Your March issue of Small Cap Investigator

28th March 2024 |

- The cable-maker looking to lead the electrical infrastructure revolution

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

The cable-maker looking to lead the electrical infrastructure revolution

There’s a truism in the power industry that’s long been universal: everything that requires electricity also requires cables.

Power lines and high voltage cables are the cornerstones of electrification, after all.

As well as more clean energy, Britain and the wider world need miles and miles of extra cable to carry it.

Of course, without building the links needed to transport electricity from where it is generated to where it is needed, there will simply be no energy transition at all.

Electricity demand in the UK is forecast to more than double by 2040 as heat pumps and electric vehicles eat into current market dominance of gas-fired boilers and internal combustion engines, while heavy industry must also switch away from fossil fuels in favour of clean power.

In response to the needs of a more electrified economy, the government aims to increase the UK’s offshore wind power capacity to 50 GW by 2030, alongside anticipated growth in solar farms and battery facilities nationwide.

But according to Keith Anderson, boss of UK utility Scottish Power, for every pound spent on clean energy projects, another pound must be spent on upgrading the power grids. As he says, there’s no point investing in renewables without investing in the grid.

“It’s like buying a new iPhone and not having a cable to go with it,” says Anderson.

This requires vast amounts of new cabling spread out over equally vast distances, as developers try to best harness the wind and sun.

Indeed, analysis of Britain’s existing power grids and the country’s predicted electricity demand reveals that, within the next 17 years, more than 600,000 kilometres of electric lines will need to be either added or upgraded across the UK.

According to the data, engineers need to roll out more than 100 kilometres of electric cabling every day until 2040 if the government hopes to power the country towards its climate goals – in the UK alone.

Globally, nearly 50 million miles of overhead or underground power cables are in use, comprising both high-voltage transmission and lower-voltage distribution networks.

But the International Energy Agency (IEA) estimates that, by 2040, more than 30 million miles of new lines need to be built and more than 18 million miles of existing lines need to be replaced and modernised.

That’s equivalent to power cables long enough to reach from the Earth to the Moon 200 times over needed to be built over the next 17 years alone.

Supply chain stresses and strains

But the energy transition, just like all technological innovations, is only as strong as its weakest link.

Unfortunately, it’s looking increasingly doubtful that manufacturing capacity will align with the rapid pace at which new projects need to be built.

Evidence now points to a severe shortage of cabling that could entirely threaten the clean energy transition entirely.

Already, demand for interconnectors and other associated electrical infrastructure is putting unprecedented strain on supply chains for the cables needed for connection to the grid.

Undersea high voltage lines that connect offshore wind farms now face order backlogs of two to five years, with demand for such cables sent to set to ramp up significantly over the next ten years.

Up to now, offshore wind farms have mainly been placed in the close, easy locations, so connections are now having to go further out to sea than ever.

High-voltage cables look set to be in short supply for years or even decades, Nick Winser, Britain’s first electricity networks commissioner, warned in a landmark report last year because already producers were struggling to meet demand.

National Grid, which owns and runs Britain’s transmission system and is developing new cables to the continent, says it is “operating in a constrained market” driven by “a limited number of suppliers globally”.

Just last year, the completion date of the £2.4 billion NeuConnect cable between the UK and Germany was put back four years to 2028, largely due to the difficulties in obtaining high voltage direct current (HVDC) cables.

Meanwhile, a link between Denmark and Britain has been delayed by problems including “unforeseeable cable market congestion”, while a cable linking France and Spain across the Bay of Biscay is also running one year behind.

But this is not just a UK issue.

Demand for high-voltage cabling is particularly acute in Europe, where Spain and Italy each have 150 GW of solar and wind projects waiting for a connection to the grid.

Meanwhile, grid operators in the US are also facing difficulties getting equipment, with the US Department of Energy flagging a “shortage of transformers and other grid components” in 2022.

Of course, where there are bottlenecks there is also opportunity.

Booming market for power cables

Put this all together and this is a market playing out in favour of the large industry incumbents.

Supplies of electricity cables are concentrated among relatively few companies in a market where there are high barriers to entry given the technical expertise and equipment required to make and install the cables.

These companies are now investing heavily to meet demand.

Indeed, investment in power networks needs to more than double to $600 billion a year by 2030 alone, according to the IEA.

The market for high-voltage cables, in particular, is booming, climbing from a typical $3 billion of new projects awarded per year between 2015 to 2020 to $11 billion in 2022.

This year, the estimated value of new orders is likely to exceed $20 billion before settling at between $18 billion to $20 billion per year, according to market insiders.

According to an industry study, the electricity interconnector market alone is expected to grow by over 14% per year over the next eight years, driven by the “electrification of everything” that is now underway. This is a really massive figure, given the traditionally low single-digit growth for businesses in the sector.

In short, we are now entering the third electrical infrastructure revolution after previous growth spurts at the turn of the 20th century and after the Second World War.

A huge UK bounty up for grabs

Traditionally, the companies making and laying cable used to be considered low-growth businesses that merited low valuations, but that view is quickly becoming outdated.

The stock we are recommending today has a huge presence in the UK, recently winning a three-year contract with the National Grid to upgrade the grid with medium-voltage cables.

It is also working on two mammoth interconnectors, EGL1 and EGL2 (Eastern Green Link), which connect Scottish North Sea renewables to English homes.

What’s more, it has also won a contract for offshore connection for Hornsea 3 – the world’s largest offshore wind farm, in the North Sea. And finally, it completed the Viking Link to Denmark in 2023.

This company’s UK experience, relationships and exposure are industry-leading, just at a time when the UK looks set to ramp up grid upgrade spending.

Indeed, so great is the disparity between what we have and what we need that the UK Electricity System Operator (ESO) recently announced that the grid required £58 billion of spending for expansion and updates.

In a report released just last week, National Grid’s ESO mapped out power “motorways” across Great Britain to allow for the biggest investment since the 1960s.

The new “blueprint” recommends a “high-capacity electrical spine” running onshore from the north-east of Scotland through to the north-west of England, alongside a complex collection of cables stretching along coastlines.

In particular, the growth of the offshore wind industry has necessitated greater need for strong connections between the east coast of Scotland and the urban centres of England, where demand is greatest.

That sets up an amazing opportunity for companies in the space, especially any that have good exposure to the UK.

Previously, cable companies had been low-growth, low-valuation businesses but the growing market for subsea power from offshore wind and interconnectors is rewriting the old rule book.

Although our next recommendation is a mature business, it has a lot of growth ahead of it – so I’m more than happy to recommend it for Small Cap Investigator.

That stock is called Prysmian Group (LSE: 0NUX).

Our next Small Cap Investigator recommendation: Prysmian Group (LSE: 0NUX)

Milan-based Prysmian Group, born out of Italian tyre-maker Pirelli in 2005 before listing in 2007, is the world’s largest cable-maker by market share. It accounts for about 40% of global undersea interconnector installation alone.

Although it is a global business, it is mainly focused on Europe, the US and the UK, where it has a particularly strong presence.

In late 2023, Prysmian won a £750 million contract to supply cable systems for a major national grid development project between Scotland and England.

The order was awarded by Eastern Green Link 1 Limited, a joint venture between the owners of the transmission network in the UK, SP Transmission and National Grid Electricity Transmission.

This is the first of 26 critical projects to go through Ofgem’s accelerated approval process, set up to tackle the looming need for a bigger, better grid.

This came hot on the heels of Prysmian Group winning contracts for two offshore grid connection systems and an underground cable project in Germany, valued in aggregate at around €4.5 billion.

It’s certainly a suppliers’ market, as the company itself acknowledges.

“Customers are in a kind of panic mode,” says Prysmian Group CEO Massimo Battaini.

“They realise that if [they don’t] move faster than the market, their capacity will be booked by someone else. So they are kind of participating in our investment and giving us a downpayment for volume.”

This is putting the company in a strong position, with the company fully booked until 2026/27.

“We can price cables with more headroom price-wise than we used to have in the last 10 years,” he adds.

Unlike some of its competitors, Prysmian has held on to a diversified cable-making portfolio, which includes cables for telecoms, buildings, ships and railways, because these businesses are steadily cash-generative. This enables greater investment in faster growing sectors such as renewables without needing to raise the capital to do so.

Geographically it has expanded heavily into the US through the acquisition of General Cable in a $3 billion deal struck in late 2017.

It also connected its first utility scale offshore wind farm in the US last year, and it won a $900 million contract following on from that. The US is a huge market and with Prysmian’s European focus, acquiring its way into that market has been an excellent move.

The financials are impressive

The financial situation is reassuringly settled.

Its market cap is around €14 billion, on sales of €15.5 billion. Net profit margins float between 1% and 4% and haven’t gone negative in at least a decade.

Revenue growth was mid-single digit until 2017, until the defining moment of the General Cable acquisition. It was a big one for Prysmian and therefore involved a sizeable chunk of debt, which it is slowly paying down.

It also means the last five years have seen much more volatile revenues, growing over 25% in three of the years and falling in a couple of others, including 2020 with Covid but also in 2023 when they fell 4.4% (or, if you strip out currency and commodity price effects, only 1.1%).

This was partly down to two knockout years in 2021 and 2022, where it rebounded from Covid with consecutive years of 25%+ growth, something that was previously only achieved inorganically, through acquisitions.

While total revenues were down very slightly in 2023, under the surface the electricity projects division grew 16% driven by interconnection and offshore wind projects. Its backlog was also the largest ever, at €18 billion. However, the downside came in its digital division, where sales fell 18%, balancing out the electricity growth.

Margins in energy projects also improved notably from 8.1% to 10.5% in 2023, driven by demand from power networks and new renewable construction, driving overall group margins higher even as revenues slipped back a touch.

More impressively, free cash flow grew 30% in 2023 to €724 million. This allows it to invest in growth, and to be opportunistic, while retaining financial resilience and returning capital to shareholders too.

Last year, it used this excess cash to reduce its debt burden by €229 million, to €1.19 billion. Going forwards it has a stated intention to ramp up dividends and share buybacks to return capital to shareholders.

And its order backlog is massive too, standing at $11 billion, up from must $2.3 billion at the end of 2019. This really highlights the bottleneck that’s crept up on the industry.

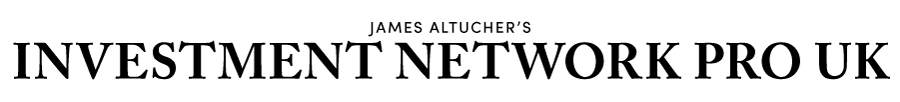

It’s certainly interesting to see how Prysmian’s financials line up against its two closest pure-play competitors, Paris-based Nexans and the Danish NKT.

As you can see, NKT is the most expensive on price-to-sales (PS) or price-to-earnings (PE) basis, and consequently has the lowest dividend yield. It’s the least indebted though, and has the best margins.

Nexans is the cheapest on the valuation front, but has the lowest margins to match, while Prysmian sits in the middle. Its higher debt to equity levels are explained by the overhang from the issuance in 2017 to fund the General Cable purchase.

Historically they are all very steady businesses, and not as cyclical as you would think. None will have a huge competitive advantage as the product is reasonably commoditised, and so increased profitability will be driven either by industry trends of the arrival exceptional management.

And in this case, it’s industry trends that matter – namely the growth of renewable capacity and interconnectors and the special case of the UK, where Prysmian has the best exposure.

As for Prysmian’s valuation, it looks cheap against sales at 0.8x, but more expensive against earnings at 26x.

Certainly, if the grid bottleneck gains wider recognition at the same time as Prysmian’s sales and margins head higher, there could be a revaluation of the business against higher sales and earnings figures giving us a double tailwind. This looks to be somewhat underway already, as the stock and sector have already got some good momentum, which we expect to continue.

However, it’s no guaranteed win, even with all that going for it.

Please consider these risks

Although the setup is hugely favourable for the industry, and Prysmian is brilliantly placed to take advantage of it, every investment carries risk – namely around price paid for the shares, but also operationally.

General risks such as recessions, commodity prices, political instability and market crashes affect many companies, but there are also company-specific risks to be aware of with Prysmian.

This is a commoditised market. High regulations on performance and safety mean that Prysmian’s products are pretty much interchangeable in many cases with those of its competitors. Given that it’s not a consumer good – where marketing and brand power come into play – that makes pricing a critical factor and differentiation very difficult.

Excellence and reputation therefore matter a lot, in areas like cost overruns and delivery times. A mistake such as the malfunction on the Western Link project in 2014 – when Prysmian experienced problems with the manufacture of the cables for the 2 GW HVDC connection – can set a company back a long way.

It’s a particularly acute concern for offshore wind, where cable insurance can be in the hundreds of millions over the life of the farm, and 85% of claims are for cable failure.

Prysmian dealt with the Western Link incident well and still managed to deliver the project and learn a few lessons along the way, but that must remain an isolated incident, not a trend. Just look at Boeing.

While the grid bottleneck presents an opportunity for Prysmian to get more work and charge higher rates, bottlenecks in component supply could hinder its ability to meet those commitments. It accounts for revenues in proportion to the work completed in a contract, so such delays would impact the timing of its income.

Prysmian also faces concentration risk in a few key assets, such as in its fleet of cable-laying vessels. It has six, a large fleet in industry terms, but still means that a single issue could affect 17% of its capacity for subsea cable work.

Of course, Prysmian has some key competitors that vie for the same contracts, not least Nexans and NKT, but also Schneider Electric in France, Hitachi Cable and Furukawa Electric in Japan, and Southwire in the US.

What’s more, the growth in renewables is attracting newer, nimbler competitors to the previously stable cable market for the first time in some years. These include British company XLCC, which specialises in HVDC subsea cables, and Typhoon HIL, which focused more on microgrids and residential energy systems.

In time, these kinds of companies may climb the ladder and move into grid-scale cables to challenge Prysmian.

However, there are pretty enormous barriers to entry, mainly in the form of huge capacity requirements and consequent upfront costs, but also the reputation, trust and accumulated expertise of these established players with long track records.

Invest before the market fully prices in the impending cable bottleneck

If you’re comfortable with the risks, then our recommendation is to buy shares in Prysmian immediately.

We believe that the company trades under a valuation that looks cheap given the gear-change we see coming for electricity grids.

With the power grid itself now the key bottleneck to electrification, Prysmian is ideally placed to take advantage.

The company’s main listing is on the Milan Stock Exchange (MI. PRY) though for the purposes of Small Cap Investigator we are recommending you buy the shares traded on the London Stock Exchange’s International Order Book (LSE: 0NUXE).

Source: Koyfin

Action to take: buy Prysmian SpA (London listing)

Ticker: LSE: 0NUXE

ISIN: IT0004176001

Current price: €48.13

Market cap: €14.5 billion

52-week high/low: €33.26 – €50.10

Buy up to: €60

Big breakthroughs

Sam:

It’s in maths we trust

This month’s big breakthrough is not necessarily new and it may even be something you may roll your eyes at as you read on.

But it is important, maybe the most important breakthrough in history. And we’re fast approaching a monumental point in its own relatively short history that has historically provided one of the most astonishing inflection points for investors to be a part of.

Will that happen again? Who knows, we don’t have a crystal ball. But in my own 14 years of experience here and looking at the previous patterns we’ve seen reveal time and time and time and time again, we must take a closer look at what exactly is going on, and why.

So, let’s dive in and explore…

Do you remember where you were on Saturday 3 January 2009?

I do.

I was tucking into a BBQ and beers at home. It was just after the New Year and only a couple months earlier I’d returned from a six-month sojourn through Europe. In fact, my final destination was London before heading home to Melbourne, Australia.

While I enjoyed the Aussie summer sun, I didn’t realise history was unfolding as well. And that very day, unbeknown to me, would change my life forever and… the world.

The only thing is only a handful of people even knew what was going on.

That same day, The Times ran the headline,

Chancellor on brink of second bailout for banks

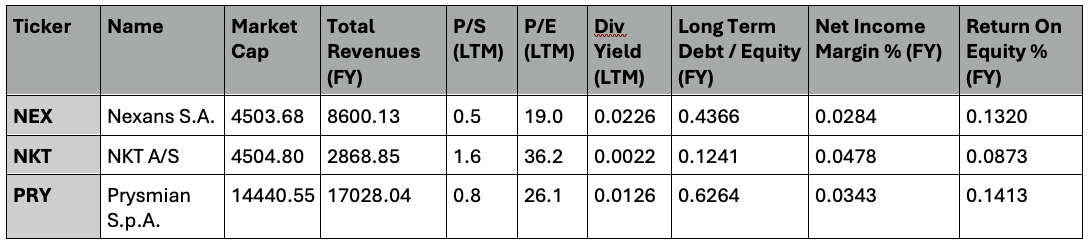

It was also the day of the bitcoin genesis block. The very first block of bitcoin’s blockchain. You and I had no idea what bitcoin was on that date.

But we all sure as heck know what it is now.

The Times headline is important, because it is hardcoded into the bitcoin genesis block data as you can see below just off to the right side of the data:

Source: Wikipedia

Bitcoin exists because in the 836,000 (and counting) blocks since that genesis, its blockchain has not failed, and thanks to its core code, we have known it to be a constant in the world.

It’s due to this code, applied in a peer-to-peer network, that has seen its astronomical growth.

But it’s also important to know that very first genesis block is crucial to the scale of bitcoin’s impact. That headline from The Times sums up exactly the core principles and philosophies of what bitcoin is.

It’s because one of the core philosophies of bitcoin is to be the antithesis to the legacy financial system. As the “TradFi” (traditional finance) system was failing and crumbling in 2008 and 2009, bitcoin was being born.

And today, it continues to play that antithesis role. It is the alternative to centralised, concentrated, controlled financial power and manipulation. It’s an “opt out” of a traditional system that is fundamentally flawed against the freedoms of the individual.

As per the original bitcoin whitepaper, it is designed to be a medium of exchange over the internet. But its philosophies of existence are very much rooted in a new, different, alternative economic system to the legacy one that continues to fail today.

When you start to appreciate that origin story, you start to really get an idea of the importance of bitcoin during the current state of play in the global economy. As central banks ratchet up the debt, as inflation runs out of control and the world realises that central banks and central bankers are at the helm of a rudderless ship, bitcoin only grows in awareness, value and importance.

But when we turn back to bitcoin’s code, we also find an interesting dynamic in how it deals with supply and demand.

You see what’s also a part of bitcoin’s core code that continues to enable it to function unbroken and undisrupted today is what we call the “halvening”.

Part of the design of bitcoin’s network is an economic incentive for peers on bitcoin’s network to secure it, add blocks to its blockchain, verify transactions – to keep the system running.

These peers are “miners” and to keep mining they need a reward.

They “mine” by solving a mathematical difficulty algorithm that’s incredibly complex and hard to solve. By solving it, they “mine” a block, which is added to the blockchain. Within that block are all the verified transactions that have taken place during that particular block.

Now mining has costs. Energy costs, time costs, hardware costs. So there must be some economic incentive for miners to continue to keep the network running. And there is.

The block reward.

Rewards and difficulty = incentive

The block reward is the number of bitcoin that miners are rewarded with for mining and adding blocks to bitcoin’s blockchain. When bitcoin first started, to attract more miners to the network the bitcoin block reward was 50 bitcoin.

And in bitcoin’s code, which cannot be changed, the bitcoin block reward would be cut in half after 210,000 blocks. This is a constant in bitcoin.

Another part of bitcoin’s code is known as the difficulty adjustment. This is a dynamic system that adjusts depending on the speed at which blocks are mined.

The “target” speed of block mining is ten minutes. That means the bitcoin blockchain is set to add one new block every ten minutes. If average block speed is nine minutes, the difficulty will adjust to make it harder to solve the difficulty algorithm, to get back closer to the target ten minutes. Likewise, if the average block speed is 11 minutes, the adjustment makes it easier to solve the algorithm – always aiming for that ten-minute target.

This difficulty adjustment happens every 2016 blocks. So quite frequently.

This is all important because it means that roughly every four years we get 210,000 blocks. And that roughly every four years we will subsequently see the bitcoin block reward halve again, and again… and again.

The halving is set to continue to take place until all bitcoin are eventually mined – which is estimated to be sometime around the year 2140. Before then, however, it is expected that as a combination of value of bitcoin and activity on the network, the miners reward from transaction fees will outweigh the block reward, which continues to provide incentive to mine and contribute to bitcoin’s blockchain.

Right now, we’re still in the early days of bitcoin’s progress and the wider crypto ecosystem’s development.

But so far, every four years marks a new halving event – and as we’ve seen with every halvening prior, a catalyst for the start of a new bitcoin and crypto megacycle. So far each mega cycle has led to a boom in crypto awareness, adoption and importantly value creation.

This happened during the period after the first halvening in 2012 (the first 210,000 blocks came faster than expected). This cut the block reward from 50 to 25 bitcoin. In the year after the halvening, bitcoin’s price shot higher and for the first time in history in early 2013, surpassed the value of one ounce of gold, which was around $1,300 at the time.

Between 2012 and 2016 we also saw an explosion of crypto projects developing and innovating in a way that was not anticipated. And while the price may have come off during this “winter”, the innovation and development in the space was relentless.

Then in 2016 we prepared for another predictable, certain, block reward halving. And at block 420,000 it happened again, cutting the reward from 25 to 12.5 bitcoin.

And from 2016’s halvening to bitcoin’s peak in 2018, bitcoin’s value went from around US$650 to almost US$20,000.

Then, as you’d have it, the cycle repeated. And the values fell away but the relentless innovation and development continued. It importantly introduced the ideas of “decentralised finance” (DeFI) and “decentralised infrastructure” (DePIN) to the industry.

Then we started to head towards the next predictable, certain, block reward halvening at block 630,000.

The block reward halved again, this time from 12.5 to 6.25 bitcoin in May 2020.

Now, before that halving in 2020, I wrote the following:

I’m saying that I think we’ll see another repeat of the last two mega cycles. But this next one could be bigger and better than the last two.

Of course past cycles are by no means a guarantee for future action. But hey, you can’t ignore patterns and trends either, right?

What we know however is that each cycle is about far more than just bitcoin. It’s a massive, expanding ecosystem of cryptocurrency that holds endless potential.

From 11 May 2020 to bitcoin’s high in the next cycle (as predicted) bitcoin went from $8,752 to just over $69,000.

Well guess what folks…

It’s that time of the quadrennial, and once again we are fast approaching the predictable, certain, block reward halving – this time at block 840,000.

The expectation is that this will happen on 19 April, so in about three weeks. And I want to go on record again saying something…

I’m saying that I think we’ll see another repeat of the last three mega cycles. But this next one could be bigger and better than the last three.

Of course past cycles are by no means a guarantee for future action. But hey, you can’t ignore patterns and trends either, right?

What we know however is that each cycle is about far more than just bitcoin. It’s a massive, expanding ecosystem of cryptocurrency that holds endless potential.

Already bitcoin’s price has hit new all-time highs in the last few weeks, topping $73,000 about two weeks ago. Is that it now? Is the run over?

I don’t think so.

I remember when I said these things in 2016 and 2020, and I expect even now people reading this will think I’m flat out bonkers. But you can make that determination yourself.

My point is that while bitcoin’s code is not “new” anymore, it is still a breakthrough technology. And what it has become over the years has changed and may very well change again in the next 15 years – and then again in the 15 years after that.

But this is by no means a flash in the pan. It’s a complete disruption, an upheaval of TradFi, and that makes this arguably the biggest technology breakthrough in history.

Buy List update

Ashtead Technology Holdings PLC (AIM: AT)

Subsea equipment rental company Ashtead Technology Holdings, recommended at 374p in July last year, has risen around 10% over the last month to trade at 742p at the time of writing, putting it 98% up in the model portfolio.

On 21 March, the stock hit a new 52-week high of 760p.

Ashtead has a history supplying subsea services to the oil and gas sector but has diversified into the fast-growing offshore wind market, specialising in renting out equipment crucial for the operations of installations throughout their lifecycle.

The company’s technology offerings include surveying equipment, sensors, and robotics essential for installation, operation, maintenance and decommissioning of assets.

It is on an ambitious growth journey and making ongoing investments in its subsea equipment rental fleet that has in excess of 23,000 assets.

Profitability in both the oil and gas sectors and the renewable energy markets has experienced a significant surge, leading to a substantial increase in earnings forecasts.

The majority of its rental fleet can be seamlessly deployed across oil and gas projects and the wind sector, thereby maintaining consistently high utilisation rates.

With continued robust investment in oil and gas fields and an anticipated surge in offshore wind installations, as well expansion through strategic acquisitions and involvement in decommissioning activities, Ashtead anticipates substantial revenue growth in the double digits over the medium term.

Ashtead’s profitability is remarkable, boasting profit margins exceeding 30% and returns on invested capital surpassing 25%. Bolstered by record order backlogs, the company’s future prospects remain highly promising.

The stock remains a HOLD while it trades above 395p.

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings is trading around £13.25, 6% down in the model portfolio, with the stock falling by nearly 16% over the last month.

European Metals part owns the Cinovec lithium asset in the Czech Republic, one of very few advanced-stage, large-scale lithium projects in the European Union with a mineral resource of nearly 7.4 million tonnes of contained lithium carbonate equivalent.

The project is being developed by Geomet, a joint venture between EMH and Czech-state-owned CEZ.

Earlier this month the company outlined key operational highlights in the six months ending 31 December 2023.

These included a strategic investment of €6 million (£5.1 million) from the European Bank for Reconstruction and Development (EBRD) to support the Cinovec Project’s development and the successful extension of all four Cinovec Exploration Licences until 31 December 2026.

Corporate and administrative updates included the issuance of shares and CDIs on the exercise of options, raising a total of $1,120,080.

European Metals’ cash position as of 31 December showed cash and cash equivalents of $5.67 million, a decrease from $8.89 million at the beginning of the financial year, reflecting the group’s ongoing investments in its core project development and operational expenditures.

The company is also expected to deliver a definitive feasibility study (DFS) on Cinovec imminently.

What’s also positive is that lithium carbonate prices now look like they have turned a corner, surging more than 15% in China since the Lunar New Year holiday finished amid reports of potential domestic supply curbs, downstream restocking and short covering by traders.

The stock remains a BUY below its 45p buy limit.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF has risen by 4% over the month to trade last at around £6.38 at the time of writing, putting it around 29% below our £8.96 entry price.

LITG has significant positions across different parts of the lithium supply chain, including in lithium heavyweights such as Albemarle, Tesla and Mineral Resources. This helps cushion it against lithium price volatility. For example, if prices fall, that’s a negative for producers but a positive for companies that buy lithium to make value-added products.

The ETF invests in the full lithium cycle, from mining and refining the metal, through battery production. It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.

By owning mining, refinery and battery production companies in the fund, Global X has its fingers in multiple parts of the lithium industry.

Although the lithium market has generally been depressed over the last few months, it should certainly benefit from heavy demand for lithium. After all, without lithium, we can’t build EVs or have the green future that countries are demanding.

We can certainly expect EV demand to pick up if the US Federal Reserve cuts rates later this year. As stated last month, with EVs expected to make up about half of new car sales worldwide by 2035, according to Goldman Sachs research, we’ll see continued demand for lithium over the longer-term.

LITG remains a BUY.

Central Asia Metals (AIM: CAML)

Central Asia Metals (AIM: CAML), a mining company with operations in Kazakhstan and North Macedonia, has risen 20% over the last month to 189p at the time of writing, still leaving it 31.5% underwater in the model portfolio.

The group’s principal business activities are the production of copper at its Kounrad operations in Kazakhstan and the production of lead, zinc, and silver at its Sasa operations in North Macedonia.

The stock has risen in line with strong copper prices, which have surged to their highest level in one year above $9,000/tonne. The rally was triggered by news that major copper smelters in China have pledged to curb output in response to a tightening copper ore market.

In its 2023 financial results, the company experienced a decline in gross revenue, with figures dropping to $207.4 million compared to $232.2 million in the preceding year.

Similarly, net revenue decreased to $195.3 million from $220.9 million, and Ebitda fell to $96.5 million with a 47% margin, down from $131.6 million with a 57% margin in 2022. This downturn was attributed to lower zinc and lead prices, coupled with increased costs at the Sasa mine and the Kounrad operation.

Despite these challenges, the company managed to generate a free cash flow of $57.5 million, a decrease from $90.22 million in the previous year.

To mitigate the impact on shareholders, management increased the dividend payout from the usual maximum of 50% to 69%. However, the full-year dividend for 2023 was declared at 18p per share, slightly lower than the 20p distributed in 2022.

Despite the financial setbacks, CAML invested $27.8 million in capital expenditure during the year to enhance long-term operational performance and growth. Ending the year with $57.2 million in cash reserves and no debt, the company remained financially stable.

On the operational side, CAML reported varied production figures, including 13,816 tonnes of copper output, 20,338 tonnes of zinc in concentrate, and an increase in lead in concentrate production to 27,794 tonnes.

The company continued its strategic investments, completing projects such as Sasa’s paste backfill plant, the transition to paste fill mining methods, the initial phase of the new Central Decline, and the Kounrad solar power project. Additionally, CAML launched CAML Exploration in Kazakhstan, securing two exploration licenses thus far.

“The company has performed well due to our low-cost operations and strong balance sheet,” said chief executive officer Nigel Robinson.

The CEO also said the company was “delighted” to have separately announced its intention to invest up to £5 million in Scottish copper and nickel explorer Aberdeen Minerals, a sign that it is searching for growth outside its existing asset base in Kazakhstan and North Macedonia.

CAML will take a 28% stake in Aberdeen Minerals for £3 million in cash.

“We have been impressed with the Aberdeen team and the company’s exploration potential and we look forward to working together to explore the prospective Northeast area of Scotland.

“We will continue to search for additional growth opportunities both at the early exploration stage and also the larger transformational transactions which will enhance shareholder value in the short to medium term.”

The driver for 2024 earnings will largely be metals prices, though CAML’s cash position and low costs mean it is insulated from prices remaining low.

CAML remains a BUY under 310p.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company, which invests in UK forestry and afforestation assets, has fallen 3% over the last month to around 66p at the time of writing, putting it around 40% down in the portfolio.

With a decline in land values continuing to impact the investment company and with the firm still not reporting any significant news this year, the firm remains a HOLD in the model portfolio.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation, the world’s largest gold miner, is trading around $33.92, up 13% on the month. The stock is now 48% below our $65.39 entry point.

With the price of gold hitting all-time highs, Newmont (NEM) has been a little slow in following suit, but there are certainly now signs that it is playing catch-up.

Gold surged above $2,200 an ounce last week for the first time and it has rallied about 10% in a month.

Certainly, if central bank demand for gold keeps increasing, that could continue to support the gold price and by extension NEM.

The rise in the gold price has certainly come at a good time for Newmont’s planned sale of its Akyem gold mine in Ghana, a move that has reportedly piqued the interest of several potential bidders, including Chinese producers.

The sale of Akyem is part of Newmont’s effort to raise $2 billion in cash through divestitures in the aftermath of its purchase of Newcrest Mining in November. On top of Akyem, Newmont wants to sell four gold mines in North America and one in Australia.

Amid optimism for NEM’s next earnings report in late April that should continue to support the stock, Newmont remains a BUY under $100.

DS Smith (LON: SMDS)

Recycled-content paperboard and packaging producer DS Smith has enjoyed another good month, rising by 10% to 359.80p at the time of writing, putting it 13.50% up in our model portfolio.

The reason for the uplift is not hard to find: DS Smith and Mondi, the global packaging and paper group, have announced a potential merger worth around £5.1 billion.

A joint announcement on 7 March revealed that the two companies have struck an agreement in principle on the “key financial terms” of a merger.

Under the proposed terms announced in the deal, shares for DS Smith will stand at 373 pence per share, a 33% premium to its pre-offer price.

If the deal goes ahead, Mondi would own a 54% stake in the company with the remainder of the shares (46%) being owned by DS Smith.

According to the statement, a merger of the two companies would create “a leading player in corrugated packaging across Europe”.

Combining both Mondi’s and DS Smith’s strengths in the corrugated value chain would also provide “strategically located and integrated recycled containerboard production”, the statement added.

The deal would also see “significant value creation for both Mondi and DS Smith shareholders from substantial synergies”.

While Mondi serves as a paper supplier to the UK market, it doesn’t have any mills that are located within the UK, unlike DS Smith. Instead, Mondi operates OCC mills in Sweden, the Czech Republic, Poland, Finland, Russia, Turkey, and South Africa.

The announcement states that the current deadline for Mondi to announce a firm intention to make an offer for DS Smith has been extended to 4 April, 2024, as per the request of the DS Smith board.

This extension provides the parties with additional time to continue discussions regarding the potential merger.

The agreement remains subject to various conditions including regulatory approval and satisfactory due diligence from both parties.

According to broker Jefferies, a merger would lower paper and box production costs across the group, and decrease earnings volatility. It predicted cost savings of €300 million.

The stock remains a BUY.

Kraneshares MSCI China Clean Technology Index UCITS ETF (LON: KGRN)

Kraneshares MSCI China Clean Technology Index UCITS ETF, recommended at $24.83 on 12 October, the day it listed on the London Stock Exchange, was last seen at $20.36, putting it 18% down in the model portfolio. It has risen by nearly 7% on the month.

KGRN, which tracks the MSCI China IMI Environment 10/40 Index, is the only UK-listed ETF to specifically tap into China’s cleantech industries.

I’m certainly happy to continue to have exposure to some of China’s world-leading manufacturers of clean-energy technology, from solar panels and wind turbines to electric vehicles, in our portfolio.

According to an analysis by the Centre for Research on Energy and Clean Air, the energy transition is of unprecedented importance to the Chinese economy. In 2023, 40% of China’s GDP growth came from the clean-energy sector.

The ETF is a BUY below $26.83.

NET Power (NYSE: NPWR)

We recommended carbon capture company NET Power at $9.49 in the November issue of Small Cap Investigator. At the time of writing, it is fetching $11.22, putting it 18% up in the model portfolio, with the stock surging 37% over the last month.

As you’ll recall, NET Power has developed a natural-gas power plant that makes it easy to capture carbon dioxide released by the burning of natural gas.

The company released Q4 results that showed that it ended 2023 with a strong balance sheet including approximately $637 million of cash and short-term investments.

NET Power continues to make progress on its utility-scale combustor, which should help the firm de-risk the design stage fast enough for licenses to be issued before the first plant is built.

What is interesting is that, according to the corresponding Q4 analyst call, the firm’s management are keen to promote NET Power’s modular design as a perfect match to serve the power requirements of data centres, in the wake of increasing awareness of the vast load projections for AI.

“These data centers are hungry for power, they’re expected to become one of the largest segments for load growth in the U.S. through 2030 and beyond, and because our NET Power plants are designed to deliver low cost, low carbon intensity, 24X7 reliable power, we think our product will be the best fit amongst options for this category,” said NET Power CEO Danny Rice.

“The initial size we’re bringing to market with generation one will be targeting roughly 250 megawatts, so we could see perfect pairing of NET Power plants with a single hyper scale data center. And as you see, these data centers becoming larger up to 750 to a 1,000 megawatts, it really lends itself to NET Power’s modular design in order to deploy fleets of three to four NET Power plants to match each data centre’s load.”

The stock remains a BUY up to $11.

Stellantis NV (NYSE: STLA)

We recommended multi-car brand giant Stellantis at $22.84 in the January issue of Small Cap Investigator. At the time of writing, its shares are trading at $28.70, putting it 26% up in the model portfolio, after rising 12% over the last month.

The rise in the share price has seen Stellantis eclipse Volkswagen, its fiercest European rival, in market value.

While VW has opened new factories dedicated to electric-only models, which has led it to scale back production as EV appetite slows, Stellantis has bet on “multi-energy” platforms that allow it to make hybrid, petrol and electric cars on the same production line. When demand for one type falls, the same workers can increase production of alternatives.

Stellantis’s other strengths include a vibrant US operation, with the profitable RAM pick-up trucks and Jeep vehicles, and a unique approach to China, where its deal last year with Chinese start-up Leapmotor should help it in the country while also giving it a slice of every EV sold outside of China by the fledgling group.

The stock remains a HOLD while it trades above its buy limit of $23.50.

AltC Acquisition Corp (Oklo)

With the company in the midst of completing its reverse merger/business combination (expect around July) things continue to move forward with Oklo’s path towards its small-scale nuclear reactors.

Of note, in mid-March the company announced it’d achieved a major milestone in completing the second phase of the testing of its Thermal Hydraulic Experimental Test Article (THETA).

The company explains that, “Ultimately, the THETA testing campaign enables the opportunity to further improve the demonstrated safety and economic potential of bringing Oklo’s fast fission technology to market.”

ETC Group Digital Assets & Blockchain ETF (LON: KOIP)

Just over a week ago ETC Group Digital Assets & Blockchain ETF merged with ETC Group’s other crypto-related ETF, the ETC Group Global Metaverse ETF (LON: METR).

The reason for doing so was to combine the assets under management of two relatively similar ETFs that had plateaued in terms of AUM growth.

What you might see in your brokerage accounts is KOIN/KOIP ETF showing as offline or it may disappear from your list of investments. Often it take brokers a week or two to sort out corporate actions like these. According to HANetf, “Shareholders will receive 0.290841740 shares in ETC Group Global Metaverse UCITS ETF for each share in ETC Group Digital Assets and Blockchain Equity UCITS ETF.”

What will happen is that soon enough your investment will reappear as Metaverse ETF, with the ticker METR.

In terms of investments there are a number of similarities between the two, including stocks like Coinbase, Block Inc., Nvidia, PayPal and, of course, Metaverse-focused ones like Meta, Roblox and Netflix.

In short, while the merger does take this ETF away from “Blockchain” and into “Metaverse” there is an alignment between the two. This ETF continues to provide wide exposure to big tech and thematic opportunities in both blockchain and metaverse opportunities.

So, for that reason, we recommend that you continue to hold the newly merged ETF which will now be tracked in our Buy List as ETC Group Global Metaverse ETF.

Inside the lives of James and Sam

Sam:

You’ll probably notice that a lot of my content this month is heavily crypto tilted. That’s because there’s so much going on in this sector right now and it’s on such a tear that it’s important to stay on top of it all.

I know that most people by now would have dabbled in it, maybe invested in it or are wanting to invest in it. So making sure you’ve got all the information needed is still important, even though it’s not something we specifically recommend here at Small Cap Investigator.

That said, if you think that crypto is something we should be giving a lot more attention to, I’d love to hear your thoughts and feedback as to what that’s like. You can send me a note to [email protected].

On this topic, we have been publishing a free e-letter through Substack called AI Collision 💥 which focuses on the big developments in AI and the stocks that are shooting up the charts making it happen. If you’re not already one of our subscribers there, you can head here to check it out, completely free.

We’ve also toyed with the idea of running a parallel publication to that, also on Substack and completely free, to focus on the big developments in crypto and the tokens that are shooting up the charts. It would also be to help everyday folk avoid some of the traps and pitfalls this high-risk (but also exhilarating) market throws up.

So in your feedback, let me know if you think that’s a good idea… I think Crypto Collision 💥 would be its title (happy to take suggestions on that too).

I bring all this up because that’s pretty much what I’ve been up to this month. Testing, trying out new developments in crypto, speaking and connecting with people in the industry, understanding what the big themes are and what’s going to shoot higher if this bull market really grabs hold… and also keeping myself up to date with the latest scams that are out there.

That’s what I wanted to talk to you about now. You see every big crypto cycle, the scammers and fraudsters come out of the woodwork to try to capitalise on FOMO (fear of missing out) and people who are green when it comes to this market.

I’m seeing new scams pop up through social media primarily, but also through to my inbox. So I want to point a few out to you, and to also remind you, that if you are in any doubt about something that you feel is not right in crypto, that you might suspect is a scam, you can contact me and check what I think before you do anything. I’ve seen a lot this year and have already helped people avoid scams, so never be shy about asking.

Here’s a few new ones I’ve seen recently that you should be wary of and stay away from.

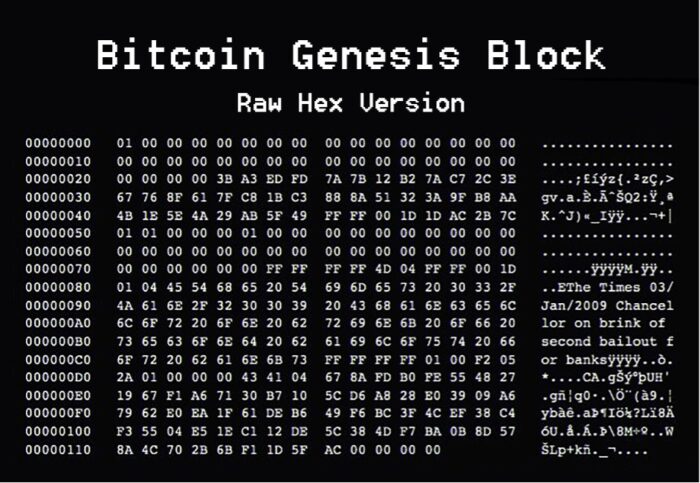

The first is the fake airdrop. An airdrop in crypto is when a project sends out free tokens to wallets and addresses that have in some way connected or interacted with it.

On balance, airdrops are worthless. You should never go chasing them in my view. If they happen to fall to your advantage, that’s great. However, scammers are rife in the airdrop space and they try to sucker you in for a free airdrop, when really they want you to connect to their site or smart contract, where they go on to drain your crypto wallet.

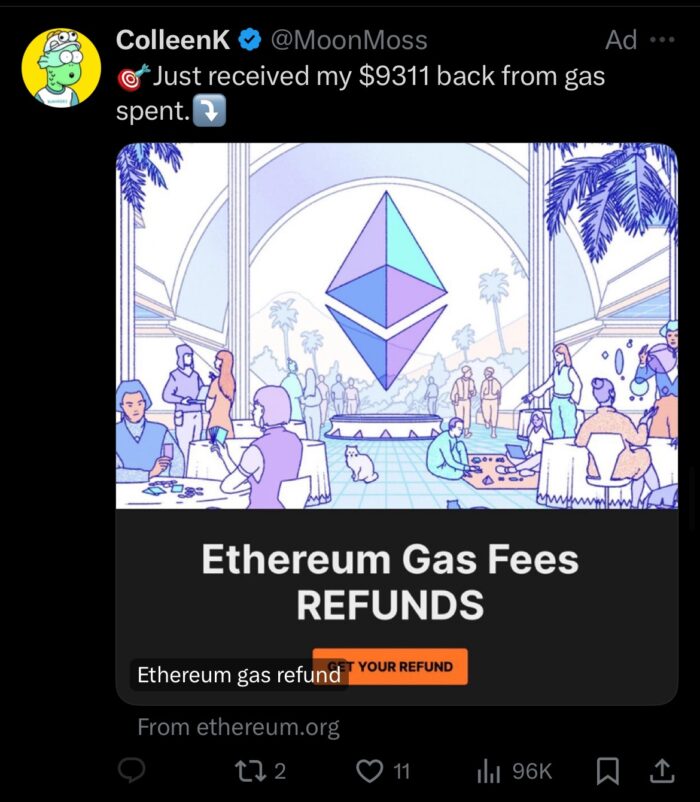

Here’s an example of one that I’m pretty sure is a scam. For a start, this isn’t a regular post, it’s an advert. You can see that in the top-right corner. That’s the first red flag and is alone enough to steer well clear.

But then you notice comments are turned off at the bottom too. Another red flag. Comments would likely be people commenting that this is indeed a scam. It’s also trying to entice you to click through, to “check eligibility”. In all likelihood it’s some kind of malicious link or takes you to a malicious site.

All in all, this smells like and looks like a scam. You will likely see variations of this – different token, different X.com account – but they’re all to be avoided.

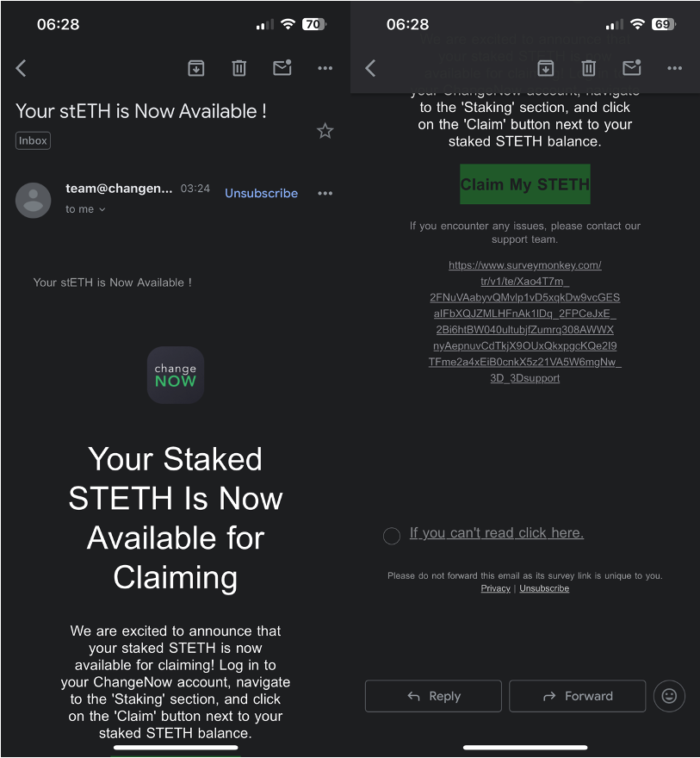

Here’s another that I saw recently:

What do you notice here? Similarities to the first one? Yes.

It’s an ad. Its comments are turned off. It’s trying to entice you to click through.

With this, you also don’t get refunds from the gas you spend on Ethereum. That just doesn’t happen. Ever. So I know this is a scam from the outset. But I’ve been around in crypto longer than Ethereum has existed, so I know. But a lot of people would fall for this.

Don’t let that be you.

Here’s one more that hit my inbox recently:

I mean this is just scam city here. I don’t have stETH, so that alone is enough to hit delete. Then the email comes from some utterly random email address. Red flag. Then there’s claim buttons and weird SurveyMonkey links at the end.

But here’s the best bit: the link and button at the end that says “If you can’t read click here.”

I mean, you couldn’t make this stuff up if you tried. Yet here it is, front and centre in my inbox. These things are phishing emails. The links will be malicious, all of it is a big scam. Steer well clear. This kind of email is prevalent through the cycles when prices are shooting higher, but again, just be careful of things like this.

So that’s just three examples this month that I’ve seen and are relatively new. Or at least they’re variations of older ones I’ve seen before.

It’s risky out there, so be careful. Ask questions, ask me, and you can navigate this fun world with success.

James:

Thirty-two months and counting.

That’s how long it’s been since my tortuous and over-budget house renovation project started.

Regrets, I’ve had a few, notably in choosing the dodgiest of dodgy builders to carry out the job that was slated to take only six-to-nine months back in the much more innocent days of summer 2021.

My girlfriend and I finally kicked the builders off the job in early February (a more complicated process than you might think considering they hadn’t actually been on site for months). Legal proceedings are underway to recoup losses. Considering what’s gone on, the police might even get involved.

But out of the gloom we now have some hope, at least.

New builders started on site earlier this month with an aim to complete the job by the summer, and they’ve already made huge progress. The house is now – finally – water-tight.

One of the first jobs the new builders concentrated on was plumbing. As long-term readers will know, my girlfriend and I decided to eschew running the house off a gas-fired boiler in favour of installing an air source heat pump – our contribution to the electrification trend documented at the start of this issue.

Although we had received permission from the council to locate the heat pump on our roof terrace, the previous mob of builders somehow forgot about that and decided to close up the roof and install a roof light before even thinking about what to do with the pump.

This meant that, just last week, we were forced to hire a crane at not inconsiderable expense to lift the heat pump onto the roof – a job that, remarkably, was completed from start to finish in just 20 minutes.

The complementary aspect of the job was for the plumbers to install the water cylinder that pairs with the pump to provide hot water. This was installed in the basement, though we didn’t appreciate just how much space the various cylinders and associated vessels would take up.

The plumber ended up specifying an extra buffer cylinder that allows the heat pump to operate for more extended periods at a consistent output, avoiding frequent starts and stops, which can be less efficient.

This sounded good in theory – and much needed – though we didn’t appreciate just how much extra room this Dalek-looking device would take. Needless to say, the laundry cupboard we had envisaged for that space will now barely host a sock.

But if that sounds like yet another blow, then we did receive much better news this week when the company we contracted to supply the heat pump told us that, due to the length of time the job has been ongoing, we were now in line for a £7,500 grant from the government via the Boiler Upgrade Scheme rather than the £5,000 in place when we signed the contract.

This means we’re due to be refunded £2,500 – which, thinking about it, is perhaps the first and only “win” on the project we’ve ever had (though this gain would have been that much greater if we had been able to pay the current price of the heat pump rather than those of two years ago, such has been the decline in prices seen in the market).

The final aspect of the job that is of supreme relevance to this month’s recommendation – which is entirely predicated on the need to beef up the grid to account for increased electricity demand from clean energy sources – occurred just yesterday, when the electrician informed me that the house’s main fuse would need to be upgraded from 50amps to 100amps.

This is because our planned power requirements include not just the air source heat pump, but an electric vehicle charger, induction hob and even, if budget permits down the line, a hot tub. After all, we are fully electrifying the house, having already had the gas meter removed and supply disconnected.

This necessitated a call to UK Power Networks, the distribution network operator for electricity covering South East England, the East of England and London, to start our application for a fuse upgrade – a process that should be complete within three weeks and involve a site visit from an engineer.

I’ve learnt not to expect things to run smoothly over the last 32 months but if UK Power Networks can fulfil that promise on time and at no cost to me, the consumer, then I will be very satisfied indeed. In that case, maybe my luck has turned after all.

Crypto Corner

Why offensive memecoins indicate the cycle is starting

I’m going to reel off a list of crypto tokens below. It is ridiculous. Some even offensive. Many more I haven’t listed here are racist, antisemitic and borderline verge on hate crimes.

Many make no sense, many have no sense, most are worthless, many are what we call “rug pulls” (more on that in a moment).

But they are all a sign of the early stages of a crypto bull market. The ridiculousness of the crypto casino you’ll see below is what starts the cycle and what drags attention and eventually capital to this market.

Stupid, childish, irresponsible, whatever you want to call it, you can hate it and dislike it all you want, but it is an unquantifiable anomaly and reflection of the state of global finance (and probably society) that these things even exist… and they are resulting in millions being made (and lost) in the crypto casino.

So, what am I talking about? Here’s a few popular crypto tokens, mainly on the Solana and Base blockchains:

- Slerf

- Peng

- Catcoin

- Doland Tremp

- Jeo Boden

- Elizabath Whoren

- Briun Armstrung

- Jizzlord

- Costco Hot Dog

- Adulph Hidler

- RETARDIO

And so on…

There are no spelling mistakes there. And you will note that a few of them are intended plays on the names of Donald Trump, Joe Biden, Elizabeth Warren, Brian Armstrong (CEO of Coinbase)… and that guy from history.

Just to make the ridiculousness even more weird, the Slerf token did a “pre-sale”. Then the $10 million or so worth of Solana tokens the “dev” was sent were accidentally burnt (destroyed). But then the market decided to pump the heck out of the dumpster fire it had become. Now it has a fully diluted value of around $380 million with something like $150 million in trading liquidity.

Bonkers. Utter madness.

But this is exactly what all the attention in crypto is focused on at the moment.

These are all “memecoins”. And it’s the memecoins that drive moments in time that often precede significant crypto bull markets.

That’s because in extremely rare situations money is genuinely made from trading these memecoins. Getting ahead of the “pump” and getting out before you’re “rugged” is possible. You are ultimately extracting profits from someone – remember that there’s always two sides to a trade – but the reality is that money is being made by those launching these things and those trading them.

Until the insanity stops.

Often it stops with tokens when what’s called a “rug pull” takes place. That means that a trading token has all liquidity pulled from its trading liquidity pools. That is often by the original token creators, who sell everything and make off with all the funds that have been made as unsuspecting token holders buy and buy as the value of these things goes up.

This is what a rug pull looks like on a chart. This is the MOG token that was recently traded on Base for all of about ten hours.

This token launched and traded at a price of 0.0000045. For the next few hours, it pumped higher and higher, hitting a high of 0.0006. That’s a 13,233% rise in a few hours. Enough to get the “hopium” flowing that this might be the next millionaire maker…

Until this wallet, 0x21c96f56ab739b44da9dd8b0d68126d8dc5bea47, sold 4.4 quadrillion MOG tokens and made off with 44.71ETH ($162,632).

Anyone else still holding MOG now had a worthless token with no liquidity pool. In other words, rug pulled.

I know that most people will never find themselves in this casino. Except the problem is, many still do. And many are looking for the next Dog Wif Hat or the next, next, next Pepe token (there’s literally hundreds of Pepe tokens over time – it’s an utter roll of the dice as to whether it is successful or not), or the next Dogecoin or Shiba Inu.

Yes, I know how bonkers this all seems. But if you’ve been in crypto a minute, you’ll know and see a lot of people that claim to have turned $20 into $200,000 in a week trading Solana memecoins.

Maybe. Most often not. Photoshopping “successes” are rampant and designed to pump particular memecoins – and lure the “degens” into the casino.

I can tell you first hand though that memecoin investing can be successful. It should form a tiny, tiny, tiny part of your overall crypto portfolio. But more often than not, when you see these things, you should run for the hills.

I would highly recommend staying well clear of Solana or Base memecoins that come out of nowhere and may even be clones of other crypto you think you’re investing in.

Having said that… there’s no harm in rolling the dice on some of the more established memecoins out there. Just as a bit of play and fun. But only do it if you’re familiar with the memes that are involved in the market. And only if you’re confident that the distribution is such that you can’t get rugged from a token. That’s relatively easy to check, because you can see on the blockchain explorers the holder distribution of any token contract.

Anyway, as insane as this all is, it gets attention. A lot of attention. And a lot of capital ends up flowing into memecoins. By default that also means that a lot of capital flows through decentralised exchanges (DEXs) on networks like Solana and Base (the two big memecoin casinos right now).

So, you find that tokens related to the DEXs also tend to see a pump in value. We’ve seen that on Base recently, in particular with the likes of Aerodrome Finance which is now up over 1,400% since launch.

With Solana, the bigger established DEXs, Raydium and Orca, have also benefitted. Raydium is up over 800% and Orca is up over 400% in the last year.

These DEXs are legitimate projects, so you already see that the memes feed decentralised finance projects like DEXs. And that gets eyes and attention to these networks and legitimate projects. Then other legitimate projects based on things like decentralised finance, AI, decentralised infrastructure and tokenisation of real-world assets (RWAs) look to launch through these DEXs. Then new capital comes to these opportunities, in turn launching some of them higher in value.

Some call this “rotation” but it’s really capital flow, from one thing to another to another. The hype and FOMO grows and the cycle then feeds itself into higher highs.

Of course, this often comes as the greed and fear indicators light up into extreme greed. When it’s combined with bitcoin’s price heading higher, we find ourselves in those crazy blow-off-top bull market cycles.

And this is what’s happening now.

I believe we are getting warmed up for another of those cycles. And this will go on to be bigger than all those prior. So, things are definitely getting hotter – and things will get crazy, so you need to tread carefully. Don’t get sucked into the casino and understand that if this cycle plays out like the ones prior (and I don’t expect that this time will be any different) then what cycles up also cycles down.

So have fun, get involved and take profits from altcoins where you can whilst remembering the much higher risk involved, and always focus on the bigger, long-term picture when it comes to the crypto cornerstone that is bitcoin.

What else we’ve been looking at this month

James:

Amazon goes nuclear

Amazon just bought a massive data centre under construction at one of America’s largest nuclear plants – and this article by Heat Map goes a long way in explaining just why this deal is so intriguing.

Amazon Web Services (AWS), the tech giant’s cloud computing unit, bought the centre from US power generator Talen Energy, which developed the site adjoining the Susquehanna nuclear power station, which is 130km north-west of Philadelphia.

The $650 million deal will see AWS siphon somewhere between 480 and 960 MW of capacity from the 2,500 MW plant under a ten-year power-purchase agreement.

By buying a data centre that uses such a large proportion of a massive nuclear plant’s output, Amazon is effectively announcing that it’s now becoming a nuclear-powered company.

This is big for the “Nuclear Energy as ESG” story, certainly.

Unlike Microsoft which has long had a pro-nuclear founder in Bill Gates, Amazon has long been silent on nuclear, so Amazon’s first-ever agreement with a nuclear power facility could be transformative in how nuclear is viewed as a low-carbon source of electricity.

Of course, a huge bottleneck for growth for companies such as Amazon, Google, Microsoft and Facebook is access to constant electricity.

As the Heat Map article states, with the power demand for data centres and AI soaring, these companies need power, and they want it at cheap rates. Operating costs for the Susquehanna nuclear plant in Pennsylvania are very low – likely around $25 per MWh.

Microsoft has already signed a nuclear power deal with Constellation Energy to supply power to data centres in Virginia, while both Gates and Sam Altman, the head of Microsoft-backed OpenAI, have both invested in nuclear startups, as has Google.

In short: uranium can now be viewed very much as an AI play.

James Altucher’s life in 4 trades

I’m a big fan of the “My Life in 4 Trades” podcast that sees investors and traders tell their life stories via four trades or business decisions. These conversations with veteran business broadcaster Maggie Lake can be deeply personal and philosophical, and challenge how we think about decision-making. I love hearing how veteran investors manage risk and profit in both work and life.

So I was particularly pleased to stumble across a recent episode of the podcast that featured James Altucher, a celebrated venture capitalist, entrepreneur and an uncannily accurate tech market forecaster who predicted the rise of bitcoin, VR and AI years before most people would take them seriously as an investment.

Of course, as many of you will know, James recently joined Southbank Investment Research as the editor of Altucher’s Investment Network UK in what was a huge coup for the firm.

In this podcast, James talks about how he went broke and lost everything before rebounding and finding new success. He talks about his trades in the ensuing weeks of 9/11 – which he witnessed first-hand, just three blocks away from Ground Zero – that ultimately led to years of post-traumatic stress disorder. He also explains why resilience and open-mindedness is so important when it comes to trading and investing and why he writes down ten ideas every morning.

An exhaustive list of storage technologies

Sceptics of clean energy argue that the intermittency of wind and solar means that they just cannot be the foundation of a dependable electricity grid. Relying on renewable sources of energy, they say, will make the electricity supply entirely undependable.

But proponents counter that the intermittency of wind and solar is a challenge that is being met head on by huge advancements in complementary battery and storage technologies. These allow energy to be stored during sunny and windy periods, and be released when it is needed. Although it may sound like a simple concept, there are a number of ways energy storage can be achieved – as this thread by Kit Fitton of Octopus Energy on X, formerly known as Twitter, shows.

As Fitton explains, there are now 20 technologies on his exhaustive list of energy storage systems, up from 12 the year before.

Sam:

Space is still the final frontier

I think I’ve said before but my boys are obsessed with space at the moment. We were even walking through IKEA the other day and one of them was so adamant on getting a big poster of the moon we’d passed by that the boys now have a big IKEA poster of the moon in their room.

I even downloaded and bought a year’s subscription to the Night Sky app which allows us to use augmented reality to overlay all the known stars and planets onto our location. It’s awesome by the way.

So when I came across this piece about potentially exploring Jupiter’s moon Europa for liveable conditions, my ears pricked up. My son knows all the moons of Jupiter so he was pretty pumped to think that exploration on Europa was taking place.

And it does raise the question, why? Why do we bother looking to places like Europa for conditions that could support life? Is it so that one day they can support our life? Or is it to just get a better understanding of our life here on Earth? In this case, mainly the second one.

But it does mean that if we can find some kind of life out there, somewhere, that perhaps there’s an off chance that a trillion light years away on another life-bearing planet in another solar system in another galaxy there’s some bloke writing about a trillion light years away about how perhaps there’s life out there too.

Two hours, three minutes and four seconds of your time needed

I covered this next bit in AI Collision which I mentioned earlier. You can see that full issue here.

But I understand not everyone subscribes to my content at AI Collision (why not?) so I figured best to show you here too what I think is one of the most important two hours, three minutes and four seconds of 2024 so far.

It’s the keynote speech from Nvidia CEO Jensen Huang at the company’s GTC developers conference a week ago.

It’s worth your time. 1. Because it’s actually a great, interesting watch. He’s very personable and entertaining on stage. 2. It’s full of great information and insight as to what Nvidia is doing and why it’s the leader in the AI boom right now… and the foreseeable future.

You can see the full video on Nvidia’s YouTube page here.

Reddit’s $10 billion IPO

Reddit IPO’d and listed last week on the New York Stock Exchange. It’s now worth $10.35 billion. I, for one, am quite amazed. After all, it’s a platform for anyone to post and comment on the most random things.

Of course, Reddit is using its hordes of users to advertise. There’s one problem though. The people who’ve built Reddit’s success – the moderators, the users, the posters and commentors – got nothing.

This is indeed the Wall Streetification of what used to be a public open platform. And the fact that greed won out might spell the end for Reddit. Or maybe it goes on to be bigger better and even more popular.

It is hard to tell, but this is a particularly good take at what’s been going on and why the whole process feels a bit icky and why it could mean trouble for Reddit.

James Allen and Sam Volkering

Editors, Small Cap Investigator