Your January issue of Small Cap Investigator

2nd February 2024 |

- Buy the automaker at the head of the pack in the great EV race

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

Buy the automaker at the head of the pack in the great EV race

In May last year, we wrote about sodium becoming a viable alternative to lithium in batteries.

A few months prior, Chinese automaker JAC had unveiled a test version of its Sehol E10X electric car that used sodium-ion battery cells and not its better-known and more widely touted counterpart.

In one fell swoop, JAC – and the Chinese company supplying the cells – had joined a host of players in the emerging battery space racing to create a new generation of lower-density batteries that use cheaper raw materials than lithium-ion cells.

As we wrote, despite being chemically very similar, sodium, found all over the world as part of salt, sells for just 1% to 3% of the price of lithium.

The demonstration car had a range of about 250 kilometres (155 miles) per charge and it supported fast charging – so certainly acceptable to most electric vehicle (EV) drivers today.

Sodium, of course, has a particular advantage in the low-cost or entry level EV segment, due to its abundance and chemical nature. Thermal runaway – the chance batteries spontaneously combust when hot – is a key risk factor for lithium-ion batteries, and sodium offers the potential for greater stability and, therefore, reduced fire risk.

Their slightly lower energy density, that helps mitigate that risk, makes them more applicable for the mass market than high-end or critical applications.

Sodium-ion technology is also sufficiently similar to lithium-ion that the same manufacturing processes can be used, making its advancement a seamless development from what’s already operational.

The establishment of new production methods and capacity is a key challenge for more alternative chemistries in development. Sodium’s feasibility and scalability, however, are key advantages.

As we wrote last year, we can certainly expect more advances and more companies entering the space. After all, sodium-ion “hits the holy trinity of being affordable, feasible and scalable”.

We’ve been on the lookout for the smartest way to play the development in sodium battery chemistry for some time – and I’m pleased to say we’ve now found that company.

Just weeks ago, the firm – our latest Small Cap Investigator recommendation – invested in a French sodium battery technology company called Tiamat.

The investment in Tiamat will ensure a sodium-ion battery factory in France gets underway. Tiamat, a division of the French National Centre for Scientific Research, may well be the first company in the world to commercially produce a sodium-ion battery.

Tiamet will begin by building batteries for power tools and energy storage devices and will scale up to “second-generation” cells for EVs, though when that might occur is unclear.

But the company making the investment is no one-trick pony – far from it. Its investment in Tiamat is merely the trigger for my interest.

In fact, the investment forms part of a broad technological push by this automaker, inherent in its innovative and decarbonisation-focused culture, to cut battery weight by 50% by the end of this decade.

It is making the biggest push towards EVs of any of the top original equipment manufacturers (OEMs), and has secured supplies of EV raw materials through 2027 by signing key agreements around the world to support that ambition.

No wonder, then, that the stock is now the largest holding of the hedge fund run by the inimitable value investor Michael Burry (of The Big Short fame), who can certainly see the direction of travel.

The company I’m talking about, and the one I’m recommending today for Small Cap Investigator, is Stellantis (NYSE: STLA).

Stellantis is a much larger and more mature company than we usually look at, so we will go through it in a more methodical and detailed way as the picture is more complex. This will look at six main factors: its business model, strategy, management and backers, financials, competitive advantages and risks.

Let’s get cracking.

The business and operational model behind Stellantis

Stellantis was formed in January 2021 by the merger of Fiat Chrysler and the French PSA Group (Peugeot-Citroen). The full list of brands it has is: Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep, Lancia, Maserati, Opel, Peugeot, Ram and Vauxhall.

It also has two of what it calls “mobility” divisions: Free2Move offers vehicle rentals (short term), and Leasys does business and private vehicle leasing (longer term). Both offer only EVs and hybrid vehicles and focus on renting/leasing Stellantis’ brand’s vehicles across the US and Europe. It also has a financing division for creating and managing auto loans to customers who pay on financing.

Stellantis operates globally, along the full value chain: design, engineering, manufacturing, distribution, and sale of a vehicle. It also builds engines, transmission systems, metallurgical products and production systems separately.

It is perhaps the most ambitious of the traditional auto OEMs when it comes to electrification. It is targeting 100% of European and 50% of US sales to be fully battery electric by 2030, by which time it will offer 75 different electric models across its 14 brands.

Stellantis has set up a system for battery EV manufacturing with four vehicle platforms, upon which branded chassis are then placed. With two different battery chemistries, this gives Stellantis the flexibility to release a wide range of EV models each year across multiple brands, while consolidating production to improve the efficiency of production, thus lowering costs.

Each platform, by sharing the use of certain components and manufacturing processes, is capable of producing over two million vehicles per year. The goal is to achieve economies of scale, whereby the various merged entities – the 14 brands – are stronger together than individually. By combining manufacturing and increasing order size with suppliers, Stellantis can achieve lower costs, and thus, improve margins. The proof is in the pudding and, so far, it seems to be working as profit margins since 2021 have been higher than before the merger – as you’ll see in the financials section below.

The range of its four platforms goes from 500km to 800km, and the four platforms are flexible in length and width, to improve its diversity of offering.

Stellantis possesses key strategic advantages

For Stellantis, its agility, long-term thinking, family ownership and strategic clarity are all advantages against other legacy automakers.

Meanwhile, a cash-generative legacy business, global penetration and relationships, production capabilities, a broad product range, regulatory compliance and brand heritage are all advantages against Tesla and other new entrants.

For years, the EV story has been Tesla against the world. When would the response from the legacy automakers come, people wondered? Well, it’s here.

Stellantis is seeking to capitalise on the paradigm shift that is vehicle electrification, seeking to build cost and competitive advantages through a long-term plan that it is calling “Dare Forward 2030”.

Chief Technology Officer Ned Curic summarised the company’s vision well when he said, “Our customers are asking for emission-free vehicles that offer a combination of robust driving range, performance and affordability. This is our North Star, as Stellantis and its partners work today to develop ground-breaking technologies for the future.”

Why do we like the strategy?

Firstly, it capitalises on a key industry shift, in this case that of vehicle electrification and sustainability, but also technological advancement, the incorporation of software and autonomy, future battery technologies – they are all interlinked, as well as encompassing the entire enterprise.

From financing to rental and leasing, to venture capital – all auxiliary parts of the business are aligned with the core vehicle business in transitioning to a tech-first, electrified future.

Secondly, it has a cash-generative core business to fund it. We see this as an advantage, as it’s less dependent on the market financing a long runway of losses on its path to a profitable EV business. Its existing operations give it the capital needed to execute on what will be, no doubt, a costly and complex transition to an EV-dominated business model.

Thirdly, Stellantis’ advanced EV strategy should protect it from regulatory shocks and setbacks, and perhaps give it an advantage over its rivals. After all, regulations are set to be a big factor in the passenger and commercial vehicle segments in the decades to come, as governments attempt to impose the climate imperative onto one of the largest sources of emissions: road transport.

Finally, it is coherent. From battery developments to software and autonomy, to model releases and China partnerships (which we’ll get onto) – it’s all joined up across every aspect of the company. The Dare Forward 2030 strategy is also an attempt to forge a unified culture from disparate merged entities that will come with their own distinct cultures.

This kind of longer-term, industry change capturing strategy is a hallmark of family-owned businesses, which can afford to invest now (impacting shorter-term financial metrics) and reap the rewards in the years and generations to come.

An impressive cast of management and backers

Stellantis’ CEO is Carlos Tavares, who was the CEO of Peugeot-focused PSA Group before the merger. Tavares was at the helm during the turnaround that brought Citroen back into the fold, and successfully launched PSA Group back into the CAC 40 – the leading French stock index.

What I like about Tavares is that he has an appropriate focus on profitability, saying as recently as earlier this month that Stellantis wouldn’t follow some automakers in the practice of loss-leading EVs, i.e. selling them unprofitably to try and grab market share.

As for Stellantis’ key ownership, the Agnelli family (of Fiat heritage) owns 14% of the company, while the Peugeot family owns 7%. This level of family ownership lends itself to the kind of long-term thinking that has seen these brands survive for 100 years or more, as is the case for ten of Stellantis’ brands.

As for its capital allocation and decision-making, last year’s acquisition of Chinese new energy vehicle mobility company Leapmotor is an interesting signal about management. As well as fitting with its Dare Forward 2030 strategy of accelerating its shift to EV, it also adds technological capabilities and shows just how important China is for the company.

Tavares also has previous success in China at PSA Group that suggest he knows what he is doing, and that Stellantis could perform better than its peers in a critical market.

Overall, Tavares, backed by the Agnelli and Peugeot families, and evidenced by the Dare Forward 2030 strategy and Leapmotor acquisition, have all the hallmarks of a high-quality management team with good long-term financial backing, the kind we are happy to invest alongside.

The financials are impressive

The financial history is interesting. The merger between PSA Group and Fiat Chrysler was completed in January 2021, so all data before that obviously understates its current earnings power. For example, its 213% jump in revenues from 2020 to 2021 was not organic.

Saying that, however it achieved them, the company still earned $180 billion in sales in 2022, up 20% year-on-year. This compares to the current market cap of the company of only $63 billion. The price-to-sales (P/S) ratio is, therefore, really low at 0.35x. Its net profit in the last 12 months is just shy of $20 billion, giving it a price-earnings (P/E) ratio of just over 3x – also an incredibly low figure.

What’s more, Stellantis’ net profit margins have been boosted in the last two years, following the PSA Group merger.

Before they were in the 3%-5% range, since 2021 they’ve been up at 9%-10%. The fact that Stellantis achieved this against a backdrop of supplier/cost inflation and a consumer price squeeze makes it especially positive. This suggests that perhaps there are genuine economies of scale available, and that merging into a larger entity has been good for each of the merged entities.

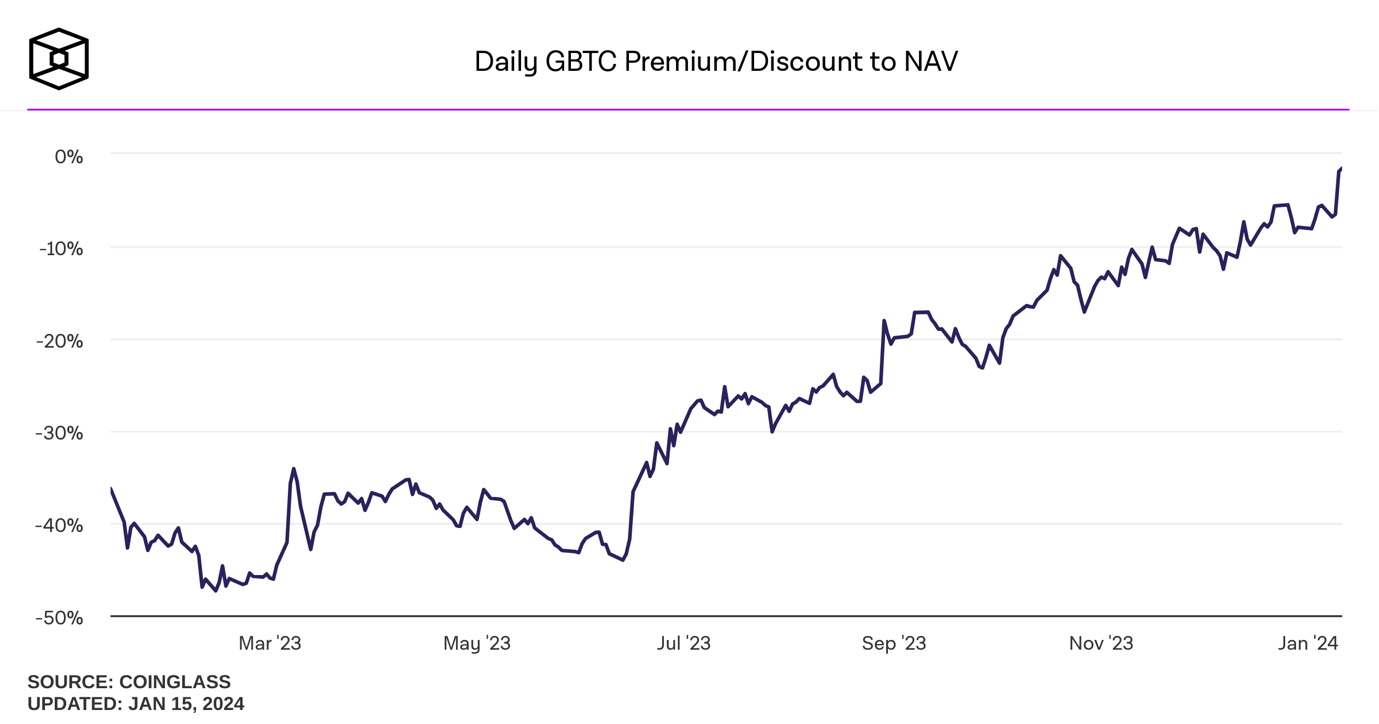

Given that Tesla’s success is a main reason why Stellantis (like every other automaker, frankly) is so incredibly unloved by investors, it’s worth comparing the two: Tesla is on a P/S ratio of 6x and a P/E of 68x. So, on the simplest, most basic comparison, Stellantis is 17-18 times cheaper per unit of sales and 21 times cheaper per unit of earnings.

When you see numbers as extreme as these, it’s best to ask what am I missing? The first thing that makes Stellantis look a little less cheap, in absolute and relative terms, is free cash flow (FCF). Net profits are an accounting measure, FCF is the actual cash generated by the business that year that is available for use – either to grow the company or give back to shareholders as dividends or buybacks.

If Stellantis’ net profit margin gas been 9%-10% for the last 2-3 years, its FCF margin has been around 6%. This offsets a bit of the low valuation, but it seems to be an industry feature.

Tesla, by comparison, is in a similar position of cash flows coming in noticeably below net profit, so in relative terms nothing changes, but it’s important to note that on a cash flow basis, Stellantis isn’t quite as cheaply valued as it first appears.

But it’s not just Tesla to which Stellantis compares favourably

Data based on 19.1.24

Data based on 19.1.24

You can see, in green, where Stellantis rates favourably against its big three competitors – the other traditional automakers. Hyundai and Volkswagen are also cheaply valued, but less profitably and more heaving in debt.

Tesla is a different beast entirely, existing almost on a different planet in valuation terms. Its margins are currently superior, but sustaining them in the face of greater competition from the top four is going to be its challenge.

Some may worry that Stellantis and Co may turn out to be “value traps” – i.e. they are cheap for a reason. I would caution though that a “growth trap” is far more dangerous, a highly valued security, bought widely for its potential future sales, that disappoints on growth. Tesla has a lot further to fall than Stellantis, if its growth disappoints.

Tesla’s market cap, for example, roughly implies 14% growth for the next 25 years (by which time its FCF would be $73.5 billion) on top of a 5% cost of capital… that would be impressive, in an industry growing at 1%-6% (depending on who you ask). Meanwhile, Stellantis’ current $62 billion market cap implies negative growth in cash flows of 7% each year for 25, using a high discount rate of 10%.

Alternatively, if you allow it a 7.5% long-term cost of capital (a more reasonable estimate), and standard industry growth rates of 2%-3%, the present value of future cash flows (over the next 25 years) are equal to $150 billion. In my view, its EV strategy, historic brands, efficient operations and strong management and backers make it likely to grow more than the industry.

Overall, Tesla’s current valuation implies extremely high levels of growth over a very long time period, while Stellantis will prove a good purchase even if growth is slightly negative or flat. That’s a margin of safety.

What’s more, in terms of operational efficiency, it is ahead of the game, too.

At Stellantis, compared to its peers, purchased raw materials are turned into finished products and sold faster, its customers pay it quicker and it waits longer before paying its suppliers. This gives it a negative cash conversion cycle (the speed at which orders to suppliers are converted into cash flow from customer sales). Negative means that on average, money comes in before it goes out. Not even Tesla can match that, let alone the other legacy competitors.

Altogether, this means Stellantis is clearly more efficient than its major peers in the traditional OEM and EV space. Its cash conversion cycle is the best at -23, vs 22 for Toyota, 32 for Hyundai, 70 for VW, and 4 for Tesla.

Stellantis’ negative cash conversion cycle is remarkable, especially given its main rivals do not share it. It suggests hugely efficient production and supply chain management, strong supplier relationships, a responsive dealer network, successful demand forecasting and a lack of product recalls and issues.

To summarise the financials, Stellantis is cheaper, more profitable and more efficient than its peers.

There are some notable risks to consider

Although it’s true to say there is a huge amount going for Stellantis from an investment perspective, it is also equally fair note that the business and the shares face serious risks, too.

First and foremost, recession is a key risk. Two of the world’s three key car markets for Stellantis are currently suffering worse than most: China and Germany.

Economic weakness in is a threat in those markets, and if they export that weakness to other nations, especially America, then the spread of weak demand could compound into a global issue, affecting Stellantis everywhere.

Within economic weakness, specific mention has to go to the EV segment, which has grown exponentially over the last five to ten years, breaking into the mainstream market much faster than so many people believed was possible.

However, as the cost pressures from inflation and the impact of higher interest rates are feeding through to a squeeze on all consumers, the cost of a new vehicle is becoming a hurdle for too many people.

Secondly, competition. The EV market that Stellantis is so focused on dominating is the golden fleece that Elon and all the Chinese argonauts are chasing. Competition will be fierce, and there will be bursts of oversupply that cause deep losses for some competitors.

The other three largest global automakers are Toyota, VW and Hyundai. In the EV space, the main competition is obviously Tesla. It is an old, and highly competitive industry that had been well-consolidated and stable, but is suddenly facing challenges from new entrants riding the wave of electrification.

Tesla has been cutting prices aggressively in the last year, and Hertz is currently flooding the market with additional used car supply. CEO Carlos Tavares recently warned of the dangers of a race to the bottom on pricing, while stating that Stellantis would prioritise margins over volumes in such a scenario, which would avoid weakening to cash generation and brand power of the company.

What’s more, the products (passenger and light commercial vehicles) face a lot of competition and are highly standardised, aside from branding/marketing. They are considered “consumer discretionary”, that is to say they are large purchases for consumers, and so differentiation, quality, curability and cost are all very important. Second only to homes in terms of purchase size and length, cars form a large part of consumers’ image and self-worth.

Thirdly, there is a two-fold transition risk. One, that it takes far longer for full mainstream EV adoption than Stellantis currently estimates, leaving them with stranded assets and no legacy models to fall back on. And, two, that the transition actually cuts out passenger vehicles more broadly and focusing more on public transportation.

E-bikes, for example, may present a cheaper and more functional alternative to a car for many urban-dwellers. We cannot assume that the car remains ubiquitous forever.

Overall, the incredible complexity of building a culture and delivering a long-term strategy internally is hard enough, but doing so in a cut-throat industry undergoing a once-in-a-century shift to EVs just means nothing can be taken for granted in the years to come.

If you’re comfortable with the risks, then Stellantis is a BUY

In summary, Stellantis’ recent formation has given it the possibility of achieving economies of scale, which it is capitalising on through a streamlined production process that is already delivering higher efficiency than its main competitors.

The combination of its technology-orientated culture and electrification strategy – as evidenced by its recent investment in sodium-ion batteries – align well with the long-term thinking of its backers and management.

All of this, built on over a century of accumulated brand value. Pulling it all together, Stellantis has the ability to be highly competitive against peers both new and old over the next decade.

If we then look at its extremely cheap valuation in that context, Stellantis looks like a smart way into the mainstream EV story with huge potential upside from even the smallest realisation of its potential value.

As such, we recommend that you buy Stellantis today.

Action to take: buy Stellantis

Ticker: NYSE: STLA

ISIN: NL00150001Q9

Current price (as of 2.02.24): $22.84

Market cap: $69 billion

52-week high/low: 15.07 – 23.66

Buy up to: $23.50

Big breakthroughs

Sam:

I love the phrase “every overnight success has been at least ten years in the making”.

I’m not sure who said it. Maybe no one did, maybe it’s my own quote. Probably not, but I like it anyway.

That’s because it’s applicable to every piece of breakthrough tech we talk about. Any time there’s a real breakthrough, the reality is the technology has been in development for years. It’s just that the tipping point into the mainstream awareness of it usually comes down to one piece of seminal tech.

The iPhone is a great example of this. By no means was it the first “smart” phone in the market. Nokia had been developing that tech for years. As was Apple and BlackBerry. But what Apple did, and what it’s renowned for, is the simplicity and form factor of the device itself.

That bridge between technology and industrial design is critical to reaching the mass market. But sometimes you can have great industrial design, yet the tech is lacking. Sometimes you can have great tech, but the industrial design is lacking.

The point where the two are in harmony is when we get a significant consumer breakthrough. Off the top of my head, I think of things like the StarTAC flip phone, the PlayStation, iPod, iPhone, Plasma TVs, even something like the Ring doorbell.

This is where tech and function meet to change the game.

The question today is are we at that point where function and design are in perfect harmony with the tech when it comes to augmented reality (AR)?

Apple’s Vision Pro has sold around 200,000 units already after its release this year. It’s now finding its way into the hands of early buyers and tech reviewers around the world.

The cheapest set costs $3,499. I specced up a pair with storage, prescription inserts and AppleCare+ and it rose to $4,574. But assuming the worst case, those 200,000 are at the lowest price point, so at a bare minimum that’s $699.8 million of revenue into Apple’s coffers.

In other words, Vision Pro is a big deal.

But Vision Pro is not the first iteration of AR. And there’s still a big question mark over if this is the device that really takes AR into the mass market. More on that in a moment.

If we’re talking about AR, then it makes sense to wind back the clock to 1962.

Morton Heilig, a cinematographer, created a device called the “Sensorama”.

It is one of the earliest examples of immersive, “multi-modal” (a term you’ll hear a lot today) technology. It laid the groundwork for virtual, immersive experiences.

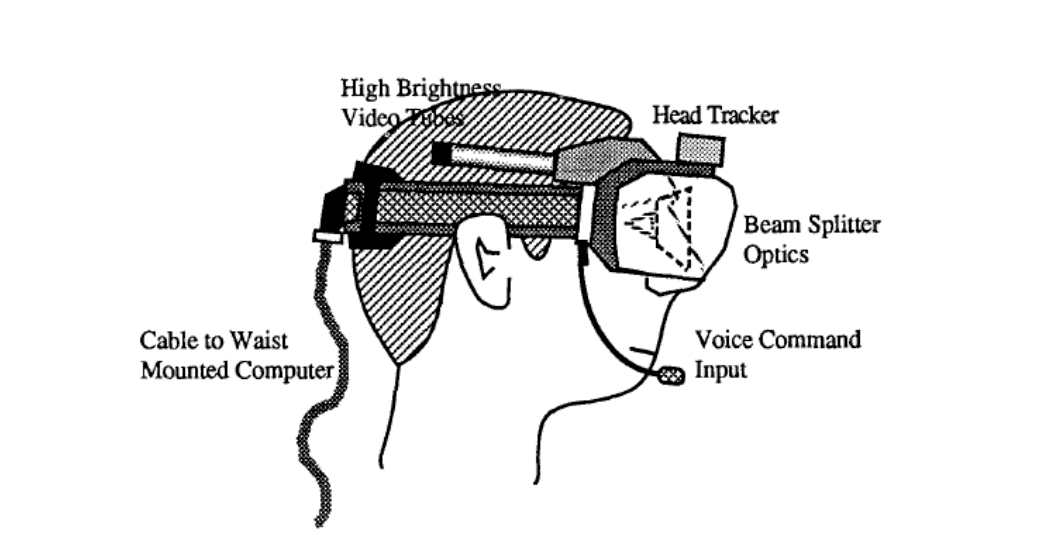

Not too long after, computer scientist Ivan Sutherland developed the first head-mounted display system that was true AR. Although rudimentary (as you can see from this grainy video) it introduced the concept of overlaying computer-generated graphics over the real world.

It seemed like there was a significant break in the progress of AR and virtual reality until the 90s and the explosion of home gaming and the PC took hold.

The term “augmented reality” is believed to have been first used by Boeing researcher Tom Caudell in his 1992 paper, “Augmented reality: An application of heads-up display technology to manual manufacturing processes.”

In the paper he describes a digital display system – the “HUDset” – which is designed to guide workers in assembling wiring harnesses for aircraft.

What’s fascinating about this is the unbelievable similarity to the Vision Pro today.

Remember, this is 32 years ago…

Source: Apple

Source: Apple

The 90s also saw the introduction of Nintendo’s Virtual Boy in 1995. Although this was more virtual reality than augmented reality it showed there was a way to market with a device for the home.

Our publisher, Paolo Cabrelli, sent me a picture of one he came across in a second-hand store only a week ago, for £300. The Virtual Boy packed a game-changing 64KB of PSRAM, 128KB of DRAM and 128KB of VRAM. It also has 1×224 linear arrays per eye to deliver the virtual experience. I note this because I’ll get to the Apple specs in a minute for comparison.

Virtual and augmented reality took a backseat again for a while. It was a case where there was still a wide divergence between the tech, the content and the industrial design. Other technologies were more relevant and fast growing in both gaming and connectivity by this stage too.

Then of course in 2009 the iPhone hit the market. This opened up a whole new world of digital connectivity and engagement.

That is until Google launched Google Glass in 2013. It was the first modern iteration of a device that provided a heads-up display (HUD) with modern features of connectivity and devices like a camera and video recorder, as well as access to apps like Maps and Gmail.

It packed 2GB RAM with a 640×360 pixel “prism projector”. Its design was minimalist, but again, for the virtues of its design, the tech and experience seemed to be lacking. Also amid concerns around privacy, it was eventually discontinued just two years later.

The failure of Google Glass was significant. It was hyped up much the same way Vision Pro is today, but after people actually got to use it, Google never really found a market fit for it.

The idea of wearing a device on your head in this way was also a form factor problem and difficult to get your head around (excuse the pun).

As newer, more high-tech iterations of AR came to market, through Microsoft’s HoloLens and Magic Leap’s device, these looked to find a smaller niche market in industrial use rather than mass market consumer devices.

That was until Apple touted it was moving into the AR space with the release of the Vision Pro. In terms of specs, the Vision Pro uses Apple’s latest M2 chip with an 8-core CPU, 10-core GPU and 16-core neural engine. In terms of RAM it’s 16GB of unified memory.

Compared to Nintendo’s 128KB RAM, Apple is packing 16,777,216KB. That means the Vision Pro is roughly 131,072-times more powerful than the ground-breaking Nintendo device from 29 years ago.

It also has 23 million pixels in its 3D display system. Compared to Google Glass’s 230,400 pixels, it’s almost 100-times better resolution than the ten-year-old AR hype-machine.

Which leads us to today and the Vision Pro. It is game-changing tech that’s for sure. It’s $700 million (so far) of game-changing tech. It’s 131,072-times and 100-times better game-changing tech.

But it’s not the first game-changing tech in the AR realm. Every step forward does change the game.

Virtual Boy was going to change gaming. It didn’t.

Google Glass was going to usher in AR to the mass market. It didn’t.

HoloLens and Magic Leap were also going to bring AR to the masses. They didn’t.

I’ve skipped a couple along the way too, like Oculus and the latest iteration of that with Meta, the Meta Quest. But again, neither of these have really change the game on AR.

And I’m here to say, I don’t think Apple will either.

It’s very good. The tech is undeniable. But like others gone by, the form factor, while pretty, is also quite ugly. While Apple will make a packet from it, that’s more due to it being an Apple product than something people will use every day, day in, day out.

Give it till the end of the year, and we’ll be seeing a lot of Vision Pro’s sat on the shelf, empty of battery and rarely used.

AR will change the game. We will get better devices. Somewhere there will be the ideal form factor and tech convergence – maybe closer to Google Glass’s design, but with Apple’s tech packed in.

But we’re not there yet. We’re closer, a lot closer, but we’re not there yet.

Buy List update

The trading updates and quarterlies are flooding in…

It’s that time of the year when companies are reporting their trading updates. Some quarterly, some half-yearly, some for the full 2023 year.

These include a number in our portfolio.

Team Internet (LON: TIG)

Team Internet’s update was generally positive. It showed growth in both reporting segments, Online Marketing and Online Prescence, tallying up to around US$835 million in gross revenues. That’s a 15% rise from the previous year.

While the company has been in our buy list for almost a year, we’re in a small profit position. We think its focus on AI-based solutions for its customers will help more growth in 2024 – and finally see that stock price really lift off.

It is still an open buy for us while trading under 153GBp.

DotDigital (LON: DOTD)

DotDigital has seen the same kind of direction, seeing headline revenue grow by around 15% for its half-year update. Nothing to blow the roof off, but a solid reporting period in line with the market and board’s expectations.

As the stock is trading over 95GBp it is a hold in our buy list.

Aura Energy (LON: AURA)

Aura Energy noted in its quarterly report the strength of the uranium price which in 2023 saw around a 90% increase. As we’re seeing more and more reports about the need and increasing demand for nuclear energy, the expectation is that the price is not coming back any time soon.

It is key to remember that Aura is a long-term play on uranium. It is an exploration company with significant resources at Tiris, as well as in Sweden. If the Swedish government does clear the path for uranium mining as is expected, it will be a boon for Aura. Due to the positive results from Tiris, the company is looking to expand that further.

We still see Aura as undervalued considering its direct play into the uranium market. While it is trading under 20GBp, it remains an active buy.

Mirriad Advertising (LON: MIRI)

Mirriad Advertising also reported growth in revenue compared to the prior year and positive momentum with growth in the valuable US market for its in-content advertising.

The stock is on hold for us as the price crashed. But fundamentally the technology and offering is good, and we do see a path to recovering the falls in the stock price. Yet due to the risky nature that still remains with the company it does remain on hold for now until we see tangible deals and revenue flow in 2024. In absence of those, then later this year we will likely look to exit the stock if it can’t demonstrate an impact on the underlying stock price.

MPAC Group (LON: MPAC)

Turnarounds of a sizeable nature are possible and do happen. We’ve seen with MPAC Group how quickly that can come about with smaller cap stocks.

MPAC’s stock price is up around 80% in the last month and a half. The company’s latest update reports strong growth, a strong order book and an expected profit before tax for the full 2023 year.

We are still in a loss from our original entry, but things are coming back to level. We still expect MPAC to turn into a profit position for us in 2024.

It is still an open buy for us at this level. However, the current buy limit is wide. As such we’re going to reduce the buy limit down to our original entry price of 525GBp.

Yellow Cake (LON: YCA)

Yellow Cake also reported its quarterly net asset value and operating update. As you would expect, the numbers were all positive as the strength in the uranium price continued.

This is also reflected in the fact that our position is now up 63%. We expect it to rise into triple figures in 2024.

Of note in the update though is that the company estimates its current net asset value as of the end of January to be around £8.40 per share, based on the current spot price, its cash and other current assets and liabilities.

The market is trading shares at £7.27 at the time of writing, indicating a more than 13% discount to its estimate NAV per share. If the spot price continues higher, then we would expect that gap to close somewhat. The main reason for it is there’s still volatility in the spot price. While the nuclear future looks inevitable there’s still pushback and a lot of regulatory risk in the mix.

As one of our stronger performers, it does show that the right idea at the right time can lead to healthy returns.

AB Dynamics (LON: ABDP)

AB Dynamics again is one of our stronger performers. The company certainly is an entrenched player in the automotive safety market. We don’t see that changing soon. This is a strong company with a very specific array of products and services that fits a growing market.

The company is financially sound and its latest full-year report shows that growth is happening too. With increases in revenue, gross margin, operating profit, net cash, earnings per share and total dividend per share, this is a great company to own.

Again, a company that’s performing well, that fits our bigger thematic views, but also that has the potential to deliver growth and a stock price to reflect that. It remains a hold. We also expect it will head higher into triple figure returns for us in 2024.

Ashtead Technology Holdings PLC (AIM: AT)

Subsea equipment rental company Ashtead Technology Holdings, recommended at 374p in the July issue of Small Cap Investigator, has been flat over the last month, meaning at the time of writing, it holds onto its 76% gain in the portfolio.

Ashtead has a history of supplying subsea services to the oil and gas sector but has diversified into the fast-growing offshore wind market.

The stock jumped at the end of November on the acquisition of ACE Winches for £53.5 million, expanding its global capabilities. But that was the last major news. Since then, it’s been business as usual and little has changed in the share price.

The stock remains a HOLD while it trades above 395p.

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings (AIM: EMH) is trading around 15.25p, down 54% in the portfolio, with the stock falling more than 30% over the last month.

European Metals’ Cinovec project in the Czech Republic could become the largest hard-rock lithium deposit in Europe. It has government support and has been given strategic investment by the EU.

Lithium price declines have been the main issue for the stock. China is clearly a big story here, where the weak economy has hit all commodities, especially lithium. But increasing talk of stimulus has stabilised prices in recent months.

The start of this year will be important, as its Cinovec definitive feasibility study (DFS) is expected to be completed by the end of Q1. But in the meantime, we are unlikely to see any material updates. That’s the one to watch.

The stock remains a BUY below its 45p buy limit.

Central Asia Metals (AIM: CAML)

Central Asia Metals (AIM: CAML), a mining company with operations in Kazakhstan and North Macedonia, has fallen about 8% over the last month to 166p, still leaving it down 40% in the model portfolio.

CAML has interests in copper at its Kounrad operations in Kazakhstan and in lead, zinc and silver at its Sasa operations in North Macedonia.

It provided an operations update in mid-January. Copper production at Kounrad was at the upper end of guidance at 13,816 tonnes, and zinc and lead production at Sasa was in the middle of the guided range. The Kounrad solar power plant has been completed and is operational, proving zero-marginal-cost clean power to the site. The Sasa paste backfill plant has also entered operation, which will take the tailings (waste rock) from mineral extraction, mix them with cement and reinject them into the earth. Finally, it was granted a new copper exploration licence in Kazakhstan.

Things are going well, and it has a cash pile of $57 million to support its operations and growth plans, with business development a key priority for 2024.

The stock remains a BUY under 310p.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF (LON: LITG) has fallen more than 11% over the month to trade last at around 589.95p at the time of writing, putting it around 34% down from our 896p entry price.

The exchange-traded fund (ETF) invests across the lithium value chain, from mining and refining to battery production. It tracks the Solactive Global Lithium Index.

As I mentioned above, lithium prices have stabilised just recently. China’s economy has been struggling in the last year, contributing to lithium’s hefty decline from its post-Covid peak price. Things have settled down now, though. The Chinese are talking up stimulus (more on this below), and the worst of the price decline seems to be behind us.

Australian miners have taken the step of cutting production in the face of cuts, suggesting a breakeven point has been reached below which there’s no economic benefit for them to sell their product. It’s better to store it and wait for better prices. This will help solidify a floor under the price and benefit the ETF.

LITG looks oversold. As such, it remains a BUY.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company (LON: FSF), which invests in UK forestry and afforestation assets, is up around 15% over the last month, shrinking the discount to net asset value (NAV) and leaving it 28% down in the portfolio.

The Investment Trust discount story is widespread in the UK, but forestry is a much more stable, inflation-resistant asset than the private, illiquid companies that a lot of them hold. FSF has been unfairly lobbed in with the rest on this front, but I have faith that the underlying assets correspond more accurately to its stated NAV than in many other trust cases.

As such, we are being offered a discount on high-quality, long-term alternative assets. Thus, it’s no surprise to see the discount start to close over the last few weeks.

FSF remains a BUY under 150p.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation (NYSE: NEM), the world’s largest gold miner, is trading around $34.51, down slightly in January. The stock is now 47% below our $65.39 entry point. This is despite gold trading right next to all-time highs, with falling interest rates expected and fears of a recession floating around.

Newmont’s AU$26.2 billion takeover of Newcrest Mining, now complete, gave Newmont even more scale and added copper exposure.

Copper diversifies a gold miner by giving it procyclical earnings power. Copper does well in booms, gold in busts.

It will report fourth-quarter results on 22 February.

Newmont remains a BUY under $100.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has traded flat over the last month to around 282p at the time of writing, now around 11% below our entry price.

That doesn’t include dividends, and its 6.3% current dividend yield actually offsets all of that paper loss, leaving it flat since our recommendation.

Since its half-yearly results in early December, there have been no major updates, but the stock remains a BUY up to the 400p buy limit.

PS. On a separate note, the company warned of an investment scam for paper customers, using its name. You can read more here.

Kraneshares MSCI China Clean Technology Index UCITS ETF (LON: KGRN)

We recommended the Kraneshares MSCI China Clean Technology Index UCITS ETF on the day it listed on the London Stock Exchange at $24.83 on 12 October. Its current price is $18.23, putting it 26% down in the portfolio.

It tracks the MSCI China IMI Environment 10/40 Index, which is the only UK-listed ETF to specifically tap into China’s cleantech industries. China is, in many ways, the powerhouse of clean tech investment and green energy deployment.

The ETF is down well over 50% in the last couple of years, giving us the opportunity to invest in the biggest Chinese energy transition companies at attractive prices relative to history. The price has continued to slide a little since our purchase. We were never going to catch the bottom right on time, but recent news has given me extra hope that we won’t have been far off.

Chinese economic weakness has been the story of the last 18 months. The post-Covid boom never came and, in fact, went the other way. Commodities have suffered, as has been described above. But so far in January, policymakers have been signalling new and increased forms of stimulus with increasing regularity, suggesting they’ve reached a point of discomfort with economic and stock market performance. While that suggests genuine concern, the first step to solving the problem is admitting you have one – something the Chinese authorities occasionally struggle with.

The long-term prospects for the Chinese economy remain strong, especially for clean tech where it is such a determined investor and leader.

The ETF is a BUY below $26.83.

NET Power (NYSE: NPWR)

We recommended carbon capture company NET Power at $9.49 in the November issue of Small Cap Investigator. It’s fallen slightly and is now priced at $8.90, putting it 6% down in the portfolio.

NET Power has developed a natural-gas power plant that makes it easy to capture carbon dioxide released by the burning of natural gas.

Not much has changed since the original recommendation a couple of months ago or since the last monthly update.

The stock remains a BUY up to $11.

Inside the lives of James and Sam

James:

I can’t lie: 2024 hasn’t got off to the best of starts.

I’ve been laid low for much of January by a bout of dengue fever.

I was infected with the tropical disease during a family holiday to (and violins at the ready, please) sunny Barbados over the festive period.

My entire family was on the trip – 18 of us in total – and half of us ended up contracting the mosquito-borne disease at some point during our stay on the island.

My twin brother was the first to fall ill on New Year’s Day, followed by his wife, my partner Deborah and one of my nephews.

All complained of high fever, headache, joint and muscle pain, rash and fatigue – and basically spent what was left of their holidays in bed.

Five more of us – including me – started to fall ill in the days following our return to London. I started to shake violently with cold one evening and then threw up in the night – at which point I knew that I was the latest to succumb.

However, at this point, none of us realised we had dengue fever – we all thought we had the flu. But suspicions that we all had something else started to form over the next day or two when we read – somewhat belatedly, you might think – about an outbreak of dengue in Barbados and the surrounding region.

Certainly, the range of symptoms (which for me included shivering, severe nausea and vomiting, as well as shooting bolts of pain down my legs at night), the duration of incubation, the absence of a sore throat or cough and the fact that we learned that Barbados currently has three times more dengue than flu cases strongly pointed to the former than the latter.

But it wasn’t until I took myself to the walk-in clinic at the Hospital for Tropical Diseases in London that our suspicions were confirmed. After taking a swab and blood tests, a doctor at the hospital eventually ruled out the flu, Covid and a range of other illnesses and said that indeed, I most likely picked up dengue from a certain type of mosquito lurking near pools of stagnant water.

(It so happened that a few of the kids found a favoured spot to make sandcastles near such a pool of water on the beach, which then became a focal point for much of the family.)

The doctor’s diagnosis was later confirmed by the UK’s Rare Imported Pathogens Laboratory, where a sample of my blood was sent.

Luckily, in most cases, the symptoms of dengue pass on their own accord. I’ve been taking paracetamol to bring down my fever and minimise discomfort, and I’m pleased to say – along with the rest of my family – I’m now pretty much fully recovered.

But on top of all this – and by far more devastating – we’ve also been dealing with the sudden death of Deborah’s mum, Linda, who died suddenly on 17 January after a recent diagnosis of stomach cancer.

This has really knocked us for six and certainly put everything else in perspective.

Linda was a fabulous mum, wife and grandma – our kids adored her – and she’ll be missed enormously.

I apologise for the sombre tone of this month’s personal missive from me but, as we move into a new year, perhaps it’s no bad thing to be reminded of what’s really important.

If it needs saying, families and health really are life’s priorities. Everything else is secondary.

I’ll be back in touch next month with hopefully a more upbeat missive.

Sam:

Why does January always feel like it has around 75 days in it, not just the usual 31?

Definitely the “longest” month of the lot. Probably just the come-down from Christmas and New Year’s.

But it does feel like it’s been a long month, which means when I was in Las Vegas for the CES expo in early January, that feels like years ago now.

But it was only about two and a half weeks since I got back and it was an absolute whirlwind of a trip.

There were loads of tech on display, from the future TVs that we’ll see hitting the shelves (so many TVs!) through to self-driving cars, artificial intelligence agriculture and an interesting tilt back towards hydrogen technology.

In terms of the good, the bad and the ugly, I have to say that in terms of the good, those transparent TV screens were actually quite breathtaking.

Now you might think: why would I want a transparent TV? And it’s a great question. After all, sitting in your lounge room, it’s unlikely you’d want to see the wall behind it.

But hear me out…

The TVs, for a start, aren’t always transparent. They can cycle through a regular-backed TV and then reveal the “other side” on command. Now that doesn’t make much sense if you’ve got a plain wall behind it.

But maybe you want to use it as a feature to display some images, a fake fireplace or something, anything while not using it. And that it doesn’t back onto a wall, but it’s in the middle of a room for all to see.

The TV itself becomes somewhat of a piece of tech art.

Ok, maybe that’s not convincing you to get one. Which is fine. But where I saw these transparent screens really come into their own was the application for things that aren’t TVs.

Like LG’s “Dukebox” which is an audio device that displays information on the screen, but you can also see through it to reveal the amplifier tubes and internal workings of the device. It was arguably the coolest thing at CES and something that’s going straight onto my own shopping list.

So that was up there with the cool tech.

And what about the other end of the spectrum?

What about the crappy tech?

Well, literally, the crappiest tech for me was the smart toilets from Kohler. Yes, that’s right, a smart toilet.

It’s not that it didn’t look good. I mean, the toilet itself was able to change its visual design and patterns on it when closed. And it did a whole range of different “smart” things to your backside when you’re doing the business. Visually, it’s certainly a statement.

But really… why?

A toilet doesn’t need to be a statement. It needs to quietly blend into the background –unnoticeable, innocuous.

I’m all for a smart, connected world. But when it comes to my schedule and that part of my life, I feel like analogue is the way forward. I don’t want it to be smart. I just want it to do what it’s supposed to do – nothing more, definitely nothing less.

It was a fun week, and there’s too much to cover in this section of our monthly update. But it was easily the thing that kept me busiest this month and has also shaped some ideas for the kinds of tech and stocks we might be looking at in the near future.

Crypto Corner

Sam:

In somewhere between 75 to 80 days’ time, bitcoin’s block reward is getting halved, again.

The reward drops from 6.25 to 3.125 bitcoin per block.

On average there are around 144 blocks confirmed each day on bitcoin’s blockchain.

That means the new daily supply of bitcoin will go from about 900 to 450.

That’s per day.

Not a lot is it.

Now think about this. In the first seven days of existence, the US-based spot bitcoin exchange-traded funds (ETFs) gobbled up over 100,000 bitcoin. That’s 14,285 bitcoin per day.

Put another way, the ETFs’ demand was 15.87-times greater than the new daily supply.

After the halving in April and based on that demand, you’re looking at 31.74-times greater demand for bitcoin from just those ETFs than the daily supply will be.

So with such divergence in demand and supply, a lot of questions arise as to why the bitcoin price hasn’t already exploded.

And that’s where the detail here is important, for now.

Sucking up supply for now…

After the US Securities and Exchange Commission (SEC) approved spot bitcoin ETFs, there was an immediate supply flood into the market.

That was down to the Grayscale Bitcoin Trust converting to an ETF – a very liquid ETF at that.

It had previously not been as easy to trade in the Grayscale Trust, but as an ETF, the floodgates proverbially opened. While demand in the seven days has been huge, Grayscale has seen around 80,000 bitcoin outflow from its (now) ETF.

This “dump” was for several reasons.

The first being that Grayscale’s fees are up around 1.5% whereas others like the iShares Bitcoin ETF are closer to 0.2%.

So ask yourself this, if you’re sitting on a million worth of bitcoin, would you rather pay $15,000 for the privilege or $2,000? Well the correct answer is $0. But for many, the idea of custody with a financial institution for that size of capital makes better security sense, and they’ll pay for that.

But $2,000 is closer to the mark than $15,000.

Another reason for the exit is that no doubt investors would have taken profits from the divergence in Grayscale’s price to net asset value.

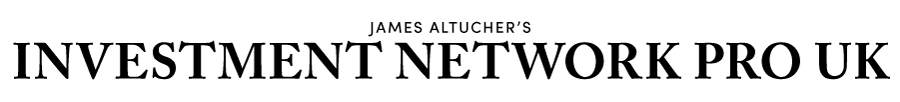

This chart from The Block shows that in February last year the Grayscale Bitcoin Trust (GBTC) was trading at a 46% discount to its net asset value. As the ETF approval got closer and closer, that premium closed in to 0%.

In addition, bitcoin was trading at $21,000 in February 2023. That discount effectively priced the bitcoin in the fund at $11,340. So as the fund closed in to parity of price to NAV, some of those who’d bought in while the discount was large no doubt would have clipped some profits.

It’s also believed that a large portion of FTX bitcoin assets were sold off to fund the liquidation process that’s still ongoing with FTX’s failure.

Furthermore, anecdotally I’ve been hearing of bitcoin holders transitioning away from self-custody bitcoin storage to the ETFs. And I can truly understand that perspective.

Don’t get me wrong, I’m all for self-custody and breaking free of the shackles of traditional finance. But safety and security must also be a factor in how you hold your assets.

For large hodlers of bitcoin – and I mean on a scale that most never will get close to – when it comes to self-custody devices, there’s a physical security element you need to consider.

It’s akin to using your own house as a treasury, storing kilos of gold bars or piles of cash. It’s not really the safe move is it?

That’s why I’ve heard that in the US in particular there’s been some selling of bitcoin to move into these ETFs. Now that’s not a Grayscale thing, but it has added supply to the market, which gets gobbled up by the ETFs right away.

Therefore the demand for bitcoin by the ETFs has more or less been met by these additional supplies plus the regular liquid market in bitcoin.

However, Grayscale outflows look to be slowing. This transition period in the early weeks of these ETFs is starting to wind down. Which means in the next couple of weeks we’ll start to see a clearer picture as to the real demand/supply imbalance from the ETFs and the available bitcoin in the market.

We know that these ETFs have already been the most successful launches in history. Demand indicates that they will go on to soak up billions more in capital over the year. Billions more in demand that must come from a market with dwindling supplies.

That logically indicates that bitcoin’s value has but one direction to take.

Stack sats

Of course it’s not as linear as that. There will be supply coming from hodlers who no longer wish to hodl. Plus demand for the ETFs will eventually find a limit, albeit I expect far from here.

But then you also need to factor in demand for bitcoin regularly as well, particularly if the price levels up back towards its previous all-time highs. That’s when the retail FOMO kicks in again, and we launch into the next big bull cycle.

We’re only about 50% off that mark. So it’s not a leap to see that happening in 2024 – possibly not long after the halving. All this means, in my view, is that if you’re stacking your sats, if you’re getting a position in bitcoin, while you can, now’s as good a time as any to be doing it.

As for the rest of the market, that will follow bitcoin heavily into a new bull market. It does almost become a case of everything heads higher. But in particular I think some of the big areas of opportunity in the altcoin market will come from sectors like artificial intelligence (AI), bitcoin layer-2, decentralised infrastructure, modular blockchains and some of the larger community-backed meme coins.

In other words, a lot. But first and foremost, it’s bitcoin that’s going to drive the market. It’s sats that I think should be stacked and bitcoin that should be the first point of diversification in a portfolio.

What else we’ve been looking at this month

James:

Why Jeremy Grantham likes clean energy stocks — even if they’re getting smashed

Jeremy Grantham got rich by profiting from bubbles in late-1980s Japan, in turn-of-the-century tech stocks and in US housing prior to the 2008 financial crisis.

Now, the investment company he co-founded says clean energy has momentous growth and major public policy on its side, with the “abysmal” performance in the stock market over the last two and a half years creating exciting opportunities for long-term investors.

In a report dating from September, but only landed on my desk last week, Grantham’s GMO said inflation and rapidly higher interest rates during the past 12 months had made clean energy projects more expensive to finance and less attractive as future cash flows are discounted at a higher rate.

Rising interest rates also caused investors to re-evaluate growth stocks and clean energy companies “got caught up in the broader growth unwind,” said Lucas White, Lead Portfolio Manager for the Resources and Climate Change Strategies at GMO said.

What’s more, the Inflation Reduction Act has also impacted clean energy performance in a way that was unexpected, according to White.

Although the landmark legislative package, which included clean energy incentives, will drive investment over the long term, clean energy projects were delayed in the short term because stakeholders were waiting to learn the final details of the law.

“Public policy changes often pull demand forward, but in this case, demand has been pushed into the future,” White wrote in his report.

The new market regime, coupled with policy changes, negatively impacted clean energy company earnings and their stock prices were impacted disproportionately, said White.

Canadian Solar, the world’s largest solar developer, had been beaten up to such an extent that it was trading at less than five times forward earnings, despite growing at 25%-30% per year, said White, noting something similar happened to the company SolarEdge.

White said:

However, this is not the Tech Bubble or Tech Bubble 2.0. Clean energy companies are growing profits rapidly, and the sector is maturing. At some point, one would expect the sector to withstand a bit of bad news. In the meantime, these situations create opportunities for long-term investors.

And GMO believes the growth and public policy changes will continue to support the sector.

The Infrastructure Investment and Jobs Act, the CHIPS and Science Act, the European Green Deal Industrial Plan and other more local public policies will help transform clean energy in the future. But the impact of the Inflation Reduction Act’s $369 billion package of incentives — many of which take the form of uncapped tax credits — will be huge. It hasn’t been appreciated by markets yet either.

GMO stated:

Barring a stunning change in course, it’s clear that US investment in climate will dwarf anything we’ve seen before, and the same is true around the world. In fact, the U.S. has lagged China and Europe in driving clean energy investment over the last few years and needed to act aggressively in order to catch up.

From 2019 to 2023, China has increased its annual clean energy investments by $180 billion, the European Union has invested $150 billion and the US has invested about $110 billion more, according to estimators by the International Energy Agency (IEA). “Clean energy isn’t just the future. It’s the here and now.”

The full report is certainly worth reading. You can read it here.

Electric aircraft may have more potential than we thought

Although batteries are doing a great job replacing petroleum in car engines, they’ve been a lot less successful in the skies. Efforts to make a working electric airplane prototype have perennially come up short.

After all, the conventional wisdom about battery-electric planes is that they can’t be large or travel very long distances because of the weight of the batteries.

However, according to Dutch electric aviation firm Elysian, launched last year, previous analysis has been based on “several misconceptions”, leading to the conclusion that battery-powered aircraft would only be suitable for short-range aircraft in the sub-19-seat commuter class.

But Elysian has now showcased plans for its E9X aircraft. The plane is engineered to carry 90 passengers up to 800 kilometres.

The forecast capabilities, which go beyond previously announced projects, are based on two scientific studies carried out in collaboration with Delft University of Technology in the Netherlands.

The first study introduces new “parametric” designs for an electric aircraft suitable for 40-120 passengers and presents design principles for a higher range than previously thought possible. While the second study presents a conceptual design of a battery-electric 90-seater aircraft, including batteries integrated into the wings, a low-wing configuration, and folding wingtips.

In short, the findings show that large battery-electric aircraft can carry much more energy and are aerodynamically more efficient than originally assumed.

The team at Elysian is now working through a list of technical challenges, from battery development to how power moves through the plane. They plan to have an updated design by the end of the year and then dive into more detailed development. If all goes as planned, the first flights could begin in 2033.

Analysts struggle to keep up with exponential green expansion

Renewables are growing so fast that the IEA has had to – yet again – revise its forecast, this time up an incredible 33% in one year.

Renewable power capacity is expected to grow by 7,300 GW through 2028 under countries’ current policies and will overtake coal as the leading source of electricity globally by 2025, according to a new analysis by the IEA. That would mark a 33% increase over 2022 projections, led overwhelmingly by surging renewable energy generation in China.

Renewable energy capacity grew by 50% in 2023 to more than 500 GW, the fastest rate of growth in more than 20 years, according to the IEA.

With the dramatic increase seen over the past year, the “Renewables 2023” report found that the world is now on track to grow renewables capacity by 2.5x by 2030, putting the global goal established at the COP28 climate conference to triple renewable energy capacity by the end of the decade within reach.

The expansion happened almost exclusively among the world’s 20 largest economies, with China far out in front. In fact, China commissioned more renewable power last year than all other countries combined did in 2022, and it’s expected to account for around 60% of renewable power additions in the next five years, the IEA said.

Analysts are having a seriously hard time keeping up with what’s going on: an exponential expansion of renewables everywhere, all at once.

Sam:

When is a 50/50 outcome actually a 51/49 outcome?

The answer to that question is all the time. This story in Scientific American magazine had me enthralled. The very idea that a coin toss is not a 50/50 outcome is a game changer. There’s not much to explain other than to say read this because it will change your perception of the phrase “it’s a coin toss”.

The reality is that it’s not a coin toss at all, unless someone is a favoured outcome.

When will virtual actually become reality?

This YouTube video is a few months old, but I only just got around to watching it this month. The reason is that the hype surrounding Apple’s latest Vision Pro device, its augmented reality headset, is reaching a fever pitch.

The company has already sold 200,000 Vision Pro headsets, which, at around $3,500 a pop, is a lazy $700 million, or so, in revenue coming Apple’s way. But I also saw some people describe the FaceTime calling function within Vision Pro as resembling 90s NPCs (non-playable characters) from the original PlayStation games.

And then someone pointed me to how good the virtual avatars that Meta and Mark Zuckerberg were working on, at least compared to Apple’s. Also, the best example of just how good the interview Zuckerberg did with Lex Fridman was.

I don’t know about the headsets. And you can see in this month’s breakthrough tech section my discussion about it all. But you can’t argue that Meta does seem to be streets ahead of Apple in this case.

A good read of bitcoin, past, present and future

I’ve been in the crypto space for a long time now. And the changes and developments in this space are astounding. The “altcoin” market is a big driver of that development, but there’s also a fast-growing movement of innovation and development with bitcoin.

It’s something that not a lot of people understand very well. To be honest, there’s so much information out there that it’s hard to piece it all together.

So, when I came across this in-depth look at the bitcoin ecosystem, it was refreshing to see something quite detailed and easy to read that explains where everything is at for bitcoin right now.

I highly suggest you have a read of it to get a solid footing of what the bitcoin ecosystem is beyond just bitcoin.

James Allen and Sam Volkering

Editors, Small Cap Investigator