the biggest technology breakthrough we’ve seen since the invent of the internet?

I’ll tell you what happens… with a meme.

The rise of AI comes at a cost.

According to the International Energy Agency (IEA), it’s projecting that by 2026, thanks to the rise of AI, that data centre energy consumption will be double that of 2022. The IEA exclaims it will be roughly equivalent to the entire consumption of Japan.

It’s a relatively simple equation. AI uses millions of semiconductors (in the form of GPUs, CPUs, servers, a whole host of networking and data centre technology). As AI scales higher, the power demands for those processing technologies also rises.

Imagine you had 100,000 GPUs powering your AI engine… and then by the end of 2024 that increased sixfold to 600,000 GPUs because your AI needed more “grunt”.

That would also require a massive demand of energy to get those GPUs whirring away. Note: 600,000 GPUs is about the estimates that Meta expects it’ll be using by year end to power its AI ambitions.

But we already live in a world where energy supply is delicate (to say the least). And where energy prices are continuing to increase at a ridiculous pace.

So, what is the answer?

That’s where the leader of the current AI boom comes into play, Sam Altman.

Sam Altman, before he founded OpenAI, was a lead investor in a start-up company called Oklo. The mission of Oklo is very simple: the development of small, advanced nuclear reactors it calls “microreactors”.

Oklo was founded in 2013. Altman led the company’s seed round in 2015, became chairman, took the company through Y Combinator and has now brought the company to the public markets… sort of (more on that in a moment).

Oklo’s microreactors are designed to be modern looking and simple in design, using reliable, cheaper and easier-to-access materials, are faster to build and install, as well as being clean, efficient and powerful. Importantly, they are specifically designed as power for things like industrial sites, data centres, small communities and defence facilities.

Oklo’s business model is a little different to typical nuclear energy too. The company plans to sell direct to consumers into what it projects to be a $3 trillion market opportunity. With an estimated cost per 15 MWe reactor of just $60 million, Oklo thinks commercialisation of this technology is a big opportunity.

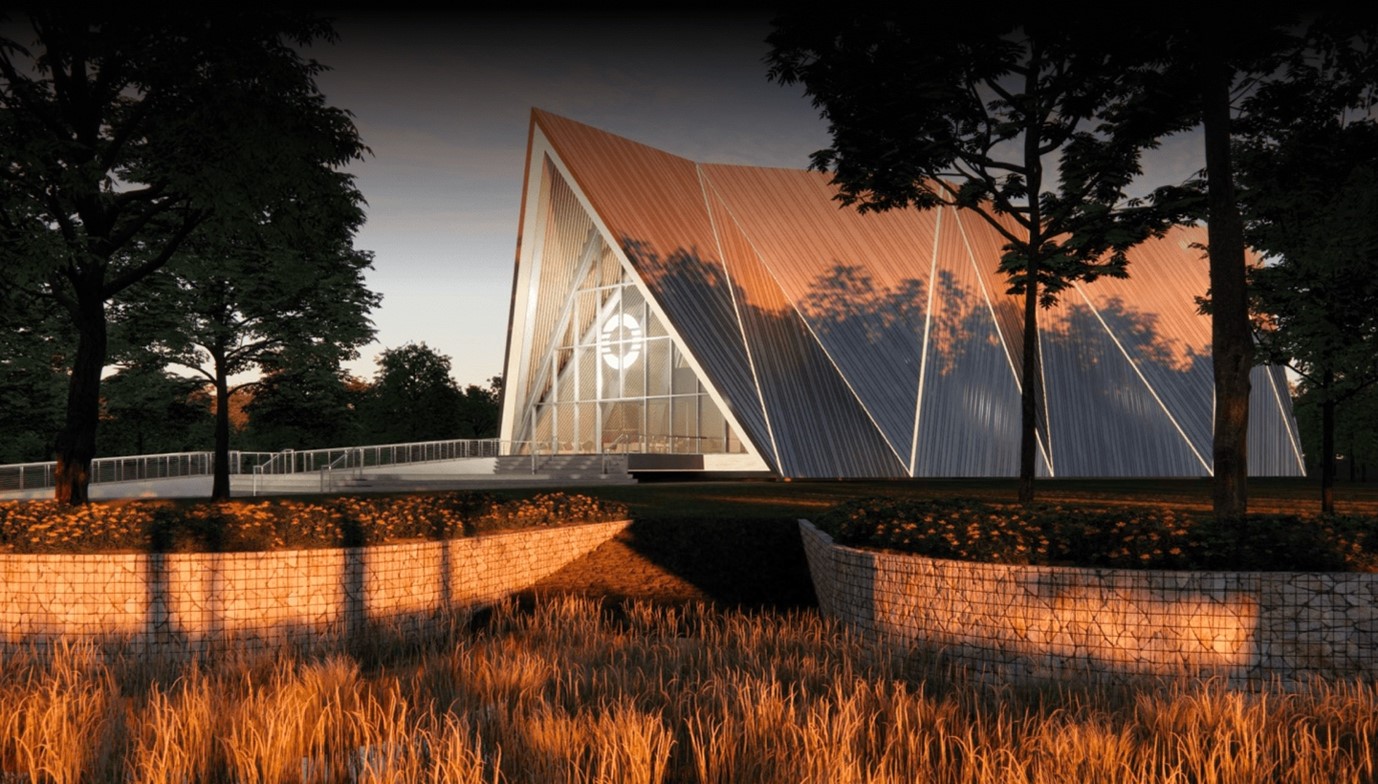

But for us, one of the things that really differentiates Oklo compared to traditional nuclear reactors is the design.

The design is important. That’s because nuclear energy has long had an image problem. The mere site of a nuclear facility (as we know them today) puts the fear of apocalypse into most people.

But what if your local nuclear reactor looked more like a Swiss ski chalet? Our own fear levels have already decreased 10-fold – and we inherently trust and feel safe by regular nuclear reactors!

Source: Oklo

This is Oklo’s Aurora Powerhouse and is the flagship offering from the company. Should the company complete its listing process, the proceeds from its listing and its $850 million pre-money valuation will be put into the first deployment of this “powerhouse”.

Oklo expects the first plant deployment in 2026 or 2027. While that’s some way away, this is a long-term play that we think is on par with what Altman has achieved with OpenAI. In short, we think he is a key catalyst that will help take Oklo to great heights as the AI theme rises, as he become more of a revered “tech mogul” in the vein of Elon Musk and as the world continues to wake up to the huge energy potential of nuclear energy.

As Altman explains,

“My whole view of the world is that the future can be radically better, and the two things we need for that are to lower the cost of energy and lower the cost of intelligence.”

He’s not wrong. And he’s deeply involved in making both of those outcomes a reality.

You latest recommendation is Oklo but via the AltC Acquisition Corp SPAC

You see, Oklo isn’t currently listed on the market.

The company is aiming to be listed in the next month or so. However, right now it’s not actually listed. How you invest in Oklo today is via a special purpose acquisition company (also known as a SPAC) that is in the process of reverse merging with Oklo, which will then form the listed company Oklo after the business combination.

Admittedly it’s a little complex. But when you get your head around what’s happening, you realise that right now – before most of the market switches on – you can invest in what will become Oklo.

The way a SPAC merger like this works is typically through three phases.

Phase one: the SPAC does an initial public offering (IPO) with a cash treasury. This can be anywhere from a few tens of millions to hundreds of millions. It is in effect a cash vehicle.

Phase two: the SPAC goes on the hunt for a private business to merge with. This “business combination”, as it is often referred to, is typically outlined in the SPAC filing by the SPAC targeting a particular industry or opportunity. Then the SPAC management finds a business it likes and wants to list with via this merger.

Phase three: the SPAC and the targeted business agree to merge and go through the regulatory processes of combining the businesses. Then once all is agreed, further capital is typically raised. The merged entity (SPAC + target) relists on the market usually in the name of the target company.

The way this has played out with Oklo is along these lines.

Sam Altman founded and became CEO of a SPAC called AltC Acquisition Corp. That SPAC listed on the Nasdaq under the ticker ALCC in 2021.

The AltC SPAC then went “hunting” for a business to merge with. But all along, considering Altman’s expertise, it was more than likely the AltC SPAC would end up targeting one of the companies he was involved with, be it AI or energy.

As it pans out, AltC decided to create a business combination with Oklo in July last year.

As per the announcement from AltC in July, Altman said,

“I am thrilled to announce this partnership that provides the opportunity for AltC’s shareholders to become investors in Oklo and fund the first deployment of the Aurora powerhouse. I think the two most important inputs to a great future are abundant intelligence and abundant energy. I have long been interested in the potential that nuclear energy offers to provide clean, reliable, and affordable energy at great scale.”

As of the time of writing, the merger hasn’t completed. It’s expected to complete in Q1 2024, which means by the end of March.

If that happens, then the ALCC stock will relist as Oklo.

That means by investing today, you are investing in AltC Acquisition Corp (NYSE:ALCC), with the view that the business combination will complete and your stock will convert to Oklo stock as it relists on the market.

Risks

Now clearly this is high risk. For a start, this is a company that currently is 100% development focused. So, no revenues, and profits, just development costs towards commercialisation.

The SPAC listing fills the coffers with cash, estimated to be up around $1.3 billion. There’s a good chance more capital may be needed down the track, which may dilute holdings.

Furthermore, there’s no guarantee the company can even build and commercialise this technology. Let alone sell the energy and make profits from it.

We’re backing Altman’s ability to take Oklo to the same kind of heights he’s done with OpenAI. And that through his deep connections and standing in tech, getting these powerhouses into the market is a natural progression with the rise of his AI ambitions.

That said, there’s also no iron-clad guarantee the business combination will complete. If it doesn’t and you’re holding the ALCC acquisition company stock, as we’ve seen previous with other SPACs, when they are wound up, the cash in the cash trust is returned to shareholders at par value, which is roughly $10 in this instance.

The stock itself is currently trading at $10.65. Which means that should the combination not occur and cash is returned, you would expect a small loss, but effectively get $10 back per share.

That said, it’s not something we’re expecting. We think the combination will take place and Oklo will list on the market.

We then expect some momentum behind the stock purely for Altman’s involvement, and the thematic investment plays of AI, nuclear energy and the need for both.

We think most of the market misses the fact you can invest in Oklo via the SPAC, but once the listing occurs, that will change.

But expect volatility in this play.

Action to take: BUY AltC Acquisition Corp (NYSE:ALCC) with the view to the business combination with Oklo to complete and your stock to convert to Oklo stock upon relisting.

Current price $10.65. Buy up to $11. We will set a stop loss under this position at $6.

Big breakthroughs

In January this year, Sam Altman, the creator of ChatGPT, said a breakthrough in nuclear fusion would be needed to meet the vast energy requirements of future artificial intelligence (AI).

So it’s not without irony that, just one month later, scientists pursuing fusion energy say they have made a key breakthrough in overcoming one of fusion’s biggest challenges to date – by using AI.

As you might know, nuclear fusion is a process that creates energy by mimicking the natural reactions that occur within the Sun. It involves smashing together two atoms with so much force that they fuse into a single, larger atom, releasing huge amounts of energy in the process.

In fact, nuclear fusion has the potential to provide near-limitless energy, leading some scientists to describe it as the “holy grail” of clean energy.

However, there are many obstacles to such claims – including but not limited to generating more energy than it takes to power the reactors, developing reactor-proof building materials, keeping the reactor free from impurities and restraining that fuel within it.

But that last problem, at least, could now be solved.

Engineers from Princeton University and its Princeton Plasma Physics Laboratory have developed an AI model that predicts, and then figures out how to avoid, plasma – the hot, charged state of matter composed of free electrons and atomic nuclei that fuels fusion reactions – becoming unstable and escaping the strong magnetic fields that hold it inside certain donut-shaped reactors called tokamaks.

If the plasma escapes the magnets’ clutches, the reaction ends, so it’s enormously exciting that the engineers’ innovative AI model can predict and prevent these disruptive events happening in real time.

The team found that its AI controller could forecast potential plasma tearing up to 300 milliseconds in advance, plenty of time for it to then change certain operating parameters to make sustained fusion reactions more stable.

The team published its findings last week in the journal Nature.

Be clear: this AI application not only represents a significant technical achievement, paving the way for sustained high-power fusion reactions, a crucial milestone for efficient energy production, but also illustrates the potential for AI to play a pivotal role in making fusion energy a practical reality.

“The experiments provide a foundation for using AI to solve a broad range of plasma instabilities, which have long hindered fusion energy,” a Princeton spokesperson said.

The findings are “definitely” a step forward for nuclear fusion, said Egemen Kolemen, a professor of mechanical and aerospace engineering at Princeton University and an author of the study.

At this stage, all the authors of the study describe their work as proof-of-concept and write in their paper that it’s still very much in the early stages of fine-tuning. They are hopeful, however, that it could be eventually applied to other reactors, also to optimise the reaction or harvest the energy from it.

This is just the latest breakthrough in fusion.

Earlier this month scientists and engineers near Oxford set a new nuclear fusion energy record, sustaining 69 megajoules of fusion energy for five seconds – enough to power roughly 12,000 households for the same amount of time – using just 0.2 milligrams of fuel.

Although that experiment still used more energy as input than it generated, another team in California managed to produce a net amount of fusion energy in December 2022. The team has now replicated this process three times since.

Of course, despite the promising progress, fusion energy remains a long way from becoming commercially available. But it’s becoming increasingly clear that AI will play a large role in its development.

Buy List update

Saietta (LON: SED)

Last week Saietta’s management dropped a bomb that the company would be formally seeking to sell the company. Even though they had been optimistically putting out announcements about developments and important pipeline deals, they now believe that the company may not be able to “solvently trade” should certain cash receipts not come through.

The ability of management to have ground this highly promising technology company into the ground is quite something. And it leaves shareholders in a horrible position where value is unlikely to ever be recovered.

Even with a sale, there may be even less value to be extracted than what’s available by selling the stock in the market.

Action to take: SELL Saietta

Clean Power Hydrogen (LON: CPH2)

The company released a very positive announcement on 21 February that it had reached a significant milestone with its membrane-free electrolyser testing with Ireland Water. The outcome means the company can progress to the final stages of the factory acceptance test. This means it’s close to the first customer acceptance and validation of its technology.

Yes, the company is high risk. AYes, it’s early stage. But it’s on the cusp of commercialisation of an important energy technology. And whilst the price may be in the red for us, when the stock jumps 50% on an announcement like this, it tells us there’s still potential to recover back to a profit position long term.

The stock remains in our buy list as an open buy for consideration.

Sprott Global Uranium Miners UCITS ETF (LON: URNM) and Yellow Cake (LON: YCA)

Long term we can see the possibility of a problem in energy markets that has nothing to do with oil or gas or solar or wind. The problem may very well be a supply shortage of uranium for the increasing demand for nuclear fuel.

In absence of nuclear fusion, which is still some way away, nuclear fusion remains the most necessary energy technology on earth.

We’ve seen the price of uranium surge in the last year. And this is amplified by the US deciding to introduce the NO RUSSIA bill into US Congress. This is a bill that stands for National Opportunity to Restore Uranium Supply Services In America Act.

Crazy right. Well we talk of energy security, and security of nuclear fuel is a pretty big thing too. Expect this to become a political football too in the coming months, which could further emphasise the pressure on uranium prices higher.

In short, we think that uranium has a long way to run still. Another 100% or more in the next year is a high possibility.

As such, we’re lifting the buy limits on both Sprott Global Uranium Miners UCITS ETF and uranium hoarder Yellow Cake.

We’re now lifting the buy limit on Sprott Global Uranium Miners UCITS ETF to $12, and the buy limit on Yellow Cake to 700GBp.

Cyngn (NASDAQ: CYN)

Cyngn has been progressing with its autonomous AI-enhanced technologies and customer rollouts. Notably a deployment with U.S. Continental of DriveMod Stockchasers has seen the contract renewed thanks to the 4x improvement in efficiency the company found using Cyngn’s technology.

The stock has been a rollercoaster, which for a small-cap, AI-focused autonomous robotics company isn’t a huge surprise. The moves of this stock into profit will be off the back of continued momentum in the AI investment theme, which we expect along with further positive company announcements and more customer deployments.

We also should note the company has been granted a 180-day extension for listing on the Nasdaq. This is due to the stock price trading below $1 for 30 consecutive days or longer. This is typically the minimum price Nasdaq requires to meet compliance for listing.

It’s not a huge concern, as we expect the stock to trade back over $1 in the next 180 days. The company can also do a stock consolidation if necessary to see the price get back into compliance. But it’s worth noting that from here, we think organic trading back to $1 is a feasible outcome for this high-tech, highly volatile stock.

Ashtead Technology Holdings PLC (AIM: AT)

Subsea equipment rental company Ashtead Technology Holdings, recommended at 374p in the July last year, has risen around 4% over the last month to trade at 687p at the time of writing, putting it 84% up in the model portfolio.

On Monday 19 February, the stock hit a new 52-week high of 750p.

Ashtead has a history supplying subsea services to the oil and gas sector but has diversified into the fast-growing offshore wind market.

It is on an ambitious growth journey and making ongoing investments in its subsea equipment rental fleet that has in excess of 23,000 assets.

At the end of November, the company announced it had expanded its mechanical solutions service offering with the acquisition of ACE Winches for £53.5 million in cash.

The stock remains a HOLD while it trades above 395p.

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings is trading around 1538p, 54% down in the model portfolio, with the stock nudging up by nearly 1% over the last month.

European Metals part owns the Cinovec lithium asset in the Czech Republic, one of very few advanced-stage, large-scale lithium projects in the European Union with a mineral resource of nearly 7.4 million tonnes of contained lithium carbonate equivalent.

The project is being developed by Geomet, a joint venture between EMH and Czech-state-owned CEZ.

At the end of January, the company announced the extension of all four Cinovec exploration licences on Monday, until 31 December 2026.

The AIM-traded firm said the licences encompass all three granted preliminary mining permits (PMPs) for the Cinovec Project.

The necessity for the extension arose from the limitations of the granted PMPs, which, although granting sole and exclusive rights to apply for a final mining permit, did not permit further drilling until the final mining area was granted.

Given the company’s intentions to conduct additional metallurgical and measured resource drilling, an extension for the licences, originally set to expire in December 2023, was sought and granted.

The stock has continued to take direction from a depressed lithium market that has seen prices fall by around 70% over the past year as EV sales growth slowed and new supply hit the market.

However, there are signs that prices of lithium ore spodumene are starting to level out, with producers reporting a pick-up in buyer interest in recent weeks.

We can certainly expect EV demand to pick up if the US Federal Reserve cuts rates later this year. With EVs expected to make up about half of new car sales worldwide by 2035, according to Goldman Sachs research, we’ll see continued demand for lithium over the longer-term.

Global EV sales declined 26% month over month in January, but grew 69% in the first month of 2024 on an annualised basis, according to data compiled by consultancy firm Rho Motion.

In the case of European Metals Holdings, the company is expected to deliver a definitive feasibility study (DFS) on the project in the first quarter this year.

The stock remains a BUY below its 45p buy limit.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF has risen by 9% over the month to trade last at around £6.44 at the time of writing, putting it around 28% below our £8.96 entry price.

LITG has significant positions across different parts of the lithium supply chain, including in lithium heavyweights such as Albemarle, Tesla and Mineral Resources. This helps cushion it against lithium price volatility. For example, if prices fall, that’s a negative for producers but a positive for companies that buy lithium to make value-added products.

The ETF invests in the full lithium cycle, from mining and refining the metal, through battery production. It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.

By owning mining, refinery and battery production companies in the fund, Global X has its fingers in multiple parts of the lithium industry.

Although the lithium market is depressed right bow, it should certainly benefit from heavy demand for lithium. After all, without lithium, we can’t build EVs or have the green future that countries are demanding.

LITG remains a BUY.

Central Asia Metals (AIM: CAML)

Central Asia Metals (AIM: CAML), a mining company with operations in Kazakhstan and North Macedonia, has fallen 7% over the last month to 154.55p at the time of writing, still leaving it 40% underwater in the model portfolio.

The group’s principal business activities are the production of copper at its Kounrad operations in Kazakhstan and the production of lead, zinc, and silver at its Sasa operations in North Macedonia.

Amid an ongoing lack of news, the stock has continued to take direction from a weak copper market, where mine closures and disruptions have started to change the landscape for copper supplies.

Metal prices in general corrected heavily in the last 12 months owing to macroeconomic weakness. But they are expected to rebound, partly because it is increasingly difficult to permit new mine builds – a factor that is also depressing company valuations.

However, there are signs that the copper market is starting to pick up.

Three-month copper on the London Metal Exchange was trading near a three-week high of $8,548 per metric tonne on 21 February.

Prices could also be supported by potential Federal Reserve interest rate cuts.

CAML remains a BUY under 310p.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company, which invests in UK forestry and afforestation assets, has fallen 13% over the last month to around 67p at the time of writing, putting it around 38% down in the portfolio.

A decline in land values has impacted the investment company and with the firm not reported any significant news this year, I’m moving it to a HOLD in the model portfolio.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation, the world’s largest gold miner, is trading around $29.87, down 13% on the month. The stock is now 54% below our $65.39 entry point.

Towards the end of last week, Newmont said it intends to divest eight non-core assets and trim its workforce to cut debt following its $17.14 billion purchase of Newcrest.

Newmont said it aims to realise over $2 billion in cash from portfolio optimisation with Newcrest and will focus on growing its tier-1 assets as part of its transformation strategy.

The company is eyeing near-term debt reduction of $1 billion. Newmont had a total debt of $8.8 billion at the end of last year.

The gold major reported a net loss of $2.5 billion, driven by $1.9 billion in impairment charges, $1.5 billion in reclamation charges and $464 million in Newcrest transaction and integration costs.

However, revenue for the year remained stable at $11.81 billion.

Adjusted net income came to $1.41 a share, as the company beat quarterly profit estimates.

This year, the miner is targeting gold production of 6.9 million ounces for the total Newmont portfolio, underpinned by 5.6 million gold ounces from the tier-one portfolio.

Newmont remains a BUY under $100.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has enjoyed a good month, rising by nearly 14% to nearly 321.10p at the time of writing, putting it 1.3% up in our model portfolio.

At the start of February, shares jumped after Mondi said it was in the early stages of considering a possible all-share bid for its smaller rival DS Smith, a move which could create a packaging giant worth more than £10 billion.

DS Smith also disclosed that it received a highly preliminary expression of interest from Mondi, although no formal proposal.

“The board of DS Smith notes the recent media speculation and confirms that it has received a highly preliminary expression of interest from Mondi plc regarding a combination with DS Smith,” the business said in a statement to investors.

With paper and packaging a very fragmented industry, Mondi’s interest in DS Smith is neither a surprise nor even the first time such a tie-up has been mooted.

In February 2021, Bloomberg reported that Mondi was weighing a £5 billion takeover of its rival.

After seeing a pandemic sales boom on e-commerce demand as online shopping took off, paper packaging firms have suffered from low volumes and prices in the past year as customers de-stocked amid tough market conditions.

Mondi is now required to announce a plan to make a firm offer for DS Smith by the close of play on 7 March, or confirm that it does not intend to bid for the business.

We will keep you informed. In the meantime, the stock remains a BUY.

Kraneshares MSCI China Clean Technology Index UCITS ETF (LON: KGRN)

Kraneshares MSCI China Clean Technology Index UCITS ETF, recommended at $24.83 on 12 October, the day it listed on the London Stock Exchange, was last seen at $21.39, putting it nearly 14% down in the model portfolio. It has risen by around 13% on the month.

KGRN, which tracks the MSCI China IMI Environment 10/40 Index, is the only UK-listed ETF to specifically tap into China’s cleantech industries.

China remains by far the biggest spender in the clean energy transition with $676 billion spent last year.

In fact, China installed more solar panels in 2023 than any other nation has built in total, adding to a huge renewable energy fleet that’s already leading the world by a wide margin.

The country added 216.9 GW of solar last year, a huge increase from its previous record of 87.4 GW from 2022, and more than the entire fleet of 175.2 GW in the US, the world’s second-biggest solar market.

Wind-energy installation additions were 76 GW last year, more than the rest of the world combined.

I’m certainly happy with exposure to some of China’s world-leading manufacturers of clean-energy technology, from solar panels and wind turbines to electric vehicles, in our portfolio.

The ETF is a BUY below $26.83.

NET Power (NYSE: NPWR)

We recommended carbon capture company NET Power at $9.49 in the November issue of Small Cap Investigator. At the time of writing, it is fetching $7.86, putting it 17% down in the model portfolio, with the stock falling 12% over the last month.

As you’ll recall, NET Power has developed a natural-gas power plant that makes it easy to capture carbon dioxide released by the burning of natural gas.

The stock has suffered from a lack of newsflow so it will be interesting to see what the company announces when it releases its fourth quarter and year-end 2023 financial results on 11 March.

The stock remains a BUY up to $11.

Stellantis NV (NYSE: STLA)

We recommended multi-car brand giant Stellantis at $22.84 in the last issue of Small Cap Investigator. At the time of writing, its shares are trading at $26.18, putting it 14% up in the model portfolio.

Stellantis reported in the middle of February that its net profit rose 11% last year to €18.6 billion and sales increased 6% to €190 billion – excellent figures that have helped propel the shares to record highs and prompted the firm to announce a €3 billion share repurchase plan.

Netherlands-headquarterd Stellantis’ mass-market brands include Jeep, Peugeot, Fiat, Citroen, Opel and Vauxhall. Other marques include premium wannabes Alfa Romeo and DS, and the iconic Italian luxury-sports car maker Maserati.

In an important milestone for the car industry, Stellantis is now turning a profit on EVs, with the company’s CEO declaring it will not cut back on producing EVs.

Some of Stellantis’ rivals have struggled to make money on EVs even as demand has grown.

“Stellantis’ strategy is very different… from the other competitors from Detroit. We’re keeping full speed on electrification,” CEO Carlos Tavares told journalists after the company reported its third straight year of record profits since the merger of Fiat Chrysler and PSA Group created the company in 2021.

Stellantis, which makes vehicles at its US plants under the Jeep, Ram, Chrysler and Dodge brands, has been selling EVs in Europe, but will introduce its first EVs to the US market this year.

The stock remains a HOLD while it trades above its buy limit of $23.50.

Inside the lives of James and Sam

Sam:

February is always a busy month for me.

Add to the mix that it’s a couple days shorter than your typical month (even with a leap year) but it’s hectic as there’s several birthdays in the family and always a bit of extra work jammed into the 29 days we’ve got.

And that’s exactly how it played out.

Birthdays and birthday parties for the kids every weekend of the month. Some of the days had multiple parties, which meant splitting the gang, one to one, one to the other. Party bags, a few drinks, lots of soft play centres… good times.

Then, of course, the birthdays of the rest of the family, so more parties, dinners, lunches, cakes, presents and general mayhem!

Then I got a nasty bout of bronchitis (still trying to clear it) which made things additionally more hectic.

However, as fun and frantic as things have been, I also managed to get on a plane, fly back into the UK and get into the studio for one of the most important recordings we’ve done for a while.

That’s me in the studio, just after wrapping filming on a special broadcast where I talk about how big and significant the AI boom is going to be. Not just another tech trend to dabble in, but a world-changing explosion of opportunity for those switched on to what’s happening.

You may have seen that broadcast already. But if not, I suggest you do, right now, as there are three AI stocks that I’ve targeted with the trusty help of our exclusive AI-investment assistant, our Predictive Analytics Machine (PAM). They’re red-hot, flying fast and a must buy for investors at the start of 2024.

It’s why we’ve made sure to highlight a bunch of AI-related and AI-focused stocks here in our own buy list too. And why it’s an area of opportunity we’ll continue to highlight and look at where we can unlock big potential plays in the market, just like we’ve seen earlier with our Oklo recommendation.

But with February over, March is probably going to be just as hectic, albeit thankfully not so many birthday parties on the weekends (at least for now).

James:

I’ve just returned from a short three-day skiing trip to the French Alps.

You might remember that my partner and I jointly own a two-bed apartment in Avoriaz with my twin brother and his wife.

We bought the apartment back in February 2020, one month before the resort, like the rest of the French Alps, closed for the better part of two years due to sweeping Covid-19 lockdown measures – so it’s fair to say that it’s not yet lived up to expectations as an investment property.

It’s also been a struggle to rent the property out this season – though for an entirely different reason: a severe lack of snow for most of this winter.

In fact, many resorts across Europe have battled unseasonably high temperatures, resulting in historically low levels of snow.

According to our agents, it’s been the worst season for rentals in both Avoriaz and nearby Morzine in at least the last seven years, with many of their properties currently sat empty at the height of the ski season.

Even though there’s been recent snowfall, the lack of snow in January and early February is still putting people off booking in the second half of the season, they said.

In fact, February is now on course to become the hottest since records began.

The duration of snow cover across the Alps is now 36 days shorter than the long-term average, cutting effective ski seasons shorter and shorter each year, a study claims.

Of course, global warming could spell disaster for many low-lying ski-resorts in the future, but it’s also to say there are other factors at play causing the so-called “big melt”.

Currently, the planet is in the midst of an El Niño – a phenomenon in the Pacific Ocean where changes in pressure cause warm water to flow east, bringing with it excessive heat.

It happens naturally on a fairly regular basis and is often followed by a La Niña which, in contrast, has a global cooling effect – so I for one am hoping this arrives sooner rather than later to counter the sorry picture coming out of some of Europe’s favourite resorts.

In our case, Avoriaz is the highest mountain resort in the vast Portes du Soleil ski area, so selfishly I’m hopeful it will be one of the last to feel the full effects of potentially warming temperatures over the longer term.

There are certainly some ingenious methods resorts are trying out to ensure resorts are tackling climate change, from helicopters stealing snow to giant fields of ice covered in fleece, so fingers crossed human enterprise will keep all resorts open for a long-time yet.

Certainly, my recent trip to Avoriaz highlighted just why I enjoy skiing so much. I went with my brother and three friends and, as well as some rather leisurely skiing, we enjoyed more than one meat fondue and cheese raclette, washed down with a glass or three of red wine.

I can’t wait to get back.

Crypto Corner

Sam:

This month’s crypto update is about getting yourself ready. Ready to treat this bull market cycle as you should… like all the others.

It is a reminder that there are two main things to focus on as this bull market gets going.

- When it runs, it will be hard and fast so be prepared.

- Take profits on the way up.

I’ll start with point 1.

Chances are this bull market is going to be exactly the same as the previous four.

I was messaging my brother today and he was asking me (again) how long ago it was that I had priced up a bitcoin mining rig but then decided it wasn’t worth the expenditure and risk.

He thought it was 2013. I sighed. It was earlier. It was 2011.

A couple years later I had been writing about that period, here’s what happened…

In 2011 bitcoin relative to the USD was in a bubble. It had increased almost 10,000% in just six months. At the time I was working as a financial adviser. I’d been researching bitcoin since 2010.

I’d been talking to a colleague of mine Daryn about it. We’d thought about setting up a mining rig. And after the price spiked, we figured it was easy money, we would have paid off the equipment in about two months once set up.

Our idea was to get bitcoin and sell it back into USD. Then I didn’t realise it. But in doing that we would have been part of the problem bitcoin faces. Then the price fell and fell and fell.

We weren’t so confident getting bitcoin was a good idea. After all we were both (thought) we were pretty smart financial guys. But that insane volatility was just not workable.

By October the price was back under $3. We decided between full time work and the initial outlay for a mining rig mining and trading bitcoin wasn’t for us at the time. A year on and we were pretty happy with our decision. Bitcoin had really done nothing, was stable, and was looking more like a normal currency.

All up we were looking at about a $3,000 mining rig. The payback at $30 per BTC was quick. At $3 not so much. But if it continued back to $1 and then to 30 cents as I’d seen it rise from, the payback might have never come.

The reason I write this is because that was my first bitcoin cycle. That cycle repeated again in 2013. At the time you think, “This time will be different”. But it’s not. And the thing about the 2013/14 cycle is that now we were also dealing with the phenomenon of altcoins.

Then the 2017 cycle wound up. And it was a monster, bigger than anything prior. And again, you can’t help but think, “This time will be different.” But it’s not. And again, the cycle plays out.

Then it happens again, as it did in 2021. Again, “This time will be different.”

Guess what?

It’s not.

As we approach what is now the fifth cycle, again it will reach a point where the calls will be, “This time will be different.”

And once again, it won’t be.

Now it’s worth saying that along the journey, cycles or no cycles, bitcoin long term has gone in only one direction. I’m suggesting that pattern doesn’t break. It will of course cycle higher and lower, but for me it’s still the best asset that you’ll likely ever own long term.

But be forewarned, most people will pay top dollar in this cycle, be annoyed that for the next couple of years they’re underwater on that and then the sixth cycle will roll through again.

And yes, there are big institutions in the game now. There are different themes, catalysts, awareness, adoption, etc. But in my eyes, it will not be different. The cycle will again play out.

In the altcoin space, that means you need to be ready to move, fast, know when enough is enough and know that if the cycle plays out again as it has done time and time again, you want to be holding virtually nothing as the slide into a winter comes.

I would say the only thing you’ll want is bitcoin, and probably Ethereum. But in this cycle, if you’ve got bags of altcoins, be looking to maximise your profits, and then look to roll those into bitcoin and/or Ethereum.

Which leads me to point 2.

In the stock market we marvel at how in a year a gigantic tech stock like Nvidia can rise 200% or so. In crypto if you don’t 5x in a month if feels like you’ve underperformed.

Reset your expectations.

If you’re getting 5x, 10x from a position, you’re a marvel. The chances of hitting 10,000%, 100,000% or 1,000,000% from a position are so rare that it’s more than likely you’ll hold bags and “roundtrip” them to pennies. This is what happens with high risk, volatile assets like crypto. So if you’re not prepared for that risk and volatility, then you probably have no business in this market.

Set exit points along the way. And even if you take a big win of a few hundred percent, celebrate that, and move on. Maybe it pumps another 5x or even 10x. Chase that higher and you’re destined for failure.

Or at the very least de-risk your initial capital along the way, and then free ride some positions in the event that some of them do, “do an Axie” or “do a SHIB” and rise to eye-watering levels.

You will have a window of weeks and maybe months with some of your altcoins. Take your profits as the market rises. No one was even sad they made money of an investment. You can cry spilt milk of what could have been later. But I guarantee you a 1,000% gain that could have been a 10,000% gain is far better than a 100% loss.

So, in short, when the FOMO kicks in when the market really goes flat-knacker-bonkers, be ready to exit, to sell to de-risk capital – but always keep stacking those sats.

What else we’ve been looking at this month

James:

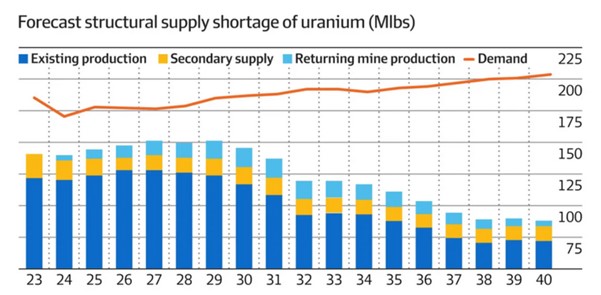

If you’re a uranium investor, you’ll love this chart

If you’re invested in uranium, you might enjoy staring at this chart for a while.

Source: Tribeca, Bloomberg, Paladin

Whilst doing so, perhaps ask yourself the following question: in what year do you see uranium supply meeting demand?

The answer should be obvious: not any time soon.

It will certainly take a lot of supply from existing production, new mines, new discoveries and some new secondary sources to even start to fill the gap.

I stumbled upon the graphic while reading an article entitled “Uranium’s renaissance brings big opportunities for investors” in the Australian Financial Review, dated 8 February.

The chart is attributed to Tribeca Investment Partners’ nuclear energy portfolio manager Guy Keller, who is well known in uranium circles for his ability to distil yellowcake’s investment case into easy-to-understand graphics.

In the article, Keller says the rising cost environment means the marginal cost of production for uranium is now far higher than $75 a pound, meaning it’s theoretically uneconomical to bring new projects to market unless the price is significantly higher.

“At these prices we’re still not even solving the supply deficit created yesterday,” says Keller.

“And we must also solve the deficits for today, tomorrow and out to at least 2030,” adds Keller, who forecasts uranium to jump by about 70% this year to $175 a pound.

Much to unpick in BloombergNEF’s annual Energy Transition Investment Trends report

Last year broke all records for renewable financing, but at $1.8 trillion the sector still lags far behind where it needs to be.

That was perhaps the headline conclusion from BloombergNEF’s annual Energy Transition Investment Trends report that found global investment in clean energy sectors rose 17% in 2023 to almost double 2020 levels of investment.

However, energy transition investment spending needs to grow more than 170% if we are to get on track for net zero in the coming years, according to the report.

Even so, with total investment in the energy transition now setting records every year for a decade even as the cost of clean energy has fallen, then each dollar has bought more and more each year, so it’s fair to say these numbers are still extremely impressive.

Other highlights from the report include EV investment taking the lead with the largest sectoral investment, growing 36% year on year, knocking renewables (which were up 8% too) out of the no.1 slot. Hydrogen investment doubled while carbon capture and storage tripled, though both sectors are small in comparison.

Meanwhile, the global wind sector saw a record investment year, begging the question that perhaps the doldrums we’ve seen in the US are unique or even if the pipeline is rebuilding for projects to finish in 2024.

China represents 38% of global energy transition investment in 2023, which is by far the largest market globally, though the US in second place is closing the gap.

The fastest growth, however, is in US, UK and Europe, which collectively represented more energy transition investment than China for the first time in many years. Saying that, the US Inflation Reduction Act is expected to drive far larger investment in 2024 and beyond as subsidy rules were finalised in 2023.

Of the $1.8 trillion in energy transition investment, $1 trillion is clean energy supply investments (vs energy consuming devices/kit). That’s still behind global fossil fuel supply investment, which was $1.1 trillion, but, given the growth rates, it looks like clean is likely to outpace dirty in 2024.

Getting more energy on the wires

As you will be aware, to decarbonise our electricity supplies, countries around the world plan to deploy thousands of gigawatts of new wind and solar power.

To transport this electricity, many hundreds of billions of dollars’ worth of new high-voltage power lines will be needed. But transmission projects in places such as the US can take up to a decade to site, permit, finance and build, resulting in many proposed transmission projects falling by the wayside after failing to overcome the regulatory, legal and financial challenges involved.

But what if I said there was a very simply cure to congested grids that dodges permitting problems, saves money and could potentially bring large amounts of renewables online, but that this seemingly simple option remains largely unused?

That’s the conclusion reached by a recently published working paper from researchers at the University of California, Berkeley, and GridLab, an energy consulting firm, that landed on my desk via an article published last week in newsletter Heatmap.

The solution? Simply replacing the old wires with new, better wires in a process known in the industry as “reconductoring”.

According to the paper, replacing steel-reinforced lines with composite-core lines to carry more energy has the potential to double the amount of electricity the US’s existing transmission system can handle, for less than half the price of building new lines.

In short, reconductoring is a way to squeeze more power flows from already-built transmission corridors. The deployment of new conductors – the cables that carry high-voltage power – could significantly expand capacity on existing transmission towers and along existing rights of way.

According to the paper’s authors, interviewed in the Heatmap article, one reason utilities are already rushing to implement reconductoring is because of a lack of awareness and comfort with the technology.

But that looks like changing, with some interesting start-ups now entering the space.

I think there could be an investable opportunity here, so watch this space.

Sam:

The tech pioneer more important than Elon Musk

Elon Musk is revered as a modern “Tony Stark” (Ironman). And he does deserve a lot of the plaudits he gets.

But for me, Jensen Huang of Nvidia is more important to the way our word works now and in the future. He’s not as out there as Musk, but I take everything he says with great significance. And I believe you should too. It does give you a glimpse of what the most important technology company in the world is working on for tomorrow.

And this is a great piece, an interview with Huang, that’s well worth your time.

New moons!

Our household is obsessed with space at the moment. Both my boys are fascinated with the planets, stars, the galaxies and universe.

So when I was reading that new moons had been discovered orbiting Neptune and Uranus, my attention peaked. And it’s worth understanding how advances in space technology is leading to new and fascinating discoveries all the time. Not just in the wider universe, but still here right in our very own solar system.

Reddit lining up an IPO

OK, this is an SEC filing, so visually its horribly boring. But I was keen to know why a company like Reddit was going to IPO and, importantly, how it’s going to IPO.

When you think Reddit, you don’t think mega-cash-generating tech giant, but maybe, just maybe, there’s more to this one than meets the eye?

As such, reading through the Reddit IPO filing is well worth a long (and at times boring) read.

James Allen and Sam Volkering

Editors, Small Cap Investigator