Your May issue of Southbank Growth Advantage

30th May 2024 |

- Here’s how we should play the silver boom

- Big breakthroughs

- Buy List update

- Inside the lives of James and Sam

- Crypto Corner

- What else we’ve been looking at this month

Here’s how we should play the silver boom

James:

Like all investors, I’ve made my fair share of mistakes.

Unsurprisingly, perhaps, some of the most naive investment mistakes I’ve made were also among my first.

Back in the early noughties, not too long out of university, I decided to buy a few bars of silver more or less on a whim.

It was one of those impulsive purchases where you buy first and think later.

I had read that silver was about to turn bullish and I decided I wanted a piece of the action.

But not knowing too much about it, I decided, above all else, I wanted to hold silver bars as a physical asset that I could see, touch and, perhaps, impress my friends with.

Taking to the internet, I discovered a slew of US-based silver dealers that were selling my silver bar of choice: a 100-troy ounce Engelhard, named after the famous American precious metals’ refinery.

These silver bars contain 100 ounces or 3.11 kgs of 0.999 fine silver – so almost completely pure.

I can’t quite recall what made me choose that brand, in particular, but I know I liked the fact that the front of the Engelhard bar featured not just the company’s name, but also the weight, fineness and serial number – it seemed official and, to my mind, stated exactly what a silver bar should state.

After contacting a few dealers, I settled on one who ran a bullion dealership out of Florida who could sell me a handful of Engelhard bars that from the photos all appeared in excellent condition. He quoted me a price based on the prevailing price of silver that day – which was around $5/oz – and which included a three-figure sum for delivery to London.

After wiring him the requisite amount of dollars, I sat back and waited for my bars to arrive.

But a week or so later, I received a call from a handler from the UK delivery service requesting that I pay VAT on the bars. In my eagerness to buy, I hadn’t realised that both silver bullion coins and silver bullion bars were subject to standard VAT, then set at 17.5%.

This was not an insignificant setback as it meant my purchase price was a lot higher than I had originally considered.

But such concerns were largely forgotten when the bars arrived and I could see and touch them for the first time. If it wasn’t quite love at first sight, it was certainly something close. They were shiny and magnificent and in immaculate condition, just as the dealer had promised.

The bars were kept in special plastic pouches that I left in a box in the attic.

Over the intervening years, I got them out occasionally – sometimes to show friends and family but mainly just to look at them and prove that they were still there… that they were still mine.

Certainly, looking at them became a lot more enjoyable as the price of silver rose.

From a price of around $5/oz at the time of purchase in 2001, silver rose to around $14/oz in 2007 – a 180% or so rise in six years.

At this point, I was looking to sell, not least because I was concerned the market was about to turn over but notably as I was looking to purchase an investment property in Berlin in Germany and very much needed the cash.

This time, I decided to find a local bullion dealer in London and found one near Leicester Square that said he was happy to buy my Engelhards off me.

The deal was consummated in person and was over before I knew it.

After the dealer had inspected both my bars and the paperwork provided by the Engelhard dealer six years prior, he consulted the silver price on a screen and informed me of the price he would pay in dollars. After agreeing the payment method (a bank transfer) I was on my way.

Of course, when I looked at the amount of pounds in my account it was obvious that my bars hadn’t returned anywhere near as much as 180%. This was not just because of the delivery and VAT charges I had incurred at the time of purchase but also because the GBP/USD exchange rate had moved against me quite severely.

Back in 2001, one pound bought less than 1.5 dollars but six years later every dollar I sold only returned roughly 50p – an appreciation in cable that had eroded a good portion of my profits.

It was certainly frustrating that my bullish call on the market hadn’t been rewarded as fully as it might have been, had I not incurred all the auxiliary charges, taxes and exchange rate costs.

Those costs (which, somewhat naively, I hadn’t taken into proper consideration when I bought the bars back in 2001) somewhat tarnished by experience of holding bullion as a physical asset, though not, it needs to be said, my love of silver itself – even as I watched the price of silver subsequently explode first to $20/oz in 2008 and then, after a brief downturn, to over $48/oz in 2011.

Of all the precious metals, silver will always be my first true love.

Solar demand causing silver to break out

In fact, ever since I sold my Engelhard bars, I have kept a close eye on the silver market. Certainly, I know a lot more about the precious metal now than when I did when I bought those silver bars shortly after the turn of the millennium.

And what I know for sure is this: there is hardly another commodity on the planet better positioned for a continued breakout.

As you might know, silver has experienced a significant price surge in recent weeks, hitting a multi-year high of $32.49/oz on 20 May.

This is, in part, caused by an emerging shortage derived from another industry I know a lot about: solar.

That’s because silver, in paste form, provides a conductive layer on the front and the back of silicon solar cells.

But the industry is now beginning to make more efficient versions of cells that use a lot more of the metal, which is set to boost already-increasing consumption. Indeed, panel technologies such as TOPCon, or tunnel oxide passivated contact, and heterojunction technology, known as HJT, can use more than twice as much silver as earlier efforts.

Although solar is still a fairly small part of overall silver demand, it’s growing. It currently makes up around 14% of consumption, up from around 5% in 2014.

But the drive for green energy and government incentives are accelerating solar power adoption and, with it, demand for silver.

Demand for silver in the photovoltaic (PV) industry increased by 64% from 118.1 million ounces in 2022 to 193.5 million ounces in 2023, according to the World Silver Survey 2024, which was recently published by the Silver Institute. The report forecasts the demand could increase a further 20% this year, reaching 232 million ounces.

But photovoltaic demand may hit 370 million ounces by 2030 out of global silver demand approaching 1.4 billon ounces, according to investment manager Sprott, which specialises in precious metals.

Already this demand from the PV market is having a pronounced effect on the market as buyers in India and China amp up purchases.

Indeed, one interesting story emerging in the silver markets is that increasing amounts of the precious metal is being transferred outside of the Comex vaulting system with a view to being physically delivered.

According to Alasdair Macleod, head of research for Goldmoney, India’s Reliance Industries recently bought over 1,000 tonnes of silver on Comex to supply a new mammoth PV plant in Jamnagar in India.

It’s unusual that the trading of commodities such as silver on Comex is settled by physical delivery, so this could be a sign that a) Reliance was unable to secure sufficient silver from refiners and b) that increased demand for silver from the solar industry from countries such as India (that are heavily backing PV plants) will soon start to feed into prices.

Indeed, India imported a record 77 million ounces of silver in February and the first quarter exceeded all of last year, according to the Mumbai-based Economic Times newspaper.

In China, silver imports are also set to jump as solar demand lifts prices.

Although silver prices have risen to an 11-year high, the arbitrage window – or the spread between Chinese and world prices – has widened even further. That creates the incentive to send more metal to China, potentially squeezing supply for other countries and depleting inventories around the world.

Certainly, solar capacity additions to global grids should help to keep a bid under silver for many years to come.

Silver’s fundamentals are now unlike any time in recent history

Saying that, this isn’t just a solar story.

Unlike gold, which is used mainly as a store of value, silver is also used for other industrial purposes and commonly incorporated in the manufacturing of automobiles (including electric vehicles), jewellery, biomedical applications (including next-generation anti-superbug antibiotics) and electronics, where silver’s unique properties, such as its high electrical conductivity, make it an essential material in various devices, including smartphones, tablets, computers, and televisions.

In fact, the electronics and electrical industry makes up over one third of silver demand and growth is now accelerating.

Industrial consumption, which hit an all-time high in 2023, is expected to expand another 9% to reach 711 million ounces this year, the Silver Institute said in its World Silver Survey report in April.

Total global silver demand is forecast to rise 2% this year to 1.2 billion ounces, which would mark the second-highest level on record, the Silver Institute said.

But while the silver market over the previous decade was basically evenly matched in terms of demand and supply, the last few years have been marked by a supply deficit.

Indeed, global silver production has slid by about 6% to 831 million ounces over the past ten years, according to the Silver Institute. Although recycling and other sources bring the total supply to about 1 billion ounces this year, total supply is pegged to fall 1% this year.

“Even though silver comes with usually lead, zinc, copper or gold, it’s getting harder and harder to find an economic deposit,” Maria Smirnova, a portfolio manager at asset manager Sprott, said on a 14 May conference call.

“Grades are coming down. Geopolitics are playing a role because many countries are becoming more difficult to work in.”

In particular, silver production in Peru, the third largest producer in the world, continues to fall severely, now down 43% from peak levels.

According to the Silver Institute, the global silver deficit is expected to rise by 17% to 215.3 million ounces in 2024, the second-highest on record. Silver now faces the fourth year of a structural market deficit.

Others think the deficit this year will be even larger.

Sprott, which holds $5.3 billion in physical silver, says this year’s 1 billion oz. in global supply will fall 265 million ounces short of meeting demand because of declining production and rising industrial use.

“You take a stagnating mine supply, you add to that a very healthy growth in demand and then that translates to dwindling inventories,” according to Sprott’s Smirnova.

The 265-million-ounce projected deficit might require 20 new mines to erase, she added.

Whatever the true size of the deficit, limited new supply paired with structurally higher demand is the perfect recipe for major price surges in any commodity.

This makes it the perfect time for us to gain exposure to a metal that some forecasters expect to reach three figures before the year is out.

As such, I’ve been on the hunt for a silver miner with exceptionally strong fundamentals as a way to play the silver boom.

After scanning the market, I’ve found a unique silver miner with a clean balance sheet, low costs and solid free cash flow, making it a potential high-flyer as silver prices rise.

Its name is SilverCrest Metals Inc. (TSX:SIL) and it is our next Southbank Growth Advantage recommendation.

SilverCrest Metals Inc.: a producing, low-cost silver miner

SilverCrest Metals Inc. (TSX:SIL) is a Canadian precious metals producer.

Its principal focus is its Las Chispas mine in Sonora province, in northwest Mexico. It has a 55/45% silver/gold split and is a high-grade underground mine, with a low-cost profile. This is measured with the all-in sustaining cost (AISC), which includes all the costs incurred to achieve current production. On this metric, SilverCrest is in the lowest quartile.

Given that the product is a commodity with market pricing – i.e. everyone gets basically the same for their product – cost is a key area of competition, so you want to be investing in the low-cost producers. They will be likely to have higher margins, and therefore generate more cash flows for shareholders.

SilverCrest’s AISC is between $15 and $16 per oz of silver equivalent (AgEq) sold. With silver prices currently shooting north of $30/oz, this gives it a 50% gross profit margin, before other general costs and taxes are included. What’s more, the peer average is just over $20/oz. We’ll tackle the financials fully in a moment.

In terms of production, it is doing so at a rate of 10 million ounces of silver equivalent per year sold to the market (10m oz AgEq/yr). It only recently entered production though, with first revenues coming at the end of 2022.

It has increased production of both gold and silver in the first quarter of 2024, compared to Q1 2023. This is based on high and improving recovery rates (how much of the metal contained in the ore mined is economically recovered). Above 90% tends to be an industry benchmark, and SilverCrest achieved a very impressive 98.3% in its most recent quarter. So, it is improving its operations and is reaching high levels of efficiency.

Beyond the AISC, the company says its sustaining capital is around $40-$44 million per year. This represents the capital expenditure required for maintaining and sustaining existing production assets. This includes the replacement of plant and machinery and capital expenditure related to health and safety, the environment and other similar things.

Debt paydowns give financial strength

SilverCrest is in a good position financially, having paid down all its debt and worked its way towards a positive retained earnings position only six quarters after starting production.

It has $70 million in cash and zero debt, and has a $70 million debt facility available to it, giving it a wide cushion if it wants to invest in further growth without tapping up the equity market and diluting shareholders.

Equally, a miner-specific benefit appears in the form of $20 million worth of bullion. The company actually buys bullion rather than not selling some as that would distort operating performance reporting, so it views bullion as a use of capital rather than inventory. In that sense, it isn’t just a silver and gold producer; it is also an investor.

It has now been in a net cash position (more cash than debt) for six quarters. A peer group of silver producers with market caps of over $100 million collectively has a net debt position of $1.5 billion. Given that until the last couple of months silver was a weakly priced commodity, this net cash position is a great achievement, and will only get better as the current surge in silver pricing flows through to the company’s financials.

One main issue for the company is that its main productive asset is in Mexico. This brings not only physical risk – Mexico is seeing increasing levels of drug related violence and corruption – but also currency risk (as I experienced with my Engelhard bars).

However, SilverCrest has decided not to take a chance in this respect and has hedged 80% of its currency exposure.

An eight-year mine life with expansion possibilities

What’s more, SilverCrest is planning to invest in further exploration both at Las Chispas and further afield.

Its current expected mine life is eight years, based on reserves of 78 million ounces AgEq and an operational output of 10 million ounces/year. I expect this to extend further in time and scale, however, as the company has only recently entered production. It can now expand its focus to proving out more of the resource, which up until now are classified as “inferred” not “proven”. It already has drilling plans and targets to expand the mine size/life.

It has a 2024 budget of $12-14 million for exploration, both for converting inferred resources to proven at Las Chispas, as well as exploring new or under-drilled targets close to the current mine. It will also look at other assets in the region, especially its owned El Picacho project 85km from Las Chispas. El Picacho is a historic resource area which has previously been productive, and has a current estimated reserve of 7.8 million ounces of silver equivalent.

SilverCrest is not satisfied to operate the assets in production and steadily extract and return the cash flows. It will seek to deploy the capital it is now generating to further the exploration of Las Chispas, and perhaps even buy other exploration land or developing projects.

In Q1 2024, SilverCrest achieved high recovery rates leading to a record quarter for sales in both volume and total revenue terms. This was achieved at average prices of $2,062/oz Au and $23.37/oz Ag. Given that prices as at the time of writing are $2,354 and $32.29, respectively, Q2 could yield even better results.

SilverCrest also achieved an especially low AISC of $12.90 per oz of silver equivalent sold, and the ore mined was a higher grade for both gold and silver, generating more precious metal per tonne than a year earlier.

So, this is an asset that is improving its yield as it gets used to operating it, in a rising price environment.

Please consider these risks

But while improving efficiency and grades are good signs, they may fluctuate. It is worth saying that SilverCrest’s share price shares a high correlation with a broader peer group of productive silver miners so far this year. Clearly, the silver price is the key driver of share price in the short term.

Obviously, given that silver prices are the key driver of the share price, the key risk is that the silver price breakout fades and falls back into a range.

Of course, recent gains in precious metals’ pricing recently are also strongly connected with the US economic situation and the expectation of more interest rate cuts by the US Federal Reserve.

But if interest rates instead remain high, that could certainly pressure the silver market.

What’s more, still sizeable amounts of identifiable silver inventories, as well as vast metal stocks held by individuals and investors off exchange, could also continue to protect the silver market from a squeeze.

Stocks held in commodity exchange depositories and London vaults amounted to nearly 15 months of global supply as of end-2023, though they did fall by 5%, according to the Silver Institute.

But as I said earlier, record industrial usage and a supply deficit should mean prices remain well supported no matter what the Fed does. And I fully expect Chinese industrial demand, in particular, to erode available stocks.

Regarding SilverCrest specifically, a key risk is its jurisdiction. While Mexico is traditionally one of the better places to operate, an election at the start of June could provide some uncertainty, and increasing rates of narco-violence have made Mexico a tough place to operate.

Add in the potential difficulty of navigating the US/China trade tensions and Mexico is not without risk.

However, most of the jurisdictional difficulties short of serious criminal activity/state confiscation come during the approval and permitting process, so this risk is somewhat diminished.

Certainly, SilverCrest has an experienced management team that should help mitigate these risks.

Led by CEO, Eric Fier, a certified professional geologist in the US and certified engineer in Canada, the management team has extensive experience across the precious metal mining sector, discovery, financing, and budget construction through to construction and operation.

So, if you’re comfortable with the risks, then our advice is to move fast. With silver prices starting to jump, SilverCrest has already risen by over 45% this year alone.

Action to take: buy SilverCrest Metals Inc. (TSX:SIL)

Ticker: TSX:SIL

ISIN: CA8283631015

Current price: C$12.55

Market cap: C$1.85 billion

52-week high/low: C$5.54 – C$12.70

Buy up to: C$16

Big breakthroughs

Sam:

The Majorana Demonstrator – observing 100 trillion times the age of the universe in just one year

The universe is approximately 13.7 billion years old. There’s a bit of leeway in that number, give or take around 200 million years.

Humanity knows this thanks to the Wilkinson Microwave Anisotropy Probe (WMAP) project. And according to NASA,

“The WMAP team’s results are based on the underlying model used to fit their data. This model assumes that 70% of the energy of the present universe is in the form of dark energy, 26% of the energy is in the form of cold (not thermalized) dark matter, and the remaining 4% of the energy is in the atoms and photons. According to their estimates the universe is 13.7 billion years old with an uncertainty of 200 million years.”

The fact we are able to accurately understand the age of the universe is quite the feat of human achievement.

The reason we can do these things is because of incredible people with the drive and resources to question fundamentals of our world. That curiosity and critical thinking leads to great innovation, creation and the understanding of how our world and the universe works.

Which in turn leads to understanding and innovation in more practical areas of science, and technology which ends up in a world where I can sit in a room in Portugal on a device that is currently not connected to anything, sending you insight into new breakthroughs wherever in the world you are, on a device you might be carrying in your pocket.

Understanding the nature of physics is at the top end of the ability to innovate and create our high-tech world. Without that knowledge, there’s no way we’d be talking about 208 billion transistors on a chip and the development of AI data centres.

But what if the known standards of physics were not complete, and potentially even wrong? The standard model of particle physics explains three of the four forces of nature, electromagnetism, weak force and strong force. The other, gravity, it does not explain.

Now before I go on, I should point out I am not a particle physicist, nor a quantum physics expert. You might be, or you might know someone that might be, and if so inclined, after reading the rest of this, I’d love to hear feedback if you’re knowledge extends deep enough to provide such with authority.

Nonetheless, currently in a high-tech underground fortress laboratory in the Black Hills of South Dakota, research is underway that may re-write the foundations of the Standard Model.

The Majorana Demonstrator is a collaboration between over 100 researchers and 19 institutions from countries such as the US, Canada, Japan and even China and Russia.

Its aim is to search for neutrinoless double beta decay.

The specifics of this have taken my brain into a realm that makes it want a sit down and a stiff drink. I’m not equipped with the time nor resources to properly understand it all. But from what I can conclude, if scientists are able to observe the double beta decay, it will take particle physics into a new era, and provide proof of a Majorana particle.

And if Majorana particles are proven, it could be a game-changer in the development of fault-tolerant quantum computers.

That’s the crux of the importance to the long-term future of tech. Again, I’m leaving out a lot of physics here. But what I found interesting about the developments of the Majorana Demonstrator is how they’re going about their research.

As they noted in a recent article when explaining how to detect double beta decay:

How do you detect such a rare event? If you watch a single germanium-76 atom for one and a third sextillion years, the chances are 50-50 you’ll see it decay. On the other hand, if you watch one and a third sextillion germanium-76 atoms for just one year, the chances are 50-50 that you’ll catch at least one of them decaying.

Now, just for an idea of how long one and a third sextillion years is, it’s roughly 100 trillion times older than the universe. In short, it’s expected our sun will die in five billion years, so it’s probably best to not wait around to observe that single germanium-76 atom.

Hence to observe this (at least a 50-50 chance of it) the best shot is to get one and third sextillion germanium-76 atoms.

Now that sounds like a lot of germanium. And it is. But thankfully that equates to about a tonne of enriched germanium. And therein is what I found most fascinating about the research at the Majorana Demonstrator.

We know that germanium is currently listed as a critical material by the US government and European Union. Part of their listing of this as a critical metal for technology and energy is that China has historically controlled about 60% of the world’s supply of germanium. This was part of our investment rationale behind Rockfire Resources in August last year as we know it has germanium at the Molaoi project in Greece – as you’ll see in the buy list update below too.

While we know that germanium is needed for high-tech industry, energy, AI, and EVs as a few examples, what we didn’t realise was its importance in particle physics research.

Considering that annual production of germanium is roughly 95 tonnes from China, five from Russia, and about 40 tonnes from the rest of the world, slicing off a tonne of it for particle physics research is actually quite a chunk.

It reinforces our view that strategic metals like germanium are of upmost importance to governments and wrestling away Chinese control. And it’s from areas that are unexpected like proving Majorana particles that emphasise the importance of these metals and the potential of any non-Chinese source that can dig it up out of the ground.

Buy List update

European Metals Holdings (AIM: EMH)

At the time of writing, European Metals Holdings is trading around £22.40, 9% up over the last month, though the stock is still 31% down in the model portfolio.

European Metals part owns the Cinovec lithium asset in the Czech Republic, one of very few advanced-stage, large-scale lithium projects in the European Union with a mineral resource of nearly 7.4 million tonnes of contained lithium carbonate equivalent.

The project is being developed by Geomet, a joint venture between EMH and Czech-state-owned CEZ.

At the end of April, the company announced it had chosen a new site for its lithium processing plant, situated in an industrial area and further away from inhabited areas as the previous site had been.

Following evaluation and with relevant municipal and regional governments, the site of the former Prunéřov 1 power station, which was decommissioned in 2020, has been chosen.

The site, which is owned and operated by CEZ, is also much larger than the former site at Dukla and the company said it should enable the processing plant to be laid out in a more effective and less costly manner, and enable “better and faster constructability”.

“While providing a good outcome for the surrounding communities, the decision to move the lithium processing plant from the Dukla to the Prunéřov site is expected to have a positive outcome on the capex [capital expenditures] and opex [operating expenses] per tonne of the project due to the possibility of quicker permitting process and more effective layout of the processing plant,” executive chairman Keith Coughlan said in a statement.

These reductions in capex and opex will be incorporated into the delayed definitive feasibility study (DFS), he added.

“As would be expected in such circumstances, we were unable to provide information on this matter whilst a revised project configuration was being formulated, due to social and environmental impact sensitivities and had to defer the DFS until the details of the new site were agreed,” Coughlan added.

“We understand that a deferral to a DFS is usually considered a negative matter, but in this case, we consider it to be for a positive result, particularly as the Prunéřov site is currently home to the Prunéřov Power Plant, and the permitting can now be advanced in a more timely manner with the cooperation of the local, regional and federal governments.”

Shares also found support seemingly on confirmation its switch of domicile from the British Virgin Islands is progressing with the forms submitted for it to become an Australia-based company.

EMH also confirmed it would continue to be listed on AIM but as an Aussie company rather than one from the BVI.

In a quarterly trading update, EMH stated that cash at the end of March 2024 was A$5 million with a further A$1.4 million due from associate, Geomet.

The stock remains a BUY below its 45p buy limit.

Global X Lithium & Battery Tech UCITS ETF (LON: LITG)

Global X Lithium & Battery Tech UCITS ETF has fallen by 3% over the month to trade last at around £6.23 at the time of writing, putting it around 30% below our £8.96 entry price.

LITG has significant positions across different parts of the lithium supply chain, including in lithium heavyweights such as Albemarle, Tesla and Mineral Resources. This helps cushion it against lithium price volatility. For example, if prices fall, that’s a negative for producers but a positive for companies that buy lithium to make value-added products.

The ETF invests in the full lithium cycle, from mining and refining the metal, through battery production. It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.

By owning mining, refinery and battery production companies in the fund, Global X has its fingers in multiple parts of the lithium industry.

Of course, the ETF benefits from the surging demand for the silvery-white metal from electric vehicle (EV), renewable energy storage and mobile device industries.

However, increasing supply of the white metal, particularly in the China market, has caused lithium prices to fall since hitting record highs in 2022. Although still down by about 45% in the past year, the price of lithium carbonate in China has rebounded in the first five months, rising more than 14% year-to-date (YTD), suggesting the market has started to recover.

LITG remains a BUY.

Central Asia Metals (AIM: CAML)

Central Asia Metals, a mining company with operations in Kazakhstan and North Macedonia, has risen 4% over the last month to 221p at the time of writing, still leaving it 20% underwater in the model portfolio.

The group’s principal business activities are the production of copper at its Kounrad operations in Kazakhstan and the production of lead, zinc, and silver at its Sasa operations in North Macedonia.

The stock continues to rise in line with strong copper prices, which has surged to an all-time high above $11,000-per-tonne, a rally largely driven by financial speculators who predicted that a supply shortage would push up prices.

Copper have risen by 31% in the past year and 25% year to date.

CAML is a BUY under 310p.

Foresight Sustainable Forestry Company (LON: FSF)

Foresight Sustainable Forestry Company, which invests in UK forestry and afforestation assets, has risen 6% over the last month to around 70.50p at the time of writing, putting it around 35% down in the portfolio.

In a company update published 10 May, the company announced that its unaudited NAV per share increased 3.9% to 102.2p in the six months to end-March 2024 on a successful completion of planting and value ascribed towards the creation of carbon credits at newly planted afforestation properties.

“I am delighted to report that FSF has been successfully driving NAV gains by planting a further 2.3 million trees during the period, bringing the total number of trees planted since IPO to 4.3 million at the reporting date,” said FSF chairman Richard Davidson in a statement.

Planting has continued at pace since period end with a further 650,000 trees planted since 31 March 2024, and we are pleased to outline the additional impact that this is expected to have on the value of our portfolio.

“Despite headwinds seen in the investment trust market, we continue to build meaningful value across our afforestation portfolio. Add to this strengthening timber and property prices and it is clear that we have a strong platform from which to build.”

The firm remains a HOLD in the model portfolio.

Newmont Corporation (NYSE: NEM)

At the time of writing, Newmont Corporation, the world’s largest gold miner, is trading around $41.98, 1% down on the month. The stock is now 36% below our $65.39 entry point.

Newmont is well positioned to take advantage of rising prices of gold, which remains among the best investments of 2024.

Gold rose to $2,454.20 an ounce on 20 May, an all-time high, amid prospects for lower interest rates and strong market demand for precious metals.

Newmont remains a BUY under $100.

KraneShares MSCI China Clean Technology Index UCITS ETF (LON: KGRN)

KraneShares MSCI China Clean Technology Index UCITS ETF, recommended at $24.83 on 12 October, was last seen trading flat on the month around $21.96, putting it 11.5% down in the model portfolio.

KGRN, which tracks the MSCI China IMI Environment 10/40 Index, is the only UK-listed ETF to specifically tap into China’s cleantech industries.

China is set to funnel over $7 trillion into energy transformation through 2040, according to Goldman Sachs estimates.

We remain happy holders.

The ETF is a BUY below $26.83.

Stellantis NV (NYSE: STLA)

We recommended multi-car brand giant Stellantis at $22.84 in the January issue. At the time of writing, its shares are trading at $22.31, putting it 2% down in the model portfolio, after falling 10% over the last month.

The stock reached an all-time high at nearly $30 on 25 March but has since fallen back, in part due to an industry sell-off sparked by concerns over electric vehicle (EV) demand.

In mid-May, Stellantis said it expects to quickly grow sales of China-made EVs outside of the country through a new joint venture with Leapmotor, starting in September.

Sales of the China-built Leapmotor vehicles will begin through Stellantis’ distribution networks, including dealers in Europe from France, Italy, Germany, Netherlands, Spain, Portugal, Belgium, Greece and Romania.

Those markets will be followed by the Middle East and Africa, India and Asia Pacific, and South America in late 2024.

The announcement comes amid increasing geopolitical tensions surrounding China-made EVs in the US, Europe and other regions and fears the less-expensive, China-made vehicles will flood the markets, undercutting domestic-produced EVs.

The stock is a BUY while it trades below its buy limit of $23.50.

Prysmian Group (IL: 0NUX)

Prysmian Group, which entered the model portfolio at €48.13 in the March issue, now trades at around €58, putting it 22% up.

The Italian cabling giant has made a solid start to 2024, reporting a net profit of €190 million for the first quarter of the year, compared to €187 million in the first three months of the prior year.

Adjusted EBITDA (earnings before interest, taxes, depreciation and amoritisation) reached €412 million, compared to €427 million in Q1 2023, with improving margins at 11.2% compared to 10.7%.

The stock remains a buy up to €60.

Centrus Energy Corp (NYSE American:LEU)

Centrus Energy has got off to a strong start for us since our recommendation. As the realisation that US produced enriched uranium becomes ever more present and the desire for uranium fuel for things like AI data centres continues to become a hot investment topic, the company is reflecting this change of attitude to nuclear energy.

It’s price recently broke through $50 and has fast broken through our upper buy limit number. We are always conscious of a stock fast breaking above our buy limits. But there is a long-term fundamental change happening in US energy markets. And to be able to source enriched uranium, and high-assay low-enriched uranium (HALEU) fuel for modern reactors and small modular reactors does make Centrus Energy a company of huge importance to US energy security.

For that reason, and with the fact that a US election is likely going to be a good outcome for the nuclear industry with either party we think it remains a good time to buy the stock.

That’s why we’re also going to raise the buy limit on Centrus to $52.52.

That’s a 30% level from our original entry point. And we think provides sufficient leeway for entry into one of the most important energy stocks in the US, and possibly the world.

Oklo (NYSE:OKLO) (Formerly, AltC Acquisition Co.)

It’s fair to say the re-listing of Oklo as a standalone stock from the SPAC AltC Acquisition Co. was a rollercoaster ride.

As the SPAC pushed higher and higher above $18 in anticipation of the relisting as Oklo, it subsequently crashed lower wiping over 50% off the stock price in a day.

That volatility is enough to scare anyone away and scare plenty of investors to the exits. But this is the kind of volatility you need to get used to with stocks that are chock-full of potential, and growth, but trade a lot on news, deals, a bit of hype and hope and even a bit of meme-factor in the mix (that means a favourite stock for high-risk taking retail investors).

Oklo will be volatile, and the attachment to Sam Altman, the rise of AI, the energy demands of AI all combine to make this stock move quickly up and as we’ve seen down. This is a stock that very much trades on momentum.

However, the fundamental base case for long term investment here is sound. And that was reinforced by Oklo last week as they announced a non-binding letter of intent to supply 100 megawatts of energy to Wyoming Hyperscale’s datacentre campus.

The LOI is a 20-year power purchase agreement that tells us energy hungry data centres are well aware of their energy demands, so are locking down where they can supply of efficient, affordable and green energy.

The reason this is a LOI is clearly because Oklo is yet to get a reactor operational. But the founder of Wyoming Hyperscale said,

“Our goal is to create data centers with minimal environmental impact. This collaboration with Oklo perfectly aligns with our vision for sustainable, efficient operations. By merging sustainability with advanced technology, we are setting a new standard for the future of accelerated computing.”

We expect that Oklo will enter more of these deals. Of course, it’s all predicated on actually getting the Aurora powerhouse into production and operation, so until that happens, there will be ongoing volatility.

And should there be adverse news on the progress of the Aurora powerhouse, then the stock may take a decent hit. But we’re seeing already this week, the stock starting to claw its way back to that lofty pre-Oklo price around $18. I expect long term to see it blow right past that mark and into a hefty profit.

For that reason, we stick with the recommendation, which is Oklo (NYSE:OKLO) with a buy up to limit of $16.50.

Rockfire Resources (LSE:ROCK)

Rockfire published a drilling update from the Molaoi project last week primarily focusing on the zinc potential of the project.

Their goal is to expand the zinc resource in depth and the north with a target of at least 400,000 tonnes. Their highest result drilling hole provided 22.8% zinc, but also 6.3% lead, 149 grams per tonne of silver and 26.20 grams per tonne of germanium.

The best result for germanium was at 32.64 grams per tonne.

Overall, the results were promising, and with a fourth and fifth hole drilling underway (and results from those impending) there may be some further positive news on the near horizon for Rockfire.

The stock price has been volatile, and while currently showing a loss, after a trend lower in 2024, we do expect that strong positive news will lift that back to breakeven and then into profit that we had been in earlier this year.

Rockfire stays in the buy list with its current buy up to of 35 GBp.

Pod Point Group (LSE:PODP)

Pod Point is one of our poorest performers in the portfolio. The company does make a great, useful product. And they have plenty of cash in the bank, and access to a £30 million facility should they need it.

The problem is year on the year the company’s losses have widened, and while it’s been able to lock in contract wins and roll out their products across the UK, the company has been unable to gather any meaningful momentum.

This is reflected in the stock price which has been unable to fire up and get any momentum higher. And we’re now at a point where the temperature for EVs and the potential long-term rollout of EVs and EV infrastructure looks to have completely lost steam in the UK.

We may see that change however with a change of government in the UK. And the focus back on green technology might be a renewed angle from Labour. Hence, we will admit that Pod Point is looking like a prime candidate to exit the portfolio.

However, we will wait it out to the end of the general election to see what policies land in the next few weeks, and what the impact of a change of government in the UK is going to have.

We stick with Pod Point for a few more weeks and will decide at the end of the general election if it stays or we exit the position.

Inside the lives of James and Sam

Sam:

This is my life currently…

I’m a part-time professional Hot Wheels track builder. I can build loop the loops, race tracks, drag strips, even a replica of Silverstone…ok not quite the last one yet, I need to buy some more track builder packs for that.

But therein lies what I’ve been doing outside of work this month. I’ve been deep in Hot Wheels, from the tracks to the cars to the Netflix series, Hot Wheels: Let’s Race.

I love it. Always have. I’ve even got a whole collection of my own Hot Wheels cars from when I was a kid that are now well over 30 years old. You can see my 1985 Hot Wheels Shark Cruiser below.

The owner of Hot Wheels has always been Mattel. In fact, much of Mattel’s success is down to the longevity of Hot Wheels, both as a brand and of the toys themselves.

I stand testament to that, with hundreds of them, just like the Shark Cruiser, some even stretching back before I was born, that were my dad’s, which made it into my collection and then my collection making into my boys’ collection.

And in another 30 years when they have kids, their Hot Wheels will likely make it into their kids’ collection.

In the 80s, you could pick up Mattel stock for a bit over $1. Today it’s worth about $17. And the company has gone through many rises and falls in stock price over the years.

But it’s still here. It’s the kind of company that has longevity, maybe its nostalgia that keeps it relevant, or maybe they’re just a bloody good toy company?

What I know is, I’m certainly contributing to their bottom line, and anytime I do that, I wonder that if long term it’s a good investment not necessarily for me, but for my boys or even for their kids down the track.

James:

Some of you might recall that I contracted Dengue fever in early January during a family holiday to Barbados.

It laid me low for the best part of three weeks with a nasty range of symptoms that included shivering, severe nausea and vomiting, as well as shooting bolts of pain down my legs at night-time.

It was perhaps the sickest I’ve ever been and something I’d rather not go through again if I can at all help it, especially as the symptoms can be a lot more severe the second time around and even lead to life-threatening hemorrhagic fever.

But it turns out that committing to not getting it again isn’t quite as straightforward as it might be – at least for the time being.

Earlier this month, I had a follow-up call with a doctor at the Hospital for Tropical Diseases in London – the medical facility I visited soon after displaying symptoms.

I had been interested in taking the new vaccine for Dengue called Qdenga. This vaccine, developed by Japanese firm Takeda, is given in two doses over a three-month interval and protects against four serotypes of the dengue virus.

As the doctor explained, when infected with one serotype, the body develops life-long immunity to that specific serotype but only temporary protection from infections lasting a few months with the remaining three serotypes.

After that short period, I could be infected with any of the remaining three dengue serotypes on different occasions.

But it turns out that I shouldn’t start taking the Qdenga vaccine just yet.

The doctor said I needed to wait for a minimum of nine to 12 months from contracting Dengue before receiving the vaccine. Administering the vaccine any sooner might potentially reduce the effectiveness of the vaccine, potentially rendering it entirely ineffective, she said.

This means I’m now in a window of a few months before I can start taking the vaccine where I don’t have much natural immunity to three of the serotypes of the mosquito-borne disease.

The doctor’s advice was to avoid dengue-endemic countries in Africa, the Americas, South and South-east Asia, and the Western Pacific region if I could at all help it – and that’s certainly what I plan to do.

Those regions have seen an explosion of Dengue cases this year, with figures of cases and deaths way up on last year.

In fact, in Latin America and the Caribbean alone, approximately 5.9 million people were affected by dengue fever between January and April this year, which is around 1.5 million cases more than in the whole of 2023.

Apparently, the dengue surge is partly due to the expansion of urban centres in tropical climates and the increased travel in those regions, but also because global warming has increased hospitable weather conditions for the Aedes mosquito, the species responsible for spreading dengue.

If the good news is that I have absolutely no intention to travel to those Denge-endemic regions over the rest of this year, then the bad news is that the Aedes mosquito (otherwise known as the Tiger mosquito) carrying dengue is now sweeping into countries such as France, where I certainly had planned to visit this summer.

According to a recent article in the Times, dengue cases in France have jumped by a factor of 13 in the first four months of the year compared with the same period last year, with more than 2,000 reports by the end of April, an all-time high.

French public health officials are now warning that the “unprecedented situation” is expected to worsen this summer.

Although most cases in France are thought to have been imported from the overseas territories of Guadeloupe and Martinique, the doctor still advised me, if I did travel to France, to be careful and avoid stagnant pools of water, a breeding ground for the insects, and apply lots of insect repellent.

Of course, I’d have to be incredibly unlucky to pick up a second dose of dengue in France so soon after my first bout so, with forecasters predicting a summer of persistent rain and wet weather here in the UK, it’s fair to say there’s a P&O ferry (at least an outbound, anyway) with my name on it.

Crypto Corner

It’s now all about ETH ETFs

In January it was all about the impending approval of bitcoin ETFs.

Now, it’s all about approval of Ethereum (ETH) ETFs. And the expectation thereafter…other altcoin ETFs.

In short, as predicted, with bitcoin ETF approvals now done, and those ETFs fast becoming the biggest and fastest growing ETFs in history, the floodgates are flung open.

Now, the anticipation around the approval of an Ethereum (ETH) in the United States has reached a fever pitch. But what is this doing to the overall market?

Because when you look at prices, it seems not much.

Is the bitcoin approval process the preview of ETH ETFs?

The pathway to the approval of an Ethereum ETF has been considerably quicker than that of the Bitcoin ETFs.

As expected, the bitcoin ETF process presented at the bare minimum a relatively easy to follow roadmap of what to do with the rest.

And then just this week we learnt (as per a report on Cointelegraph) that,

On May 29, BlackRock updated its Form S-1 for its iShares Ethereum Trust (ETHA) with the Securities and Exchange Commission nearly a week after the regulator approved its 19b-4 filing — both need approval for the ETF to start trading.

The U.S. Securities and Exchange Commission (SEC) has shown a cautious yet progressively more open stance towards cryptocurrency ETFs, since the bitcoin ETF launch.

Even though they’re still applying a litigate first ask question later approach with other altcoins, it seems like ETH is at least clearly the next digital asset to find its way into ETFs on the US stock market.

The reason for this acceleration we think comes from a political standpoint. What’s interesting is that things have seemed to loosen right after former President Trump said that a vote for Trump was a vote for crypto.

His open stance towards crypto, which we’ve known about for some time (you can see my interview with Nigel Farage where Nigel says his friend Trump is open to crypto), has meant that millions of crypto holders and market participants know that siding with Trump is good for the industry.

The Democrats though until now have been very anti-crypto. The rumour is they’ve nudged the SEC to say, hey don’t be too rough on the market, and hence the doors for the ETH ETF have now been opened up.

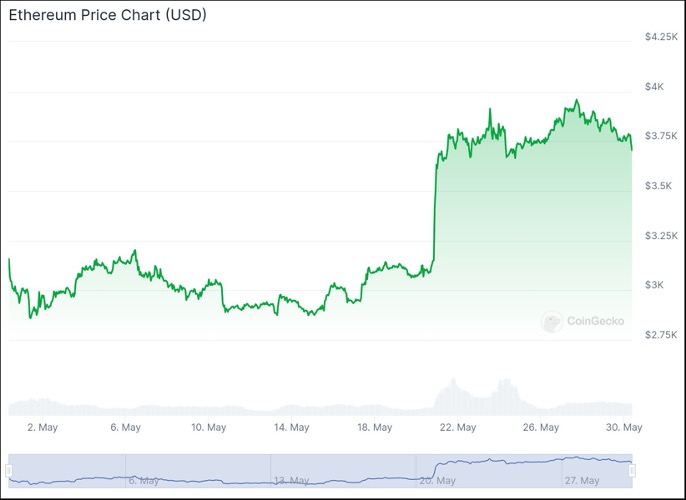

This led the price of Ethereum to surge (as you can see below) as the likelihood of the ETF opened up. But then the prices pulled back as the realisation was that it might still take a few weeks. Furthermore, the applications were required to pull back on the possibility of staking for investors within the ETF.

That idea of generating passive income from staking within the ETF was a major drawcard. That now seems unlikely at this juncture. But it’s certainly still something we expect Wall St. will push hard for as the US opens up to crypto as a legitimate asset class.

We also know from previous discussion with major investment managers like Fidelity that staking, and passive income that way is something they want to implement, and their clients are demanding. So, it might not come right away, but we thoroughly expect it will come.

Furthermore, we thoroughly expect a change of government in the US. If that eventuates and the US has another term under Trump, we do expect the SEC to have a major overhaul and the US environment for crypto and crypto related businesses to brighten significantly.

What does that mean for the market now and longer term? Well, not much now. We’ve started to see signs of the market heating up again but it’s not into full on up-cycle mode yet.

Bitcoin recently broke back up through $70,000 and ETH got close to $4,000 but things have once again stabilised just below those levels.

However, longer term the thing is we expect that after ETH ETFs are green lit, and money starts to flow there, then others will follow too. Solana, Stacks, Avalanche, Polygon, these are all crypto that have the potential to be “ETF-ified”.

Overall, it presents opportunities for more investors to diversify across this new asset class. And we know for sure the adoption is increasing, and the tokenisation of assets is fast becoming an exciting new avenue for capital markets (more on the tokenisation of assets is coming next week by the way – be sure to keep an eye on your inbox on something special coming from me, something BIG!).

So, for now, the market remains subdued, but we anticipate things are going to change fast, and that for a few months of this year, we will really see the market shift into overdrive. It may come at the point of the US election, maybe before, but there’s certainly a lot of things happening all positive that is getting the market nicely warmed and primed for a big run in 2024.

What else we’ve been looking at this month

Sam:

The most exciting boring thing you’ll read this month

This is not for the faint hearted. Mainly because reading a transcript of an earnings call for some may be the most boring idea on the face of the earth.

And typically, I’d agree with you. Except not this time.

That’s because this earnings call transcript is from Nvidia’s latest earnings call just last week. These earnings releases have become an event in their own right, because it gives an indication as to how hot (or cold) the AI and semiconductor market is.

And what we learnt from this call is it is definitely not cold. Nvidia is dominating. They’re breaking their own revenues and earnings records. They cannot keep supply up with demand for their cutting-edge AI products, they are pumping resources into next generation technologies all the time and they’re streets ahead of their competitors.

It is worth the time and effort to see just how much they’re smashing it by because it very much tells us this the AI market is growing, it is the engine of growth in the US and arguably the world. And that off the back of what Nvidia is doing, there will be investment opportunity abound simply on this theme alone.

The risks taken to maintain our survival are extraordinary

This is one of the most fascinating reads I’ve had in recent times.

Should note, that the article on Wired, should be free (you get a certain amount of free Wired articles per month), but if not you can always access it via the wayback machine snapshot here.

In short, it’s about secret classified research from the second world war, that was at the limits of extremity and risk taking, all to help win the war.

It’s new information previously never heard about or seen and goes to show you just what humans are capable of in extreme situations.

Utterly brilliant, and I don’t want to say too much more, because everything about this is simply astonishing.

The algorithms are talking

You know how you might be talking to someone about a particular topic and then like a day or so later, adverts and topics on your social media feeds start popping up about that topic.

That feeling that you’re constantly being listened to, watched…

Well, it’s all data, your data, what you see, watch, listen to, pause on, pay the slightest of attention to – and that data is fed right into the veins of algorithms.

These “algos” govern your existence online, what you see, when you see it and how you see it. And there aren’t too many algos more powerful than what Google has, which govern its search functions.

Google loves to tweak and tinker with their algos too. They change them, sometimes for the better, sometimes for the worse. But they’re always evolving, and more recently integrating AI into the mix.

This is a tightrope of privacy, control, ownership and freedom that google always seems to walk right up to, but as of yet never (provably at least) crossing over.

And they’ve recently just made more tweaks to the algos that will govern how we use the internet, and how the internet uses us. This is a good look at what that means, how its applied in practice and the power of the algo.

James:

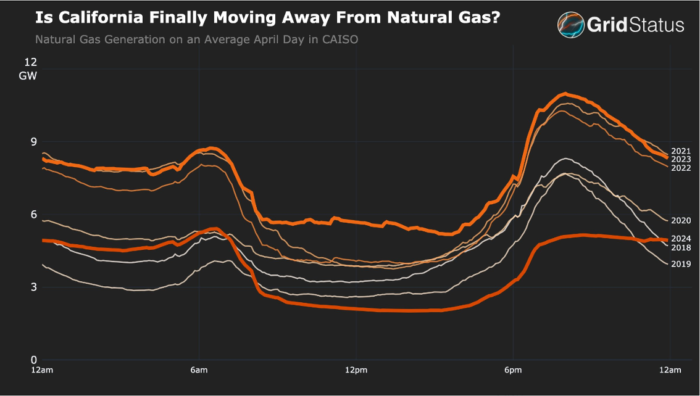

Battery storage is dramatically reshaping the California grid

Here’s a candidate for the chart of the year to date:

The chart, by data analysis firm Grid Status, shows that gas output effectively halved in California on average in April this year – both in the morning peak on the left and the evening peak on the right.

In fact, according to Grid Status, natural gas generation on an average April rose to a seven-year low in 2024, a significant trend reversal from previous years.

The reason? The big influx of battery storage on the California grid in the past two years that has dramatically reshaped the demand curve and reduced the impact and dominance of natural gas.

In a series of illuminating charts that depict how the grid has changed as more batteries have materialised, Grid Status reveals just how battery storage has pushed out gas as the major provider of power in the valuable evening peaks, while soaking up excess solar power during the day before storing it for use when it gets dark.

What’s interesting is that natural gas prices fell over 50% between 2023 and 2024 yet gas power production slumped in that timeframe. Batteries are truly starting to change the rules of the game.

Has CATL just changed the game for EVs?

Back in August 2023, Chinese EV battery giant presented its Shenxing battery that offered a ground-breaking range of 700 kilometres.

But just eight months later, the global battery market leader said its new battery, Shenxing Plus, can power an electric car for up to 1,000 kilometres on a full charge and add 600 kilometres in just ten minutes.

This is quite extraordinary.

The Shenxing Plus battery uses cheaper, more advanced lithium iron phosphate for even faster charging, improving on an already solid cell design that is currently equipped in four car models across Chinese manufacturers. By the end of the year, 50 additional vehicles in the country will utilise the Shenxing battery.

But CATL’s new battery should not only be possible to travel further on a single charge but also allow commute for a month without recharging, said Gao Huan, chief technology officer of CATL’s electric car division, when presenting the battery at the auto show in Beijing.

The video is well worth watching. After all, make no mistake, this could be a real game changer, shifting electric vehicles into high gear.

This is also potentially good for KraneShares MSCI China Clean Technology Index UCITS ETF (KGRN), which entered the Southbank Growth Advantage portfolio in October 2023. CATL is KGRN’s second biggest holding.

The EV battery giant dominates the industry after leading again in 2023 for the seventh straight year, while its share of the market reached as high as 36.8% in 2023, nearly 21% ahead of its closest rival, BYD.

Could the world really run out of cocoa?

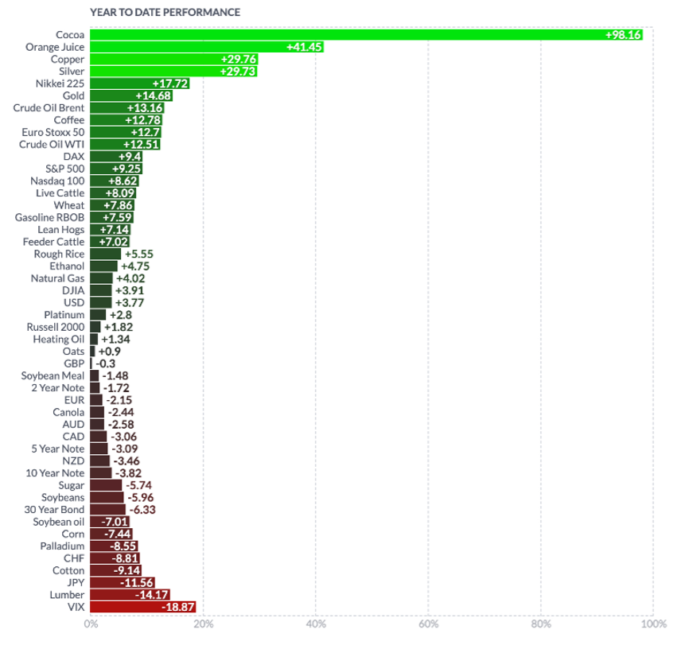

You’ve probably heard that this year is already looking a standout year for commodities, but can you guess which specific commodity is the top performer?

Copper?

Silver?

It’s actually neither of those two metals, despite the headlines each has generated in the financial press.

The tog dog when it comes to commodities so fat this year is actually cocoa, which has gained nearly 100% so far this year.

That compares to 41% for orange juice and 30% for both copper and silver.

So what’s going on in the cocoa market, where futures hit a record of $11,722 per metric tonne earlier this year?

Well, cocoa prices have soared amid a shortage of cocoa beans due to supply disruptions, including heavy rains and disease. The surge also heightened fears of steeper prices for the chocolate ingredient in the supermarkets for consumers.

But according to one prominent hedge fund manager, this year’s rally in cocoa prices likely has further to go, with prices potentially reaching as high as than $20,000 this year or the next.

In fact, the trader in question – Pierre Andurand, founder of Andurand Capital Management LLP – now sees a risk that the world runs out of cocoa stocks altogether.

It must be said that Andurand has made a big bet on the beans so no doubt there’s an element of him talking up his book. But it’s also true to say that he has made seemingly outlandish predictions before, most notably in the European carbon market where Andurand first accurately predicted permits would slump before later forecasting they would soar.

In fact, Andurand is riding a multi-year bull market in commodities to power a more than sevenfold increase in his clients’ invested capital over the course of three years.

If you want to hear why the energy market veteran has been lured to the softer side of commodities trading, and what we might all expect from the cocoa market in the forthcoming months and years, then check out this recent episode of the Odd Lots podcast.