Your July issue of Small Cap Investigator

27th July 2023 |

- The perfect stock to play the great energy market collision

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

The perfect stock to play the great energy market collision

Back in March, we wrote to you to say a powerful “collision” of forces was at play in the energy markets.

As we spelled out, off the back of the biggest threat to global peace since the Second World War, last year, countries the world over started to rewrite their rulebooks in order to secure their energy supply chains.

As Russia weaponised its oil and natural gas exports, energy prices started to spike and most of the planet scrambled to cope with the resulting chaos.

Increasingly, this meant that countries upped investment in fossil fuels in return for security, under the premise of not going dark before going green.

Investors such as BlackRock started to ease off calls for rapid climate action in the face of domestic challenges, while consumer countries, from China to Europe, upped coal burning as high gas prices and disruptions distorted the market.

This acted as a major tailwind right across the traditional energy sector.

Of course, while the energy transition undoubtedly hit some speed bumps, the long-term drive towards clean energy hasn’t gone away.

In fact, the green energy sector has already started to feel the force of US President Joe Biden’s Inflation Reduction Act 2022, while other regions are now also adopting state-led industrial policy in an attempt to accelerate a huge, global and long-term renewables build-out.

Hence, we have a powerful “collision” of forces at play.

Last year, in fact, the world invested a record $1.1 trillion towards transitioning to clean power, exactly the same as the amount spent producing oil and gas.

As we wrote:

So you could say we’re seeing a two-pronged system develop as competing agendas of energy security and decarbonisation battle it out.

We now live in a world where clean energy gets $369 billion of investment one day and BP posts annual profits of nearly $28 billion the next.

Right now, clean or dirty – it doesn’t really matter.

This collision of investment into green energy and fossil fuels, all at once, has created a true golden age for energy investors…

We have found the perfect stock to capitalise on this collision of old and new. In fact, it should continue to thrive no matter how the energy markets evolve and the transition towards clean energy develops.

Right now, it benefits in the short term from serving an oil and gas industry that is working overtime following Russia’s invasion of Ukraine. But it is also increasingly exposed to the transition to renewables where it also has a significant and growing footprint.

In fact, the vast majority of the company’s capacity is transferable between these two sectors, a flexibility that means it is set up to thrive no matter how the energy markets change over time.

Certainly, increased activity offshore and the emergence of the energy trilemma, a three-way push-pull of energy security, affordability and sustainability is playing to the company’s strengths.

The company we are recommending today is extremely cash generative, has a high-quality customer base and is on a mission for growth, both organically and by making strategic acquisitions.

The name of the company — our latest Small Cap Investigator recommendation — is Ashtead Technology Holdings PLC.

The latest Small Cap Investigator recommendation: Ashtead Technology Holdings PLC (AIM: AT)

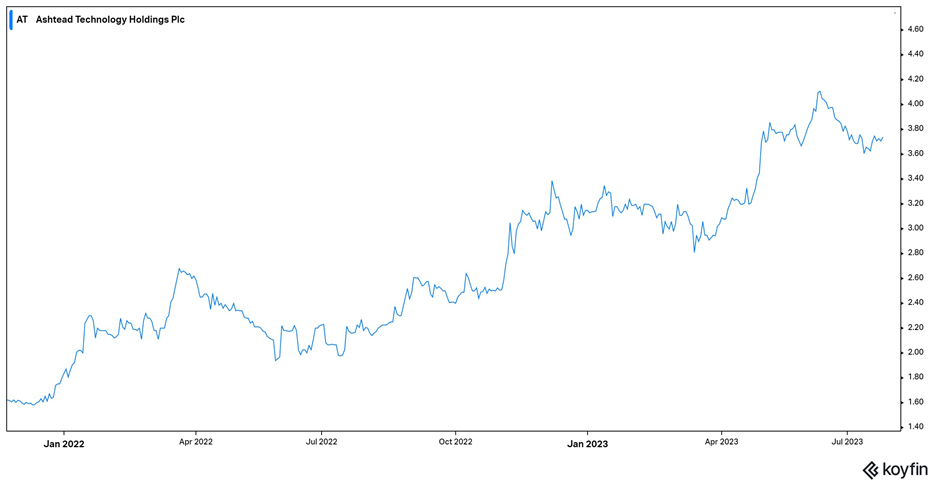

Ashtead Technology Holdings was founded in 1985 and floated on London’s AIM exchange in November 2021 by placing shares at 162p, valuing it at £130 million. Twenty months later, the firm’s shares trade at around 374p, giving it a market cap of just over £300 million.

But the party is far from over, with the Aberdeen-based business perfectly placed to capture business from the evolving dynamics of the energy markets.

So, what does Ashtead actually do?

Well, it rents out a wide array of industrial kit used under the sea, including remotely operated vehicles and pipeline cleaning machinery. Alongside inspection and maintenance services, it also offers design, fabrication and manufacturing capabilities to offshore operators.

In fact, you should think of Ashtead as a fully integrated offshore services company, offering not just the rental of specialised equipment but also technical services, custom-built solutions and equipment to customers for various applications, water depths and deployments.

Ashtead provides its specialist equipment and integrated services to the offshore wind, oil and gas sectors, specifically.

In the offshore wind sector, Ashtead offers customers support through the project development, construction and installation phases, and offers customers inspection, maintenance and repair (IMR) help once wind farms are operational.

This is an important and growing part of the business.

Over the past four years, the revenue contribution from wind power has experienced significant growth, more than tripling its share to now account for 31% of total revenue. Remarkably, in the latest 12-month trading period, the segment achieved an impressive revenue growth rate of 22%.

Certainly, this is a trend that is likely to continue as the energy transition gathers steam.

As the offshore wind industry matures, so will the adoption of ever-larger wind turbines that will necessitate ever-more extensive foundations, resulting in heightened subsea work and ongoing maintenance requirements for a company like Ashtead.

Yet, despite the progress in the wind sector, it’s also true that, currently, most of Ashtead’s business comes from the more mature oil and gas sectors, which contributed a substantial 69% of Ashtead’s revenue last year.

Here, the company’s equipment and services are used for a wide range of applications, including IMR and decommissioning as assets reach the end of their operational life and need to be safely removed.

As described above, oil and gas production remains an important constituent in meeting global energy demand, and significant expenditure is required just to keep the taps flowing from existing fields.

But, of course, the UK and US are not alone in also having a large inventory of oil and gas fields set to be decommissioned over the next decade, offering a significant growth market for Ashtead to tap into.

The company saw revenue from offshore oil and gas increase by an extremely impressive 35% year-on-year in 2022.

Interestingly, around 85% of Ashtead’s 17,000 fleet of rental equipment products can be utilised across both the oil/gas and the renewable energy sectors, a transferability that gives it flexibility and the capacity to thrive no matter how the energy transition evolves.

Currently, the company operates across both the wind and oil/gas markets in three specific business lines:

- Survey & Robotics: this segment offers a wide assortment of survey and robotics equipment and was responsible for approximately 64% of the group’s revenue in 2021.

- Mechanical Solutions: this segment brings a blend of in-house designed and third-party mechanical equipment solutions, including dredging, cutting and driver mechanical tools for the subsea market. It contributed about 25% of the group’s revenue in 2021.

- Asset Integrity: this segment delivers custom-engineered packages designed to meet operational demands in challenging offshore environments, such as hull inspection, mooring inspection, and subsea sensor packages. This segment generated about 11% of the group’s revenue in 2021.

We also know that Ashtead is a global business, which is operating from nine prominent offshore energy hotspots spanning the UK, North America, Asia and the Middle East. The firm also extends its reach through international partnerships in the Caribbean, West Africa and Australia.

In fact, the firm’s clientele encompasses the majority of the leading subsea services firms that provide services to oil/gas and offshore wind asset owners. Such blue-chip customers include Boskalis, Fugro, Helix Energy Solutions, Oceaneering, Subsea7, TechnipFMC and Saipem.

What’s more, eight out of Ashtead’s ten major customers have been loyal to Ashtead for over a decade. Revenue stability is facilitated by enduring framework arrangements with six of these customers.

Right now, Ashtead is benefiting from tight market conditions. Lead times for new equipment and spares are rising, which is increasing the propensity for customers to rent equipment, enabling Ashtead to push through price rises and mitigate the impact of inflationary pressures.

This is driving up both the company’s cost utilisation – a useful indicator of the performance of the equipment fleet – and gross margins to an extremely impressive 74%.

In 2022, the group delivered an eye-catching 21% return on invested capital (trading profit as a percentage of average net debt and equity), highlighting the returns that the business can generate.

Also notable is that the company has looked to boost growth through bolt-on acquisitions, purchasing seven companies in the last six years, alone.

Most recently, it spent £32.9 million in H2 last year to acquire two firms that are active in offshore markets: WeSubsea, a provider of high-performance dredge systems; and Hiretech, a specialist in marina and subsea equipment rental assets.

By the end of the year, these deals had already contributed £1 million to annual revenue, according to Ashtead.

But with a net debt-to-earnings ratio of just one, the company certainly has the firepower for further deals.

Indeed, Ashtead CEO Allan Pirie said he believes that the company can act as a consolidator in what is a “fragmented” market.

Certainly, shareholders can expect further revenue growth for the foreseeable future.

According to energy consultancy Rystad Energy, Ashtead’s total addressable market is expected to grow at a compound annual growth rate (CAGR) of 12%, from 2021 to 2025, to $2.2 billion.

Ashtead is well-positioned to capture this growth. The company has a strong track record, a long-standing customer base and a differentiated product offering that lends itself to long-term customer relationships and is driving higher returns on capital.

Let’s now take a closer look at the books.

Rock-solid financials

As a result of higher activity levels and recent acquisitions, Ashtead has already seen strong earnings growth.

On 3 May, it reported a 34% leap in annual profits as revenues increased 31% year-on-year, from £55.8 million to £73.1 million.

Operating profit was up 47% to £20.1 million. On a pre-tax basis, profits for the firm totalled £16.6 million, more than four times that of 2021’s £3.6 million.

The business is highly cash generative. Cash inflow from operations was £36 million in 2022, up from £11.7 million in 2021, with the company ending the year with a cash and cash equivalents (CCE) balance of £9 million.

Although net debt rose slightly from £22.7 million in 2021 to £28.7 million last year, that equates to only one times last year’s cash profit, meaning the firm is potentially in good shape to pay down debt sharply over the next few years from free cash flow should it wish to.

Off the back of the results and accompanying guidance, house broker Numis Securities boosted earnings forecasts by 11% for this year and 14% for 2024.

The directors also recommended a full dividend of 1p per share for the year ended 31 December 2022, adding that they would look to grow it “progressively”.

There are some notable risks to consider

Despite the strong financials, this is an investment with some notable risks.

Firstly, inflationary pressures are putting huge upward pressure on costs, which is being felt not just inside the company, but right across the offshore supply chain as well.

By way of example, earlier this month, Swedish energy group Vattenfall said it had suspended work on its 1.4 GW Norfolk Boreas offshore wind farm after a 40% rise in the costs of the project.

If activity offshore slows down, this could certainly limit the amount of business Ashtead could win.

Of course, rising costs could also hit Ashtead’s own margins. As said above, so far, the firm has coped well to mitigate rising costs through increased pricing and an increased utilisation of its equipment rental fleet, but this is certainly something to keep an eye on in future earnings reports.

Secondly, any rise in the sterling could also hamper earnings. Ashtead has an international operation with around 46% of group revenue generated outside Europe, including 20% in the Americas.

For example, in H2 last year, the group actually benefited from a foreign-exchange tailwind, with 3.6% of the annual revenue growth coming from positive foreign-currency movements. But any strength in the pound against the dollar specifically could mean this tailwind turns into a headwind.

Thirdly, as hinted at above, it’s worth noting that a significant proportion of the company’s revenue derives from a relatively small number of customers.

This means that the company is under pressure to maintain strong relationships with this core group of clients and offer them a high level of service. It also means that any issues or change of circumstances at one or more of these customers could have a large adverse knock-on effect at Ashtead.

Finally, we can’t ignore the wider questions over the direction of the energy transition, which has hit a few speedbumps over the last couple of years amid Russia’s invasion of Ukraine. This has diverted investment back towards the oil and gas markets, which, if continued, would threaten growth in Ashtead’s offshore wind market.

However, on this front, Ashtead has most bases covered. Certainly, the fungibility of the company’s equipment and services means it is well-placed to support both markets, no matter what direction the transition takes.

Now is a good time to invest

The stock has been on a fine run since it listed in November 2021 but, despite the risks, it likely hasn’t come close to peaking.

Overall, Ashtead is a growth stock with a strong business model, generating strong earnings growth and free cash flow.

The company is well positioned to benefit from the energy transition, no matter how it evolves.

Of course, ongoing expansion of offshore wind energy production, coupled with the decommissioning of aging oil and gas infrastructure, means that the energy transition is a key driver of Ashtead Technology’s revenue growth.

But it’s equally true, right now, that meeting global energy demand remains all important, and maintaining production from existing oil and gas fields continues to be a critical strategy for many countries around the world.

Ashtead’s specific prowess in both the offshore wind, oil and gas markets place it in a unique and advantageous position.

Its ability to adapt and excel in both domains positions them to drive continued success in a rapidly evolving energy landscape.

As such, we recommend you buy Ashtead Technology Holdings today.

Action to take: buy Ashtead Technology Holdings PLC

Ticker: AIM: AT

ISIN: GB00BLH42507

Market cap: £308.7 million

52-week high/low: 420p/210p

Buy up to: 395p

Source: Koyfin

Source: Koyfin

Big breakthroughs

SMRs: pioneering the future of nuclear energy

Earlier last week, the UK government launched its “Great British Nuclear” strategy.

The aim is simple: increase the “rapid expansion” of nuclear energy in the UK. That means more funding, streamlining approvals, and moving towards 25% of energy in the UK being nuclear energy by 2050.

This, of course, is nothing new to us. As a Small Cap Investigator subscriber, you already have four nuclear-related stocks in our Buy List: Sprott Uranium Miners ETF, Yellow Cake, Aura Energy and engineering powerhouse Rolls-Royce.

These are all relevant to this British strategy, a strategy that, we might add, was unavoidable. Nuclear energy is clean, efficient and is necessary for any country to achieve energy independence.

Of note, however, in the launch last week, was the highlighting of small modular reactor (SMR) technology. It’s a technology that is being developed by a handful of companies around the world. Notably here in the UK, it’s Rolls-Royce developing SMR tech.

You’re going to hear a lot more about SMRs, so it makes perfect sense to get up to speed with what it’s all about and why it’s so important to the future of nuclear energy – not just in the UK, but around the world.

Let’s dive in…

In recent years, SMR nuclear technology has emerged as a promising solution to address the growing energy demands of the UK. Unlike conventional nuclear reactors, SMRs offer a new way of looking at nuclear energy generation.

Some of the potential benefits include enhanced safety, improved economics, and far greater flexibility in location and construction.

SMRs operate on the same principles as conventional nuclear reactors but with a notable difference in size and design. While traditional nuclear reactors typically have large capacities ranging from 1,000 to 1,500 megawatts, SMRs have significantly lower power outputs, ranging from ten to 300 megawatts.

This compact size allows SMRs to be assembled at a fixed manufacturing facility and then transported to the desired location, making them a cost-effective, scalable and flexible energy solution.

The compact size of SMRs makes them more manageable and suitable for diverse applications, including powering small communities, remote areas and industrial facilities. Instead of a few large nuclear plants, think of, perhaps, many hundreds. Their modular nature enables rapid deployment and expansion, reducing the financial risk associated with large-scale nuclear projects.

SMRs also incorporate innovative safety systems, such as natural circulation and inherent shutdown mechanisms. These features significantly reduce the risk of severe accidents and eliminate the need for active cooling systems and external power sources, making them more resistant to catastrophic events (which are a rarity for conventional plants, anyway).

SMRs are also incredibly efficient and a great alternative to fossil fuels. For example, think of a remote region or small island community that depends heavily on energy like diesel generators. SMRs can provide a stable and sustainable energy source, meaning that they don’t need to rely on diesel or other fossil fuels to sustain their energy.

In the industrial sector, SMRs can also serve as a source of process heat for various applications, such as hydrogen production or desalination. This versatility positions SMRs as key players in the global transition to cleaner and more efficient energy systems.

Finally, what’s really getting governments moving towards SMR support is their cost-effectiveness. The modular construction process decreases capital costs, and their size allows for rapid deployment, reducing financial risk and providing a more feasible option for investors and governments.

In short, SMRs can contribute to the energy grid faster and more efficiently (energy and cost-wise), delivering energy security to the country.

In terms of the kinds of companies actively developing SMR technology, we’ve already touched on one: Rolls-Royce. Others include NuScale Power, TerraPower, Westinghouse, BWX Technologies and Kairos Power.

This is an area that you should certainly pay more attention to, and these companies are all worth keeping a close eye on in the near future.

Buy List update

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings (AIM: EMH) is trading around 46.5p, over 41% up in the Buy List.

The Australia-based lithium mining company gained from under 43p after it announced on 21 July it is to receive a €6 million investment from the European Bank for Reconstruction and Development (EBRD) to help fund the Cinovec lithium project in the Czech Republic.

EBRD’s investment will see it buy 12.3 million shares in EMH through a private placing at 42.3p each.

As part of its due diligence, EBRD engaged an independent, international mining consultancy to conduct a technical review of the Cinovec project, EMH said in a statement.

EBRD also performed a review of the project with respect to compliance with EBRD’s Environmental and Social Policy.

Keith Coughlan, EMH’s executive chairman, said that the EBRD investment aims to fund the project’s predevelopment work and opens a pathway to potentially securing project financing.

“The successful completion of the technical due diligence process is a testament to the quality of the Cinovec team.”

Cinovec is being developed by Geomet, a 51/49% joint venture between state-owned CEZ and EMH.

Cinovec will be a significant pure lithium producer in the EU – a region where there is little domestic raw material production and a region with a huge demand as it battles to achieve a carbon-neutral future.

The stock remains above its 45p buy limit so is now a HOLD in the Buy List. Should it fall back below this level, then it will move back to a buy in the Buy List.

Central Asia Metals (AIM: CAML)

Copper producer Central Asia Metals (AIM: CAML) has ticked higher over the last few weeks, rising from around 175p on 6 July to 184p at the time of writing, still leaving it 33% underwater in the buy list.

Copper prices have moved higher this month, likely supporting CAML’s share price.

CAML owns a copper mine in Kazakhstan and a zinc-lead operation in North Macedonia.

On 11 July the company reported broadly stable production levels in the first half of 2023 from the Kounrad dump leach, solvent extraction and electro-winning copper recovery plant in Kazakhstan and the Sasa zinc-lead mine in North Macedonia.

In the first half of the year, copper production totalled 6,716 tonnes, up 1.5% from 6,617 tonnes during the same period the year prior.

Zinc production in the dropped in the first half as a whole, with zinc production falling 6.7% to 9,764 tonnes from 10,465 tonnes year-on-year.

Meanwhile, lead production dipped 0.7% to 13,734 tonnes from 13,827 tonnes.

However, Central Asia Metals said it was on track to achieve its full-year guidance. In 2023, the company expects to report copper production between 13,000 to 14,000 tonnes, zinc in concentrate production between 19,000 to 21,000 tonnes, and lead in concentrate production between 27,000 to 29,000 tonnes.

“Benefitting from our low production costs, [Central Asia Metals] continues to generate enviable cash flow and has a strong balance sheet with $50.6 million in cash and no debt,” said CEO Nigel Robinson.

“This enables us to continue to pay some of the highest dividends in the sector whilst actively considering various business development opportunities.”

The wider macro environment remains challenging for CAML, with elevated interest rates re-shaping the risk profile for all such small-cap miners, though the firm seems to be delivering on what it can in terms of production targets and cost control.

CAML is mainly a play on expected tightness in the copper market, where a supply shortage is likely to emerge in a few years leading to a rise in copper prices.

Copper is a key component in electricity-related technologies and, by extension, a linchpin in energy transition projects.

The stock remains a BUY under 310p.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company (LON: FSF), which invests in UK forestry and afforestation assets, was last seen around 101p, level with where it started July, though still down 7% in the buy list.

The group owns nearly 30,000 acres, half of it already covered in established woodland, with the rest at various stages of development but should be turned into fully fledged forests over the next few years.

The group aims to increase the value of its assets and thereby drive long-term share price growth. To date, asset valuations are up more than 10% since 2021 to £186.6 million, or £1.09 per share. However, the stock price, at slightly over £1, the same as on flotation, still lags slightly behind.

The company hasn’t released any news, though it did receive a positive update from the Midas column in the Daily Mail on 23 July, which said that the shares should “bounce back”.

It continued, “Forestry assets are in demand, their eco-credentials are hard to beat and the long-term outlook is sound. Existing shareholders should stick with the stock. New investors may also find current levels attractive.”

Certainly, with the long-term demand outlook for sustainable timber in both the UK and Europe remaining positive and underpinned by the prevailing decarbonisation agenda, FSF looks well positioned to deliver on its business objectives.

As such, it remains a BUY.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF (LON: LITG) has risen from around £8.40 at the start of May to slightly above £9 at the time of writing, 1.41% above our £8.96 entry price.

There are currently 40 holdings in the Global X Lithium ETF, with Albemarle Corporation being the top holding with about 8.67% of the fund’s total share currently.

The underlying Solactive Global Lithium Index tracks the performance of the largest and most-liquid listed companies that are active in the exploration and mining of lithium, or the production of lithium batteries.

Overall, the fund is designed to mostly react to the global EV growth trend, though is not tied specifically to the fate of miners, but rather a mix comprising the entire EV supply chain.

Lithium prices have been on the rebound since May after falling between 50% and 70% since November.

Although demand for electric vehicles (EV) in China took a hit at the start of the year following the discontinuation of a decade-old New Energy Vehicle subsidy, EV sales picked up pace in February after a Tesla-induced price war spurred local rivals to offer steep discounts as well. In late June China extended the sales tax break for EVs until 2027, potentially boosting demand.

The Global X Lithium & Battery Tech ETF remains a BUY.

Aurubis AG (DE: NDA)

Germany-based copper smelter and recycler Aurubis AG (DE: NDA), which ended June at around €78.50, was last seen around €84, putting it 25% up in the buy list.

Like CAML, Aurubis has also likely benefited from rising copper prices over the last month.

In late June, Aurubis said it had completed within the planned time and budget a €60 million maintenance and improvement project at its Pirdop plant in central Bulgaria.

On 19 July, the stock received a Buy rating from Baader Bank, which set a target price at €110.

The stock remains a BUY up to €100.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation (NYSE: NEM), the world’s largest gold miner, is trading around $43, just up from prices at the end of June but down 33% from our $65.39 entry point.

In a second quarter update on 20 July, Newmont missed profit expectations as lower production and sales volumes weighed on profitability.

Newmont’s gold production fell 17% to 1.24 million ounces, after a labour strike ground production to a halt at the company’s Peñasquito mine in Mexico. Meanwhile, the company temporarily shut its Eleonore mine in Quebec, Canada in response to wildfires, and reported below-average production at its Cerro Negro mine in Argentina and Akyem mine in Ghana.

Although the company’s revenues fell 12% from the year-ago quarter, dragged down by lower gold and silver prices, some of that was offset by gains from the sale of other metals such as copper and lead. Adjusted earnings per share (EPS) came in at 33 cents, down from 46 cents in the same quarter last year.

However, the company is expected to finalise its purchase of Australian gold miner Newcrest Mining Ltd later this year, which could help boost profitability.

As such, Newmont remains a BUY.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has risen from around 278p at the start of July to 301p at the time of writing, around 4% below our entry price.

It has been a quiet month on the news front for the firm, though its Green arm did announce a €33.9 million investment in its Greek operations.

DS Smith Hellas, the leading manufacturer of sustainable packaging solutions in Greece, said the investment would be split between three sites innovating in sustainable packaging over the next two years.

The investment is focused on equipment upgrades, including purchasing state-of-the art machinery for innovative packaging solutions and capacity enhancements.

In June, the firm suffered the first decline in demand for its packaging in over a decade, as the rising cost of living hit spending on online shopping from the US to Europe.

The stock remains a BUY though we are watching market dynamics closely.

Watsco Inc (NYSE: WSO)

Heating, ventilation, and air conditioning (HVAC) distributor Watsco Inc (NYSE: WSO) has fallen from around $381 at the end of June to around $367 at the time of writing, 24% up from our entry point.

Watsco, the biggest HVAC distributor in the US, declared a regular quarterly cash dividend of $2.45 payable on 31 July to shareholders of record at the close of business on 17 July.

Watsco remains reasonably valued and is still a BUY.

Yara International (OL: YAR)

Yara International, one of the world’s largest producers of nitrogen-based mineral fertilisers, has risen from around NOK379 at the end of June to NOK418 at the time of writing, leaving it 4% up in the model portfolio.

Although second quarter earnings fell short of expectations in the last quarter due to falling prices, there have been recent signs of an improved outlook in key markets, according to its CEO.

CEO Svein Tore Holsether told Reuters that farmers had been delaying purchases due to the uncertain economic outlook and high fertiliser prices last year, contributing to falling fertiliser prices this year, but that trend was now starting to reverse.

“From mid-June to around right now, we have seen a rebound in urea prices of about 22% and a further increase earlier this week as well,” Holsether told Reuters in an article published on 19 July.

“So there has been a rebound now … (And) if you look at farmer economics, the ratio between fertiliser and crop prices, they are very healthy,” Holsether added. “So we do see positive signs and a tighter nitrogen fertiliser market ahead.”

However, second-quarter earnings before interest, tax, depreciation, amortisation and excluding one-off items fell to $252 million versus $1.48 billion a year earlier, missing the $550 million expected by analysts.

As noted by Norne Securities, the latest results featured a major miss to estimates for the second straight quarter.

“We are yet to see the stabilisation of earnings post super profits last year and uncertainty is very high,” the analysts said.

Last year, fertilisers became more costly to produce and thus more expensive for farmers to buy after prices of gas – a key component to produce fertilisers – surged amid Russia’s invasion of Ukraine.

With concerns over demand, the stock remains a HOLD.

CentralNic (LON: CNIC)

CentralNic, the domain and web services business, released its first-half trading update this month. Double-digit increases across the board (compared to the same period last year) in gross, net revenues and EBITDA (earnings before interest, taxes, depreciation and amortisation). In short, the results were in line with the company’s expectations, and the reaction from the stock price says as much too.

The stock didn’t move greatly off the back of the solid announcement, but for a long-term play, we’re not expecting it to rocket off the back of solid earnings. We anticipate more integration of artificial intelligence (AI) into its services and continue with our long view of this company being a breakout star.

Blancco Technology Group (LON: BLTG)

Our data management and security play, Blancco, announced in early July that full-year results were expected to be above expectations. This positive, short but sweet announcement was well received by the market. It lifted Blancco out of a bit of a funk, pushing the stock back up to an intraday high of 191GBp around 10 July.

That’s not far off our original entry point. While Blancco has already been a long-term play for us and being around break-even isn’t our expectations of the company, we do believe it has the potential (as seen by the announcement) to lift higher and return to those lofty 2021 levels up closer to 300GBp.

HydrogenOne Capital Growth (LON: HGEN)

Not a great deal of news out from HydrogenOne this month. However, it has published a fantastic guide it calls, “The Bluffer’s Guide to Hydrogen”. It’s well worth downloading and reading. If anything, it will help deepen your knowledge of the sector, dispel some myths and help you understand the big opportunity in play.

We’d also suggest sharing it with anyone else you know that may still be a tad sceptical about the hydrogen industry.

You can find the link to the report here.

Mirriad Advertising (LON: MIRI)

It’s a continuation of a tough year for Mirriad. Although the company had seen a strong surge from its integrations and collaboration with Microsoft, the stock has continued to struggle as it restructured the company.

This meant an exit from the China market, a reduction in headcount and all-round cost-cutting measures. Still, the company was able to raise funds, has kept revenues coming in and expects a shift to programmatic sales coming in 2024 to lift the company’s bottom line and scale up the potential.

We continue to keep a close eye on things, but for now at least, it’s got the means to keep moving forward and we will stick with this longer in anticipation that the company can recover some value for shareholders.

Rolls-Royce Holdings (LON: RR)

Rolls-Royce released its trading update for the first half of the year this week – and it was a great outcome. The company expects earnings to be “materially above” market expectations. How much you ask, well consensus operating profit was around £328 million. The company now expects that to be in the range of £660 million to £680 million – 100% higher than consensus!

One of the biggest contributors to this was in the civil aerospace division. It’s a great result from Rolls-Royce and pushed the stock over 20% higher in trading on Wednesday.

Rolls-Royce has been in our Buy List for some time and continues to show resilience and a return to pre-Covid level for the stock price we think is achievable in the next year or two. So, we stick with it long term, we like this display of financial strength and continue to be optimistic about its developments in new areas like SMR technology.

Yellow Cake (LON: YCA)

Yellow Cake, our pure-play uranium company, released its full-year results mid-month.

Considering the spot price of uranium was down 12.5% from March 2022 to March 2023, the company itself remained resilient and increased its uranium (U3O8) 4%. The company also noted that net asset value per share was £4.23. The company continues to trade very close to that NAV, as we would expect.

However, this company will rise and fall on the spot uranium price. Right now, we’re seeing a strengthening in the price which has jumped from around $50 in March, when the company recorded results, to over $56 at the time of writing.

That’s seen the stock return to our entry levels. We still see the demand and price for uranium increasing as the demand for nuclear fuel ramps up as countries around the world continue to push for more nuclear power.

While the move to more nuclear takes a long time, companies will secure their fuel source (uranium) well in advance, so companies like Yellow Cake with a lot of it, are in a prime position to benefit from this move to more nuclear, globally.

We stick with the stock anticipating a boom in nuclear energy and uranium in the years to come.

Inside the lives of James and Sam

James:

My daughter, Ivy, turned the grand old age of three earlier this month. To celebrate, we invited a load of her nursery pals and their parents, as well as an assorted group of other family and friends, over to the house for a little garden party.

We got very lucky with the weather, which was just as well as we didn’t really have a plan B if it had rained all day.

A large part of Plan A, in fact, was a bouncy castle complete with inflatable internal slide that we hired for the day and stuck down at one end of the garden.

For all the kids, and a disconcertingly large amount of the adults, the bouncy castle was definitely the main attraction and ensured the party went down a storm – which, considering it cost around £200 to hire (once a few other party sundries were added to the rental company’s payment basket), was probably just as well.

I can certainly think of much worse lines of work to be in than hiring out bouncy castles.

The guy who delivered the bouncy castle told me that he had seven other deliveries to make just on that Sunday alone, following similar numbers the day before. That’s around 16 bouncy castles hired for just one weekend. If other families were spending £200 a pop, that’s £3,200 a weekend!

The guy, who told me he was the actual owner of the business, told me he’s flat out all summer, with the business a bit quieter in autumn and certainly not as quiet as you might think in the winter and much of spring (when, he said, parents mainly hire a community or church hall to hold the party and accommodate the bouncer).

But, still, if we assume that there are roughly 15 weekends when the market is at its absolute peak, it works out that the company rakes in nearly £50,000 for one summer alone.

Obviously, there are a lot of assumptions there and I might be a bit off with the numbers. It’s also undoubtedly a lot of hard work. The guy who set up our bouncy castle was on a tight agenda and, while extremely polite, made it clear he didn’t really have time to chat to me about the ins and outs of his business plan – he was there to work and had a long day ahead. Fair enough.

But it seems to me that to run a successful bouncy castle hire business, you don’t necessarily have to give up your full-time job or even make a huge capital investment. Of course, you’ll need to buy a few bouncers themselves, as well as rain covers, electric blowers, extension cables and anchor stakes. And you’ll no doubt also need some form of public liability insurance cover, which likely doesn’t come cheap.

But after that, it must be a question of doing your research and getting your branding and marketing right – which is probably a lot harder than you might think considering there are likely a lot of companies all competing for the same business.

But, still, one of the eye-opening things about becoming a parent is the industry that accompanies absolutely every aspect of parenting. Parents are seemingly willing (as we were for Ivy’s party) to throw decent money to ensure everything is tickety-boo for their little Johnnies and Olivias. And there are a lot of Johnnies and Olivias out there to keep happy.

In any case, I might need to have another chat with the nephew of mine that I’ve been talking to about work experience and future career plans. As I wrote in May, we had been chatting about a career in air source heat pumps but we now might have to reconsider!

Sam:

This month has been a month I’d rather put behind me.

The reason being that I’m currently homeless.

Well, sort of.

The Volkering family is in the process of moving. We’re not moving to another county, not to another British territory, not even back to Australia or any of the other “Commonwealth” countries.

We’re in the process of moving to Portugal.

On the face of it, and from a lot of the information you’ll read online, it’s a fast, easy and hassle-free process.

Err, that’s not quite the case.

Once we’re out there, I plan on writing an extensive piece on what it’s like to practically move countries (having done it a couple times now) by doing it all yourself.

But it’s not all it’s cracked up to be (at least the process of getting there isn’t so hassle free so far).

Let me explain one of the main frustrations we’ve experienced…

We’ve rented out our house here, found ourselves a house down there in Portugal, but as of the time of writing, we’re in a state of limbo.

One of the prerequisites to getting the specific kind of visa I (and we) need to live in Portugal is having somewhere to live. That means either buying a house there or having a rental contract in place.

We didn’t want to buy there yet, so we got ourselves a rental. So far, so good. The only problem is that long-term (12 month) rentals are as rare as hen’s teeth. Most of the properties are short term and holiday lets.

That means the selection we had to pick from was small.

It also means that you can’t wait about too long or the one you like can get snaffled up by someone else or quickly taken off the market for a summer short-term rental.

We were able to find something, however, we couldn’t say, we’ll sign a lease agreement, but have an indefinite start date – no landlord has ever agreed to that!

It means that we had to start renting a house, without having a visa in place. But to get the visa, we had to have a rental agreement in place.

See the problem there? So, I’m now paying for a house in Portugal (albeit rented) that I can’t move to yet. This is one of the things you don’t read about when you see those “live happy overseas” pieces in the MSM.

It’s a bit of a pain in the backside, but an inevitable part of the process. I’m sure when we’re settled there and I can jump in the car and five minutes later, I am sat on the beach, I won’t complain.

But it’s one of the things, at least in moving to Portugal, to consider if you decide to pack up stumps like us and move down there.

Nonetheless, moving at any time is stressful, and doing it with a four- and two-year-old even more so. Doing it while your entire household goods are in storage awaiting a “go date” and you’ve got two pets you’re also transporting adds some layers on complexity.

Thinking about it now, with everything going on, and all the moving parts, I might write an entire book about the process!

So that’s what’s been consuming the Volkering household this month so far – but hopefully by the time your next monthly edition rolls around, it’ll come from me, either on the beach or at the very least on the rooftop terrace, finally in Portugal.

Wish us luck!

Crypto Corner

I’ve been thinking about the best way to write about crypto in this month’s crypto section. In doing so, I have decided that one of the hardest, but most important, things you need to achieve success in this market is to take a bloody long hard look at yourself in the mirror and figure out who you are and why you’re doing any of this.

If you’re not prepared mentally, this market can easily and quickly rip your soul out, chew it up and spit it back at you in a pit of isolation.

Now, if you’re coming out of your first “crypto winter” – being the fall from the highs of 2021 into the depths of 2022 – then I promise you this, it will be very hard to contemplate another bull market cycle and higher highs in the next one.

In fact, when markets aren’t moving in your favour, you will often feel downright depressed about it.

I can promise you that if this is your second cycle, your second crypto winter (2019 and 2022), it will be very hard to contemplate another new set of all-time highs. And again, you can find despair creeping into your psyche.

The overriding feeling is that you’ve seen one big boom, and fall, and then another and that perhaps that was the last big one and the chances of another is a diminishing outcome.

Well, I can tell you that having been through four prior bitcoin booms and busts, the anticipation of another big bull market is always very hard to envision. The dark ghouls of “what ifs” and “it’s over” will always linger on the outskirts of consciousness.

You can’t help but feel as though you’ve run out of chances to maximise your wealth potential, as you always have that lingering question in the back of your mind, what if the last boom cycle was indeed, the last?

That’s what makes the crypto market, and all financial markets for that matter, so frustrating, so difficult, time consuming, intellectually consuming – all consuming.

You are in a constant battle with emotion, facts, intangibles and time.

None of these are easy to deal with, but dealing with all of these is crucial to surviving the crypto market. Deal with them well, and you’ll cruise through like you’re coated in Teflon.

A good example of what happens when you don’t keep things in check can be found on a few (slightly depressing) Twitter accounts. One of those is “Coinfessions”. It’s a strong reminder of what can happen in crypto markets when things go wrong, very wrong.

If you’ve got the time, go have a look. It’s littered with stories about overleveraging, losing entire savings… basically, horror stories that would be enough to frighten the life out of anyone even contemplating this market.

But I find it useful as a way to remember that any time you’re investing in any market, you’ve got to have your wits about you. You’ve got to understand what risk really means to you. You’ve got to understand when it’s time to get out, what your levels of success are like and how you plan to keep yourself in check.

I’ve been around long enough in all kinds of markets to come to a few key fundamental understandings. These are applicable to life and hence roll into your investing in both traditional markets and crypto markets.

My view is that these understandings have kept me sane over my career, kept my expectations in check and kept me always wanting to keep investing and to keep riding the markets for the long-term benefits they often provide.

The first of these lessons is very much tied to that last paragraph: always take the long view.

I know there are ways to trade the market. There are ways to quickly enter and exit positions for profit. This can be a fun part of the market. But for me, my overarching and primary focus is on the long game. What are the assets I want to hold and still have in my portfolio 30 years from now?

That kind of time frame discipline is hard. For some people, it’s too hard to manage. That’s why I actually don’t mind locking away funds in pensions; it forces me to have the ultimate long-term horizon in play.

People will criticise that because I won’t be able to access those funds until I’m a lot older, but at some point, I will, and they will be useful to me then. Of course, you can’t hold a lot of direct crypto in pensions (yet) so you can always play that through stocks involved in the sector as well as a splattering of exchange-traded funds (ETFs) that are relevant to the market.

But the key point, in my view – and this is applicable to your regular crypto portfolio – is that your core holdings should be the long game. That also helps you to ride cycles and not get too distressed when you live through a boom and bust (or two, three or four).

And therein lies the next lesson: do yourself a favour and really sort out your risk tolerance.

Having lived through it, you need to figure out if you can stomach it and get on with life, keep investing and keep going at it if you had the opportunity to pocket £1 million, and didn’t. This is also in line with ensuring that in that situation, you’d also be financially fine.

Imagine you had £1,000. And that became £1 million. Now if that then became £1,000 again. What would you do? How would you manage your mental state going forward?

If you think you’d be fine, jump onto Coinfessions and see what other people have done in similar situations. The art of “revenge trading” is what many turn to. That’s basically angrily trading and aggressively trading the market, in the depths of the garbage out there, and trying to quickly (and often unsuccessfully) “winning” back those previous gains.

It never plays out well.

All of this is avoidable. Your emotions can be comfortably kept in check by simple knowing your real attitudes to risk.

I still believe that most people do not truly understand it, do not honestly comprehend the impact it would have on them and do not invest in the market accordingly. Don’t be one of them.

Finally, the other lesson to learn is that it’s ok not to be filthy rich with fancy things and the “Insta-life” that’s the poster of success, it seems, in our world today.

When I’m dead, the only people that will truly remember me are the ones closest to me. My wife, kids, immediate family and friends. No one else really matters. I can still contribute to the world and be a positive influence while I do what I do. But no one outside of my immediate circle will remember me, so my legacy is to them.

That helps keep ego in check. It also means that I don’t care if I never own a Lambo, a yacht or a horribly ugly diamond-encrusted Rolex. I don’t need the flash to sustain my self-worth. I just want to look after my family and be there financially for my kids if they need it when they’re older.

That keeps the sensible hat on in the markets too and means that when it comes to the really high-risk stuff, if it pays off, great; if it doesn’t, so be it. But my core portfolio is for the next 30-50 years, letting it do its thing. The rest is a sideshow that’s fun, exciting and makes things entertaining.

I reckon applying that to the crypto markets will mean a lifetime of fun and enjoyment in it too and keeps things a) in perspective and b) keeps you sane while doing it.

What else we’ve been looking at this month

Sam:

Sugar tax, plastic bag tax… climate tax?

How much do you think that you control the things that you do? How much do you think that there are external forces trying to influence the things that you do? What you might have come to discover in the last few years is that the government is actively trying to influence and manipulate your behaviours.

It doesn’t even hide the fact that it’s trying to do it anymore. It’s the little things that the government does, like a plastic bag charge or a sugar tax, that change your behaviours. So, what comes next? Well, perhaps, it’s a tax on meat to get you to eat more “sustainably” or perhaps an increase in taxes on flights to force you into addressing climate change. Either way, the government is looking at ways to influence your behaviour – see for yourself.

Barbenheimer

This past weekend saw somewhat of a “comeback” by Hollywood. It was the opening weekend for both the Barbie movie and Oppenheimer.

I reckon that you’d be hard-pressed to find two more opposing kinds of movies launching on the same weekend. In fact, it even led to a weird fan phenomenon known as “Barbenheimer” where moviegoers planned to see both movies back-to-back.

In which order? Who knows, but I’d reckon that ending on Barbie would probably be the preferred method.

Nonetheless, both appear to be smashing the box office figures and will both end up as roaring successes. However, you can thank social media and the mainstream media for putting out a bunch of garbage headlines about these movies, which are essentially clickbait articles. I saw one last week about how Oppenheimer would inspire a whole generation of kids to make their own DIY bombs at home.

It reminded me of the furore around The Anarchist Cookbook some years back. It, supposedly, was destroying a generation… which it didn’t.

However, I did come across some good pieces relating to Oppenheimer. The movie has brought back a whole range of information about the war, about J. Robert Oppenheimer himself, and about the Manhattan Project. You may be very familiar with what it was all about, or maybe not.

Either way, this is a good piece, and even I learned a new thing or two about it all. This is highly recommended reading.

Where are all the aliens?

There’s recently been some back-and-forth with some editors here at Southbank Investment Research on the idea of alien life on Earth, them having visited Earth or being hidden on Earth.

You might have seen in the news that there’s a resurgence (seemingly) of alien encounters, possible alien spacecrafts having landed on Earth, and rumours that possible presidential candidates may release classified information relating to alien life.

That’s all good and well. I, for one, think about this regularly. But from the angle of where are all the aliens? This thought process is known as the Fermi paradox. It raises the question of: where are all the aliens? And it has led to much conjecture over the years.

If, like me, you do love going down an alien rabbit hole from time to time – do they exist? don’t they? etc – then I’d get yourself familiar with the Fermi paradox. There’s a lot available online, but this one page that I revisited recently was a good explanation, with a decent dose of maths in there, too!

James:

A futurist talks about the direction of travel for clean tech

As watchers of Southbank Investment Research’s Beyond Oil series, from three years ago, will know full well, when futurist, author and investor Ramez Naam speaks about the direction of travel for clean energy, it’s worth paying close attention.

Naam was one of the first to forecast the exponential cost declines of clean energy technologies, such as solar, batteries and electric vehicles (EVs), and to predict that clean energy and transport would become cheaper than fossil-fuelled versions.

Naam headlined the recent Canary Live Seattle event, where he had a far-ranging conversation with David Roberts, founder of the Volts podcast and newsletter, and editor-at-large at Canary Media. Their full hour-long conversation, which touched on hydrogen, ultra-long-distance transmission, the problem with cows, and the potential of space-based solar power, can be watched via this link.

There goes peak phosphate

Geologists have spent the last decade or two hunting high and low for battery materials – and one lucky mining firm has just struck gold.

Anglo-Norwegian firm Norge Mining recently discovered a massive underground deposit of high-grade phosphate rock in Norway that’s large enough to satisfy world demand for fertilisers, solar panels and EV batteries over the next 50 years. The Norwegian deposit is estimated to be worth 70 billion tonnes at least, very close to the global reserves of phosphate already proven and known about.

This is a huge, potential game-changer for Norway and Europe. Phosphate is one of the key materials used in one type of lithium-ion battery, known as “LFP”, and demand for these batteries – and the underlying phosphate – is growing fast. Seek and ye shall find!

When trades look too good to be true, they usually are

Earlier this month, a trader, or a group of traders, spent $5 million on purchasing half-a-million call options on Bright Health Group, a little-known small cap in the US. Although such a large bet that is using options on such a small company is unusual at first glance, the price paid – between five and ten cents each, targeting shares at $2.50 a piece – seems a no-brainer given the stock was trading around $14.

But the problem is a recent reverse stock split approved in May sparked a price adjustment for the options contracts to the effect that the options contract is now valued at around $0.16, meaning the buyer(s) spent all of that money for the right to buy an asset if it rallies at least 1,462% by the 17 November 2023 expiration date. So, was this:

- An extremely bullish bet? or

- A misunderstanding, thanks to the complex mathematics of options?

As someone who knows how difficult pricing options can be, I’m pretty confident that I know the answer.

James Allen and Sam Volkering

Editors, Small Cap Investigator